Skewness Premium with Lévy Processes††thanks: We thank seminar participants at École Polytechnique, HEC Paris, Universität de Barcelona, IMPA, PUC-Rio, Universität de Navarra, Séminaire Groupe Parisien Bachelier. The ususal disclaimer applies

Abstract

We study the skewness premium (SK) introduced by

\citeasnounBates91 in a general context using Lévy Processes.

Under a symmetry condition \citeasnounFajardoMordecki2006b

obtain that SK is given by the Bate’s rule. In this paper we

study SK under the absence of that symmetry condition. More

exactly, we derive sufficient conditions for SK to be positive, in

terms of the characteristic triplet of the Lévy Process under the

risk neutral measure.

Keywords: Skewnes Premium; Lévy Processes.

JEL Classification: C52; G10

First draft 05/10/06

1 Introduction

The stylized facts of option prices have been studied by many

authors in the literature. An important fact from option prices is

that relative prices of out-of-the-money calls and puts can be

used as a measure of symmetry or skewness of the risk neutral

distribution. \citeasnounBates91, called this diagnosis

“skewness premium”, henceforth SK. He analyzed the behavior of

SK using three classes of stochastic processes: Constant

Elasticity of Variance (CEV), Stochastic Volatility and

Jump-diffusion. He found conditions on the parameters for the SK

be positive or

negative.

But, as many models in the literature have shown, the behavior of

the assets underlying options is very complex, the structure of

jumps observed is more complex than Poisson jumps. They have

higher intensity, see for example \citeasnounYacine2004. For

that reason diffusion models cannot consider the discontinuous

sudden movements observed on asset prices. In that sense, the use

of more general process as Lévy processes have shown to provide

a better fit with real data, as was reported in

\citeasnounCarrWu04 and \citeasnounEberleinKellerPrause98. On

the other hand,

the mathematical tools behind these processes are very well

established and known.

When the underlying follows a Geometric Lévy Process,

\citeasnounFajardoMordecki2006b obtained a relationship between

calls and puts, that they called Put-Call duality and

obtain as a particular case the Put-call symmetry, and

obtain that SK is given by the Bate’s rule. The Put-Call duality has important applications, in particularly the Put-Call symmetry, as \citeasnounBC94 and \citeasnounCEG98 show using symmetry we can construct stactic hedges for exotic options..

In this paper we study the SK under absence of symmetry and

obtain sufficient conditions for the excess of SK be positive or

negative. The main idea behind the proofs is to exploit the

monotonicity property of option prices with respect to some

parameter of the Lévy measure. This monotonicity is not an easy task, monotonicity with respect to the intensity parameter of

the jump have been recently address by \citeasnounEkstromTysk05, while the monotonicity with respect

to the symmetry parameter have not been totally addressed in previous works.

A particular answer is given for the case of GH distributions in

\citeasnounBergenthum07.

The paper is organized as follows: in Section 2 we introduce the Lévy processes and we present the duality results. In Section 3 we discuss market symmetry and present our main results. In Section 4 we study the skewness premium. Section 5 discuss monotonicity with respect to the symmetry parameter and Section 6 concludes.

2 Lévy processes and Duality

Consider a real valued stochastic process , defined on

a stochastic basis , being càdlàg, adapted, satisfying

, and such that for the random variable

is independent of the -field , with

a distribution that only depends on the difference . Assume

also that the stochastic basis satisfies the usual

conditions (see \citeasnounjacodShiryaev87). The process is

a Lévy process, and is also called a process with stationary

independent increments (PIIS). For general reference on Lévy

processes see \citeasnounjacodShiryaev87,

\citeasnounSkorokhod91, \citeasnounBertoin96,

\citeasnounSato99. For Lévy process in Finance see \citeasnounBL02, \citeasnounSchoutens2003 and \citeasnounCT04.

In order to characterize the law of under , consider, for the Lévy-Khinchine formula, that states

| (1) |

with

a fixed truncation function, and real

constants, and a positive measure on

such that , called the

Lévy measure. The triplet is the

characteristic triplet of the process, and completely

determines its law.

Consider the set

| (2) |

The set is a vertical strip in the complex plane, contains the line , and consists of all complex numbers such that for some . Furthermore, if , we can define the characteristic exponent of the process , by

| (3) |

this function is also called the cumulant of , having for all , and . The finiteness of this expectations follows from Theorem 21.3 in \citeasnounSato99. Formula (3) reduces to formula (1) when .

2.1 Lévy market

By a Lévy market we mean a model of a financial market with two assets: a deterministic savings account , with

where we take for simplicity, and a stock , with random evolution modelled by

| (4) |

where is a Lévy process.

In this model we assume that the stock pays dividends, with

constant rate , and that the given probability

measure is the chosen equivalent martingale measure. In other

words, prices are computed as expectations with respect to

, and the discounted and reinvested process is a -martingale.

In terms of the characteristic exponent of the process this means that

| (5) |

based on the fact, that , and condition (5) can also be formulated in terms of the characteristic triplet of the process as

| (6) |

In the case, when

| (7) |

where is a Wiener process, we obtain the

Black–Scholes–Merton (1973) model (see

\citeasnounBlackScholes73,\citeasnounMerton73).

In the market model considered we introduce some derivative assets. More precisely, we consider call and put options, of both European and American types. Denote by the class of stopping times up to a fixed constant time , i.e:

Then, for each stopping time we introduce

| (8) | ||||

| (9) |

In our analysis (8) and (9) are auxiliary quantities, anyhow, they are interesting by themselves as random maturity options, as considered, for instance, in \citeasnounSchroder99 and \citeasnounDetemple01. If , formulas (8) and (9) give the price of the European call and put options respectively.

2.2 Put Call duality and dual markets

Lemma 2.1 (Duality).

Proof.

See \citeasnounFajardoMordecki2006b. ∎

The above Duality Lemma motivates us to introduce the following market model. Given a Lévy market with driving process characterized by in (3), consider a market model with two assets, a deterministic savings account , given by

and a stock , modelled by

where is a Lévy process with characteristic exponent under given by in (11). The process represents the price of dollars measured in units of stock . This market is the auxiliary market in \citeasnounDetemple01, and we call it dual market; accordingly, we call Put–Call duality the relation (10). It must be noticed that \citeasnounPeskirShiryaev2001 propose the same denomination for a different relation. Finally observe, that in the dual market (i.e. with respect to ), the process is a martingale. As a consequence, we obtain the Put–Call symmetry in the Black–Scholes–Merton model: In this case , we have no jumps, and the characteristic exponents are

and relation (10) is the result known as put–call symmetry. In the presence of jumps like the jump-diffusion model of \citeasnounMerton76, if the jump returns of under and under have the same distribution, the Duality Lemma, implies that by exchanging the roles of by and by in (10) and (12), we can obtain an American call price formula from the American put price formula. Motivated by this analysis we introduce the definition of symmetric markets in the following section.

3 Market Symmetry

It is interesting to note that in a market with no jumps (i.e. in the Black-Scholes model), the distribution of the discounted and reinvested stock both in the given risk neutral and in the dual Lévy market, taking equal initial values, coincide. It is then natural to define a Lévy market to be symmetric when this relation hold, i.e. when

| (13) |

meaning equality in law. Otherwise we call trhe Lévy market Assymetric. In view of (12), and due to the fact that the characteristic triplet determines the law of a Lévy processes, we obtain that a necessary and sufficient condition for (13) to hold is

| (14) |

This ensures , and from this follows , giving (13), as we always have . As pointed out by \citeasnounFajardoMordecki2006b condition (14) answers a question raised \citeasnounCarrChesney96. With this condition in mind we can obtain the following result.

Corollary 3.1 (Bates’ % Rule).

Proof.

Follows directly from Lemma 2.1. Since and . ∎

From here calls and puts at-the-money () should have the same

price. As we mention this rule, in the context of Merton’s

model was obtained by \citeasnounBates97. That is, if the call

and put options have strike prices out-of-the money relative

to the forward price, then the call should be priced higher

than

the put.

3.1 Empirical Evidence of Symmetry

In \citeasnounFajardoMordecki2006b several concrete models proposed in the literature are reviewed. More exactly, Lévy markets with jump measure of the form

| (16) |

where is a symmetric measure, i.e.

, everything with respect to the risk

neutral measure .

As a consequence of (14),

\citeasnounFajardoMordecki2006b found that the market is

symmetric if and only if . Then, as we have seen when

the market is symmetric, the skewness premium

is obtained using the rule.

Although from the theoretical point of view the assumption (16) is a real restriction, most models in practice share this property, and furthermore, they have a jump measure that has a Radon-Nikodym density. In this case, we have

| (17) |

where , i.e. the function is even. More

precisely, all parametric models that we found in the literature,

in what concerns Lévy markets, including diffusions with jumps,

can be reparametrized in the form (17):

The Generalized Hyperbolic model proposed by

\citeasnounEberleinPrause2000, The Meixner model proposed by

\citeasnounScoutens2001 and The CGMY model proposed by

\citeasnounCGMY02. Recently, \citeasnounFajardomordecki2007 shows that under some conditions the Time Changed Brownian motion with drift is also included in this class. Then, they show

that the resulting processes will satisfy the above symmetry if and only if the drift equal -1/2.

Using the risk neutral market measure and the Esscher transform

measure as EMM, \citeasnounFajardoMordecki2006b obtain evidence

that empirical risk-neutral markets are not symmetric. Then, the

question naturally arises: How to obtain a Put-call symmetry,

under absence of symmetry? In what follows we try to answer this question.

Henceforth take . We need the following assumption

Assumption 1.

Option prices are monotonic with respect to the symmetry parameter .

Our main result is stated as follows.

Theorem 3.1.

Proof.

We have that

Then, has of . By monotonicity

were the last equality is obtained from duality and the fact that .

The same can be obtained if put prices were decreasing on , we have: implies

∎

Remark 3.1.

In the particular case of the GH distributions Assumption 1, can be guaranteed by Th. 4.2 in \citeasnounBergenthum07.

3.2 Diffusions with jumps

Consider the jump - diffusion model proposed by \citeasnounMerton76. The driving Lévy process in this model has Lévy measure given by

and is direct to verify that condition (14) holds

if and only if . This result was obtained by

\citeasnounBates97 for future options, that result is obtained

as a

particular case.

Note that in that model , so we obtain that sufficient conditions can be replaced by , as also \citeasnounBates97 found.

4 Skewness Premium

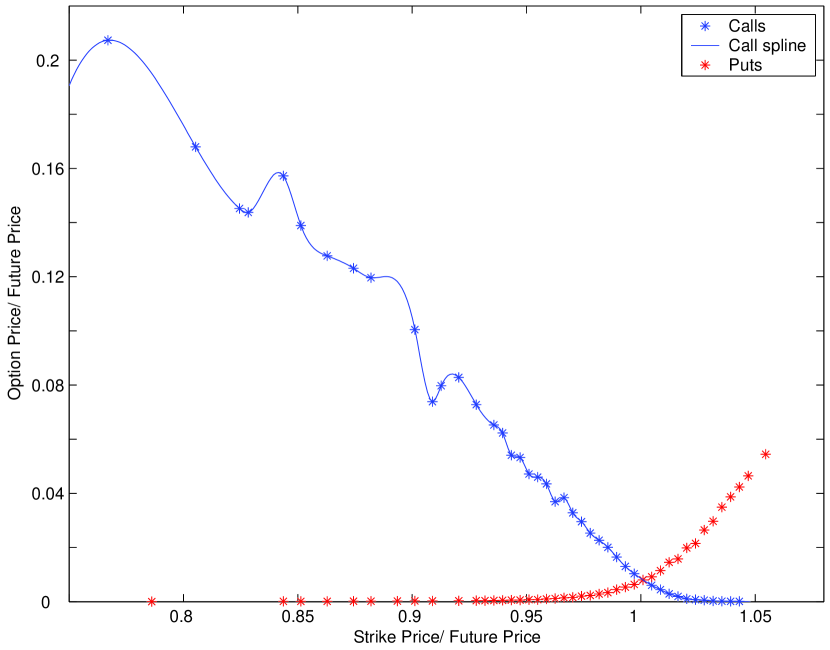

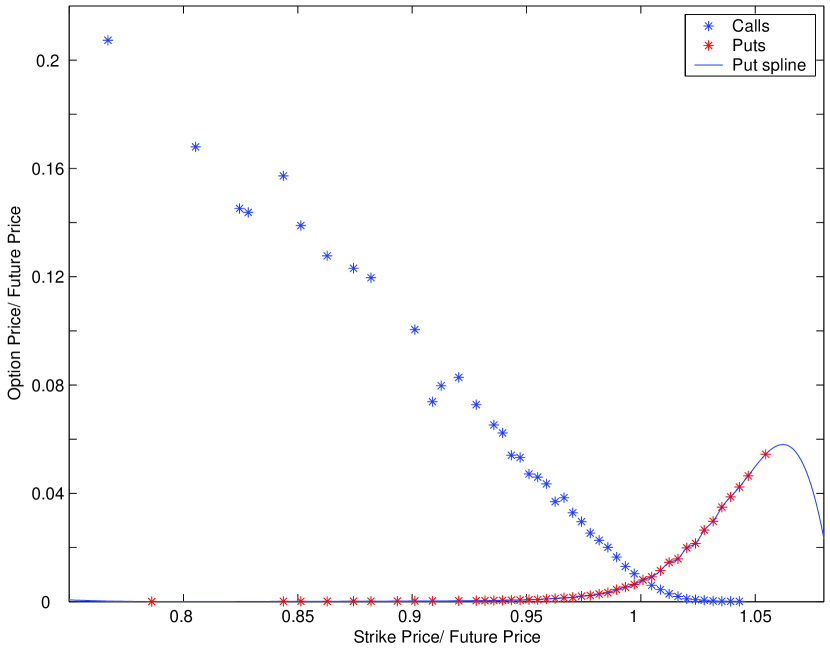

In order to study the sign of SK, lets analyze the following data on

S&P500 American options in 08/31/2006 that matures in 09/15/2006

with future price . To verify if the Bates’ rule holds we

need to interpolate some non-observed option prices. To this end we

use a cubic spline, as we can see in

Fig. 1.

The Skewness Premium is defined as the

percentage deviation of OTM call prices from OTM put

prices. The interpolating calls and put prices for the

non-observed strikes are presented in Tables 1 and 2 at the end.

We can see in both tables that this rule does not hold. Moreover,

for OTM options usually , what implies and for ITM options, ,

implying .

| 1230 | 1382.07 | -0.05662 | 0.050681 | -0.1073 |

|---|---|---|---|---|

| 1235 | 1376.475 | -0.05278 | 0.13642 | -0.1892 |

| 1240 | 1370.925 | -0.04895 | 0.115006 | -0.16395 |

| 1245 | 1365.419 | -0.04511 | 0.197696 | -0.24281 |

| 1250 | 1359.957 | -0.04128 | 0.277944 | -0.31922 |

| 1255 | 1354.539 | -0.03744 | 0.280729 | -0.31817 |

| 1260 | 1349.164 | -0.03361 | 0.536286 | -0.5699 |

| 1265 | 1343.831 | -0.02977 | 0.574983 | -0.60476 |

| 1270 | 1338.541 | -0.02594 | 0.606719 | -0.63266 |

| 1275 | 1333.291 | -0.0221 | 0.675372 | -0.69748 |

| 1280 | 1328.083 | -0.01827 | 0.691325 | -0.70959 |

| 1285 | 1322.916 | -0.01443 | 0.966306 | -0.98074 |

| 1290 | 1317.788 | -0.0106 | 0.904839 | -0.91544 |

| 1295 | 1312.7 | -0.00676 | 0.794059 | -0.80082 |

| 1300 | 1307.651 | -0.00293 | 0.78018 | -0.78311 |

| 1305 | 1302.641 | 0.000905 | 0.614561 | -0.61366 |

| 1310 | 1297.669 | 0.00474 | 0.532798 | -0.52806 |

| 1315 | 1292.735 | 0.008575 | 0.427299 | -0.41872 |

| 1320 | 1287.838 | 0.01241 | 0.108911 | -0.0965 |

| 1325 | 1282.979 | 0.016245 | -0.11658 | 0.132826 |

| 1330 | 1278.155 | 0.020079 | -0.45097 | 0.471053 |

| 1335 | 1273.368 | 0.023914 | -0.50378 | 0.527697 |

| 1340 | 1268.617 | 0.027749 | -0.61306 | 0.640807 |

| 1345 | 1263.901 | 0.031584 | -0.73872 | 0.770305 |

| 1350 | 1259.22 | 0.035419 | -0.81448 | 0.849896 |

| 1355 | 1254.573 | 0.039254 | -0.80297 | 0.842224 |

| 1360 | 1249.961 | 0.043089 | -0.82437 | 0.867454 |

| 1250 | 1359.957 | 0.043056 | -0.88837 | 0.931421 |

|---|---|---|---|---|

| 1255 | 1354.539 | 0.0389 | -0.86897 | 0.907873 |

| 1260 | 1349.164 | 0.034778 | -0.85655 | 0.891331 |

| 1265 | 1343.831 | 0.030688 | -0.78107 | 0.81176 |

| 1270 | 1338.541 | 0.02663 | -0.70531 | 0.731941 |

| 1275 | 1333.291 | 0.022604 | -0.63926 | 0.661869 |

| 1280 | 1328.083 | 0.018609 | -0.51726 | 0.535865 |

| 1285 | 1322.916 | 0.014646 | -0.31216 | 0.326801 |

| 1290 | 1317.788 | 0.010713 | -0.20329 | 0.214005 |

| 1295 | 1312.7 | 0.006811 | -0.03659 | 0.043397 |

| 1300 | 1307.651 | 0.002938 | 0.090739 | -0.0878 |

| 1305 | 1302.641 | -0.0009 | 0.130843 | -0.13175 |

| 1310 | 1297.669 | -0.00472 | 0.252541 | -0.25726 |

| 1315 | 1292.735 | -0.0085 | 0.261905 | -0.27041 |

| 1320 | 1287.838 | -0.01226 | 0.242817 | -0.25507 |

| 1325 | 1282.979 | -0.01598 | 0.346419 | -0.3624 |

| 1330 | 1278.155 | -0.01968 | 0.183207 | -0.20289 |

| 1335 | 1273.368 | -0.02336 | 0.237999 | -0.26135 |

| 1340 | 1268.617 | -0.027 | 0.145858 | -0.17286 |

| 1345 | 1263.901 | -0.03062 | 0.152637 | -0.18325 |

| 1350 | 1259.22 | -0.03421 | 0.101211 | -0.13542 |

| 1355 | 1254.573 | -0.03777 | -0.03964 | 0.001869 |

| 1360 | 1249.961 | -0.04131 | 0.028337 | -0.06965 |

| 1365 | 1245.382 | -0.04482 | -0.0101 | -0.03472 |

| 1375 | 1236.325 | -0.05177 | -0.0451 | -0.00667 |

Then we want to know for what distributional parameter values we can capture the observed vies in these option price ratios. To this end we use the following definition introduced by \citeasnounBates91.

| (19) |

where .

The SK was addressed for the following stochastic processes: Constant Elasticity of Variance (CEV), include arithmetic and geometric Brownian motion. Stochastic Volatility processes, the benchmark model being those for which volatility evolves independently of the asset price. And the Jump-diffusion processes, the benchmark model is the Merton’s (1976) model. For that classes \citeasnounBates96 obtained the following result.

Proposition 1 (\citeasnounBates96).

For European options in general and for American options on futures, the SK has the following properties for the above distributions.

-

i)

for CEV processes with .

-

ii)

for jump-diffusions with log-normal jumps depending on whether .

-

iii)

for Stochastic Volatility processes depending on whether .

Now in equation (19) consider

Then,

-

iv)

for CEV processes only if .

-

v)

for CEV processes only if .

When is small, the two SK measures will be approx. equal. For in-the-money options , the propositions are reversed. Calls in-the-money should cost less than puts in-the-money.

Proof.

See \citeasnounBates91. ∎

Now using Th. 3.1, we can extend Bates’ result to Lévy processes.

Proposition 2.

Consider Lévy measures given by (16). Under Assumption 1, we have

And from here we obtain the sign of the excess of skewness premium for a huge class of Lévy processes.

5 Monotonicity and Symmetry Parameter

As we have seen in the last section we need

the monotonicity of option prices with respect to the symmetry

parameter to obtain our main result. The literature had study

extensively the monotonicity properties of option prices. The main

idea is to exploit the convexity preserving

property111We say that a model is convexity

preserving, if for any convex contract function, the

corresponding price is convex as a function of the price of the

underlying asset at all times prior to maturity. Many models do

not satisfy this property as for example general stochastic

volatility models., to obtain the monotonicity of option prices

with respect to certain

parameter of the model. See \citeasnounBGW96, \citeasnounElkarouiJS98 and \citeasnounEkstromTysk05.

On the other hand, this question is very related to the

ordering of option prices by changing the equivalent martingale measure. That is, imposing conditions on

the predictable characteristic of the underlying process, an ordering in option prices with respect to the equivalent

martingale measures is established, see \citeasnounBellamy00, \citeasnounHendersonHobson03, \citeasnounHenderson05, \citeasnounJakubenas2002, \citeasnounGuschinMordecki02 and \citeasnounBergenthum06.

But we are interested in the possible mispecification in the models when using a fixed equivalent martingale measure. That is, if we change the parameter on the Lévy measure described by (16) what happen with the option price. To answer partially that question, we can apply Lemma 5.1 in \citeasnounGuschinMordecki02 for a certain group of Lévy measures (16), that is if the Lévy measure satisfy the assumptions of that lemma, we obtain and order in option prices. Then, Assumption 1 will be satisfied.

6 Conclusions

Under a given risk neutral probability measure. We use a measure

of symmetry, introduced by

\citeasnounFajardoMordecki2006b, to address the Skewness premium

under absence of symmetry. First, we analyze the sign of the

Skewness premium using data

from S&P500 and we obtain evidence that Bates’ rule does not hold. In that

case we derive sufficient conditions for excess of SK to be positive or negative. In particular on the

symmetry parameter. In this way we obtain simply diagnostic to

observe what Lévy model deals with both the behavior of the

underlying and with the sign of SK.

Interesting issues to study in future works are the empirical evidence of Assumption 1 and under what conditions, on the symmetry parameter, the monotonicity of option prices with respect to symmetry parameter holds. In that sense the results obtained by \citeasnounBergenthum07 for the GH distributions can bring some insights.

References

- [1] \harvarditem[Aït-Sahalia]Aït-Sahalia2004Yacine2004 Aït-Sahalia, Y. (2004): “Disentangling Diffusion from Jumps,” Journal of Financial Economics, 74, 487–528.

- [2] \harvarditem[Bates]Bates1991Bates91 Bates, D. (1991): “The Crash of ’87 – Was It Expected? The Evidence from Options Markets,” Journal of Finance, 46(3), 1009–1044.

- [3] \harvarditem[Bates]Bates1996Bates96 (1996): “Dollar Jump Fears, 1984-1992: Distributional Abnormalities Implicit in Foreign Currency Futures Options,” Journal of International Money and Finance, 15(1), 65–93.

- [4] \harvarditem[Bates]Bates1997Bates97 (1997): “The skewness premium: Option Pricing under Asymmetric Processes,” Advances in Futures and Options Research, 9, 51–82.

- [5] \harvarditem[Bellamy and Jeanblanc-Picque]Bellamy and Jeanblanc-Picque2000Bellamy00 Bellamy, N., and M. Jeanblanc-Picque (2000): “Incompleteness of markets driven by a mixed diffusion,” Finance and Stochastics, 4, 209–222.

- [6] \harvarditem[Bergenthum and Rüschendorf]Bergenthum and Rüschendorf2006Bergenthum06 Bergenthum, J., and L. Rüschendorf (2006): “Comparison of option prices in semimartingale models,” Finance and Stochastics, 10, 222–249.

- [7] \harvarditem[Bergenthum and Rüschendorf]Bergenthum and Rüschendorf2007Bergenthum07 (2007): “Comparison of semimartingales and Lévy processes,” Annals of Probability, 35(1), 228–254.

- [8] \harvarditem[Bergman, Grundy, and Wiener]Bergman, Grundy, and Wiener1996BGW96 Bergman, Y. Z., B. D. Grundy, and Z. Wiener (1996): “General Properties of Option Prices,” Journal of Finance, 51, 1573–1610.

- [9] \harvarditem[Bertoin]Bertoin1996Bertoin96 Bertoin, J. (1996): Lévy Processes. Cambridge University Press, Cambridge.

- [10] \harvarditem[Black and Scholes]Black and Scholes1973BlackScholes73 Black, F., and M. Scholes (1973): “The Pricing of Options and Corporate Liabilities,” Journal of Political Economy, 81, 637–659.

- [11] \harvarditem[Bowie and Carr]Bowie and Carr1994BC94 Bowie, J., and P. Carr (1994): “Static Simplicty,” Risk, 7(8), 45–50.

- [12] \harvarditem[Boyarchenko and Levendorskiĭ]Boyarchenko and Levendorskiĭ2002BL02 Boyarchenko, S., and S. Levendorskiĭ (2002): Non-Gaussian Merton-Black-Scholes Theory. World Scientific, River Edge, NJ.

- [13] \harvarditem[Carr and Chesney]Carr and Chesney1996CarrChesney96 Carr, P., and M. Chesney (1996): “American Put Call Symmetry,” Preprint.

- [14] \harvarditem[Carr, Ellis, and Gupta]Carr, Ellis, and Gupta1998CEG98 Carr, P., K. Ellis, and V. Gupta (1998): “Static Hedging of Exotic Options,” Journal of Business, 53(3), 1165–1190.

- [15] \harvarditem[Carr, Geman, Madan, and Yor]Carr, Geman, Madan, and Yor2002CGMY02 Carr, P., H. Geman, D. Madan, and M. Yor (2002): “The Fine Structure of Assets Returns: An Empirical Investigation,” Journal of Business, 75(2), 305–332.

- [16] \harvarditem[Carr and Wu]Carr and Wu2004CarrWu04 Carr, P., and L. Wu (2004): “Time-changed Lévy Processes and Option Pricing,” Journal of Financial Economics, 71(1), 113–141.

- [17] \harvarditem[Cont and Tankov]Cont and Tankov2004CT04 Cont, R., and P. Tankov (2004): Financial Modelling with Jump Processes. Chapman & Hall /CRC Financial Mathematics Series.

- [18] \harvarditem[Detemple]Detemple2001Detemple01 Detemple, J. (2001): “American options: Symmetry Property,” in Option Pricing, Interest Rates and Risk Management, ed. by M. M. E. Jouini, J. Cvitanic. Cambridge University Press.

- [19] \harvarditem[Eberlein, Keller, and Prause]Eberlein, Keller, and Prause1998EberleinKellerPrause98 Eberlein, E., U. Keller, and K. Prause (1998): “New insights into Smile, Mispricing and Value at Risk: the Hyperbolic Model,” Journal of Business, 71, 371–405.

- [20] \harvarditem[Eberlein and Prause]Eberlein and Prause2000EberleinPrause2000 Eberlein, E., and K. Prause (2000): “The Generalized Hyperbolic Model: Financial Derivatives and Risk Measures,” in Mathematical Finance-Bachelier Congress 2000, ed. by S. P. T. V. H. Geman, D. Madan. Springer Verlag.

- [21] \harvarditem[Ekström and Tysk]Ekström and Tysk2007EkstromTysk05 Ekström, E., and J. Tysk (2007): “Properties of Option Prices in Models with Jumps,” Mathematical Finance, 17(3), 381–397.

- [22] \harvarditem[El Karoui, Jeanblanc-Picque, and Shreve]El Karoui, Jeanblanc-Picque, and Shreve1998ElkarouiJS98 El Karoui, N., M. Jeanblanc-Picque, and S. Shreve (1998): “Robustness of Black and Scholes formula,” Mathematical Finance, 8, 93–126.

- [23] \harvarditem[Fajardo and Mordecki]Fajardo and Mordecki2006FajardoMordecki2006b Fajardo, J., and E. Mordecki (2006): “Symmetry and Duality in Lévy Markets,” Quantitative Finance, 6(3), 219–227.

- [24] \harvarditem[Gushchin and Mordecki]Gushchin and Mordecki2002GuschinMordecki02 Gushchin, A. A., and E. Mordecki (2002): “Bounds on option prices for semimartingale market models,” Proc. Steklov Inst. Math., 237, 73–113.

- [25] \harvarditem[Henderson]Henderson2005Henderson05 Henderson, V. (2005): “Analytical comparisons of option prices in stochastic volatility models,” Mathematical Finance, (15), 49–59.

- [26] \harvarditem[Henderson and Hobson]Henderson and Hobson2003HendersonHobson03 Henderson, V., and D. Hobson (2003): “Coupling and Option Price Comparisons in a jump-diffusion model,” Stoch. Stoch. Rep., (75), 79–101.

- [27] \harvarditem[Jacod and Shiryaev]Jacod and Shiryaev1987jacodShiryaev87 Jacod, J., and A. Shiryaev (1987): Limit Theorems for Stochastic Processes. Springer, Berlin, Heidelberg.

- [28] \harvarditem[Jakubenas]Jakubenas2002Jakubenas2002 Jakubenas, P. (2002): “On option pricing in certain incomplete markets,” Proc Steklov Inst. Math., 237, 114–133.

- [29] \harvarditem[Merton]Merton1973Merton73 Merton, R. (1973): “Theory of Rational Option Pricing,” Bell J. Econom. Manag. Sci., 4, 141–183.

- [30] \harvarditem[Merton]Merton1976Merton76 (1976): “Option Pricing when the Underlying Stock Returns are Discontinuous,” Journal of Financial Economics, 3, 125–144.

- [31] \harvarditem[Peskir and Shiryaev]Peskir and Shiryaev2001PeskirShiryaev2001 Peskir, G., and A. N. Shiryaev (2001): “A note on the call-put parity and a call-put duality,” Theory of Probability and its Applications, 46, 181–183.

- [32] \harvarditem[Sato]Sato1999Sato99 Sato, K.-i. (1999): Lévy Processes and Infinitely Divisible Distributions. Cambridge University Press, Cambridge, UK.

- [33] \harvarditem[Schoutens]Schoutens2001Scoutens2001 Schoutens, W. (2001): “The Meixner Process in Finance,” EURANDOM Report 2001-002, EURANDOM, Eindhoven.

- [34] \harvarditem[Schoutens]Schoutens2003Schoutens2003 (2003): Lévy Processes in Finance: Pricing Financial Derivatives. Wiley, New York.

- [35] \harvarditem[Schroder]Schroder1999Schroder99 Schroder, M. (1999): “Change of Numeraire for Pricing Futures, Forwards, and Options,” The Review of Financial Studies, 12(5), 1143–1163.

- [36] \harvarditem[Skorokhod]Skorokhod1991Skorokhod91 Skorokhod, A. V. (1991): Random Processes with Independent Increments. Kluwer Academic Publishers, Dordrecht.

- [37]