On properties of Continuous-Time Random Walks with Non-Poissonian jump-times

Abstract

The usual development of the continuous-time random walk (CTRW) proceeds by assuming that the present is one of the jumping times. Under this restrictive assumption integral equations for the propagator and mean escape times have been derived. We generalize these results to the case when the present is an arbitrary time by recourse to renewal theory. The case of Erlang distributed times is analyzed in detail. Several concrete examples are considered.

keywords:

Continuous-Time Random Walks, Non-Markovian Processes, Transition Probability, Mean Exit TimePACS:

02.50.Ey, 02.50.Ga, 02.30.Rz, 05.40.Fb1 Introduction

In this article we study transition probabilities and mean exit times of continuous-time random walks (CTRWs). By this we understand a random process whose evolution occurs purely via jumps of a random magnitude that happen at random times where the “waiting times” are independent and identically distributed (iid). CTRWs have revealed as an interesting tool to model a large variety of physical phenomena that undergo sudden random changes. From a Mathematical perspective the consideration and interest in those processes can be traced back to the seminal work of Kolmogorov [1] and Feller [2]. Applications to describe changes of stock markets due to unexpected catastrophes were first noted in the seminal work of Merton [3], where it is assumed that inter-catastrophe times are exponentially distributed independent of the magnitude of the catastrophe, i.e., that catastrophes are driven by a compound Poisson process (CPP). CTRWs generalize in an important way the latter processes allowing for general distribution of the waiting times. Correlation between waiting times and jumps is also permitted.

In Statistical physics CTRWs became popular after the work of Montroll Weiss [4], and have been used to describe physical phenomena ever since. To list a few examples we note applications to earthquake modelling (e.g., [5, 6]), rainfall description [7] or to transport in disordered media (e.g., [8]). More recently, the use of CTRWs has been advocated to give a microscopic, tick-by-tick, description of financial markets: see [9, 10, 11, 12, 13, 14].

Unfortunately, the Markovian nature of CPP does not extend to the more general CTRW. In spite of this ominous situation, CTRWs satisfy a pseudo-Markovian property, namely that the knowledge of the past-prior to the last jump provides no further information to determine the future evolution than merely knowing the state of the system at such a jump time —cf. Eq. (4). This fact explains why scholars have usually focused in studying the statistics of CTRWs right after a jump occurs. In this regard, a linear integral equation for the mean escape times off a given interval has been derived [12, 13]. Similarly, the basic probability for the process to be found in a certain region, given the position at a jump time, satisfies a certain integral equation first derived by Weiss [15, 4].

However, this setting —wherein the present must be one of the jumping times— does not cover the most general situation. The relevance of this fact is further stressed by noting that in several physical problems one may not be able even to decide if such arrival has occurred. Hence, the issue of how to generalize the aforementioned framework to arbitrary present times arises naturally. In this sense some extensions have been considered in the past [15, 16], where it is assumed that the process starts at and behaves in a different way in the time period prior to the first jump. Nevertheless, to our knowledge, there is no robust and self-contained development on this topic in the literature. This paper tries to fill this gap and considers, in particular, the determination of the propagator. We also show how to obtain the mean exit time. We find that, unless jumping times are exponentially distributed, the results of [15, 12] must be corrected. The implications of this fact to the calculation of the correlation function of the process are obvious. We consider here the simpler uncorrelated case: the more general case when jumps and sojourn times are correlated requires new ideas and will be the subject of a future publication.

The structure of the paper is the following. In section 2 we obtain the unrestricted propagator of a CTRW and relate it with that corresponding to starting at jump times. This connection involves a certain object whose distribution may be found by recourse to classical renewal theory[17, 18]. General correlation functions follow immediately. Section 3 is devoted to solving the integral equation for the after-jump propagator by means of a joint Fourier-Laplace transform. In section 4 we extend the results of Masoliver et al. [12] and obtain the mean escape time off intervals starting at an arbitrary instant. In section 5, concrete, explicit formulae are given in the case that waiting times have Erlang distribution. Recently, Erlang times have been the subject of much interest in the context of information traffic and phone-calls waiting times [19, 20]. In the context of transaction orders in financial markets the appearance of this distribution can also be expected since it takes, at least, two arrivals (buy and sell orders) for a transaction to be completed. For further applications to ruin problems and insurance see [21].

To help a reader not familiar with measure theory we assume that all distributions involved have a density. However, we find that all results extend to a general situation.

2 Fundamentals of CTRWs

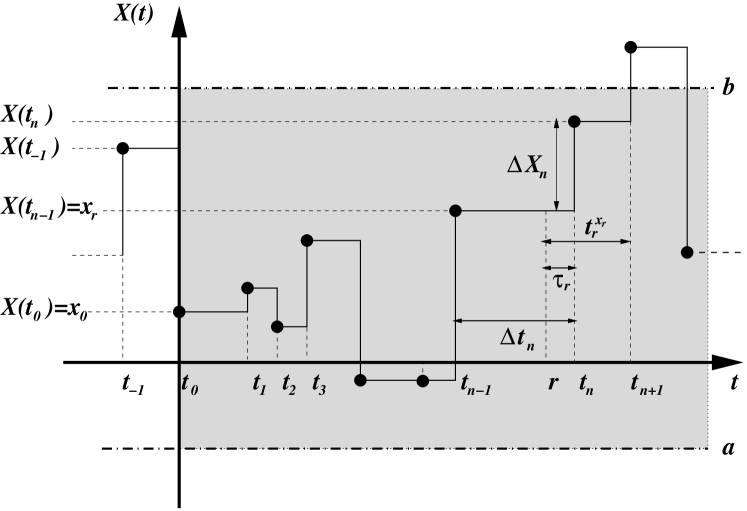

Recall that any realization of a CTRW is given by a series of step functions in such a way that changes at random times , while it remains fixed in place between successive steps —see Fig. 1. The interval between these successive steps defines a sequence of independent identically distributed (iid) random variables , the waiting times. The (random) change, or jump, at in the process is given by . We assume that defines a sequence of iid two-dimensional random variables having joint and marginal densities , and given by

| (1) |

| (2) |

2.1 The propagator and related quantities

One of the basic objectives within the theory of stochastic process is to obtain the future evolution given the actual state of the system; in this regard the main object is the conditional density of given the present position or, in more physical terms, the propagator . If where the propagator reads

| (3) |

Note that , and every are clock times; this is unlike which gives the measure of a time interval. In order to have a frame of reference, we must specify some time origin. For convenience we take it to coincide with one of the jump times, say. In some problems may be identified as the starting point of the process , but this is just one possible occurrence —see Fig. 1.

Now, recall that a generic CTRW is non-Markovian, and hence knowledge of the past gives additional information to that already provided by the state of the system at present. An exception to this occurs when the present happens to be one of the jump times: transition probabilities starting at a jumping time , show a pseudo-Markovian property:

| (4) |

and, whenever is

| (5) |

which is the backbone of these renewal processes. Intuitively, once a jump happens the system forgets all the past previous to the jump time starting anew. It must be stressed that in the expression above could be interpreted as the propagator starting from the jumping time —i.e., roughly is interpreted as whereas when we write the time is arbitrary. Further, it can be proven that must satisfy the homogeneity condition

| (6) |

These properties imply that solves the following integral equation (see Weiss [15]):

| (7) |

where . Note that a class of CTRWs for which this equation can be solved in a closed form has been given in [13]. We elaborate on this in section 3 below.

However, although the assumption that the present is one of the jumping times may be convenient, there is, unfortunately, no convincing reason to that effect, neither from a mathematical nor a physical point of view. The evolution of the system is then described by the more general object and the issue of determining it arises in a natural way. Here we address this problem, assuming for the sake of simplicity, that jump times and jump-magnitudes, and , are mutually independent, i.e., that . The general, correlated case will be the subject of a future publication.

To this end set in Eq. (3) where is the probability of a transition from to in the time interval occurring with no jumps. Obviously

Here denotes the number of jumps of on . We next evaluate the probability that a such transition occurs with one or more jumps:

| (8) |

To this end we introduce the “excess life” as follows: is the time at which the first jump past occurs. Note that is random, in contrast with above, which is a number. Obviously, for some (see Fig. 1 above). By conditioning respect to this object one has, by the total probability theorem and the memoryless property (4)

| (9) |

Note that we use the convenient notation and so forth. A further simplification arises from the independence assumptions:

Hence, by substitution into the RHS of (3) we find

| (10) |

Here and denote accumulated distribution function and the density of :

| (11) |

To summarize, the propagator is recovered by (10) if and are known.111Two-point and correlation functions follow immediately from Eq. (10). The latter can be completely retrieved by means of a joint Fourier-Laplace transform (see section 3). It turns out that the former can also be recovered in closed form by means of classical renewal theory as we now show. To this end let denote the renewal function, the mean number of jumps between and . It satisfies the integral renewal equation (see [17] or [18]) . Further, by the law of total probability one finds that solves the following renewal equation

| (12) |

whereupon, appealing to the renewal’s theorem one finds that are given by

| (13) |

Laplace transformation is useful to evaluate in an explicit form the latter objects. To this end note that manipulation of Eq. (13) yields also

| (14) |

Let and be the Laplace transforms of and . Upon Laplace transformation, we find

| (15) |

| (16) |

The above results recover the propagator in closed form. We next mention properties of this object that follow from Eq. (10). Note first that is spatially-homogeneous: . This in turn implies that is independent of for any two times . This does not imply, though, the stronger property of independence of the increments as in Lévy processes.

By contrast, is homogeneous in time only when is independent of : . Similarly, a comparison between (7) and (10) shows that for the condition to hold one needs, again, that . It can be proven that the latter holds only if waiting times are exponentially distributed. If this is not the case the after-jump propagator does not describe the temporal evolution of the system; instead, the more general object must be used.

The non-Markovian character of the process (see section 3) implies that any available information about prior evolution of the process affects the transition probability. Suppose for instance we wish to determine the future evolution of the system if we know that and, in addition, the value of the previous jumping time, say . With no loss of generality set . The transition probability adapted to that information is

| (17) |

With similar ideas to those used before one can prove that

| (18) |

3 Transition probabilities in frequency domain

Since Eq. (7) is of convolution type an explicit analytical solution can be retrieved in the Fourier-Laplace domain. We remind how this is done —for other considerations on this regard see also [15, 13, 22, 23]. By taking a Fourier (Laplace) transform in space (respectively, in time) Eq. (7) yields that the joint Fourier-Laplace transform of is recovered as:

| (19) |

Here is a real variable while is complex, and we define

| (20) |

By inversion one could, in principle, recover both and . Regarding the latter we note that must be a combination of an isolated mass at and a sub-stochastic density which is the inverse FT of . Thus, the inversion formula reads

| (21) |

Recall that for to be Markovian, both the propagator and after-jump propagator must satisfy the Chapman-Kolmogorov equation. Using the spatial invariance, we find that this equation reads, in Fourier domain, as for all and times . This is Cauchy’s functional whose solution is Taking a further Laplace transformation (in time) a comparison with Eq. (19) shows that we must require for some positive , i.e. that times must be exponentially distributed for the process to be Markov.

For illustrative purposes, we consider an example. Assume that the jump probability is exponentially distributed with parameter but with different probabilities to jump left and right:

| (22) |

where and are parameters. In this case we find

| (23) |

where and . Inversion of the corresponding Laplace transform can be accomplished when , and . In this case one finds that

| (24) |

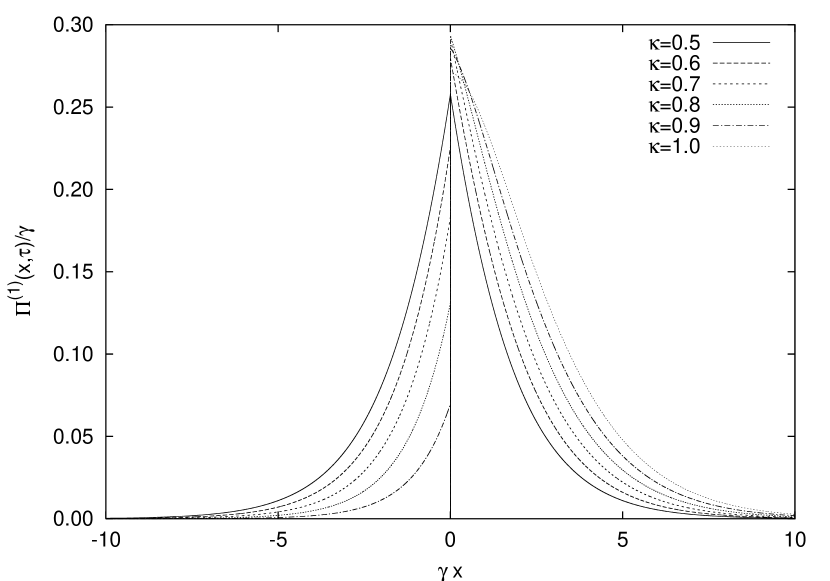

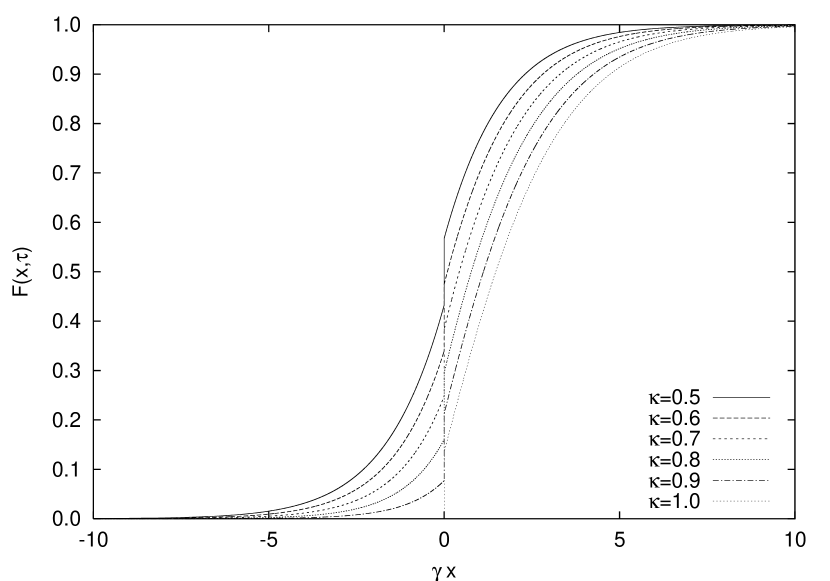

where is the modified Bessel function of the first kind with order . For general values of one must resort to numerical techniques. In Fig. 2 we perform a numerical inversion of Eq. (23) corresponding to and to different values of the parameter . In the upper panel we plot the “density contribution” to the propagator as a function of for fixed value of time. Notice how the discontinuity of at —cf. Eq. (22)— is inherited by . The lower panel plots the accumulated distribution function , whose discontinuity comes from the delta contribution to at .

Returning to the general case, we now derive the propagator. Operating with the Fourier-Laplace transform and using (15), (16) and (19) we obtain that in the Fourier-Laplace domain, Eq. (10) reads

| (25) |

The representation shows that the transition probability contains an isolated mass at —which gives the probability that no jump has taken place— and a sub-stochastic density . Upon inversion

| (26) |

Eq. (26) gives the propagator in a fully explicit way. We skip a similar expression for .

The above expressions simplify if , which corresponds to the steady-state solution. This limit is relevant both from the mathematical and the applied point of view, since it describes the case in which the only information available to the observer is the present value of the stochastic process. Using equation (25) and setting the full propagator reads

| (27) |

Eq. (27) coincides formally with an equation already reported in [16]. We admit that the resemblance is not spurious, but it must be stressed that the problem addressed there, although related, is different from ours. Nevertheless, we can go a step further by evaluating explicitly; indeed, the renewal theorem yields that , where is the mean sojourn time. Inserting this into Eq. (16) we obtain

| (28) |

4 Mean exit times

Another significant magnitude in CTRW problems is the mean exit time off a given interval . This is defined as follows: suppose we observe that at a certain moment the process was in . Then is the mean time that takes for the process to exit . Note that for ease of notation we usually write . When is one of the jump times, say, we can simply write . It can be proven that satisfies the following linear integral equation (see [12])

| (29) |

We next show how to generalize these results to obtain . Let and be the first jump time and, respectively, the first time past at which exits so that —see section 2 and Fig. 1. Obviously if the process exits at the first jump after while if the process jumps to a position still within . Thus we can write By taking an average we find that

| (30) |

where, in the spirit of the total probability theorem, we have conditioned on the after-jump position and used the “lack of memory past jump-times” property, viz. Eq. (4). This expression is simplified further by noting that . Further,

| (31) |

since the jump amount is statistically independent of the previous position. Hence, the RHS of (30) equals . By substitution we finally have

| (32) |

5 Erlang sojourn times

5.1 Distribution and mean of the first jump past

Even although for a large variety of physical situations waiting times can be fitted by an exponential distribution, there exist other possibilities of interest. Here we consider an alternative distribution. Recall that a random variable is said to have Erlang distribution whenever it can be expressed as a sum of , , iid exponential variables with parameter . It turns out that coincides with the Gamma distribution whenever is an integer. This corresponds to

| (33) |

To recover we first consider the case of the renewal function, cf. Eq. (15). Here the integrand has poles at points where . Hence, by closing the contour appropriately in the complex -plane and integrating by residues we find that the renewal function is (note that )

| (34) |

Inserting this into (16) we find upon Laplace inversion that

| (35) |

Further, the identity shows that and . Also

| (36) |

We next evaluate the mean of this distribution. The upper expression in Eq. (35) yields

| (37) |

In particular, if , then

| (38) |

Some of these calculations can be extended to cover the more general Gamma distribution , whose density is still given by Eq. (33), whenever is a rational number: with irreducible integers. Closing the contour appropriately in the complex -plane we find the derivative of the renewal function as

| (39) |

In some cases the above integral can be evaluated in closed form. For instance, if we will have

| (40) |

where is the complementary error function.

5.2 Propagator and escape times under the Erlang distribution

Given that the expected remaining time to exit , , follows by inserting (37) into (32); since the mean of Erlang distribution is we find that

| (41) |

In particular, if , then .

We next consider the after-jump transition probability. Note that for Erlang times Eq. (19) yields

| (42) |

The integrand has poles at where is a determination of . Note that and all poles are located on the left half-plane. Thus, Cauchy’s theorem yields that the “after-jump” propagator is , where

| (43) |

When , (43) is the well-known inversion formula for a CPP. When one has that

| (44) |

Note that, as , which confirms again that the process can not be Markov.

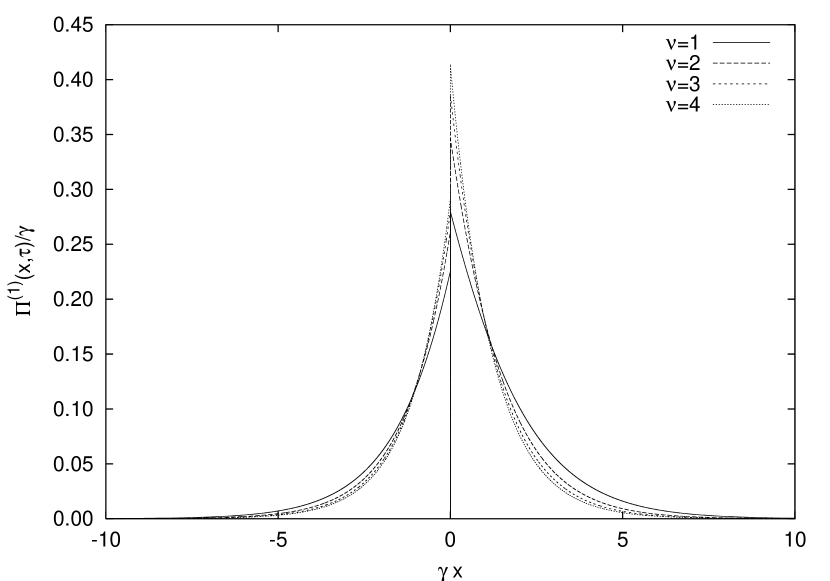

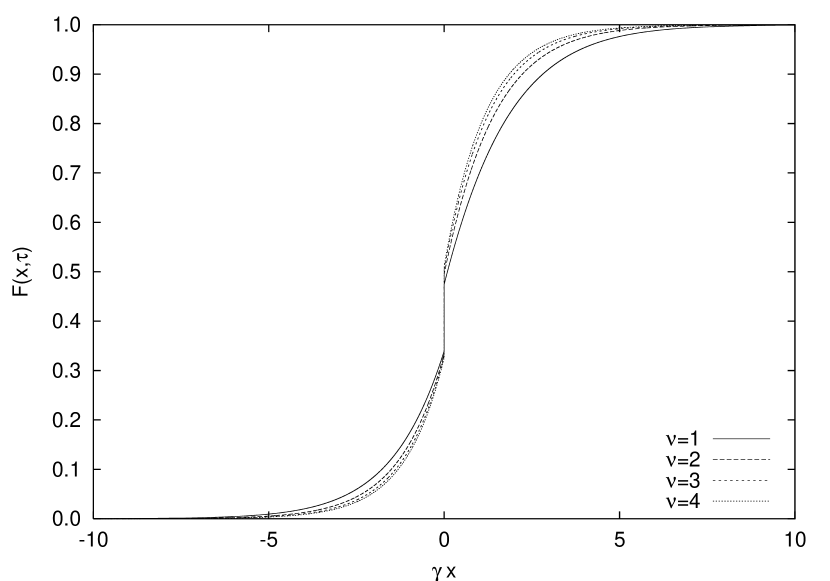

In Fig. 3 we perform a numerical inversion of Eq. (43) corresponding to the jump density of Eq. (22) where and we take different values of the parameter , concretely . In order to keep the plots commensurable we have changed the parameter in such a way that the no-jump probability remains fixed. Observe the different decay behavior which is noticeable both in and in the accumulated distribution function .

The propagator can be evaluated in closed form when . For , say, upon inversion of (27) with (32), we find that reads

| (45) |

Notice how it does not quite settle to the after-jump propagator of Eq. (44). In particular for , exhibits a quite different behavior, since Eq. (45) implies that

| (46) |

where we recall that . We point out that the expansion (46) also holds in the general case as can be easily seen using Eq. (27).

References

- [1] Kolmogorov A. Über die analytische Methoden in der Wahrscheinlichkeitsrechnung. Math. Ann., 1931; 104: 451-458.

- [2] Feller W. Integro-differential equations of purely discontinuous stochastic processes. Trans. Amer. Math. soc., 1940; 48: 488-515.

- [3] Merton RC. Option Pricing when underlying stock returns are discontinuous. Journal of Financial Economics, 1976; 3: 125-144.

- [4] Montroll EW, Weiss GH. Random Walks on Lattices, II. Journal of Mathematical Physics, 1965; 6: 167-181.

- [5] Vere-Jones D. Earthquakes prediction-a statistician view. J. Phys. Earth, 1978; 26: 129-142.

- [6] Helmstetter A, Sornette D. Diffusion of epicenters of earthquake aftershocks, Omori s law, and generalized continuous-time random walk models. Physical Review E, 2002; 66: 061104.

- [7] Rodriguez-Iturbe I, Cox DR, Isham V. A point process model for rainfall: further developments. Proc. R. Soc. Lond., A, 1988; 417: 283-298.

- [8] Montroll EW, Shlesinger MF. Nonequilibrium Phenomena II: From stochastics to hydrodynamics. In: Lebowitz JL, Montroll EW (Eds.). Amsterdam: North-Holland; 1984.1-121

- [9] Scalas E. The application of continuous time random walk in finance and economics. Physica A, 2006; 362: 225-239.

- [10] Kutner R, Switala F. Stochastic simulations of time series within Weierstrass-Mandelbrot walks. Quantitative Finance, 2003; 3: 201-211.

- [11] Masoliver J, Montero M, Weiss, GH. Continuous-time random-walk model for financial distributions. Physical Review E, 2003; 67: 021112.

- [12] Masoliver J, Montero M, Perelló J. Extreme times in financial markets. Physical Review E, 2005; 71: 056130.

- [13] Masoliver J, Montero M, Perelló J, Weiss GH. The continuous time random walk formalism in financial markets. Journal of Economic Behavior and Organization, 2006; 61: 577-598.

- [14] Montero M, Perelló J, Masoliver J, Lillo F, Micciché S, Mantegna RN. Scaling and data collapse for the mean exit time of asset prices. Physical Review E, 2005; 72: 056101.

- [15] Weiss GH. Aspects and Applications of the Random Walk. Amsterdam: North-Holland; 1994.

- [16] Tunaley JKE. Moments of the Montroll-Weiss Continuous-Time Random Walk for Arbitray Starting Time. J. Stat. Phys., 1976; 14: 461-463.

- [17] Cox DR. Renewal Theory. John Wiley and Sons: New York; 1965.

- [18] Karlin S, Taylor H. A first course in stochastic processes. Acad. press: New York; 1981.

- [19] Soong BH, Barria JA. A Coxian Model for Channel Holding Time Distribution for Teletraffic Mobility Modeling. IEEE Comm. Lett., 2000; 4, n. 12: 402-404.

- [20] Fang Y, Chlamtac I. Analytical Generalized Results for Handoff Probability in Wireless Networks. IEEE Trans. Comm., 2002; 50: 396-399.

- [21] Dickson DCM, Hipp C. On the time to ruin for Erlang(2) risk processes. Insurance: Mathematics and Economics, 2001; 29: 333-334.

- [22] Balescu R. Langevin equations, continuous time random walks and fractional diffusion. Chaos, Solitons & Fractals, 2007; 34: 62-80.

- [23] Gorenflo R, Mainardi F, Vivoli A. Continuous-time random walk and parametric subordination in fractional diffusion. Chaos, Solitons & Fractals, 2007; 34: 87-103.