Between the Information Economy and Student Recruitment: Present Conjuncture and Future Prospects

Abstract

In university programs and curricula, in general we react to the need to meet market needs. We respond to market stimulus, or at least try to do so. Consider now an inverted view. Consider our data and perspectives in university programs as reflecting and indeed presaging economic trends. In this article I pursue this line of thinking. I show how various past events fit very well into this new view. I provide explanation for why some technology trends happened as they did, and why some current developments are important now.

1 The Downturn in Academic Computer Science Undergraduate Student Recruitment

The student recruitment crisis of Computer Science and Engineering (CS and E) has been seen as one where there is over-provision of supply relative to demand. A response has been sought in more public outreach and in restructuring course provision. I am completely at one with this important work.

In this article I want to look at this context of discomfort and indeed of crisis from a very different vantage point. I will argue that we can view the swings of fortune in CS and E student recruitment as a prism with which to view large scale underlying technology and economic trends. I will illustrate this argument in various ways.

In an ideal world we could step back and just note that student demand has gone elsewhere, assuming relatively unchanging demographics. Maybe we would even retool our expertise, by changing research discipline for example. But there has been very great fluctuation in student demand and reacting overly hastily to the ups and downs of fortune is rarely a good idea.

In this article I will look closer at this fluctuation in student demand for CS and E. I will reverse the usual view of trying to explain student demand in terms of deep-lying economy needs. Instead I will present the view that major fluctuations in the economy can – up to a point – be interpreted and understood by the available data on student demand. The fit with a wide range of important technology trends is very good, as I will exemplify.

Between technological upswings I will present the view that one should prepare well for the next upswing. In regard to how we prepare for the future, one point to be noted is that our perspective will be a cloudy one if traditional economic categories like manufactured goods and services dominate our thinking. See section 2.5 for further discussion here.

Relatively interchangeably in this article I will use the terms CS and E, and ICT or information and communications technology. The latter is preferred when the industrial, commercial and market aspects are strongly represented.

2 The Information Society and the New Economy Periods of Spectacular Growth

There have been two major ICT-led economic booms in recent times. In both phases, the communications aspect of computing was hugely prominent.

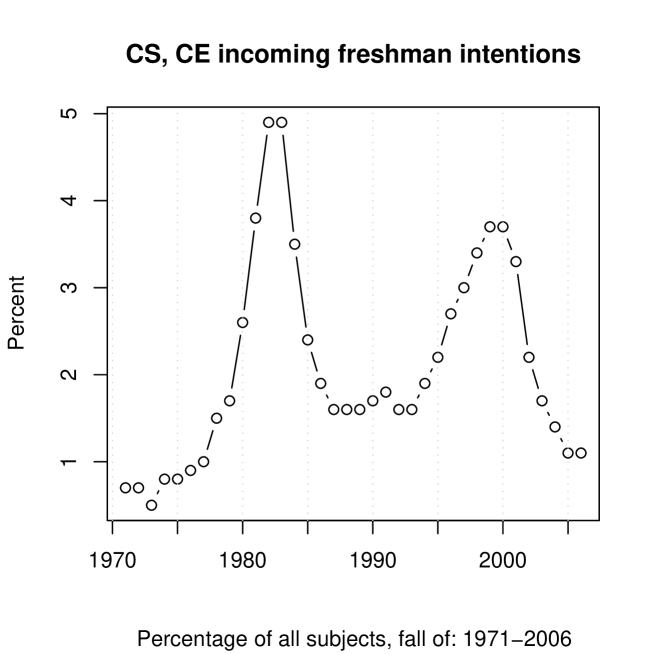

Figure 1 shows an educational reflection of what happened and when. I use North American data a number of times in this article because it is of high quality and collected in a consistent way over many years. Twice, we find major upswings in attractiveness of the science and technology. Figure 1 relates to incoming student intentions. Like business confidence surveys vis-à-vis the economy, Figure 1 expresses the pulling power of the discipline (or the generally perceived tight cluster of disciplines associated with CS and E). We see, well-mirrored in Figure 1, a massive take-off of, and interest in, computerization. By the late 1980s, this was in free-fall. Growth was ratcheted up in the 1990s. By early 2001, the economy was slipping fast (see e.g. [30] in support of the downturn starting in late 2000).

I will look at these two massive technology upswings, well expressed by the bumps in Figure 1. In line with what they have been often called, I will use the respective terms of Information Society and New Economy periods or booms. As a synonym here for boom, I will use the term upwelling. In ocean processes, upwelling is heat- and gravity-engendered. Upwelling events have important implications for biomass and later parts of the food chain. The upwelling metaphor is an apt one.

2.1 The Information Society Boom

Periodizing the earlier Information Society boom may be helped by Figure 1 and this note from [36] that “between 1980 and 1986, undergraduate CS production nearly quadrupled to more than 42,000 degrees. This period was followed by a swift decline and leveling off during the 1990s”.

The first great boom was the personal computer (PC) led one, focused on the computerization of society, and it also saw a great deal of early activity in networking. This boom was led by the generalized PC uptake in the early 1980s. It put to rest the debate on whether computerization of society could lead to productivity and general growth. A key text, with influence internationally, was the Nora/Minc report [20], which inspired French telecoms through Minitel, for example (an early chapter of [20] is entitled “From informatics to telematics”). Among the very opening lines are: “Increasing computerization of society is at the heart of the crisis” and the economic, political and social crisis is characterized generally by “grave, new challenges” under the overall heading of “the French crisis of informatics”.

Tectonic movements lay in the technology undergrowth, underlying science and engineering, and in market forces. Just to sketch a few important events of the time, Intel’s first microprocessor was launched in November 1971. The Apple II personal computer, introduced in 1977, was in continuous production until 1993. It was successful and mass-produced. The IBM PC, or IBM 5150, was launched in August 1981. Very soon the IBM PC had massively overtaken other alternative platforms [28]. 1984 saw the divestiture of AT&T’s operating companies into seven Regional Bell Operating Companies (see [23] for discussion and historical background). Mobile telephony was launched in the US in 1984. What was termed the deregularization or liberalization of the telecoms market was initiated in the European Union in 1985 through directives under the Treaty of Rome. The massive growth from the early 1990s of mobile telephony relative to fixed line telephony is well charted in [23]. So too are the organisational changes in the sector, including domestic and international alliances, and mergers and acquisitions (M&As) all of which hugely increased.

2.2 The Telecoms View Preceding the Information Society Boom

Against a background of market dominance by IBM, and the use of videotext in the UK (information delivered to end users by television signal), the national telecoms provider in France, DGT – Direction Générale des Télécommunications, obtained a superministerial budget in 1975, and in 1978, Simon Nora and Alain Minc submitted their hugely influential report, [20], to President Valéry Giscard d’Estaing.

The Nora/Minc report forecasted (the following is taken from [29]): “A massive social computerization will take place in the future, flowing through society like electricity. … The debate will focus on interconnectability.” The report concluded that the advent of cheap computers and powerful global communications media was leading to “an uncertain society, the place of uncountable decentralized conflicts, a computerized society in which values will be object of numerous rivalries stemming from uncertain causes, bringing an infinite amount of lateral communication.” To continue to compete in the first rank of nations, Nora and Minc exhorted, France would have to mount a full-scale national effort in the new field they named telematics (merging the terms “telecommunications” and “informatics”). They did not fail to note that “Telematics, unlike electricity, does not carry an inert current, but rather information, that is to say, power” and that “mastering the network is therefore an essential goal. This requires that its framework be conceived in the spirit of a public service.”

Officially launched in 1982, Minitel was a great success. In 1998 there were 5.6 million Minitel terminals available for this use of this secure but closed network [17].

2.3 Between the Information Society and New Economy Booms: An Example from Financial Data and Information

In this section I will look at one economic sector and how a major initiative was undertaken and grown before and then during the 1990s New Economy boom. I use it as an apt example of where and how new initiatives can be seeded to take advantage of economic doldroms, and perhaps particularly advantageously during such downbeat periods.

Financial services now account for a good part of leading economies. In the US, financial services contribute to GDP (gross domestic product) at 8 percent. In New York City, in 2007 the finance industry was “responsible for nearly one third of all wages earned” [32]. In the UK, the financial services sector contributes 6 percent to GDP and employs 4 percent of the national workforce. (See [9]).

Finance is based on the direct and immediate processing of data and information. In this sense it is one big application of ICT.

The International Financial Services Center, IFSC, was established in Dublin in 1987 between the two boom periods. It has been a significant success story. The IFSC now has 10,700 employed, growing by 1000 per year. More than 430 international operations trade in the IFSC, and a further 700 are approved to carry on business there. From a very low base at the beginning of the 1990s, Ireland has become an established center for the European investment funds industry, as shown in Table 1 [9].

| Luxembourg | 24.4% |

|---|---|

| France | 19.7% |

| Germany | 13.4% |

| UK | 10.3% |

| Ireland | 9.5% |

| Italy | 5.1% |

| Spain | 3.8% |

| Other | 13.8% |

| Total | 100% |

The December 2007 financial services strategy report [9] on the Irish and international financial services sector makes interesting reading too that links up with the growth in PhDs. (This is discussed further in section 3.) This report provided a rationale as to why and where more PhDs are needed in this sector. Rather than “skilled generalists” lacking specialized knowledge, this report called for “a greater focus on specializing in a number of selected areas which would support the development of a distinctive competence which was more aligned with a mid to high cost base.”

2.4 The New Economy or Dot-Com Boom

The second great boom came about through the web, with complementary activity in telecoms, e-commerce and dot-com venture capital and finance generally. Wide and popular take-up of the web was consolidated with the release of the Mosaic browser in early 1993 by Marc Andreessen, a student who graduated in 1993 at the University of Illinois at Urbana-Champaign. This led to absolute dominance over other information sharing systems that were current in the very early 1990s, such as Gopher and Veronica, WAIS (wide area information system, based on the Z39.50 protocol), archie and others.

Two markers of the Dot-Com boom are to be seen in Ireland and in Finland.

The Celtic Tiger [21] was a term coined by [11] in August 1994. The parallel was with the Asian Tiger economies. In some years of the Celtic Tiger period growth, measured by real GDP (gross domestic product), was more than 10%. Statistics and discussion can be seen at [8]. By 2008, the ICT sector had grown in Ireland to employ more than 91,000 people. The Irish software sector alone accounts for 10% of Ireland gross domestic product [31]. This spectacular Irish growth took off in 1993 and contributed crucially to Ireland’s impressive growth up to 2001 [10]. So the Irish Celtic Tiger period began at the same time as the popular take-up of the web, and both grew in tandem.

In Finland, the history of Nokia is revealing also from the point of view of timing relative to the New Economy. Nokia evolved from being an industrial conglomerate dating from the 1860s. It was established as a wood pulp mill in 1865; moved to rubber and cable companies operating in alliance with a forestry company from 1922 to 1966/1967; following a merger it expanded into electronics; and from this, telecoms took off in the 1990s. The take-off of Nokia was started in the 1990s, at roughly the same time as the Irish Celtic Tiger take-off, and the popular upsurge of the web. Nokia point to a management decision that in 1994, “formulated the key elements of Nokia’s strategy: leave old businesses and increasingly focus on telecommunications.”

So a range of momentous decisions and events were happening at roughly the same time, relating to: networks; mobile telecoms; user interfaces; the information economy; and information distribution. On the latter, information distribution, the July 1994 plunge of comet Shoemaker-Levy into the planet Jupiter, lasting a week, was an early example. Networks including the young web came of age at that time, through massive worldwide interest. My role included analyzing image data and getting information out by all available means – web, other networks (e.g., CompuServe, a dial-up network later absorbed into AOL), news and television media. The context is described by [38].

The Dot-Com boom collapsed by early 2001, and it may be the case that we are now pulling out of the downturn. A good proxy for whether we are or not is the attractiveness manifested by undergraduate student recruitment. Internationally this has been in freefall since 2001. There have been bad consequences: some departments have retrenched, and old debates about the nature of our science and engineering have again developed an unpleasant rawness.

“After six years of declines, the number of new CS majors in fall 2006 was half of what it was in fall 2000 (15,958 versus 7,798)” [35]. Nonetheless the prognosis stated there is hopeful that a turn-around is now happening.

The response to the crisis of student recruitment in CS, with knock-on budgetary (salary and support) effects, has been surprisingly uniform. It has led to attempts to refocus undergraduate curricula into new digital media such as digital music; games technologies; and information security.

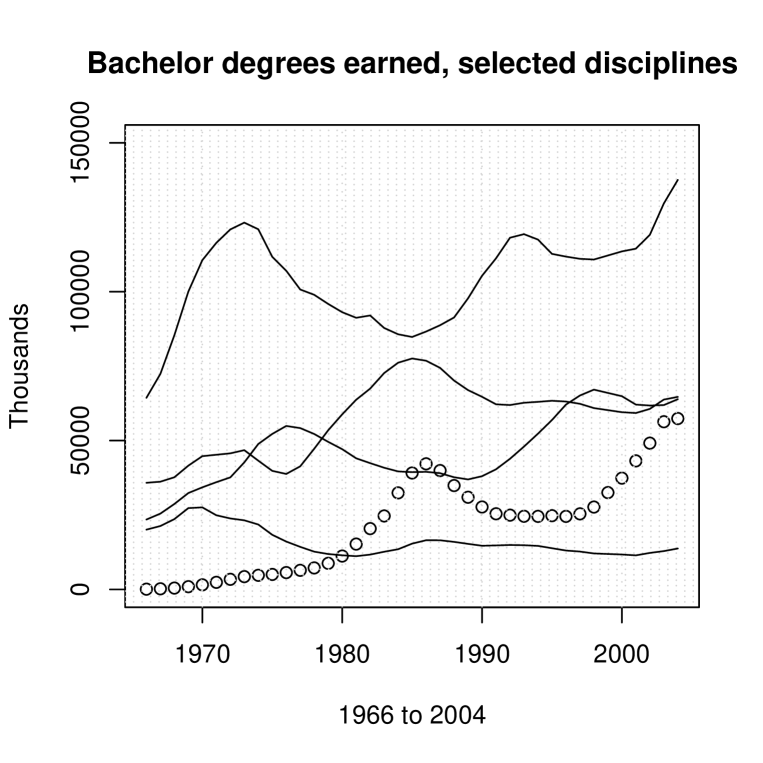

One interesting thing about Figure 2 is that it shows where the students went, given their flight from CS and E. Physical Science (Physics, Chemistry, Astronomy, Other) had a very similar curve to that of Mathematics, so we do not show it here. It does appear that for the 1980s boom, CS gained greatly in shifting students in such a way that ultimately Biological Science and Social Sciences were the losers then. In the 1990s boom there is some indication of this swing again, albeit less pronounced. Note that in Figure 2 the degrees awarded can be expected to have some lag relative to underlying economic developments, and relative to intentions as seen in Figure 1.

2.5 The Information Society and New Economy Upwelling Periods: View from Economics

How real the ICT base for society had become remained for long an open issue to be addressed, – a set of questions rather than a resoundingly clear response to profound structural changes in economy and society. It was so for both the Information Society upwelling of the 1980s and for the New Economy of the 1990s.

Pakko [22] discusses how far there was qualitative change. Temple [33] discusses whether or not the economy had become structurally new. In both cases these authors argue positively. The very fact that such questions were posed is what is curious.

IBM announced its first PC in August, 1981, but the old style of economics showed no productivity gains from the PC boom of the 1980s. PC sales peaked in 1995. For PCs, accessories and components, “… demand has slowed sharply. If we look at nominal order growth for this same industry we see a virtual collapse in orders between 1994 and 1997 despite some firming in the overall economic growth rate.” [37]. The long heralded Information Society was criticized as being nowhere to be found [16]. This is all very curious when looked at now in our rear view mirror. The low point for long-term productivity growth had later to be revised to 1982, as opposed to – 1996! [16].

Both Information Society and New Economy periods were not easy to understand for economists. In a much quoted remark, in 1987 Nobel Laureate Robert Solow said that “we can see the computer age everywhere except in the productivity statistics” (e.g. [18]). A very gloomy view of the computing and telecoms sector was presented in May 1998 by [37]: “Surveys now indicate that almost 50% of all U.S. households own PCs. The PC is a sophisticated product. Educational levels, even literacy, are inadequate for a significant percentage of the U.S. population. It is quite amazing that so high a percentage of all households own PCs. Clearly, market saturation, if it is not already here, cannot be far away.” All one can say is, thank goodness new user interface technology saved us all!

An aspect of confusion for commentators on the technology swings has been the role of services versus manufactured goods. The problem with the following view of ICT application [3] is clear enough, namely that software and similar goods are in fact – to an excellent approximation – of zero cost from the second copy onwards: “intangible goods, such as software and other digital information-goods, whose unit costs of production tend to fall rapidly with growth in the volume of production. … In this sense one may say that the information technology revolution has been contributing towards maintaining the importance of the sector of the US economy in which production is characterized by conventional, old-fashioned economies of scale.” So economy of scale is meant to explain what was happening in an ICT upwelling. I disagree: services, I believe, should not be distinguished from other classes of goods.

Another perceived problem with understanding goods versus services is that true prices of services are difficult to fathom. David [3] notes “a substantial gap between average labour productivity growth rates in the better-measured, commodity-producing sector on the one hand, and a collection of ‘hard-to-measure’ service industries, on the other.”

David [3] goes some way towards reconciling how tangible goods can be influenced by intangible services. He presents “a view of the digital technology revolution as a source of efficiency improvements that gradually have been increasing in magnitude and permeating the economy”. David sees computerization and telecoms as “general purpose technologies” or as a “general purpose engine”, deployed in the framework of more established technologies. He points to further progress to be expected, and as examples mentions (i) digitized and online intra-company workflow, (ii) wearable and similar computing platforms; and (iii) tele-working. However this perspective remains anchored in a view that efficiency of traditional market sectors is what is important, rather than something that is fundamentailly new.

My view of this is quite different. We are not witnessing just a ratcheting up of traditional efficiencies. In fact what I cannot understand is why a dividing line is drawn between goods and services. When I hear of manufacturing being distinguished from services, as economic categories, I am perplexed. A manufactured good that does not perform a service when used or consumed – that, to my mind, is a contradiction in terms. If a service is purchased and consumed then surely that is immediately and directly a manufactured good.

Indeed, further evidence of the tangibility of services was the economic downturn triggered by the US subprime borrowing sector in the second half of 2007. To illustrate how this can have implications for the ICT sector, consider India’s Tata Consultancy Services (TCS) [15] with 65% of its near US $ 40 billion in revenues earned from the US. TCS’s US earnings in turn accounted for a major share of its overall 30% of revenues from the banking and financial sector.

Maybe changes of economic categories will come about. Industrial and sectoral categorization schemes must change over time. A standard is the NAICS, North American Industry Classification System [34]. The NAICS 2007 and the NAICS 2002 standards introduced a good number of changes, in particular in the ICT area. Nonetheless there are high level categories for: Manufacturing, Information, Utilities, Professional (i.e. Services), and so on. Links can be found at [34] also to the North American Product Classification System (NAPCS) for services and separately for manufacturing. Industrial categorization schemes of these types have their use in particular areas. An example of how a different scheme was developed is GICS, Global Industry Classification Standard. It was developed by the financial sector (specifically Morgan Stanley Capital International and Standard and Poor’s) to allow for a categorization that was better correlated with profitability and rate of growth.

By distinguishing between a computer and telecom sector, on the one hand, and others with which this sector interfaces, one really has to square lots of circles. Consider the following ICT-related categories, from [14], where for example the software sector is cut off from its domain of application (not a good idea from the software engineering viewpoint of user-centered design). “IT-producing industries – semiconductors, computers, communications equipment, and software … Although three-quarters of U.S. industries have contributed to the acceleration in economic growth, the four IT-producing industries are responsible for a quarter of the growth resurgence, but only 3 percent of the Gross Domestic Product (GDP). IT-using industries account for another quarter of the growth resurgence and about the same proportion of the GDP, while non-IT industries with 70 percent of value-added are responsible for only half the resurgence. Obviously, the impact of the IT-producing industries is far out of proportion to their relatively small size.” Being stuck in an IT-producing versus IT-using view unfortunately hinders greatly an understanding of the present or the near future.

I would propose that “innovation” has to be understood in conjunction with what is at issue, just as software is closely tied to its application. Unfortunately we must often discuss innovation in the abstract, and similarly the software sector in the abstract. I have noted that instead it is the technology that has changed fundamentally. A useful supportive view is the following. While technological innovation, tax and deficit policy are interdependent, so that, for example, lower interest rates from increased savings can encourage innovation as can lower tax rates, nevertheless Mandel [16] concludes that: “In the 1990s, at least, it seems that technology is more powerful than either taxes or deficits.” It is my view that this is indeed the case, that any hard and fast distinction between goods and services is unclear at best, and that software belongs to both camps.

2.6 The Financial Side of the New Economy

The 1990s New Economy has been widely seen as an economic bubble [13]. Two examples, among many, of how this worked in practice are as follows. In what then as now is widely viewed as AOL’s purchase of Time Warner in January 2000, both were roughly equally capitalized but there were 12,000-odd employees with the former and 67,000-odd with the latter. Another example of new buying old was in February 2000 when Vodafone (telecoms, mobile, UK-based) bought out Mannesmann (engineering, German-based). By being massively valued, new wave ICT companies were able to buy out traditional, solid corporations [23]. In this section I probe the financial mechanism underlying this and its role in giving such strong trump cards to the new technologies.

For Perez [25, 26], booms such as the New Economy one are fueled by financial bubbles that are to be understood as “massive processes of credit creation”, “massive episodes of credit creation”.

Perez [24] colorfully describes a financial and economic bubble as follows: “a whirlpool that sucks in huge amounts of the world’s wealth to reallocate it in more adventurous or reckless hands … A part of this goes to new industries, another to expand the new infrastructure, another to modernize all the established industries, but most of it is moved about in a frenzy of money-making money, which creates asset inflation and provides a gambling atmosphere within an ever-expanding bubble”. When new technologies that have instigated this have consolidated, a production phase sets in, and is viewed in far more favorable terms – stable, equitable, just – by Perez.

Expressing the foregoing in another way, Perez points to the “techno-economic paradigm” of development at issue here. Development of technology without finance is unthinkable. The causal connection between finance and technology is mutually disruptive but simultaneously, at a deep level, constructive and symbiotic. Perez [26] describes how: “those radical innovative breaks also require bold and risk-loving bankers, because the ‘serious’ ones would share the same mental routines as the heads or managers of the established firms. In fact, the historical recurrence of bursts of ‘wildcat or reckless’ finance in the period of intense investment in technological revolutions suggests that these phenomena may be causally connected.”

One other term used by Perez strikes a chord, that of “clusters of radical innovation”, “Such interconnected innovations in products and processes, in equipment and organization, technical and managerial, form a coherent and mutually enhancing set of technologies and industries, capable of carrying a wave of growth in the economy”. For we can see that in the earlier 1980s Information Society boom that I discuss here, there was the penetration of computerization into all aspects of business, the rise of individual computing through the PC, Minitel as a precursor to society-wide networking, and various other facets. In the 1990s New Economy boom there was a great surge in human-computer interface technology, mobile phone uptake soared, and industrial mergers of new and long-established partners took place, such as between AOL and Time Warner, or Vodafone and Mannesmann.

3 The Changing Nature of the PhD

The PhD degree, including the title, the dissertation and the evaluation framework as a work of research (the “rite of passage”) came about in the German lands between the 1770s and the 1830s. Clark [1] finds it surprising that it survived the disrepute associated with all academic qualifications in the turmoil of the late 18th century. In the United States, the first PhD was awarded by Yale University in 1861. In the UK, the University of London introduced the degree between 1857 and 1860. Cambridge University awarded the DPhil or PhD from 1882, and Oxford University only from 1917.

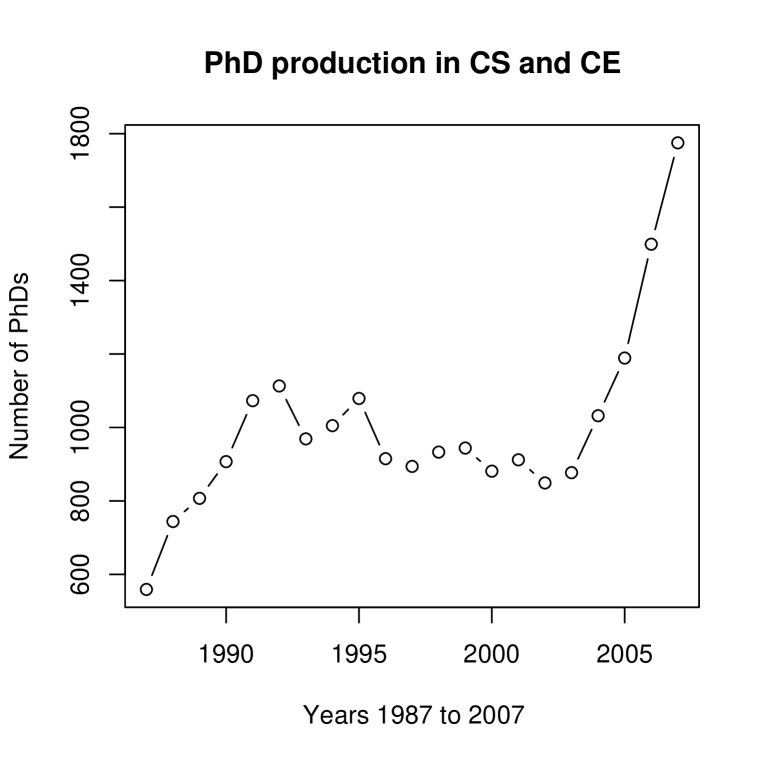

A quite remarkable feature of the modern period, post Dot-Com or New Economy boom, is how spectacular the growth of PhD numbers has now become. Figure 3 shows how PhDs dropped during the good years of the Dot-Com economy period. But now the output trend in regard to PhDs is hugely different. In just four years, from 2003 to 2007, PhD output in CS and E in North America has doubled. The Taulbee survey indicates that PhDs are expected to decline in the near future but by how much and whether then going into a further climb or a plateau are quite open issues.

Internationally the evolution illustrated in Figure 3 holds too. For example, Ireland is pursuing a doubling of PhD output up to 2013 [4].

Concomitant with numbers of PhDs, the very structure of the PhD is changing in many countries outside North America. There is a strong movement away from the traditional German “master/apprentice” model, towards instead a “professional” qualification. This move is seen often as towards the US model. In Ireland there is a strong move to reform the PhD towards what is termed a “structured PhD”. This involves a change from the apprenticeship model consisting of lone or small groups of students over three years in one university department to a new model incorporating elements of the apprenticeship model centered around groups of students possibly in multiple universities where generic and transferable skills (including entrepreneurial) can be embedded in education and training over four years.

In Finland a Graduate School system was pursued on the cross-institutional level from 1995. Like the Irish case, the aim is for more systematic education and training that is more akin to that for a profession rather than as an apprenticeship. An aim too is greater efficiency of advisor resource deployment and course provision, over a four year timeline [27]. The Engineering Doctorate in the UK is of similar duration, and professionally oriented [6]. Doctoral Training Centres in the UK have similarities with the Graduate School concept [7]. An analogous situation holds for Graduate Schools in France, supporting a three year post-Master doctorate [5]. Unlike in these cases, Germany is retaining a traditional “master/apprentice” model [12].

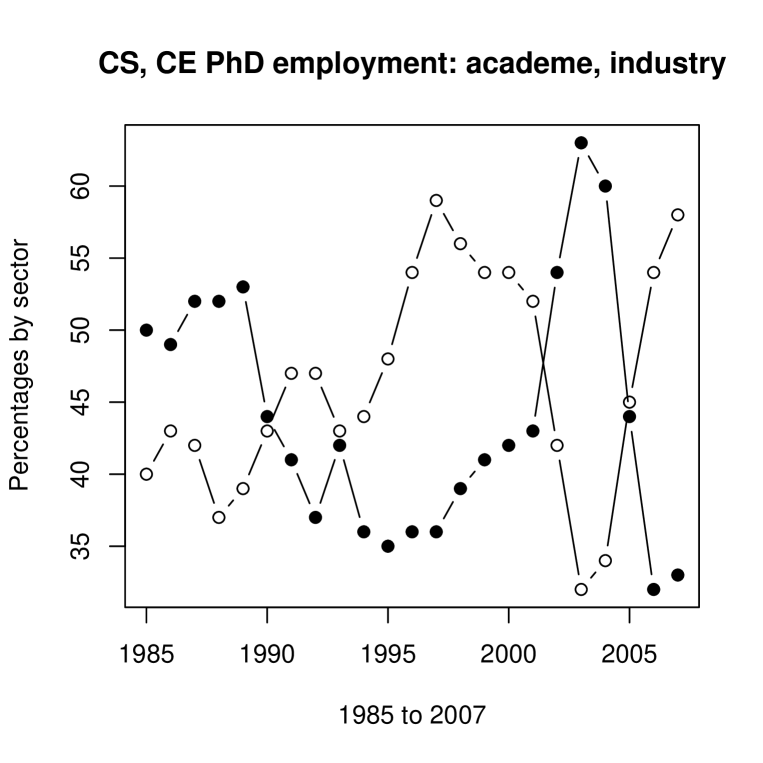

Numbers of PhDs are dramatically up, and as we have seen in many countries there is a major restructuring underway of the PhD work content and even timeline. In tandem with this, as Figure 4 shows, in North America the majority of PhDs now go directly into industry. This trend goes hand in hand with the move from an apprenticeship for a career in academe to, instead, a professional qualification for a career in business or industry.

4 Conclusion

CS and E undergraduate recruitment and PhD production figures are all key data. With various examples I have shown that they are also key to our understanding of a wide range of underlying social and technological trends.

Using these key data to study underlying economical and technological changes ought not be left to others. After all, we as Computer Scientists and Engineers have a better vantage point.

The categories we use are supremely important. The joint association of computerization and telecoms in the term ICT is just one example. So too is the multimedia information industry [23], merging telecoms, information technology, entertainment, media and consumer electronics. Official statistics lag very much behind this. So facts and figures can mislead. I have noted the confused overlapping terms “manufacturing” and “services”. An immediate conclusion is that policy makers can provide leadership by using forward-reaching categorization and prioritization of research themes and directions. Steps in this direction are discussed further in [19].

References

- [1] W. Clark, Academic Charisma and the Origins of the Research University, University of Chicago Press, 2006.

- [2] Computing Research News Online, Vol. 20, No. 3, CRA, Computing Research Association, May 2008, http://www.cra.org/CRN/online.html

- [3] P. David, “Productivity growth prospects and the new economy in historical perspective”, EIB Papers (European Investment Bank), Vol. 6, No. 1, 2001, pp. 41–61.

- [4] Department of Enterprise, Trade and Employment, Ireland, Strategy for Science, Technology and Innovation 2006–2013, 2006. www.entemp.ie/science/technology/sciencestrategy.htm

- [5] “Doctorat”, Ministry of National Education, France, October 2007, http://www.education.gouv.fr/cid306/doctorat.html

- [6] EPSRC (Engineering and Physical Sciences Research Council), UK, Engineering Doctorates, www.epsrc.ac.uk/PostgraduateTraining/EngineeringDoctorates

- [7] EPSRC (Engineering and Physical Sciences Research Council), UK, EPSRC Centres for Doctoral Training, www.epsrc.ac.uk/CallsForProposals/DTCsOutlines08.htm

- [8] ESRI, Economic and Social Research Institute, “Irish economy”, http://www.esri.ie/irish_economy

- [9] Expert Group on Future Skills Needs, Future Skills and Research Needs of the International Financial Services Industry, Forfás, December 12, 2007, 227 pp. http://www.forfas.ie/publications/show/pub285.html

- [10] G. FitzGerald, “What caused the Celtic Tiger phenomenon?”, Irish Times, 21 July 2007.

- [11] K. Gardiner, “The Irish economy: a Celtic Tiger”, MS (Morgan Stanley) Euroletter, 31 August 1994.

- [12] German Academic Exchange Service (DAAD, Deutscher Akademischer Austausch Dienst), “Paths to a Doctorate in Germany”, 2008, http://www.daad.de/deutschland/forschung/promotion/04670.en.html

- [13] A. Ghosh, “The IPO phenomenon in the 1990s”, Social Science Journal, 43, 487–495, 2006.

- [14] D.W. Jorgensen and C.W. Wessner, Eds., Enhancing Productivity Growth in the Information Age: Measuring and Sustaining the New Economy, Committee on Measuring and Sustaining the New Economy, Board on Science, Technology, and Economic Policy, Policy and Global Affairs, National Research Council of the National Academies, National Academies Press, 2007.

- [15] V. Kulkarni, “Subprime aftershock: local IT cos brace for lower tech spends. Multi-billion dollar write-offs by financial services firms may hit their 2008 IT budgets, hurting offshoring”, LiveMint.com, The Wall Street Journal, 16 June 2008, www.livemint.com/2007/11/19002722/Subprime-aftershock-local-IT.html

- [16] M.J. Mandel, “Commentary: How most economists missed the boat”, BusinessWeek Online, 15 November 1999, http://www.businessweek.com/1999/99_46/b3655147.htm

- [17] A. McIver McHoes and G. McHoes, “Minitel”, Macmillan Science Library: Computer Sciences, www.bookrags.com/research/minitel-csci-01, 2006.

- [18] C.E. Minehan, L.E. Browne and L. McIntyre, “Productivity growth and the ‘new economy’ ”, 17 pp., in 1999 Annual Report, Federal Reserve Bank of Boston.

- [19] F. Murtagh, “The Correspondence Analysis platform for uncovering deep structure in data and information”, Sixth Annual Boole Lecture in Informatics, April 2008, Computer Journal, forthcoming, 2008.

- [20] S. Nora and A. Minc, L’Informatisation de la Société, La Documentation française, 1978.

- [21] S. O Riain, “The birth of a Celtic Tiger”, Comm. ACM, 40 (3), 11-16, 1997.

- [22] M.R. Pakko, “The high-tech investment boom and economic growth in the 1990s: accounting for quality”, Review of Federal Reserve Bank of St Louis, March 2002, 3-18

- [23] J. Pennings, H. van Kranenburg and J. Hagedoorn, “Past, present and future of the telecommunications industry”, chapter, Growth and Dynamics of Maturing New Media Companies, No 15, Research Memoranda from Maastricht: METEOR, Maastricht Research School of Economics of Technology and Organization, 2005.

- [24] C. Perez, Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages, Edward Elgar, Cheltenham, UK, 2002.

- [25] C. Perez, “Respecialization and the deployment of the ICT paradigm”, report, 37 pp., 2005.

- [26] C. Perez, “Finance and technical change: a long-term view”, report, 18 pp., 2004. To appear in: H. Hanusch and A. Pyka, Eds., The Elgar Companion to Neo-Schumpeterian Economics, Edward Elgar, Cheltenham, 2004.

- [27] “Researcher training: Finnish Science and Technology Information Service”, Ministry of Education, Finland, 13 February 2008, http://www.research.fi/en/resources/researcher_training

-

[28]

J. Reimer, “Personal Computer Market Share: 1975-2004”,

http://www.jeremyreimer.com/total_share.html - [29] H. Rheingold, The Virtual Community (electronic version), http://www.rheingold.com/vc/book/8.html The Virtual Community: Homesteading on the Electronic Frontier, MIT Press, (revised edn.) 2000.

- [30] Research and Innovative Technology Administration, US Department of Transportation, Bureau of Transportation Statistics, “Transportation Statistics Annual Report 2001”, 2001.

- [31] K. Ryan, Engineering the Irish software tiger, Computer, 78–83, June 2008.

- [32] L. Story, “With economy tied to Wall St., New York braces for job cuts”, New York Times, March 24, 2008.

- [33] J. Temple, “The assessment: the New Economy”, Oxford Review of Economic Policy, 18 (3), 241-264, 2002.

- [34] US Census Bureau, NAICS, North American Industry Classification System, 2002, 2007. http://www.census.gov/epcd/www/naics.html

- [35] J. Vegso, “Continued drop in CS Bachelor’s degree production and enrollments as the number of new majors stabilizes”, Computing Research News, Vol. 19, No. 2, March 2007. http://www.cra.org/CRN/articles/march07/vegso.html

- [36] J. Vegso, “Enrollments and degree production at US CS departments drop further in 2006-07”, Computing Research News, Vol. 20, No. 2, March 2008, http://www.cra.org/CRN/articles/march08/jvegso_enrollments.html

- [37] Venoroso Associates, “High tech… the boom/bust cycle of a generation? Executive summary”, 27 May 1998 http://www.gold-eagle.com/gold_digest_98/veneroso052798.html

- [38] K. Whitehouse, “Comet explodes on Jupiter – and the web”, Computer Graphics and Applications, 14, 12–13, 1994.