Analysis of fourier transform valuation formulas and applications

Abstract.

The aim of this article is to provide a systematic analysis of the conditions such that Fourier transform valuation formulas are valid in a general framework; i.e. when the option has an arbitrary payoff function and depends on the path of the asset price process. An interplay between the conditions on the payoff function and the process arises naturally. We also extend these results to the multi-dimensional case, and discuss the calculation of Greeks by Fourier transform methods. As an application, we price options on the minimum of two assets in Lévy and stochastic volatility models.

Key words and phrases:

option valuation; Fourier transform; semimartingales; Lévy processes; stochastic volatility models; options on several assets2000 Mathematics Subject Classification:

91B28; 42B10; 60G48We would like to thank the two anonymous referees for their careful reading of the manuscript and their valuable suggestions that have improved the paper.

1. Introduction

Since the seminal work of \citeNCarrMadan99 and \citeNRaible00 on the valuation of options with Fourier transform methods, there have been several articles dealing with extensions and analysis of these valuation formulas. This literature focuses on the extension of the method to other situations, e.g. the pricing of exotic or multi-asset derivatives, or on the analysis of the discretization error of the fast Fourier transform.

The article of \citeNBorovkovNovikov02 deals with the application of Fourier transform valuation formulas for the pricing of some exotic options, while \shortciteNHubalekKallsenKrawczyk06 use similar techniques for hedging purposes. Lee \citeyearLee04 provides an analysis of the discretization error in the fast Fourier transform, while \citeNLord08 extends the method to the pricing of options with early exercise features. Recently, \citeNHubalekKallsen03, Biagini et al. \citeyearBiaginiBregmanMeyerBrandis08 and \citeNHurdZhou09 extend the method to accommodate options on several assets, considering basket options, spread options and catastrophe insurance derivatives. \shortciteNDufresneGarridoMorales09 also consider the valuation of payoffs arising in insurance mathematics by Fourier methods. In addition, the books of \citeNContTankov03, Boyarchenko and Levendorskiǐ \citeyearBoyarchenkoLevendorskii02book and \citeNSchoutens03 are also discussing Fourier transform methods for option pricing. Let us point out that all these results are intimately related to Parseval’s formula, cf. \citeN[VI.2.2]Katznelson04.

The aim of our article is to provide a systematic analysis of the conditions required for the existence of Fourier transform valuation formulas in a general framework: i.e. when the underlying variable can depend on the path of the price process and the payoff function can be discontinuous. Such an analysis seems to be missing in the literature.

In their work, \citeNCarrMadan99, \citeNRaible00 and most others are usually imposing a continuity assumption, either on the payoff function or on the random variable (i.e. existence of a Lebesgue density). However, when considering e.g. a one-touch option on a Lévy-driven asset, both assumptions fail: the payoff function is clearly discontinuous, while a priori not much is known about the existence of a density for the distribution of the supremum of a Lévy process. Analogous situations can also arise in higher dimensions.

The key idea in Fourier transform methods for option pricing lies in the separation of the underlying process and the payoff function. We derive conditions on the moment generating function of the underlying random variable and the Fourier transform of the payoff function such that Fourier based valuation formulas hold true in one and several dimensions. An interesting interplay between the continuity conditions imposed on the payoff function and the random variable arises naturally. We also derive a result that allows to easily verify the conditions on the payoff function (cf. Lemma 2.5).

The results of our analysis can be briefly summarized as follows: for general continuous payoff functions or for variables, whose distribution has a Lebesgue density, the valuation formulas using Fourier transforms are valid as Lebesgue integrals, in one and several dimensions. When the payoff function is discontinuous and the random variable might not possess a Lebesgue density then, in dimension one, we get pointwise convergence of the valuation formulas under additional assumptions, that are typically satisfied. In several dimensions pointwise convergence fails, but we can deduce the valuation function as an -limit.

In addition, the structure of the valuation formulas allows us to derive easily formulas for the sensitivities of the option price with respect to the various parameters; otherwise, Malliavin calculus techniques or cubature formulas have to be employed, cf. e.g. \shortciteNFournieLasryLebuchouxLionsTouzi99, \citeNTeichmann06 and \citeNKohatsuHigaYasuda08. We discuss results regarding the sensitivities with respect to the initial value, i.e. the delta and the gamma. It turns out that the trade-off between continuity conditions on the payoff function and the random variable established for the valuation formulas, becomes now a trade-off between integrability and smoothness conditions for the calculation of the sensitivities.

The valuation formulas allow to compute prices of European options very fast, hence they allow the efficient calibration of the model to market data for a large variety of driving processes, such as Lévy processes and affine stochastic volatility models. Indeed, for Lévy and affine processes the moment generating function is usually known explicitly, hence these models are tailor-made for Fourier transform pricing formulas.

We also mention here that the Fourier transform based approach can be applied for the efficient computation of prices in other frameworks as well. An important area is the valuation of interest rate derivatives in Lévy driven models. Lévy term structure models were developed in a series of papers in the last ten years; this development is surveyed in \citeNEberleinKluge06. For the Fourier based formulas we mention the two papers by Eberlein and Kluge \citeyearEberleinKluge04,EberleinKluge05, where caps, floors, and swaptions as well as interest rate digital and range digital options are discussed; furthermore Eberlein and Koval \citeyearEberleinKoval06, where cross currency derivatives are considered and Eberlein, Kluge, and Schönbucher \citeyearEberleinKlugeSchoenbucher06, where pricing formulas for credit default swaptions are derived. Moreover, in the framework of the ‘affine LIBOR’ model (cf. \shortciteNPKellerResselPapapantoleonTeichmann09) caps and swaptions can be easily priced by Fourier based methods.

This paper is organized as follows: in Section 2 we present valuation formulas in the single asset case, and in Section 3 we deal with the valuation of options on several assets. In Section 4 we discuss sensitivities. In Section 5 we review examples of commonly used payoff functions, in dimension one and in multiple dimensions. In Section 6 we review Lévy and affine processes. Finally, in Section 7 we provide numerical examples for the valuation of options on several assets in Lévy and affine stochastic volatility models.

2. Option valuation: single asset

1.

Let be a stochastic basis in the sense of Jacod and Shiryaev \citeyear[I.1.3]JacodShiryaev03, where and . We model the price process of a financial asset, e.g. a stock or an FX rate, as an exponential semimartingale , i.e. a stochastic process with representation

| (2.1) |

(shortly: ), where is a semimartingale with .

Every semimartingale admits a canonical representation

| (2.2) |

where is a truncation function, is a predictable process of bounded variation, is the continuous martingale part of with predictable quadratic characteristic , and is the predictable compensator of the random measure of jumps of . Here denotes the integral process of with respect to , and denotes the stochastic integral of with respect to the compensated random measure ; cf. \citeN[Chapter II]JacodShiryaev03.

Let , resp. , denote the class of all martingales, resp. local martingales, on the given stochastic basis .

Subject to the assumption that the process has bounded variation, we can deduce the martingale condition

| (2.3) |

cf. \shortciteNEberleinPapapantoleonShiryaev06 for details. The martingale condition can also be expressed in terms of the cumulant process associated to , i.e. ; for the cumulant process see \citeNJacodShiryaev03.

Throughout this work, we assume that is an (equivalent) martingale measure for the asset and the martingale condition is in force; moreover, for simplicity we assume that the interest rate and dividend yield are zero. By no-arbitrage theory the price of an option on is calculated as its discounted expected payoff.

2.

Let be a stochastic process on the given basis. We denote by and the supremum and the infimum processes of respectively, i.e.

Notice that since the exponential function is monotonically increasing, the supremum processes of and are related via

| (2.4) |

Similarly, the infimum processes of and are related via

3.

The aim of this work is to tackle the problem of efficient valuation for plain vanilla options, such as European call and put options, as well as for exotic path-dependent options, such as lookback and one-touch options, in a unified framework. Therefore, we will analyze and prove valuation formulas for options on an asset with a payoff at maturity that may depend on the whole path of up to time . These results, together with analyticity conditions on the Wiener–Hopf factors, will be used in the companion paper [\citeauthoryearEberlein, Glau, and PapapantoleonEberlein et al.2009] for the pricing of one-touch and lookback options in Lévy models.

The following example of a fixed strike lookback option will serve as a guideline for our methodology; note that using (2.4) it can be re-written as

| (2.5) |

In order to incorporate both plain vanilla options and exotic options in a single framework we separate the payoff function from the underlying process, where:

-

(a)

the underlying process can be the log-asset price process or the supremum/infimum of the log-asset price process or an average of the log-asset price process. This process will always be denoted by (i.e. or or , etc.);

-

(b)

the payoff function is an arbitrary function , for example or , for .

Clearly, we regard options as dependent on the underlying process , i.e. on (some functional of) the logarithm of the asset price process . The main advantage is that the characteristic function of is easier to handle than that of (some functional of) ; for example, for a Lévy process it is already known in advance.

Moreover, we consider exactly those options where we can incorporate the path-dependence of the option payoff into the underlying process . European vanilla options are a trivial example, as there is no path-dependence; a non-trivial, example are options on the supremum, see again (2.4) and (2.5). Other examples are the geometric Asian option and forward-start options.

In addition, we will assume that the initial value of the underlying process is zero; this is the case in all natural examples in mathematical finance. The initial value of the asset price process plays a particular role, because it is convenient to consider the option price as a function of it, or more specifically as a function of .

Hence, we express a general payoff as

| (2.6) |

where is a payoff function and is the underlying process, i.e. an adapted process, possibly depending on the full history of , with

and a measurable functional. Therefore, the time- price of the option is provided by the (discounted) expected payoff, i.e.

| (2.7) |

Note that we consider ‘European style’ options, in the sense that the holder or writer do not have the right to exercise or terminate the option before maturity.

Remark 2.1.

In case the interest rate and the dividend yield are non-zero, then the martingale condition (2.3) reads

for all , and the option price is given by

4.

The first result focuses on options with continuous payoff functions, such as European plain vanilla options, but also lookback options.

Let denote the law, the moment generating function and the (extended) characteristic function of the random variable ; that is

for suitable . For any payoff function let denote the dampened payoff function, defined via

| (2.8) |

for some . Let denote the (extended) Fourier transform of a function , and the space of bounded, continuous functions in .

In order to derive a valuation formula for an option with an arbitrary continuous payoff function , we will impose the following conditions.

- (C1):

-

Assume that .

- (C2):

-

Assume that exists.

- (C3):

-

Assume that .

Theorem 2.2.

Proof.

| (2.10) |

By assumption (C1), and the Fourier transform of ,

is well defined for every and is also continuous and bounded. Additionally, using assumption (C3) we immediately have that . Therefore, using the Inversion Theorem (cf. \citeNP[Theorem 3.4.4]Deitmar04), can be inverted and can be represented, for all , as

| (2.11) |

Now, returning to the valuation problem (2.10) we get that

| (2.12) |

where for the second equality we have applied Fubini’s theorem; moreover, for the last equality we have

Finally, the application of Fubini’s theorem is justified since

where we have used again that , and the finiteness of is given by Assumption (C2). ∎

Remark 2.3.

We could also replace assumptions (C1) and (C3) with the following conditions

(C1′): and (C3′): .

Condition (C3′) yields that possesses a continuous bounded Lebesgue density, say ; cf. \citeN[Theorem 8.39]Breiman68. Then, we can identify , instead of , with the inverse of its Fourier transform and the proof goes through with the obvious modifications. This statement is almost identical to Theorem 3.2 in \citeNRaible00.

Remark 2.4 (Numerical evaluation).

The option price represented as an integral of the form (2.9) can be evaluated numerically very fast. The following simple observation can speed up the computation of this expression even further: notice that for a fixed maturity , the characteristic function – which is the computationally expensive part – should only be evaluated once for all different strikes or initial values. The gain in computational time will be significant when considering models where the characteristic function is not known in closed form; e.g. in affine models where one might need to solve a Riccati equation to obtain the characteristic function. This observation has been termed ‘caching’ by some authors (cf. \citeNPKilin07)

5.

Apart from (C3), the prerequisites of Theorem 2.2 are quite easy to check in specific cases. In general, it is also an interesting question to know when the Fourier transform of an integrable function is integrable. The problem is well understood for smooth ( or ) functions, see e.g. \citeNDeitmar04, but the functions we are dealing with are typically not smooth. Hence, we will provide below an easy-to-check condition for a non-smooth function to have an integrable Fourier transform.

Let us consider the Sobolev space , with

where denotes the weak derivative of a function ; see e.g. \citeANPSauvigny06 \citeyearSauvigny06. Let , then from Proposition 5.2.1 in \citeNZimmer90 we get that

| (2.13) |

and .

Lemma 2.5.

Let , then .

Proof.

Using the above results, we have that

| (2.14) |

Now, by the Hölder inequality, using and (2.14), we get that

and the result is proved. ∎

Remark 2.6.

A similar statement can be proved for functions in the Sobolev-Slobodeckij space , for .

6.

Next, we deal with the valuation formula for options whose payoff function can be discontinuous, while at the same time the measure does not necessarily possess a Lebesgue density. Such a situation arises typically when pricing one-touch options in purely discontinuous Lévy models. Hence, we need to impose different conditions, and we derive the valuation formula as a pointwise limit by generalizing the proof of Theorem 3.2 in \citeNRaible00. A similar result (Theorem 1 in \shortciteNPDufresneGarridoMorales09) has been pointed out to us by one of the referees.

In this and the following sections we will make use of the following notation; we define the function and the measure as follows

Moreover , while denotes the convolution of the function with the measure . In this case we will use the following assumptions.

- (D1):

-

Assume that .

- (D2):

-

Assume that exists ().

Theorem 2.7.

Remark 2.8.

In Section 5 we will relate the conditions on the valuation function to properties of the measure for specific (dampened) payoff functions . These properties are easily checkable – and typically satisfied – in many models.

Proof.

Starting from (2.10), we can represent the option price function as a convolution of and as follows

| (2.16) |

Using that , hence also , and we get that , since

| (2.17) |

compare with Young’s inequality, cf. \citeN[IV.1.6]Katznelson04. Therefore, the Fourier transform of the convolution is well defined and we can deduce that, for all ,

compare with Theorem 2.1.1 in \citeNBochner55.

By (2.17) we can apply the inversion theorem for the Fourier transform, cf. Satz 4.2.1 in \citeNDoetsch50, and get

| (2.18) |

if there exists a neighborhood of where is of bounded variation.

We proceed as follows: first we show that the function has bounded variation; then we show that this map is also continuous, which yields that the left hand side of (2.18) equals .

For that purpose, we re-write (2) as

then, is of bounded variation on a compact interval if and only if ; this holds because the map is of bounded variation on any bounded interval on , and the fact that the space forms an algebra; cf. Satz 91.3 in \citeNHeuser01. Moreover, is a continuity point of if and only if is continuous at .

3. Option valuation: multiple assets

1.

We would like to establish valuation formulas for options that depend on several assets or on multiple functionals of one asset. Typical examples of options on several assets are basket options and options on the minimum or maximum of several assets, with payoff

where . Typical examples of options on functionals of a single asset are barrier options, with payoff

and slide-in or corridor options, with payoff

at maturity , where .

In the previous section we proved that the valuation formulas for a single underlying is still valid – at least as a pointwise limit, under reasonable additional assumptions – even if the underlying distribution does not possess a Lebesgue density and the payoff is discontinuous.

In the present section we will generalize the valuation formulas to the case of several underlyings. Once again, if either the joint distribution possesses a Lebesgue density or the payoff function is continuous, the formula is valid as a Lebesgue integral. In case both assumptions fail, we will encounter situations that are apparently of harmless nature, but where the pointwise convergence will fail. In this case we will establish the valuation formulas as an -limit; however, with respect to numerical evaluation, a stronger notion of convergence would be preferable.

Analogously to the single asset case we assume that the asset prices evolve as exponential semimartingales. Let the driving process be an -valued semimartingale and be the vector of asset price processes; then each component of is modeled as an exponential semimartingale, i.e.

| (3.1) |

where is an -valued semimartingale with canonical representation

| (3.2) |

with . The martingale condition can be given as in eq. (3.3) in \citeNEberleinPapapantoleonShiryaev08.

2.

In the sequel, we will price options with payoff at maturity , where is an -measurable -valued random variable, possibly dependent of the history of the driving processes, i.e.

where is an -valued measurable functional. Further is a measurable function , and with .

Analogously to the single asset case, we use the dampened payoff function

and denote by the measure defined by

where serves as a dampening coefficient. Here denotes the Euclidian scalar product in . The scalar product is extended to as follows: for , set , i.e. we do not use the Hermitian inner product. Moreover, and denote the moment generating, resp. characteristic, function of the random vector .

To establish our results we will make use of the following assumptions.

- (A1):

-

Assume that .

- (A2):

-

Assume that exists.

- (A3):

-

Assume that .

Remark 3.1.

We can also replace Assumptions (A1) and (A3) with the following assumption

- (A1′):

-

Assume that and ;

this shows again the interplay between the continuity properties of the payoff function and the underlying distribution.

Theorem 3.2.

Proof.

Similarly to the one-dimensional case we have that

| (3.4) |

Since and , we get that ; therefore for all . By assumption we know that ; moreover since . These considerations yield that , again by using Young’s inequality.

Hence, applying the formula for the Fourier inversion, cf. Corollary 1.21 in \citeNSteinWeiss71, we conclude that

for a.e. .

Moreover, if is continuous, then the equality holds pointwise for all . The mapping (3.4) is continuous if the mapping is continuous. Using Assumption (A3) we have that possesses a bounded continuous Lebesgue density ; cf. Proposition 2.5 (xii) in Sato \citeyearSato99. Then and

| (3.5) |

yielding the continuity of the map. Note that we have used the continuity of ; additionally, we can interchange integration and limit using the dominated convergence theorem, with majorant . ∎

Remark 3.3.

The proof using Assumption (A1′) follows analogously, with the obvious modifications for (3).

3.

Next, we consider the valuation of options on several assets when the payoff function is discontinuous and the driving process does not necessarily possess a Lebesgue density.

The main difference to the analogous situation in dimension one is that the pointwise convergence of capped Fourier integrals – as is the case in Satz 4.2.1 in \citeNDoetsch50 – cannot be generalized to the multidimensional case. M. Pinsky gives the following astonishing example to illustrate this fact, see section 4.1 in \citeNPinsky93; let be the indicator function of the unit ball in , then

| (3.6) |

for . Extrapolating the convergence results from the one-dimensional case to , we would expect pointwise convergence of the spherical sum to the indicator function, at least in the interior of the ball; on the contrary, the right hand side of (3.6) is even divergent.

As a consequence, we only derive an -limit for the valuation function.

The setting is similar to the previous sections, and we need to impose the following conditions.

- (G1):

-

Assume that .

- (G2):

-

Assume that exists.

Theorem 3.4.

Proof.

Similarly to the previous section, we have that

| (3.8) |

and, for all

| (3.9) |

Now, since , we get that and ; the proofs are analogous to Theorem 9.13 in \citeNRudin87. Moreover, we have that , because

Therefore, since also we get that and, analogously again to Theorem 9.13 in \citeNRudin87, we get that and .

Remark 3.5.

The problem becomes significantly simpler when dealing with the product of a continuous payoff function for the variable and a discontinuous payoff function for the other variable , even in the absence of Lebesgue densities. A typical example of this situation is the barrier option payoff, where and . Then, one can make a measure change using the (normalized) continuous payoff as the Radon–Nikodym derivative, apply Theorem 2.2 and then Theorem 2.7; this leads to pointwise convergence of the valuation function. The measure change argument is outlined in \citeNBorovkovNovikov02 and \citeN[Theorem 3.5]Papapantoleon06.

4. Sensitivities – Greeks

The structure of the asset price model as an exponential semimartingale, and the resulting structure of the option price function, allows us to easily derive general formulas for the sensitivities of the option price with respect to model parameters. In this section we will focus on the sensitivities with respect to the initial value, i.e. delta and gamma, while sensitivities with respect to other parameters can be derived analogously.

Let us rewrite the option price function as a function of the initial value, using that , as follows:

| (4.1) |

The delta of an option is the partial derivative of the price with respect to the initial value. For a generic option with payoff , we have that

| (4.2) |

The gamma of an option is the partial derivative of the delta with respect to the initial value. For a generic option with payoff , we get

| (4.3) |

In the above equations we have taken for granted that we can exchange integration and differentiation; however, this is the crucial step and we will provide sufficient conditions when we are allowed to do that. Using Satz IV.5.7 in \citeNElstrodt99 and the elementary inequality , we get that we can differentiate under the integral sign if there exists an integrable function such that for all and all

where

Now we can estimate the partial derivative of the function :

| (4.4) |

Analogously we can estimate for the second derivative of :

| (4.5) |

Sufficient conditions for the function in (4), resp. in (4.5), to be integrable are that , resp. , is integrable and is bounded; the first condition dictates in particular that the measure – equivalently – has a density of class , resp. ; see Proposition 28.1 in \citeNSato99. Alternatively, a sufficient condition is that the function , resp. , is integrable and is bounded, highlighting once again the interplay between the properties of the measure and the payoff function.

5. Examples of payoff functions

1.

Here we list some representative examples of payoff functions used in finance, together with their Fourier transforms and comment on whether they satisfy some of the required assumptions for option pricing. The calculations for the call option are provided explicitly and for other options they follow along the same lines.

Example 5.1 (Call and put option).

The payoff of the standard call option with strike is . Let with , then the Fourier transform of the payoff function of the call option is

| (5.1) |

Now, regarding the dampened payoff function of the call option, we easily get for that . The weak derivative of is

| (5.4) |

Again, we have that . Therefore, and using Lemma 2.5 we can conclude that . Summarizing, conditions (C1) and (C3) of Theorem 2.2 are fulfilled for the payoff function of the call option.

Similarly, for a put option, where , we have that

| (5.5) |

Analogously to the case of the call option, we can conclude for the dampened payoff function of the put option that and for , yielding . Hence, conditions (C1) and (C3) of Theorem 2.2 are also fulfilled for the payoff function of the put option.

Example 5.2 (Digital option).

The payoff of a digital call option with barrier is . Let with , then the Fourier transform of the payoff function of the digital call option is

| (5.6) |

Similarly, for a digital put option, where , we have that

| (5.7) |

For the dampened payoff function of the digital call and put option, we can easily check that for and .

Regarding the continuity and bounded variation properties of the value function, we have that

where denotes the cumulative distribution function of . Therefore, is monotonically decreasing, hence it has locally bounded variation. Moreover, we can conclude that is continuous if the measure is atomless.

Summarizing, condition (D1) is always satisfied for the payoff function of the digital option, while the prerequisites of Theorem 2.7 on continuity and bounded variation are satisfied if the measure does not have atoms.

Example 5.3.

A variant of the digital option is the so-called asset-or-nothing digital, where the option holder receives one unit of the asset, instead of currency, depending on whether the underlying reaches some barrier or not. The payoff of the asset-or-nothing digital call option with barrier is , and the Fourier transform, for with , is

| (5.8) |

Arguing analogously to the previous example, we can deduce that condition (D1) is always satisfied for the payoff function of the asset-or-nothing digital option, while the prerequisites of Theorem 2.7 are satisfied if the measure does not have atoms.

Example 5.4 (Double digital option).

The payoff of the double digital call option with barriers is . Let , then the Fourier transform of the payoff function is

| (5.9) |

The dampened payoff function of the double digital option satisfies for all .

Moreover, we can decompose the value function of the double digital option as

where and . Hence, by the results of Example 5.2, we get that condition (D1) is always satisfied for the payoff function of the double digital option, while the prerequisites of Theorem 2.7 are satisfied if the measure does not have atoms.

Example 5.5 (Self-quanto and power options).

The payoff of a self-quanto call option with strike is . The Fourier transform of the payoff function of the self-quanto call option, for with , is

| (5.10) |

The payoff of a power call option with strike and power is ; for with , the Fourier transform is

| (5.11) |

The payoff functions for the respective put options are defined in the obvious way, while the Fourier transforms are identical, with the range for the imaginary part of being respectively and .

Remark 5.6.

For power options of higher order we refer to Raible \citeyear[Chapter 3]Raible00.

2.

Next we present some examples of payoff functions for options on several assets and for options on multiple functionals of one asset, together with their corresponding Fourier transforms.

Example 5.7 (Option on the minimum/maximum).

The payoff function of a call option on the minimum of assets is

for . The Fourier transform of this payoff function is

| (5.12) |

where with for and ; for more details we refer to Appendix A. Then, we can easily deduce for the dampened payoff function that .

Moreover, for the put option on the maximum of assets, the payoff function is

for , where . The Fourier transform is

| (5.13) |

with the restriction now being for all . Again, we can easily deduce that the dampened payoff function satisfies . Therefore, condition (A1) of Theorem 3.2 is satisfied.

Example 5.8.

A natural example of multi-asset payoff functions are products of single asset payoff functions. These payoff functions have the form

for , where and , for all ; for example, one can consider and .

The Fourier transform of these payoff functions is simply the product of the Fourier transform of the ‘marginal’ payoff functions, since

for and , with in an appropriate range such that . This range, as well as other properties of , are dictated by the corresponding properties of the Fourier transforms of the marginal payoff functions .

Remark 5.9.

Further examples of multiple asset payoff functions, such as basket and spread options, and their Fourier transforms can be found in \citeNHubalekKallsen03.

3.

We add a short remark on the rate of decay of the Fourier transform of the various payoff functions and its consequence for numerical implementations.

Consider the standard call option, where the Fourier transform of the dampened payoff function has the form, cf. (5.1),

Then, we have that

which shows that behaves like for . On the other hand, a similar calculation for the digital option shows that the Fourier transform of the dampened digital payoff behaves like for .

Therefore, splitting a call option into the difference of an asset-or-nothing digital and a digital option, as many authors have proposed in the literature (cf. e.g. \citeNPHeston93), is not only ‘conceptually’ sub-optimal, as can be seen by Theorems 2.2 and 2.7. More importantly, it is also not optimal from the numerical perspective, since the rate of decay for the digital option is much slower than for the call option, leading to slower numerical evaluation of the corresponding option prices.

Indeed, we have calculated the prices of call options corresponding to 11 strikes and 10 maturities, first using the formula for the call option, and then representing the call option as the difference of two digital options. The numerical calculation using the second method lasts twice as long (6 secs compared to less than 3 secs) in a standard Matlab implementation.

6. Examples of driving processes

The application of Fourier transform valuation formulas in practice requires the explicit knowledge of the moment generating function of the underlying random variable. As such, Fourier methods are tailor-made for pricing European options in Lévy and affine models, since in these models one typically knows the moment generating function explicitly (at least up to the solution of a Riccati equation). In order to give a flavor, we present here an overview of Lévy and affine processes, referring to the literature for specific formulas and proofs.

In Lévy processes, the moment generating function of the random variable is described by the celebrated Lévy–Khintchine formula; for a Lévy process with triplet () we have:

| (6.1) |

for suitable , where the cumulant generating function is

| (6.2) |

here denotes a suitable truncation function. The most popular Lévy models are the VG and CGMY processes (cf. \citeNPMadanSeneta90, Carr et al. \citeyearNPCarretal02), the hyperbolic, NIG and GH processes (cf. Eberlein and Keller \citeyearNPEberleinKeller95, \citeNPBarndorff-Nielsen98, \citeNPEberlein01a), and the Meixner model (cf. \citeNPSchoutensTeugels98).

In affine processes, the moment generating functions are described by the very definition of these processes. Let be an affine process on the state space , starting from ; i.e., under suitable conditions, there exist functions and such that

| (6.3) |

for all , . The functions and satisfy generalized Riccati equations, while their time derivatives

are of Lévy–Khintchine form (6.2); we refer to \shortciteNDuffieFilipoviSchachermayer03 and Keller-Ressel \citeyearKellerRessel08 for comprehensive expositions and the necessary details. The class of affine processes contains as special cases – among others – many stochastic volatility models, such as the \citeNHeston93 model, the BNS model (cf. Barndorff-Nielsen and Shephard \citeyearNPBarndorff-NielsenShephard01, \citeNPNicolatoVenardos03), and time-changed Lévy models (cf. \shortciteNPCarretal03, \citeNPKallsen06).

7. Numerical illustration

As an illustration of the applicability of Fourier-based valuation formulas even for the valuation of options on several assets, we present a numerical example on the pricing of an option on the minimum of two assets. As driving motions we consider a 2d normal inverse Gaussian (NIG) Lévy process and a 2d affine stochastic volatility model.

Let denote a 2d NIG random variable, i.e.

where the parameters have the following domain of definition: , , and is a symmetric, positive-definite matrix; w.l.o.g. we can assume that ; in addition, . Then, the moment generating function of , for with , is

| (7.1) |

In the model, we specify the parameters and , and the drift vector is determined by the martingale condition. Note that the marginals are also NIG distributed (cf. \citeNP[Theorem 1]Blaesild81), hence the drift vector can be easily evaluated from the cumulant of the univariate NIG law. The covariance matrix corresponding to the -distributed random variable is

cf. \citeN[eq. (4.15)]Prause99. A comprehensive exposition of the multivariate generalized hyperbolic distributions can be found in \citeNBlaesild81; cf. also \citeNPrause99.

We will also consider the following affine stochastic volatility model introduced by \citeNDempsterHong02, that extends the framework of Heston \citeyearHeston93 to the multi-asset case. Let denote the logarithm of the asset price processes , i.e. ; then, , satisfy the following SDEs:

with initial values . The parameters have the following domain of definition: and . Here denotes a 3-dimensional Brownian motion with correlation coefficients

The moment generating function of the vector has been calculated by \citeNDempsterHong02; for we have

where , , and are

We can deduce that all three models satisfy conditions (A2) and (A3) of Theorem 3.2 for certain values of . Explicit calculations for the 2d NIG model are deferred to Appendix B; analogous calculations yield the results for the other models.

The Fourier transform of the payoff function , , corresponding to the option on the minimum of two assets is given by (5.12) for , and we get that condition (A1) of Theorem 3.2 is satisfied for such that .

Therefore, applying Theorem 3.2, the price of an option on the minimum of two assets is given by

where denotes the moment generating function of the random vector , and are suitably chosen.

In the numerical illustrations, we consider the following parameters: strikes

and times to maturity

In the 2d NIG model, we consider some typical parameters, e.g. , , , , and ; we consider two matrices and , which give positive and negative correlations respectively; indeed we get that

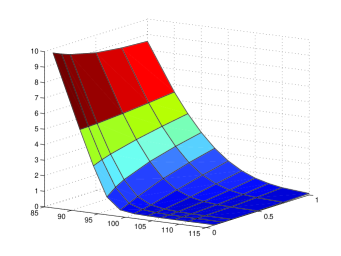

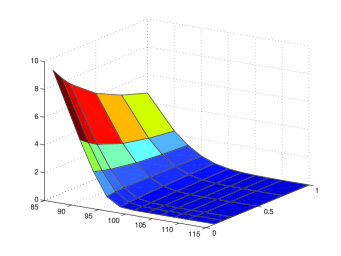

The option prices in these two cases are exhibited in Figure 1.

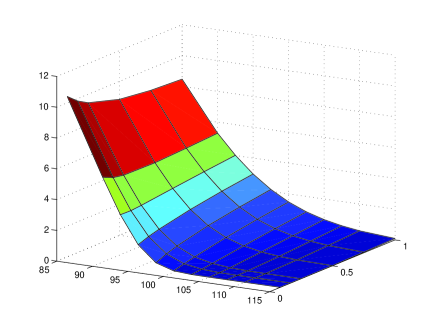

Finally, in the stochastic volatility model we consider the parameters used in \citeNDempsterHong02, that is , , , , , , , , , and ; the option prices are shown in Figure 2.

Appendix A Fourier transforms of multi-asset options

In this appendix we outline the derivation of the Fourier transform corresponding to the payoff function of an option on the minimum of several assets; the derivation for the maximum is completely analogous and therefore omitted.

The payoff of a (call) option on the minimum of assets is

The payoff function corresponding to this option is given, for , by

The following decomposition holds, if for ,

where . Define also the auxiliary functions , , where

The dampened payoff function is , where ; we define analogously the dampened -functions, i.e. . For simplicity, we first calculate the Fourier transform of the dampened -function; for we get

subject to the conditions for all and .

Hence, in general we have that

subject to the conditions for all and .

Now, we recall that , hence which yields ; therefore

This we can also rewrite as

| (A.1) |

subject to the conditions for all and .

Appendix B Calculations for the 2d NIG model

By the moment generating function of the 2d NIG process, cf. (7.1), it is evident that assumption (A2) is satisfied for with . In order to verify condition (A3) we have to show that the function is integrable; it suffices to show that the real part of the exponent of decays like . We have

Recall that the product over is defined as follows: for set . Then

and since , we get

where denotes the smallest eigenvalue of the matrix .

References

- [\citeauthoryearBarndorff-NielsenBarndorff-Nielsen1998] Barndorff-Nielsen, O. E. (1998). Processes of normal inverse Gaussian type. Finance Stoch. 2, 41–68.

- [\citeauthoryearBarndorff-Nielsen and ShephardBarndorff-Nielsen and Shephard2001] Barndorff-Nielsen, O. E. and N. Shephard (2001). Non-Gaussian Ornstein–Uhlenbeck-based models and some of their uses in financial economics. J. Roy. Statist. Soc. Ser. B 63, 167–241.

- [\citeauthoryearBiagini, Bregman, and Meyer-BrandisBiagini et al.2008] Biagini, F., Y. Bregman, and T. Meyer-Brandis (2008). Pricing of catastrophe insurance options written on a loss index with reestimation. Insurance Math. Econom. 43, 214–222.

- [\citeauthoryearBlæsildBlæsild1981] Blæsild, P. (1981). The two-dimensional hyperbolic distribution and related distributions, with an application to Johannsen’s bean data. Biometrika 68, 251–263.

- [\citeauthoryearBochnerBochner1955] Bochner, S. (1955). Harmonic Analysis and the Theory of Probability. University of California Press.

- [\citeauthoryearBorovkov and NovikovBorovkov and Novikov2002] Borovkov, K. and A. Novikov (2002). On a new approach to calculating expectations for option pricing. J. Appl. Probab. 39, 889–895.

- [\citeauthoryearBoyarchenko and LevendorskiǐBoyarchenko and Levendorskiǐ2002] Boyarchenko, S. I. and S. Z. Levendorskiǐ (2002). Non-Gaussian Merton-Black-Scholes Theory. World Scientific.

- [\citeauthoryearBreimanBreiman1968] Breiman, L. (1968). Probability. Addison-Wesley Publishing Company.

- [\citeauthoryearCarr, Geman, Madan, and YorCarr et al.2002] Carr, P., H. Geman, D. B. Madan, and M. Yor (2002). The fine structure of asset returns: an empirical investigation. J. Business 75, 305–332.

- [\citeauthoryearCarr, Geman, Madan, and YorCarr et al.2003] Carr, P., H. Geman, D. B. Madan, and M. Yor (2003). Stochastic volatility for Lévy processes. Math. Finance 13, 345–382.

- [\citeauthoryearCarr and MadanCarr and Madan1999] Carr, P. and D. B. Madan (1999). Option valuation using the fast Fourier transform. J. Comput. Finance 2(4), 61–73.

- [\citeauthoryearCont and TankovCont and Tankov2003] Cont, R. and P. Tankov (2003). Financial Modelling with Jump Processes. Chapman and Hall/CRC Press.

- [\citeauthoryearDeitmarDeitmar2004] Deitmar, A. (2004). A First Course in Harmonic Analysis (2nd ed.). Springer.

- [\citeauthoryearDempster and HongDempster and Hong2002] Dempster, M. A. H. and S. S. G. Hong (2002). Spread option valuation and the fast Fourier transform. In Mathematical Finance – Bachelier Congress 2000, pp. 203–220. Springer.

- [\citeauthoryearDoetschDoetsch1950] Doetsch, G. (1950). Handbuch der Laplace-Transformation. Birkhäuser.

- [\citeauthoryearDuffie, Filipović, and SchachermayerDuffie et al.2003] Duffie, D., D. Filipović, and W. Schachermayer (2003). Affine processes and applications in finance. Ann. Appl. Probab. 13, 984–1053.

- [\citeauthoryearDufresne, Garrido, and MoralesDufresne et al.2009] Dufresne, D., J. Garrido, and M. Morales (2009). Fourier inversion formulas in option pricing and insurance. Methodol. Comput. Appl. Probab. 11, 359–383.

- [\citeauthoryearEberleinEberlein2001] Eberlein, E. (2001). Application of generalized hyperbolic Lévy motions to finance. In O. E. Barndorff-Nielsen, T. Mikosch, and S. I. Resnick (Eds.), Lévy Processes: Theory and Applications, pp. 319–336. Birkhäuser.

- [\citeauthoryearEberlein, Glau, and PapapantoleonEberlein et al.2009] Eberlein, E., K. Glau, and A. Papapantoleon (2009). Analyticity of the Wiener–Hopf factors and valuation of exotic options in Lévy models. Working paper.

- [\citeauthoryearEberlein and KellerEberlein and Keller1995] Eberlein, E. and U. Keller (1995). Hyperbolic distributions in finance. Bernoulli 1, 281–299.

- [\citeauthoryearEberlein and KlugeEberlein and Kluge2006a] Eberlein, E. and W. Kluge (2006a). Exact pricing formulae for caps and swaptions in a Lévy term structure model. J. Comput. Finance 9(2), 99–125.

- [\citeauthoryearEberlein and KlugeEberlein and Kluge2006b] Eberlein, E. and W. Kluge (2006b). Valuation of floating range notes in Lévy term structure models. Math. Finance 16, 237–254.

- [\citeauthoryearEberlein and KlugeEberlein and Kluge2007] Eberlein, E. and W. Kluge (2007). Calibration of Lévy term structure models. In M. Fu, R. A. Jarrow, J.-Y. Yen, and R. J. Elliott (Eds.), Advances in Mathematical Finance: In Honor of Dilip B. Madan, pp. 155–180. Birkhäuser.

- [\citeauthoryearEberlein, Kluge, and SchönbucherEberlein et al.2006] Eberlein, E., W. Kluge, and P. J. Schönbucher (2006). The Lévy Libor model with default risk. J. Credit Risk 2, 3–42.

- [\citeauthoryearEberlein and KovalEberlein and Koval2006] Eberlein, E. and N. Koval (2006). A cross-currency Lévy market model. Quant. Finance 6, 465–480.

- [\citeauthoryearEberlein, Papapantoleon, and ShiryaevEberlein et al.2008] Eberlein, E., A. Papapantoleon, and A. N. Shiryaev (2008). On the duality principle in option pricing: semimartingale setting. Finance Stoch. 12, 265–292.

- [\citeauthoryearEberlein, Papapantoleon, and ShiryaevEberlein et al.2009] Eberlein, E., A. Papapantoleon, and A. N. Shiryaev (2009). Esscher transform and the duality principle for multidimensional semimartingales. Ann. Appl. Probab.. (forthcoming, arXiv/0809.0301).

- [\citeauthoryearElstrodtElstrodt1999] Elstrodt, J. (1999). Maß- und Integrationstheorie (2nd ed.). Springer.

- [\citeauthoryearFournié, Lasry, Lebuchoux, Lions, and TouziFournié et al.1999] Fournié, E., J.-M. Lasry, J. Lebuchoux, P.-L. Lions, and N. Touzi (1999). Applications of Malliavin calculus to Monte Carlo methods in finance. Finance Stoch. 3, 391–412.

- [\citeauthoryearHestonHeston1993] Heston, S. L. (1993). A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 6, 327–343.

- [\citeauthoryearHeuserHeuser1993] Heuser, H. (1993). Lehrbuch der Analysis I (10th ed.). Teubner.

- [\citeauthoryearHubalek and KallsenHubalek and Kallsen2005] Hubalek, F. and J. Kallsen (2005). Variance-optimal hedging and Markowitz-efficient portfolios for multivariate processes with stationary independent increments with and without constraints. Working paper, TU München.

- [\citeauthoryearHubalek, Kallsen, and KrawczykHubalek et al.2006] Hubalek, F., J. Kallsen, and L. Krawczyk (2006). Variance-optimal hedging for processes with stationary independent increments. Ann. Appl. Probab. 16, 853–885.

- [\citeauthoryearHurd and ZhouHurd and Zhou2009] Hurd, T. R. and Z. Zhou (2009). A Fourier transform method for spread option pricing. Preprint, arXiv/0902.3643.

- [\citeauthoryearJacod and ShiryaevJacod and Shiryaev2003] Jacod, J. and A. N. Shiryaev (2003). Limit Theorems for Stochastic Processes (2nd ed.). Springer.

- [\citeauthoryearKallsenKallsen2006] Kallsen, J. (2006). A didactic note on affine stochastic volatility models. In Y. Kabanov, R. Lipster, and J. Stoyanov (Eds.), From Stochastic Calculus to Mathematical Finance: The Shiryaev Festschrift, pp. 343–368. Springer.

- [\citeauthoryearKatznelsonKatznelson2004] Katznelson, Y. (2004). An Introduction to Harmonic Analysis (Third ed.). Cambridge University Press.

- [\citeauthoryearKeller-ResselKeller-Ressel2008] Keller-Ressel, M. (2008). Affine processes – theory and applications to finance. Ph. D. thesis, TU Vienna.

- [\citeauthoryearKeller-Ressel, Papapantoleon, and TeichmannKeller-Ressel et al.2009] Keller-Ressel, M., A. Papapantoleon, and J. Teichmann (2009). A new approach to LIBOR modeling. Preprint, arXiv/0904.0555.

- [\citeauthoryearKilinKilin2007] Kilin, F. (2007). Accelerating the calibration of stochastic volatility models. Working paper, HfB.

- [\citeauthoryearKohatsu-Higa and YasudaKohatsu-Higa and Yasuda2009] Kohatsu-Higa, A. and K. Yasuda (2009). A review of some recent results of Malliavin Calculus and its applications. Radon Ser. Comput. Appl. Math. (forthcoming).

- [\citeauthoryearLeeLee2004] Lee, R. W. (2004). Option pricing by transform methods: extensions, unification, and error control. J. Comput. Finance 7(3), 50–86.

- [\citeauthoryearLordLord2008] Lord, R. (2008). Efficient pricing algorithms for exotic derivatives. Ph. D. thesis, Univ. Rotterdam.

- [\citeauthoryearMadan and SenetaMadan and Seneta1990] Madan, D. B. and E. Seneta (1990). The variance gamma (VG) model for share market returns. J. Business 63, 511–524.

- [\citeauthoryearNicolato and VenardosNicolato and Venardos2003] Nicolato, E. and E. Venardos (2003). Option pricing in stochastic volatility models of the Ornstein–Uhlenbeck type. Math. Finance 13, 445–466.

- [\citeauthoryearPapapantoleonPapapantoleon2007] Papapantoleon, A. (2007). Applications of semimartingales and Lévy processes in finance: duality and valuation. Ph. D. thesis, Univ. Freiburg.

- [\citeauthoryearPinskyPinsky1993] Pinsky, M. A. (1993). Fourier inversion for piecewise smooth functions in several variables. Proc. Amer. Math. Soc. 118, 903–910.

- [\citeauthoryearPrausePrause1999] Prause, K. (1999). The generalized hyperbolic model: estimation, financial derivatives, and risk measures. Ph. D. thesis, Univ. Freiburg.

- [\citeauthoryearRaibleRaible2000] Raible, S. (2000). Lévy processes in finance: theory, numerics, and empirical facts. Ph. D. thesis, Univ. Freiburg.

- [\citeauthoryearRudinRudin1987] Rudin, W. (1987). Real and Complex Analysis (3rd ed.). McGraw-Hill.

- [\citeauthoryearSatoSato1999] Sato, K. (1999). Lévy Processes and Infinitely Divisible Distributions. Cambridge University Press.

- [\citeauthoryearSauvignySauvigny2006] Sauvigny, F. (2006). Partial Differential Equations 2. Springer.

- [\citeauthoryearSchoutensSchoutens2003] Schoutens, W. (2003). Lévy Processes in Finance: Pricing Financial Derivatives. Wiley.

- [\citeauthoryearSchoutens and TeugelsSchoutens and Teugels1998] Schoutens, W. and J. L. Teugels (1998). Lévy processes, polynomials and martingales. Comm. Statist. Stochastic Models 14, 335–349.

- [\citeauthoryearStein and WeissStein and Weiss1971] Stein, E. M. and G. Weiss (1971). Introduction to Fourier Analysis on Euclidean Spaces. Princeton University Press.

- [\citeauthoryearTeichmannTeichmann2006] Teichmann, J. (2006). Calculating the Greeks by cubature formulae. Proc. R. Soc. Lond. A 462, 647–670.

- [\citeauthoryearZimmerZimmer1990] Zimmer, R. J. (1990). Essential Results of Functional Analysis. University of Chicago Press.