A note on state space representations of locally stationary wavelet time series

Abstract

In this note we show that the locally stationary wavelet process can be decomposed into a sum of signals, each of which following a moving average process with time-varying parameters. We then show that such moving average processes are equivalent to state space models with stochastic design components. Using a simple simulation step, we propose a heuristic method of estimating the above state space models and then we apply the methodology to foreign exchange rates data.

Some key words: wavelets, Haar, locally stationary process, time series, state space, Kalman filter.

1 Introduction

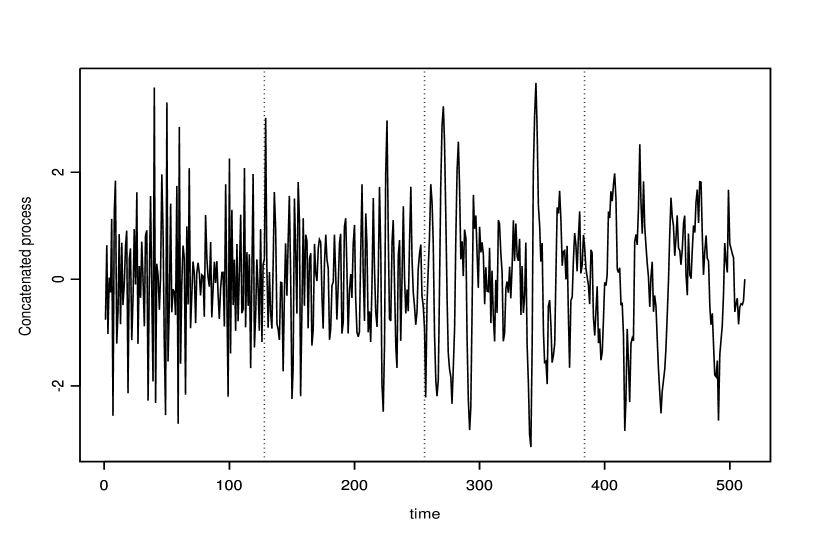

Nason et al. (2000) define a class of locally stationary time series making use of non-decimated wavelets. Let be a scalar time series, which is assumed to be locally stationary, or stationary over ceratin intervals of time (regimes), but overall non-stationary. For more details on local stationarity the reader is referred to Dahlhaus (1997), Nason et el. (2000), Francq and Zakoan (2001), and Mercurio and Spokoiny (2004). For example, Figure 1 shows the nonstationary process considered in Nason et al. (2000), which is the concatenation of 4 stationary moving average processes, but each with different parameters. We can see that within each of the four regimes, the process is weakly stationary, but overall the process is non-stationary.

The locally stationary wavelet (LSW) process is a doubly indexed stochastic process, defined by

| (1) |

where is a random orthonormal increment sequence (below this will be iid Gaussian) and is a discrete non-decimated family of wavelets for , , based on a mother wavelet of compact support. Denote with the indicator function, i.e. , if and , otherwise. The simplest class of wavelets are the Haar wavelets, defined by

for and , where is the finest scale. It is also assumed that , for all and and so has zero mean. The orthonormality assumption of implies that , where denotes the Kronecker delta, i.e. and , for .

The parameters are the amplitudes of the LSW process. The quantity characterizes the amount of each oscillation, at each scale, , and location, (modified by the random amplitude, ). For example, a large value of indicates that there is a chance (depending on ) of an oscillation, , at time . Nason et al. (2000) control the evolution of the statistical characteristics of by coupling to a function for by . Then, the smoothness properties of control the possible rate of change of as a function of , which consequently controls the evolution of the statistical properties of . The smoother is, as a function of , the slower that can evolve. Ultimately, if is a constant function of , then is weakly stationary.

The non-stationarity in the above studies is better understood as local-stationarity so that the ’s are close to each other. To elaborate on this, if (time invariant), then would be weakly stationary. The attractiveness of the LSW process, is its ability to consider time-changing ’s.

Nason et al. (2000) define the evolutionary wavelet spectrum (EWS) to be and discuss methods of estimation. Fryzlewicz et al. (2003) and Fryzlewicz (2005) modify the LSW process to forecast log-returns of non-stationary time series. These authors analyze daily FTSE 100 time series using the LSW toolbox. Fryzlewicz and Nason (2006) estimate the EWS by using a fast Haar-Fisz algorithm. Van Bellegem and von Sachs (2008) consider adaptive estimation for the EWS and permit jump discontinuities in the spectrum.

In this paper we show that the process can be decomposed into a sum of signals, each of which follows a moving average process with time-varying parameters. We deploy a heuristic approach for the estimation of the above moving average process and an example, consisting of foreign exchange rates, illustrates the proposed methodology.

2 Decomposition at scale

The LSW process (1) can be written as

| (2) |

where

| (3) |

For computational simplicity and without loss in generality, we omit the minus sign of the scales so that the summation in equation (2) is done from (scale ) until (scale ).

Using Haar wavelets, we can see that at scale 1, we have from (3) that , since there are only 2 non-zero wavelet coefficients. Then we can re-write (3) as , which is a moving average process of order one, with time-varying parameters and . This process can be referred to as TVMA process.

In a similar way, for any scale , we can write

so that we obtain the TVMA() process

| (4) |

where for all and . Thus the process is the sum of TVMA processes. However, we note that not all time-varying parameters are independent, since, for a fixed , they are all functions of the series.

We advocate that is a signal and as such we treat it as an unobserved stochastic process. Indeed, from the slow evolution of , we can postulate that , which motivates a random walk evolution for or , where is a Gaussian white noise, i.e. , for a known variance, and is independent of , for all . The magnitude of the differences between and can be controlled by and this controls on the degree of evolution of as a function of and hence on through (2).

At scale 1 we can write as

where we have used . Likewise at scale 2 we have

where we have used , and .

In general we observe that at any scale we can write

| (5) |

where the ’s follow the random walk

| (6) |

3 A state space representation

For estimation purposes one could use a time-varying moving average model in order to estimate in (4). Moving average processes with time-varying parameters are useful models for locally stationary time series data, but their estimation is more difficult that that of time-varying autoregressive processes (Hallin, 1986; Dahlhaus, 1997). The reason for this is that the time-dependence of the moving average coefficients may result in identifiability problems. The consensus is that some restrictions of the parameter space of the time-varying coefficients should be applied; for more details the reader is referred to the above references as well as to Triantafyllopoulos and Nason (2007).

In this section we use a heuristic approach for the estimation of the above models. First we recast model (5)-(6) into state space form. To end this we write

| (7) |

where and , for . In addition we assume that is independent of , for and for any , so that

| (8) |

Equations (7), (6), (8) define a state space model for and by defining and by noting that is independent of , for any , we obtain by (2) a state space model for , which essentially is the superposition of state space models of the form of (7), (6), (8), each being a state space model for each scale .

Given a set of data , a heuristic way to estimate , is to simulate independently all from , thus to obtain simulated values for and then, conditional on , to apply the Kalman filter to the state space model for . This procedure will give simulations from the posterior distributions of and also from the predictive distributions of . The estimator of and the forecast of are conditional on the simulated values of . For competing simulated sequences the performance of the above estimators/forecasts can be judged by comparing the respective likelihood functions (which are easily calculable by the Kalman filter) or by comparing the respective posterior and forecast densities (by using sequential Bayes factors). Another means of model performance may be the computation of the mean square forecast error.

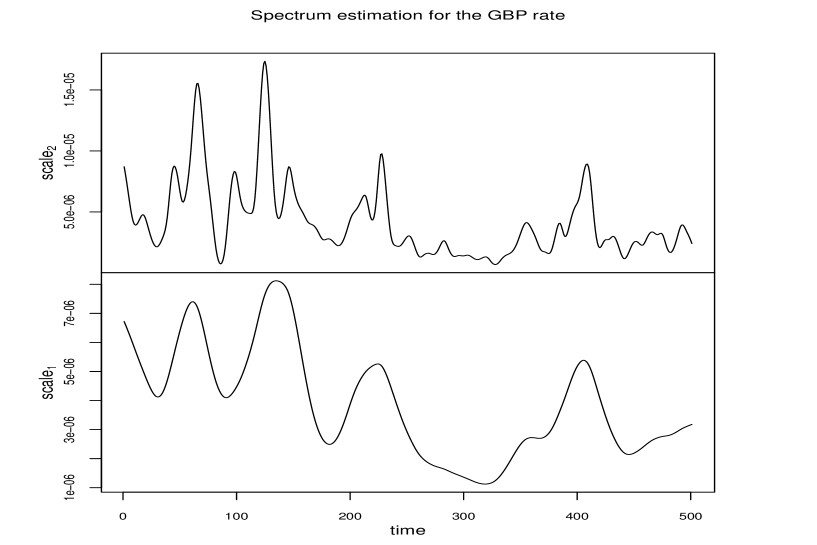

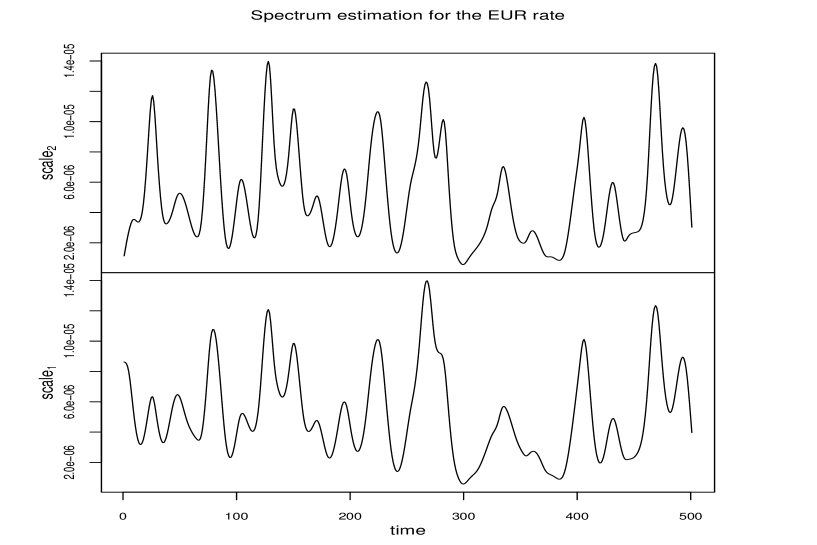

We illustrate this approach by considering foreign exchange rates data. The data are collected in daily frequency from 3 January 2006 to and including 31 December 2007 (considering trading days there are 501 observations). We consider two exchange rates: US dollar with British pound (GBP rate) and US dollar with Euro (EUR rate). After we transform the data to the log scale, we propose to use the LSW process in order to obtain estimates of the spectrum process , for each scale . We form the vector , where is the log-return value of GBP and is the log-return value of EUR. For each series and , respectively, Figures 2 and 3 show simulations of the posterior spectrum , for scales 1 and 2. The smoothed estimates of these figures are achieved by first computing the smoothed estimates using the Kalman filter and then applying a standard Spline method (Green and Silverman, 1994). We note that, for the data set considered in this paper, the estimates of Figures 2 and 3 are less smooth than those produced by the method of Nason et al. (2000). However, a higher degree of smoothness in our estimates can be achieved by considering small values of the variance , which controls the smoothness of the shocks in the random walk of the ’s.

References

- [1] Anderson, P.L. and Meerschaert, M.M. (2005) Parameter estimation for periodically stationary time series. Journal of Time Series Analysis, 26, 489-518.

- [2] Dahlhaus, R. (1997) Fitting time series models to nonstationary processes. Annals of Statistics, 25, 1-37.

- [3] Francq, C. and Zakoan, J.M. (2001) Stationarity of multivariate Markov-switching ARMA models. Journal of Econometrics, 102, 339-364.

- [4] Fryzlewicz, P. (2005) Modelling and forecasting financial log-returns as locally stationary wavelet processes. Journal of Applied Statistics, 32, 503-528.

- [5] Fryzlewicz, P. and Nason, G.P. (2006) Haar-Fisz estimation of evolutionary wavelet spectra. Journal of the Royal Statistical Society Series B, 68, 611-634.

- [6] Fryzlewicz, P., Van Bellegem, S. and von Sachs, R. (2003) Forecasting non-stationary time series by wavelet process modelling. Annals of the Institute of Statistical Mathematics, 55, 737-764.

- [7] Green, P.J. and Silverman, B.W. (1994) Nonparametric Regression and Generalized Linear Models: A Roughness Penalty Approach. Chapman and Hall.

- [8] Hallin, M. (1986) Nonstationary Q-dependent processes and time-varying moving-average models - invertibility property and the forecasting problem. Advances in Applied Probability, 18, 170-210.

- [9] Mercurio, D. and Spokoiny, V. (2004) Statistical inference for time-inhomogeneous volatility models. Annals of Statistics, 32, 577-602.

- [10] Nason, G.P., von Sachs, R. and Kroisandt, G. (2000) Wavelet processes and adaptive estimation of the evolutionary wavelet spectrum. Journal of the Royal Statistical Society Series B, 62, 271-292.

- [11] Triantafyllopoulos, K. and Nason, G.P. (2007) A Bayesian analysis of moving average processes with time-varying parameters. Computational Statistics and Data Analysis, 52, 1025–1046.

- [12] Van Bellegem, S. and von Sachs, R. (2008) Locally adaptive estimation of evolutionary wavelet spectra. Annals of Statistics, (to appear).