,

A model of subjective supply-demand:

the

maximum Boltzmann/Shannon entropy solution

Abstract

The present authors have put forward a projective geometry model of rational trading. The expected (mean) value of the time that is necessary to strike a deal and the profit strongly depend on the adopted strategies. A frequent trader often prefers maximal profit intensity to the maximization of profit resulting from a separate transaction because the gross profit/income is the adopted/recommended benchmark. To investigate activities that have different periods of duration we define, following the queuing theory, the profit intensity as a measure of this economic category. The profit intensity in a repeated trading has a unique property of attaining its maximum at a fixed point regardless of the shape of demand curves for a wide class of probability distributions of random reverse transaction (ie closing of the position). These conclusions remain valid in an analogous model based on supply analysis. This type of market games is often considered in the research aiming at finding an algorithm that maximizes profit of a trader who negotiates prices with the Rest of the World (a collective opponent) that posses a definite and objective supply profile. Such idealization neglects the sometimes important influence of an individual trader on the demand/supply profile of the Rest of the World and in extreme cases questions the very idea of demand/supply profile. Therefore we put forward a trading model in which the demand/supply profile of the Rest of the World induces the (rational) trader to (subjectively) presume that he/she lacks (almost) all knowledge concerning the market but his/hers average frequency of trade. This point of view introduces maximum entropy principles into the model and broadens the range of economics phenomena that can be perceived as a sort of thermodynamical system. As a consequence, the profit intensity has a fixed point with a astonishing connection with Fibonacci classical works and looking for the quickest algorithm for extremum of a convex function: the profit intensity reaches its maximum when the probability of transaction is given by the Golden Ratio rule . This condition sets a sharp criterion of validity of the model and can be tested with real markets data.

pacs:

89.65.Gh, 89.70.Cf1 Introduction: profit intensities

The very aim of any conscious and rational economic activity is optimization of profit in given economic conditions and, usually, during definite intervals. The interval is usually chosen so that it contains a certain characteristic economic cycle (e.g. one year, an insurance period or a contract date). Often, it is possible but, unfortunately, always risky to make prognoses for a more or less distant future of an undertaking by extrapolation from the already known facts, eg by “sort of statistical analysis”111Such a prognosis is often just a disguised guess, especially if is connected with stock exchange activities.. The quantitative description of an undertaking is extremely difficult when the duration of the intervals in question is itself a random variable. The profit gained during a specific period, described as a function of duration, , becomes also a random variable and as that does not measure the quality of the undertaking and often its even difficult to find some reasonable benchmarks for making comparisons. To investigate activities that have different periods of, possibly random, duration we define, following queuing theory [1], the profit intensity as a measure of this economic category [2]. An acceptable definition of the profit must provide us with an additive function. It seems to us that the notion of the interval interest rate used in this paper leads to consistent results. Nevertheless, such models, although simple and elegant, have several drawback from both theoretical and practical points of view. This type of market games forms often the basis for research aiming at finding an algorithm that maximizes profit of an agent who negotiates prices with the Rest of the World (a collective opponent denoted by RW in this paper) that posses a definite and objective supply profile. But one cannot claim that there always is a unique, adversary-independent probability distribution function, pdf(q), of agents demand or supply profile expressed as a function of the price . Actually, the RW demand profile (ie the shape of its pdf(q) curve) in a play against an agent, say Alice, results from the interaction among all the agents in question. Alice can probe into the RW demand (or supply) only by past events analysis222Note that stock exchange regulations often allow the possibility of (at least partial) invisibility of bids. Therefore one cannot be sure of the actual volume of demand or supply.. Unfortunately, even a thorough analysis can produce paradoxical or unwanted recommendations (the winners curse etc). If such market phenomena are analysed from the game theory point of view, we have in hands interesting new (natural?) tools for analysis of paradoxes that follows from quantum game theory [3]333”Quantization” often suggests ways of avoiding paradoxes in game theory due to the absence of limitations of the classical theory of probability. This approach has interesting consequences in decision sciences, cf for example papers by D. Aerts and M. Czachor [5], E. Haven [6], A. Yu. Khrennikov [7], A. Yu. Khrennikov and E. Haven [8], Piotrowski and Sładkowski [9], D. Sornette [10] and others. Of course, we do not claim that quantum processes play explicit role here.. Such a possibility would be welcome because the non-gaussian shape of the demand (supply) curve suggests the existence of Giffen goods [11, 12]. Obstacles in ”quantization” of such models can be overcome by replacing the maximum Boltzmann/Shannon entropy principle with the requirement that the Fisher information gets its minimum (a discussion on the connection between the principle of minimum of Fisher information and equations of quantum theory can be found in [13]). In this way a simple method of quantum-like game theory models that stem from statistical considerations and, what we show bellow, allow us for analysis of subjectivity in strategy selection. This paper is organized as follows. First we describe the merchandizing mathematician model put forward in ref. [2] and quote the relevant definitions. Then we argue for the use of logarithmic quotations and define the logarithmic rate of return and shortly describe the advantages of projective geometry approach and scaling invariance of the resulting models [4]. The results showing the usefulness of Boltzmann/Shannon entropy as a measure of strategy quality and the probability of making profits will be given in Section 3. There also the astonishing emergence of the golden ratio as a characterization of the inclinations towards concluding deals of the most wealthy agents is discussed. Finally we will point some issues that yet should be addressed.

2 The merchandizing mathematician model

2.1 The profit intensity

To proceed, let us denote by , and the beginning of an interval of the duration , the value of the undertaking (asset) at the beginning and at the end of the interval in question, respectively. We will measure profits with the help of the logarithmic rate of return defined as

| (1) |

The expectation value of the random variable in one trading cycle (buying-selling or vice versa) is denoted by . If and are finite, we can define the profit intensity for one cycle as

| (2) |

This formula is an immediate consequence of the Wald identity [16]:

| (3) |

where is the sum of equally distributed random variables and is the stopping time [1, 16]. The profit intensity we have defined in Eq.2 is just the expectation value of in the Wald identity Eq.3. The expected profit is the left hand side of the Wald identity. If we are interested in the profit expected in a time unit, we have to, according to Wald, divide the expected profit by the expectation value of the stopping time. This lead to the formula given in Eq.2. We can also calculate the variance of the profit intensity by using the proposition 10.14.4 from the Resnick’s book [16]:

| (4) |

Note that the above definition of the profit intensity is applicable also in more general cases when the random variables are correlated or have different distributions.

The expectation value of the profit during an arbitrary time interval, say is given by the formula

| (5) |

The proposed definition of the profit intensity is a very convenient starting point for analysis of various models based on the subjectivity of demand/supply ides, see the discussed below models. Relations to the commonly used measures of profits (returns) can be easily obtained by simple algebraic manipulations and is omitted here.

2.2 The merchandizing mathematician model

The simplest possible market consists in exchanging two goods which we would call the asset and the money and denote by and , respectively. The model consist in the repetition444In principle, the process is continued endlessly. of two simple basic moves:

-

1.

First move consist in a rational buying (see below) of the asset (exchanging for .

-

2.

The second move consist in a random selling of the purchased in the first move amount of the asset (exchanging for ).

By rational buying we mean a purchase bound by a fixed withdrawal price that is such a logarithmic quotation for the asset , , above which the trader gives the buying up. A random selling can be analogously identified with the situation when the withdrawal price is set to (the trader in question is always bidding against the rest of traders). The order of these transactions can be reversed and, in fact, is conventional. Note that he quotation method does not matter to the discussed process as long as it can be repeated many times. Let and denote some given amounts of the asset and the money, respectively. If at some time the assets are exchanged in the proportion then we call the number

| (6) |

the logarithmic quotation for the asset . If the trader buys some amount of the asset at the quotation at the moment and sells it at the quotation at the later moment then his profit (or more precise the logarithmic rate of return) will be equal to

| (7) |

The logarithmic rate of return, contrary to , does not depend on the choice of unit used to measure the assets in question. From the projective geometry point of view [4], is an invariant and is not, cf the discussion of demand and supply curves in Sec. 2.3. Let us suppose now that the model describes a stationary process, that is the probability distribution of the random variable (the logarithmic quotation) does not depend on time. Note that it is sufficient to know the logarithmic quotations up to arbitrary constant because what matters is the profit and profit is always a difference of quotations. This is analogous with the classical physics (eg Newton’s gravity) where only differences of the potential matter. Therefore we suppose that the expectation value of the random variable is equal to zero, . In addition, we also suppose that the market is large enough not to be influenced by the activity of our trader. Let the expression takes value 0 or 1 if the is false or true, respectively (Iverson convention) [17]. The mean time of a random transaction (buying or selling) is denoted by . The value of is fixed in our model due to the stationarity assumption. Besides, to eliminate paradoxes (e.g. infinite profits during finite time spreads) should be greater than zero. Let denote the probability that the rational buying does not occur:

| (8) |

The expectation value of the rational buying time of the asset is equal to

| (9) |

The ratio of the expected value of the duration of the whole buying-selling cycle () and the expected time of a random reverse transaction () is given by

Therefore the mean duration of the whole cycle is given by

| (10) |

The logarithmic rate of return for the whole cycle is

| (11) |

where the random variable (quotation at the moment of purchase) has the distribution restricted to the interval :

| (12) |

The random variable (quotation at the moment of selling) has the distribution , as the selling is at random. The expectation value of the of the profit after the whole cycle is555 should not be mistaken for the profit intensity also denoted by , cf eq. 2. They differ by a factor equal to the (inverse) average cycle duration.

| (13) |

which follows from Eqs 5 and 11. This function has very interesting properties (we will often drop the subscript in the following text). First we quote [2]:

Theorem

The maximal value of the function lies at a fixed point of that is fulfills the condition

| (14) |

Such a fixed point exists and 666It tempting to claim that the function is a contraction but it is not the case. Simple inspection reveals that if the probability has a very narrow and high maximum then is not a contraction in the vicinity of the maximum. Fortunately, for any realistic probability density one can start at any value of and by iteration wind up in the fixed point (c.f. Banach fixed point theorem). We skip the details because they are technical and unimportant for the conclusions of the paper..

Example

For the standard normal distribution with the variance and expectation value of a random variable

| (15) |

the expectation value of the profit during a whole cycle (we have explicitly shown the dependence on the variance ) has a nice scaling property:

| (16) |

and it is sufficient to work out the

case only. If this is the case we get the maximal

expectation value of the profit for . Therefore,

according to Theorem 1, the maximal expected profit is also equal

to . Recall that in our normalization this price is

.

The fixed point theorem recommends the following simple market strategy that maximize the trader’s expected profit on an effective market: accept profits equal or greater than the one you have formerly achieved on average during the characteristic time of transaction which is, roughly speaking, an average time spread between two opposite moves of a player (e.g. buying and selling the same asset). Unfortunately, such strategy recommendations still involves some important subjective factors that reflect personal or even instantaneous attitude towards market state.

-

•

Would a change of information measure for market strategies result in interesting recommendations?

-

•

Does different measures of information content results in different trading recommendations?

-

•

Are there more useful (convenient?) information measures than the Boltzmann/Shannon one?

2.3 The demand and supply curves

The textbooks on economics abounds in graphs and diagrams presenting various demand and supply curves777Blaug [18] quotes at least a hundred of such diagrams.. This illustrates the importance the economists attach to them despite that the whole idea supply/demad profiles has serious drawbacks, both theoretical and practical [19]. Such approach is also possible within the MM model. To this end let us consider the functions (the subscripts and denote supply and demand, respectively)

| (17) |

and

| (18) |

where we have introduced two, in general case different, probability distribution and . They may differ due to the existence of a monopoly, specific market regulations, taxes, cultural habits and so on. Let us recall that two methods of presenting demand/supply curves prevail in the literature. The first one (the Cournot convention) is based on the assumption that the demand is a function of prices. The Anglo-Saxon literature prefers the Marshall convention with reversed roles of the coordinates. The demand supply or profile is not not always a monotonic function of prices (c.f. the discussed below on the turning back of demand/supply curves) therefore the Marshall convention seems to be less convenient as one cannot use the notion of a function. The MM model with the price-like parameter refers to the Cournot convention. Therefore, for a given value of the logarithm of the price of an asset , the value of the supply function is given by the probability of the purchase of a unit of at the price . The asset could be provided by anyone who is willing to sell it at the price or lower. The function can be defined analogously. If we neglect the sources of possible differences between and and, in addition, suppose that at any fixed price there are no indifferent traders (that is everybody wants to sell or buy888That is w we consider only active agents.) then we can claim that

| (19) |

The differentiation of Eq. 19 leads to . Under these conditions the price for which establishes the equilibrium price (actually, the most frequent one).

2.4 The projective geometry point of view

The model has a natural setting in the projective geometry formalism [4]. In this approach the market is described in the dimensional real projective space, that is dimensional vector space (one real coordinate for each asset) subjected to the equivalence relation for and . That is we assume infinite divisibility of assets. Actually, a finite field approximation is possible [14, 15] - this problem will be discussed elsewhere. For example we identify all portfolios having assets in the same proportions. The actual values can be obtained by rescaling by . The details could be found in ref. [4]. In this context separate profits gained by buying or selling are not invariant (coordinate free) but there is an invariant: anharmonic ratio of four points. For example for exchange ratio it gives the relative change of quotation:

The profit gained during the whole cycle is given by the logarithm of an appropriate anharmonic ratio (see below) is invariant (e.g. its numerical value does not depend on units chosen to measure the assets). In the space this anharmonic ratio denoted by concerns the pair of points:

and the pair . The last pair results from the crossing of the hypersurfaces and corresponding to the portfolios consisting of only one asset or , respectively and the line . The dots represent other coordinates (not necessary equal for both points). The line connecting and may be represented by the one-parameter family of vectors with coordinates given by

This implies that the values of corresponding to the points and are given by the conditions:

and

Substitution of Eq. (26) leads to

and

The calculation of the logarithm of the cross ratio on the line leads to

which corresponds to the formula (7).

Let us look more closely at the problem of trading in single asset. Consider

for:

| (20) |

and the points i given by crossing of the prime and one-asset portfolios: i corresponding to assets and . The logarithm of the cross ratio on the straight line is equal to:

| (21) | |||||

| (22) |

Contrary to the classical economics the balance in the MM model does not result in uniform quotations (prices) for the asset but only in a stationarity of the supply and demand functions and . Therefore the MM model is not valid when the changes in the probabilities happens during periods shorter or of the order of the mean time transaction . Fortunately, the presented above stochastic interpretation of the supply and demand profiles of agents remains valid in such situations. Moreover, we can consider piecewise decreasing functions and . These function cease to be probability distribution functions because their derivatives (probability densities) are not positive definite. This generalization corresponds to the effect of turning back of the supply and demand curves what often happens for work supplies and, in general, for the so called the Giffen goods [11, 12]. In the Marshall convention these curves are not diagrams of functions at all and in the Cournot convention these curves are diagrams of multivalued functions. Note that in this way not positive definite probability densities (eg. Wigner functions) gain interesting economics reason for their very existence[20].

2.5 Strategy selection

By a choice of stochastic process consistent with the MM model one can determine the dynamics of such a model, c.f. Ref. [21]. Therefore we suspect that the departure from the laws of supply and demand might be the first known example of a macroscopic reality governed by quantum-like rules [22]. Such hypothetical quantum-like economics could have started with the evidence given by Robert Giffen in the British Parliament [11] and actually could have earlier origin than the quantum physics. It should be noted here that from the quantum game theory point of view the Gauss distribution function is the only supply (demand) curve that fulfills the physical correspondence principle. The authors would devote a separate paper to this very interesting problem.

Let us note that the distribution functions allow for correct description of the famous Zeno paradoxes (when grains form a pile? when you start to be bald?) because the introduction of probabilities removes the original discontinuity. For example the problem of morally rightness of prices: if the price is low (state 0) nobody wants to sell and if the price is high (state 1) everybody wants to sell. Without the probability theory we are not able to describe intermediate states which, in fact, are typical on the markets. Does it suggest that the MM model can also be applied to problems where there is a necessity of finding maximum (minimum) of a profit intensity like parameter?

3 Subjective character of market demand

The probability distribution that describes the Rest of the World strategy in the game against a single agent (Alice) is de facto of transcendental nature: agents finalizing a deal can only observe (measure) its results as values of execution prices in a way that harks back to Plato’s distinction between the idealized form of a thing and its imperfect realization in our world as if by a shadow of the form in Plato’s Cave. They might erroneously think that the shadows are ”real” and not just projections of the outside world. Note that the problem is common [23]. Therefore, as statistical physics and Shannon’s information theory teach us, the best they can do is to approximate be the appropriate Gibbs distribution following from the minimum of their knowledge (information), that is the maximum of their information entropy, constrained by the known market parameters. In the analysis of the effectiveness of strategies the distribution function has to be replaced by its ”shadow”. Let us denote the ”shadow” distribution function by . The key problem is that the concrete form of strongly depends on the adopted model of information gathering, data mining and information measures being used. In this paper we propose to select Boltzmann/Shannon information entropy to this end. Of course, there are other interesting alternatives and the conclusion concerning the shape of ) might differ in a dramatic way! We will refer to the class of assumptions regarding market, measures of information, data mining, utility functions and so on adopted by the agent (Alice) in the process of determining as Alice’s imaginoscope (Alice’s wall in Plato’s Cave).

3.1 The model

Consider the simplest case when the domain of one-side bounded. The assumption that the selling prices are bounded below (and buying prices bonded above) could by justified by, for example, the principle of rational production (one does not sell at prices below production costs), the existence of minimal salary, regulation concerning usury etc. In addition, let us assume that Alice uses the minimal number of estimates (that is one) for . The obvious one is the probability of making the deal (Iverson convention). As we assumed that the support of is bounded below, say by 0, for an effective reconstruction of the measure she needs at least one unbounded observable. Therefore, instead of the used in the quantum-like approaches variables [24, 25] we will use the observable of surpassing the minimal return rate for Alice . Under these assumptions we get the following Gibbs-like distribution function for the shadow random variable :

| (23) |

For this specific distribution, it follows that the Lagrange multiplier with the value fixed for the expectation value takes the functional form of the logarithm of the withdrawal price scaled by the factor equal to the ratio of average number of transactions and the average number of transaction that have not been finalized:

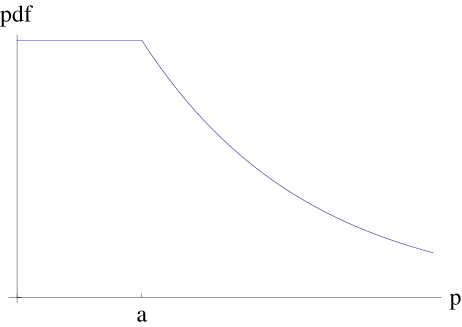

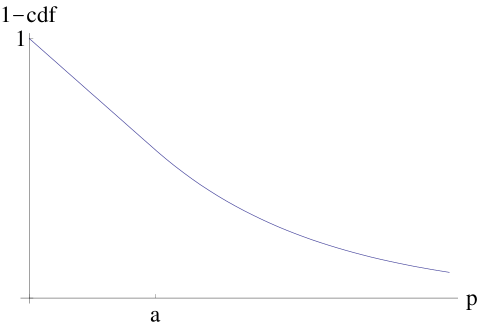

According to the Laplace indifference principle, for prices up to the value the probability of closing the deal is constant (Alice does not sell) and for higher the probability distribution is exponential. The corresponding market demand function (according to Alice’s imaginoscope!) is presented in Fig.3.

Note that we can observe (see Fig.3) that the localization of becomes obscure due to the ”continuous character” of the line tangent to the plot. The demand decreses monotonously as prices approach and then exponentially!a strategy that maximizes profit. By inserting into Eq. [13] as the probability distribution and then into the formula [14] for the fixed point of we obtain the condition under which Alice profit is maximal:

| (24) |

After integration and simple manipulations the condition reduces to the very simple formula for the probability of making transactions:

In the case of a bounded support of the demand the probability of making an optimal transaction for the most profitable (golden) Alice strategy is about 0.62. Due to the obvious symmetry of the model with respect to the involution , the solutions and conclusions for the Rest of the World supply and Alice demand profiles are analogous.

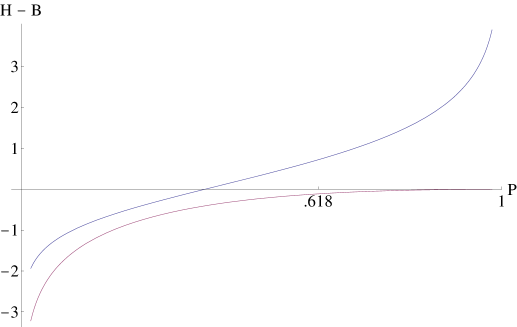

3.2 Measures of information content of marker shadows

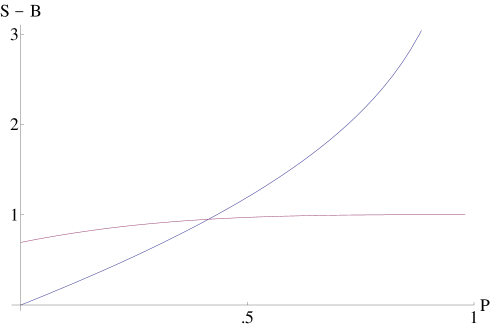

If we apply the (continuous form) formula for Boltzmann/Shanonn entropy

to subjective projection of market supply probability distribution we obtain expression for the entropy of the knowledge about market gathered by the agent, say Alice, during transactions initiated by her strategy . Fig. 4 presents plots of the function , the relative entropy corrected by the terms (blue) and (red), respectively. The market entropy calculated modulo the expectation value of the logarithmic return varies in an unimportant way in the whole domain of . This is not accidental. We have already advocated [2, 4] advantages of using logarithms of mean rates. We see that it a quite good approximation as a measure of information available about markets.

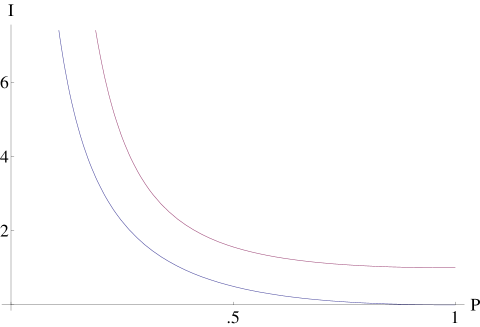

Unfortunately, the relative entropy B/S has one unpleasant feature: depending on the choice of the parameter (constraint), substantial changes could be observed c.f. Fig. 4. Nevertheless, abiding by this measure of information, we can use Fisher information for information content valuation while selecting strategies (that is determining the subjective form of ):

| (25) |

Plots of modified by the corresponding factors (i.e. units) (blue line) and (red line) are presented in Fig. 5.

Now, both curves became similar. The observed decrease in while increases is caused by dominating contribution of the integral over the ignored by Alice domain to expression , where the probability distribution is constant. Acceptation of Fisher information (25) as the measure of information results in smaller susceptibility to subjective changes in attitudes. This situation suggests that a completely new approach based on Fisher information might be more appropriate. Such approach is described in Ref. [26]. Note that it is possible to modify formula for information (general -dimensional case):

| (26) |

to get a new entropy measure that is consistent with Fisher information in the sense that it generates the same extrema of . But, in addition, it has the property of being sum of two terms of which the first depends only on or (constraint entropy) and the second depends only on the probability . This constraint entropy is identical to the Boltzmann/Shanonn constraint entropy. We present in Fig. 6 the curves that correspond to plots given in Fig. 4. The model based on maximization of Boltzmann/Shannon entropy seems to be reliable below the extremal value (c.f. Fig. 6) but for market games with higher probabilities of buying by WR we envisage that the model based on extremum of the entropy would be better.

4 Conclusions

Searching optimal solutions and fixed points are the key issues of contemporary mathematical economics and finance [27]. Such classical results as generalized Brouwer theorem [28] and the Brown-Robinson iteration procedure [29] are widely applied and useful tools. The model presented in this paper model combines both ideas with the information theoretical approach. The extension of the MM model to the randomized withdrawal price cases which might also generalize the results of [30, 31] where thermodynamics of investors was considered and the temperature of portfolios was defined. The emergence of the golden ratio as a characterization of the inclinations towards concluding deals of the most wealthy agents is astonishing! This condition sets a sharp criterion of validity of the model and can be tested with real markets data. Is this simply a coincidence or there is a deeper connection between these algorithms? There is no obvious answer to this question. The golden ratio emerges also in the most efficient algorithm for finding extremum of convex functions on a segment [32, 33]. It turns out that in the market game, the biggest of games, we can find traces of the golden ratio, so abundant in other phenomena: an excellent source of bibliography can be found in The Fibonacci Quarterly, the official journal of the Fibonacci Association.

Acknowledgments This work was supported by the scientific network Laboratorium Fizycznych Podstaw Przetwarzania Informacji sponsored by the Polish Ministry of Science and Higher Education (decision no 106/E-345/BWSN-0166/2008).

References

References

- [1] Billingsley R 1979 Probability and Measure (New York: J. Wiley and Sons 1995)

- [2] Piotrowski E W and Sładkowski J 2003 Physica A 318 496

- [3] Piotrowski E W and Sładkowski J 2004 The next stage: quantum game theory, in Charls V Benton (ed) Mathematical Physics Frontiers (New York: Nova Science Publishers, Inc.)

- [4] Piotrowski E W and Sładkowski J 2007 Physica A 382 228

- [5] Aerts D and Czachor M 2004 Journal of Physics A: Math. Gen. 37 L123

- [6] Haven E 2002 Physica A 304 507

- [7] Khrennikov A Yu 2007 Quantum-like Probabilistic Models outside Physics Preprint arXiv:physics/0702250v2 [physics.gen-ph]

- [8] Khrennikov A Yu and Haven E 2007 AIP Conf. Proc. 889 299

- [9] Piotrowski E W and Sładkowski J 2003 Int. J. Quant. Information 1 395

- [10] Yukalov V I and Sornette D 2008 Quantum Decision Theory Preprint arXiv:0802.3597v1 [physics.soc-ph]

- [11] Stigler G J 1947 J. Polit. Economy 55 152

- [12] Sładkowski J 2003 Physica A 324 234

- [13] Frieden B R 2004 Science from Fisher Information: A Unification (Cambridge: Cambridge University Press)

- [14] Kustaanheimo P Comment. Phys.-Math. Soc. Sc. Fenn. XV. 19 (1950) 1

- [15] Järnefelt G Annales Ac. Sc. Fennicae A I. Math.-Phys. 96 (1951) 1

- [16] Resnick S I 1998 A Probability Path (Birkhauser, Boston)

- [17] Graham R L, Knuth D E, and Patashnik O 1994 Concrete Mathematics (Reading: Addison-Wesley)

- [18] Blaug M 1985 Economic Theory in retrospect (Cambridge University Press, Cambridge)

- [19] Osborn M F M 2001 The Stock market and Finance from the Physicist’s Point of View (Minneapolis: Crossgar Press)

- [20] Feynman R P 1987 Negative Probabilities in Quantum Mechanics in Quantum Implications, Essays in Honour of D. Bohm Eds Hiley B J and Peat F D (London: Routledge & Kegan Paul)

- [21] Blaquiere A 1980 Wave Mechanics as a Two-Player Game in Dynamical Systems and Microphysics (New York: Springer-Verlag)

- [22] Piotrowski E W and Sładkowski J (2004) Quantitative Finance 4 61.

- [23] Polyakov A M The wall of the cave Preprint hep-th/9809057

- [24] Piotrowski E W and Sładkowski J 2002 Physica A 308 391

- [25] Piotrowski E W and Sładkowski J 2003 Physica A 312 208

- [26] Piotrowski E W and Sładkowski J 2008 A model of subjective supply-demand: the minimum Fisher of information solution talk given at the SIGMAPHI 2008 conference, submitted to Central European Journal of Physics

- [27] Debreu G 1981 in Handbook of Mathematical Economics vol. II Eds Arrow K J and Intriligator M D (Amsterdam: Elsevier Science)

- [28] Kakutani S 1941 Duke Math. J. 8 457

- [29] Robinson J 1951 Ann. Math. 54 296

- [30] Piotrowski E W and Sładkowski J 2001 Acta Phys. Pol. B32 597

- [31] Piotrowski E W and Sładkowski J 2001 Physica A 301 441

- [32] Kiefer J 1953 Proceedings of the AMS 4 502

- [33] Vorobiev N N 2002 Fibonacci Numbers (Basel: Birkhäuser Verlag)