Optimal consumption policies in illiquid markets††thanks: This work is supported partly by the Europlace Institute of Finance.

Abstract

We investigate optimal consumption policies in the liquidity risk model introduced in [5]. Our main result is to derive smoothness results for the value functions of the portfolio/consumption choice problem. As an important consequence, we can prove the existence of the optimal control (portfolio/consumption strategy) which we characterize both in feedback form in terms of the derivatives of the value functions and as the solution of a second-order ODE. Finally, numerical illustrations of the behavior of optimal consumption strategies between two trading dates are given.

| 1) | Dipartimento di Scienze Economiche | 2) | Laboratoire de Probabilités et |

| ed Aziendali - Facoltà di Economia, | Modelèles Aléatoires, | ||

| Università LUISS Guido Carli, | CNRS, UMR 7599 | ||

| viale Romania 32, 00197 Roma. | Université Paris 7, | ||

| Email: acretarola@luiss.it, | Email: pham@math.jussieu.fr | ||

| fgozzi@luiss.it | peter.tankov@polytechnique.org | ||

| 3) | CREST-ENSAE, | ||

| and Institut Universitaire de France |

Key words : Illiquid market, optimal consumption, integrodifferential equations, viscosity solutions, semiconcavity, sub(super) differentials, optimal control.

JEL Classification : G11

MSC Classification (2000) : 49K22, 49L25, 35F20, 91B28.

1 Introduction

We investigate the optimal consumption policies in the portfolio/consumption choice problem introduced in [5]. In this model, the investor has access to a market in which an illiquid asset (stock or fund) is traded. The price of the asset can be observed and trade orders can be passed only at random times given by an exogenous Poisson process. These times model the arrival of buy/sell orders in an illiquid market, or the dates on which the results of a hedge fund are published. More generally, these times may correspond to the dates on which the performance of certain investment projects becomes known. The investor is also allowed to consume (or distribute dividends to shareholders) continuously from the bank account and the objective is to maximize the expected discounted utility from consumption. The resulting optimization problem is a nonstandard mixed discrete/continuous time stochastic control problem, which leads via the dynamic programming principle to a coupled system of nonlinear integro-partial differential equations (IPDE).

In [6], the authors proved that the value functions to this stochastic control problem are characterized as the unique viscosity solutions to the corresponding coupled IPDE. This characterization makes the computation of value functions possible (see [5]), but it does not yield the optimal consumption policies in explicit form. In this paper, we go beyond the viscosity property, and focus on the regularity of the value functions. Using arguments of (semi)concavity and the strict convexity of the Hamiltonian for the IPDE in connection with viscosity solutions, we show that the value functions are continuously differentiable. This regularity result is obtained partly by adapting a technique introduced in [3] (see also [1, p. 80]) and partly by a kind of bootstrap argument that exploits carefully the special structure of the problem. This allows then to get the existence of an optimal control through a verification theorem and to produce two characterizations of the optimal consumption strategy: in feedback form in terms of the classical derivatives of the value functions, and as the solution of the Euler-Lagrange ordinary differential equation. We then use these characterizations to study the properties of the optimal consumption policies and to produce numerical examples, both in the stationary and in the nonstationary case.

Portfolio optimization problems with discrete trading dates were studied by several authors, but the profile of optimal consumption strategies between the trading interventions has received little attention so far. Matsumoto [4] supposes that the trades succeed at the arrival times of an exogenous Poisson process but does not allow for consumption. Rogers [8] considers an investor who can trade at discrete times and assumes that the consumption rate is constant between the trading dates. Finally, Rogers and Zane [9] allow the investor to change the consumption rate between the trading dates and derive the HJB equation for the value function but do not compute the optimal consumption policy.

The rest of the paper is structured as follows. In section 2, we rephrase the main assumptions of the liquidity risk model introduced in [5], introduce the necessary definitions, and recall the viscosity characterization of the value function. Section 3 establishes some new properties of the value function such as the scaling relation. Section 4 contains the main result of the paper, proving the regularity of the value function, which is used in section 5 to characterize and study the optimal consumption policies. Some numerical illustrations depict the behavior of the consumption policies between two trading dates. The technical proofs of some lemmas and propositions can be found in the appendix.

2 Formulation of the problem

Let us fix a probability space endowed

with a filtration satisfying the

usual conditions. All stochastic processes involved in this paper

are defined on the stochastic basis .

We consider a model of an illiquid market where the investor can

observe the positive stock price process and trade only at

random times with

. For simplicity, we assume

that is known and we denote by

the observed return process valued in , where we set

by convention equal to some fixed constant.

The investor may also consume continuously from the bank account

(the interest rate is assumed w.l.o.g. to be zero) between two

trading dates. We introduce the continuous observation filtration

where:

and the discrete observation filtration . Notice that s trivial for .

A control policy is a mixed discrete-continuous process

, where is real-valued

-predictable, i.e. is

-measurable, and is a

nonnegative -predictable process:

represents the amount of stock invested for the period

after observing the stock price at time

, and is the consumption rate at time based

on the available information. Starting from an initial capital , and given a control policy , we denote by

the wealth of investor at time defined by:

| (2.1) |

Definition 2.1.

Given an initial capital , we say that a control policy is admissible, and we denote if

Assumption 2.2.

-

a)

is the sequence of jumps of a Poisson process with intensity .

-

b)

(i) For all , conditionally on the interarrival time , is independent from and has a distribution denoted by .

(ii) For all , the support of is-

-

either an interval with interior equal to , and ;

-

-

or it is finite equal to , and .

-

-

-

c)

, for all , and there exist some and , such that

-

d)

The following continuity condition is fulfilled by the measure :

for all measurable functions with linear growth condition.

The following simple but important examples illustrate Assumption 2.2.

Example 2.3.

is extracted from a Black-Scholes model: , with , . Then is the distribution of

with support and condition c) of Assumption 2.2 is clearly satisfied, since in this case .

Example 2.4.

is independent of the waiting times , in which case its distribution does not depend on . In particular may be a discrete distribution with support such that and .

We are interested in the optimal portfolio/consumption problem:

| (2.2) |

where is a positive discount factor and is an utility function defined on . We introduce the following assumption:

Assumption 2.5.

The function is strictly increasing, strictly concave and on satisfying and the Inada conditions and . Moreover, satisfies the following growth condition: there exists s.t.

| (2.3) |

for some positive constant . In addition, condition (4.1) of [6] is satisfied, i.e.

where and are provided by Assumption 2.2.

We denote by the convex conjugate of , i.e.

We note that is strictly convex under our assumptions (see Theorem 26.6, Part V in [7]).

Remark 2.6.

In [5, 6], is supposed to be nondecreasing and concave

while here is strictly increasing and strictly convex. This

assumption is not very restrictive, since the most common utility

functions (like the ones of the CRRA type) satisfy it.

The main reason of this new hypothesis is that it implies the

strict concavity of the function , which is a key

assumption to get the regularity of the value functions to our control problem.

Following [6], we consider the following version of the dynamic programming principe (in short DPP) adapted to our context

| (2.4) |

This DPP is proved rigorously in Appendix of [6]. From the expression (2.1) of the wealth, and the measurability conditions on the control, the above dynamic programming relation is written as

| (2.5) |

where is the set of pairs with deterministic constant, and a deterministic nonnegative process s.t. and

| (2.6) |

where with the convention that when (see Remark 2.3 of [5, 6] for further details). Given , we denote by the set of deterministic nonnegative processes satisfying (2.6). Moreover under conditions a) and b) of Assumption 2.2, it is possible to write more explicitly the right-hand-side of (2.5), so that:

(see the details in Lemma 4.1 of [6]). Let

by setting if and if . Then, according to [5, 6], we introduce the dynamic auxiliary control problem: for

| (2.7) |

where is the set of deterministic nonnegative processes , such that

and is the deterministic controlled process by :

In particular if we consider the function defined by:

| (2.8) |

we can rewrite (2.7) as follows

| (2.9) |

We know that the original value function is related to the auxiliary optimization problem by:

| (2.10) |

The Hamilton-Jacobi (in short HJ) equation associated to the deterministic problem (2.7) is the following Integro Partial Differential Equation (in short IPDE):

| (2.11) |

with . In terms of the function :

| (2.12) |

In [6], the authors have already proved some basic

properties of the value function as finiteness,

concavity, monotonicity and continuity on (see Corollary 4.1

and Proposition 4.2).

In particular the authors have characterized the value function

through its dynamic programming equation by means of viscosity

solutions (see Theorem 5.1).

Our aim is to prove the smoothness of the value function

in order to get a verification theorem that provides the existence

(and uniqueness) of the optimal control feedback. We first prove

some further properties of the value functions (as

strict monotonicity, uniform continuity on : see Section

3. Then we will study the regularity in the

stationary case, i.e. when does not depend on .

Finally we will extend the results to the general case. In

particular we will provide some regularity properties by means of

semiconcavity and

bilateral solutions.

It is helpful to recall the following definitions and

basic results from nonsmooth analysis concerning the generalized

differentials.

Definition 2.7.

Let be a continuous function on an open set . For any , the sets

are called respectively, the (Fréchet) superdifferential and subdifferential of at .

The next lemma provides a description of , in terms of test functions.

Lemma 2.8.

Let , open set. Then,

-

1.

if and only if there exists such that and has a local maximum at ;

-

2.

if and only if there exists such that and has a local minimum at .

Proof.

See Lemma II.1.7 of [1] for the proof. ∎

As a direct consequence of Lemma 2.8, we can rewrite Definition 5.1 of [6] of viscosity solution adapted to our context, in terms of sub and superdifferentials.

Definition 2.9.

The pair of value functions given in (2.2)-(2.7) is a viscosity solution to (2.10)-(2.12) if:

-

(i)

viscosity supersolution property: and for all ,

(2.13) for all , for all .

-

(ii)

viscosity subsolution property: and for all ,

(2.14) for all , for all .

The pair of functions will be called a viscosity solution of (2.10)-(2.12) if (2.13) and (2.14) hold simultaneously.

Hence, we can reformulate the viscosity result stated in [6].

Proposition 2.10.

Proof.

See Theorem 5.1 of [6] for a similar proof. ∎

3 Some properties of the value functions

In this section we discuss and prove some basic properties (strict

monotonicity, uniform continuity on ) of the value functions

. We will always suppose Assumptions 2.2 and

2.5 throughout this section.

By Proposition 4.2 of [6], we already know that is

nondecreasing, concave and continuous on , with .

Moreover by Corollary 4.1 of [6], satisfies a growth

condition, i.e. there exists a positive constant such that

| (3.1) |

Here we provide the following properties on the function and respectively whose proof can be found in Appendix:

Proposition 3.1.

The value function is strictly increasing on .

Now recall the function given in (2.8).

Lemma 3.2.

The function is:

-

(i)

continuous in , for every ;

-

(ii)

strictly increasing in , for every and ;

-

(iii)

concave in .

If we do not assume condition d) of Assumption 2.2, then the function is only measurable in while (ii) and (iii) still hold.

To conclude this section, we discuss a property of the value function . We already know by Proposition 4.2 of [6], that is concave and continuous in , and that has the following representation on the boundary :

| (3.2) |

In addition, by Corollary 4.1 of [6], we know that there exists a constant that provides the following growth estimate:

| (3.3) |

with and is the constant given in condition c) of Assumption 2.2.

Lemma 3.3.

The value function is strictly increasing in , for every , given .

Proof.

The proof follows from the same arguments of the proof of Proposition 3.1 (see Appendix), using the strict monotonicity of in and of in respectively. ∎

3.1 The scaling relation for power utility

In the case where the utility function is given by

using the fact that if and only if for any , we can easily deduce from the decoupled dynamic programming principle in [5] a scaling relation for the value function and the auxiliary value function :

This shows that the value function has the same form as in the Merton model (confirmed by the graphs in [5]) and that the optimal investment strategy consists in investing a fixed proportion of the wealth into the risky asset. In the case , is nonnegative and we can therefore reduce the dimension of the problem and denote

The equation satisfied by the auxiliary value function then becomes

in the nonstationary case and

in the stationary case, with

4 Regularity of the value functions

In this section we investigate the regularity property of the value functions in order to provide a feedback representation form for the optimal strategies. Throughout the whole section we will let Assumptions 2.2 and 2.5 stand in force.

4.1 The stationary case

We start the study of the regularity with the simple case when the distribution of the observed return process , , does not depend on , i.e. , for every , as in Example 2.4. Then and are independent of and the IPDE (2.12) reduces to the integro ordinary differential equation (in short IODE) for :

| (4.1) |

where

| (4.2) |

with

| (4.3) |

All the properties of the value function discussed in the previous section still hold for its restriction on the set . In particular we have that given in (4.2) is concave and continuous on , strictly increasing in and satisfies the growth condition

for some positive constant , with and in particular the condition on the boundary becomes:

We start by proving a first smoothness result for the function .

Proposition 4.1.

The value function defined in (4.2) is with respect to , given . Moreover .

Proof.

We fix and let us show that is differentiable

on . First we note that the superdifferential

is nonempty since is concave. In view

of Proposition II.4.7 (c) of [1], since is concave

in , we just have to prove that for a given

, is a

singleton for any .

Suppose by contradiction that .

Without loss of generality (since ), we can assume that

. Denote by

the convex hull of the set

Since by Proposition II.4.7 (a) of [1], , there exist sequences , in where is differentiable and such that

Since condition d) of Assumption 2.2 and Assumption 2.5 hold, by Theorem 5.1 of [6], the pair of value functions is a viscosity solution to (4.1)-(4.3); then by Proposition 1.9 (a) of [1],

by continuity this yields

| (4.4) | ||||

| (4.5) |

Now let , for . Since , we have by the viscosity supersolution property of :

| (4.6) |

On the other hand, by strict convexity of , we get

contradicting (4.6). Hence is differentiable at any . Notice from (4.1) that for all , is continuous in 111This follows also from Proposition 3.3.4 (e), pages 55-56 of [2].. Now we prove the last statement. If we get in (4.2), then

Now we send in (4.1) (this is possible since and are continuous in and since is monotone in ) and we obtain

Comparing the last formulas, we obtain

| (4.7) |

∎

Before the final result we provide the following lemma.

Lemma 4.2.

Proof.

Let . Since is concave we have

Since is concave we have . Let . We have to prove that

| (4.9) |

for every such that . We first observe that

| (4.10) |

for every such that (here and are optimal for and respectively).

Now we are ready to prove the final regularity result for the stationary case.

Theorem 4.3.

Proof.

Since is concave then is nonempty at every . This implies, by (4.8), that also is nonempty for every . Since, by (4.7), (which implies ) we get that it must be and so any maximum point in (4.3) is internal. Moreover since, given we have that is in then the superdifferential is a single point and so from (4.8) also ia single point, which implies the wanted regularity of . The statement follows simply observing that , , and from (4.7) for . Finally follows from (4.1) and from Proposition 4.1. ∎

4.2 The nonstationary case

In this subsection we study the regularity of the value function in the general case where the distribution may depend on time. With respect to the stationary case, the value function is in general not concave in both time-space variables, and we cannot apply directly arguments as in Proposition 4.1. Actually, we shall prove the regularity of the value function as well as in the stationary case, by means of (locally) semiconcave functions.

First, we recall the concept of semiconcavity. Let be a subset of .

Definition 4.4.

We say that a function is semiconcave if there exists a nondecreasing upper semicontinuous function such that and

| (4.12) |

for any pair such that the segment is contained in and for . In particular we call locally semiconcave a function which is semiconcave on every compact subset of its domain of definition.

Clearly, a concave function is also semiconcave. An important example of semiconcave functions is given by the smooth ones.

Proposition 4.5.

Let , with open. Then both and are locally semiconcave in with modulus equal to the modulus of continuity of .

Proof.

See Proposition 2.1.2 of [2] for the proof. ∎

Remark 4.6.

We should stress that the superdifferential of a locally semiconcave function is nonempty, since all the properties of superdifferential hold even locally.

We introduce an additional assumption on the measure :

Assumption 4.7.

for every , the map

is locally semiconcave for , and for all measurable continuous functions on with linear growth condition.

Remark 4.8.

Since it is not trivial to check the validity of Assumption 4.7, we give some conditions the guarantee it. First of all, we exclude the case from Assumption 4.7 since in this case we have, for every

so we are in the stationary case and we already know from the previous section that is . Now, when , we set the new variable and call the measure . The measure has the following support:

-

1.

, if , and ;

-

2.

, if and

-

3.

, if and ;

-

4.

, if the support of is finite and (in this case ;

-

5.

, if the support of is finite and (in this case .

Now Assumption 4.7 can be written as: the function given by

is locally semiconcave for , and for all measurable continuous functions

on with linear growth condition.

In this form, it is easier to find conditions that guarantee the

validity of this assumption in terms of the regularity of .

For example, if we assume the measure has a density

, the integral

by the above change of variable is rewritten as:

Now, by Proposition 4.5, the local semiconcavity of

in the interior of its domain follows from its continuous differentiability.

Let us give a condition that guarantees that is in the

case 1. If the density is continuously

differentiable and suitable integrability conditions are

satisfied, then we have: for every ,

for . From the above expressions, it is easy to check that we can derive the continuous differentiability from the following assumptions:

-

•

the density is continuous and for each , the generalized integral

converges for every ;

-

•

the partial derivatives , are continuous and satisfy respectively the following integrability conditions: for each ,

converges uniformly with respect to , for any compact set of , for every , and

converges uniformly with respect to , for any compact set of , for every .

Let us check the above assumptions in the Black-Scholes model, introduced in Example 2.3. We recall that the dynamics of is given by , with , , so that is the distribution of

with support . Then, since has a lognormal distribution, the density is given by:

We compute the partial derivatives and we get:

Hence it is not difficult to check that the assumptions described above are satisfied.

We start by proving a smoothness property for .

Proposition 4.9.

Proof.

We fix and let us show that is differentiable at any . When , as we noted at the beginning of Remark 4.8, is independent of and in thanks to the results of Section 5. Take then . First, we notice from Assumption 4.7 that is (locally) semiconcave in . Together with the concavity of , this shows that is (locally) semiconcave in . Indeed, if we set we can rewrite (2.9) as follows:

For every , we put

Let , with , , with . By setting , , we have for all

by using the strict concavity of . By the semiconcavity of the

function and by taking the supremum of the functional over

the set , we can derive the semiconcavity of for

.

Hence , so we have just to

prove that is a singleton, for each

. By using

the same arguments of Proposition 4.1, we get the Fréchet differentiability.

By Proposition 3.3.4 (e), pages 55-56 of [2], we get the

continuity of the couple for

, given .

Then the value function defined in (2.7) belongs

to , given .

To get that it is enough to extend the datum (and so the

value function ) to small negative times and repeat the

above arguments.

Now we prove (4.13) by using similar arguments to the ones to check the final statement of Proposition 4.1. If we get in (2.9), then

Now we send in (2.12) (this is possible since , and are continuous in 222By Remark 4.4 of [6] we already know that is differentiable in on the boundary and in particular the continuity follows from (2.7). and since is monotone in ) and we obtain

Comparing the last formulas, we obtain

∎

Lemma 4.10.

Proof.

It works exactly as well as in the stationary case. ∎

We come now to the final regularity result for the nonstationary case.

Theorem 4.11.

Proof.

It follows as in the stationary case. ∎

5 Existence and characterization of optimal strategies

5.1 Feedback representation form of the optimal strategies

The following result guarantees the existence and uniqueness of the optimal control for the auxiliary problem (2.7).

Proposition 5.1.

Let be the value function given in (2.7). Fix . We denote by the inverse function of the derivative and we consider the following nonnegative measurable function for each :

| (5.1) |

Let . There exists a unique optimal couple at for the auxiliary problem introduced in (2.7) given by:

| (5.2) |

where , , is the unique solution of

| (5.3) |

Note that the triplet , for .

Proof.

A rigorous proof can be found in Appendix. ∎

Under suitable assumptions, we state the verification theorem for the coupled IPDE (2.10)-(2.12), which provides the optimal control in feedback form.

Theorem 5.2.

There exists an optimal control policy given by

| (5.4) | ||||

| (5.5) |

where is the wealth investor at time given in (2.1) and is the unique solution of

| (5.6) |

Proof.

Thanks to Proposition 5.1, we can prove the

existence of an optimal feedback control for

.

Given , consider the control policy

defined by (5.4)-(5.5). By construction,

the associated wealth process satisfies for all ,

since a.s. Hence, , i.e. is admissible. By Proposition 5.1 and definition of and , we have:

by Lemma 4.1 of [6]. By iterating these relations for all , and using the law of conditional expectations, we obtain

for all . By sending to infinity, we get:

which provides the required result. ∎

Remark 5.3.

In the stationary case the Assumption 4.7 is not needed to prove the existence of feedback controls, as it is automatically satisfied. Moreover we note that in the stationary case there is not an explicit dependence on of the optimal control in feedback form. Indeed, it is given by the couple , where

and in particular is the restriction on the set of the nonnegative measurable functions introduced in (5.1), i.e.

| (5.7) |

Remark 5.4.

It is not trivial to state the uniqueness of the strategy , whose existence is proved in Theorem 5.2. We can only say that, if we prove that is unique, then also will be unique thanks to Theorem 5.2. The problem is strictly related to the behavior of the functions and that are ex ante not strictly concave in .

Remark 5.5.

>From the feedback representation given in Proposition 5.1 and in Theorem 5.2, it follows that the function is strictly concave and that the functions and are strictly concave in . Indeed, given two points and calling the corresponding optimal consumption paths for the original problem, we have, for ,

| (5.8) |

Thanks to the feedback formulas, the two consumption rates must be different in a set of positive measure () so the right-hand-side of (5.8) is strictly positive and we get strict concavity of . Then the strict concavity of in follows directly from its definition whereas the strict concavity of in follows from the IPDE (2.12).

5.2 Consumption policy between two trading dates

>From the regularity properties discussed in Subsection 4, we can deduce more properties of the optimal consumption policy. We discuss them separately for the stationary and the nonstationary case.

5.2.1 The stationary case

Proposition 5.6.

Let and . Let be the optimal couple for the auxiliary problem starting at . If , then , so . If then is continuous, strictly positive and strictly decreasing while is strictly decreasing and strictly convex. Moreover and .

Proof.

The first statement follows immediately from the setting of the auxiliary problem. We prove the second statement. Indeed, by (5.7) and Remark 5.5 it follows that the function is strictly increasing and continuous in . Since and is continuous and decreasing, then also is decreasing. Moreover, for every : indeed if it becomes zero in finite time then the associated costate would have a singularity and this is impossible: see the proof of Proposition 5.10 in the non stationary case. The strict positivity of implies that is strictly decreasing and so, by (5.7) that is strictly decreasing and is strictly convex.

Finally, by the definition of the auxiliary control problem, which implies the limit of . If the limit of is , we get from the feedback formula (5.2) that

which is impossible. ∎

The regularity results for then allow to deduce an autonomous equation for the optimal consumption policy between two trading dates.

Proposition 5.7.

Suppose that with for all . Then the wealth process between two trading dates is twice differentiable and satisfies the second-order ODE

| (5.9) |

Proof.

The equation (5.9) is a second-order ODE similar to equations of theoretical mechanics (second Newton’s law), and it should be solved on the interval with the boundary conditions and (which corresponds to resetting the time to zero after the last trading date). Solving this equation does not require the auxiliary value function but only the original value function , which, in the case of power utility, can be found from the scaling relation.

The case of power utility.

In the case of power utility function , the equation (5.9) takes the form

| (5.10) |

In this case, one can deduce a simple exponential lower bound on the integrated consumption, corresponding to the solution of (5.10) in the case .

Proposition 5.8.

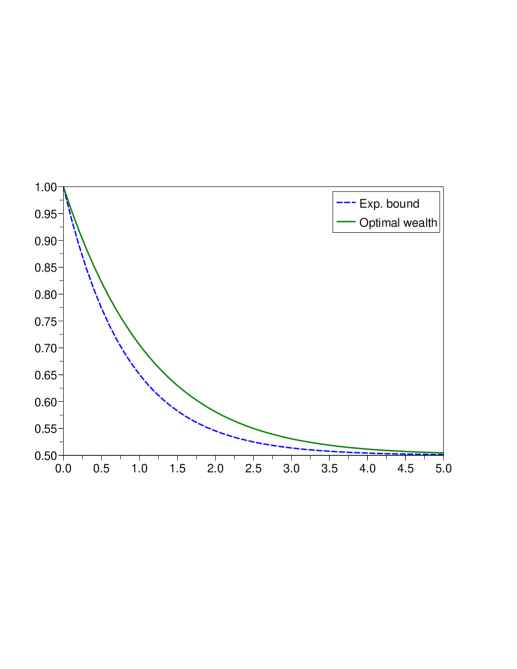

The condition means that the value function of the investor resets to zero (the investor dies) at a random future time. In this case it is clear that a rational agent will consume faster than in the case where more interesting investment opportunities are available. The typical shape of optimal consumption policies is plotted in Figure 1.

Proof.

The equation (5.10) can be rewritten as

>From Gronwall’s inequality we then find

The terminal condition implies

On the other hand, the solution of the problem without investment opportunities satisfies

Therefore,

and

Since , another application of Gronwall’s inequality shows that for all . ∎

5.2.2 The nonstationary case

In this case the regularity results for the optimal strategies are weaker and more difficult to prove.

Proposition 5.9.

Let and . Let be the optimal couple for the auxiliary problem starting at . If , then , so . If then is continuous, strictly positive and .

Proof.

The proof is the same as in the stationary case. ∎

Note that, with respect to the stationary case here we do not have monotonicity of the optimal consumption since the behavior of in the time variable is not known.

Moreover here the limiting property for is proved only under the assumption of twice continuous differentiability of , as given below.

As in the stationary case we can deduce an autonomous equation for the optimal wealth process between two trading dates. However, since we have weaker regularity results the proof is different and makes use of the maximum principle.

Proposition 5.10.

Suppose that with for all . Then the optimal wealth process between two trading dates is twice differentiable, it satisfies the second-order ODE

| (5.12) |

and .

Proof.

We cannot differentiate equations (2.12) and (5.1) with respect to as in the stationary case as we do not know if is . Then we follow a different approach. We use the maximum principle contained in Theorem 12 p 234 of [10]. Such theorem concerns problems with endpoint constraints but without state constraints. Due to the positivity of the consumption, our auxiliary problem (2.7) can be easily rephrased substituting the state constraint with the endpoint constraint . So we can apply the above quoted theorem that, applied to our case, states the following:

Assume that and are continuous. Given an optimal couple with continuous there exists a function such that:

-

•

is a solution of the equation

-

•

for every ;

-

•

, for every (transversality condition).

Since we already know (from Proposition 5.1) that there exists a unique optimal couple and that is continuous (see of Proposition 5.9) the above statements apply. Then we get that for every , that is everywhere differentiable and that

which gives the claim recalling that .

Concerning the limiting property of we argue by contradiction. Let . We have then, by the definition of , for every ,

Then from the costate equation we get that, for

Using that we get a uniform bound for . This is a contradiction as . ∎

The equation (5.12) is a second-order ODE similar to equations of theoretical mechanics (second Newton’s law), and it should be solved on the interval with the boundary conditions and (which corresponds to resetting the time to zero after the last trading date). Solving this equation does not require the auxiliary value function but only the original value function , which, in the case of power utility, can be found from the scaling relation.

Remark 5.11.

The Maximum Principle used in the above proof holds once we know that and are continuous. As observed in Remark 4.12, this is true also in cases when the semiconcavity assumption 4.7 may fail (notably in the case of power utility and in the case of ‘regular’ density). So, also in such cases the Maximum Principle could be used to get information about the optimal strategies. Clearly, without knowing the regularity of the value function such information would be much less satisfactory.

The case of power utility.

In the case of power utility function, the equation (5.12) can again be simplified:

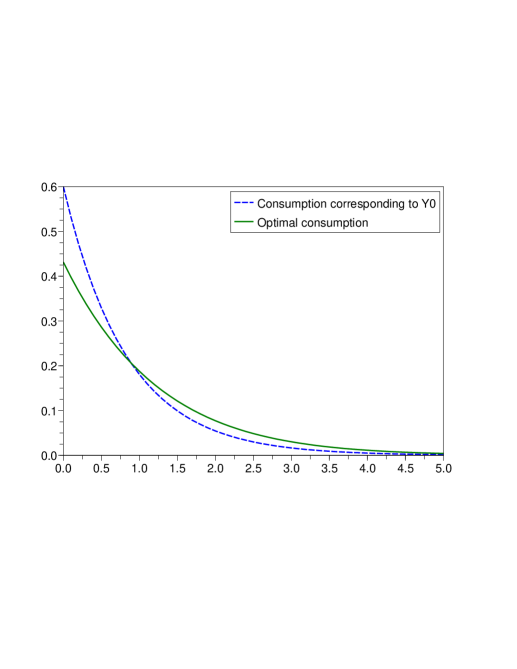

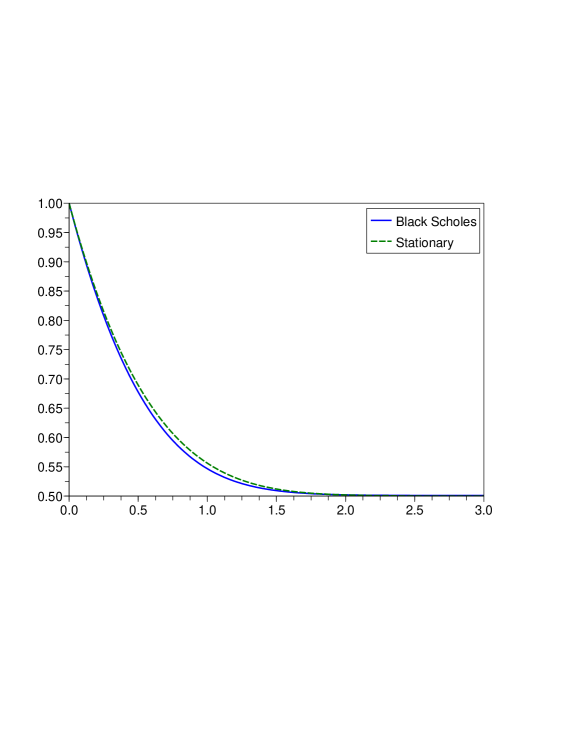

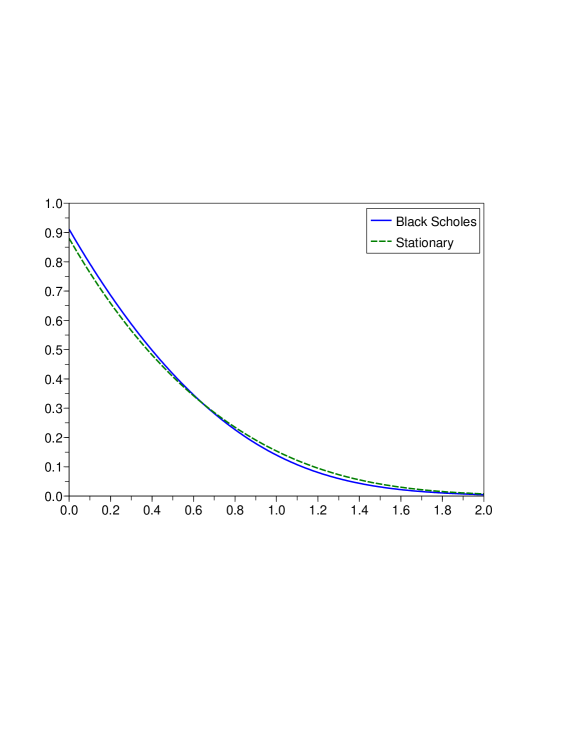

Because the second term in the right-hand side is still positive, the exponential bound of Proposition 5.8 can be established in exactly the same way as in the stationary case. Figure 2 depicts the optimal wealth process and the optimal consumption policy for the probability distribution extracted from the Black-Scholes model with the same parameter values as in [5]: drift , volatility , discount factor , intensity and risk aversion coefficient . We see that at least qualitatively, the consumption profile is similar to the one observed in the stationary model, with exponential decay. For comparison, we also plot the wealth and consumption policy for the stationary model with distribution corresponding to the Black-Scholes model in years’ time. In this case the agent consumes at a slower rate than in the nonstationary model. The explanation is that for the parameter values we chose, 3 years is a very long time horizon, because all the consumption happens, essentially, during the first 2 years after trading. During this period (first 2 years) the stationary model offers better investment opportunities, which explains the slower consumption rate.

Appendix A Appendix : Technical proofs

Proof of Proposition 3.1.

We suppose by contradiction that is not strictly increasing on This means that it is definitely constant on from a certain on, since is concave. Then we fix such that , for all . Take and a pair -optimal at . This means that , i.e.

and

Now we choose . Then we have . We consider the control policy , where , for all . Hence given , we have for every ,

with , so . Moreover we have:

since is strictly increasing. But this is not possible, since we have assumed constant from on. Hence the statement is proved.

Proof of Proposition 3.2.

- (i)

-

(ii)

The function is strictly increasing in since is strictly increasing by Proposition 3.1.

-

(iii)

This property is a direct consequence of concavity of . Indeed, given , consider , with , . First of all, thanks to the convexity of the function . Since is concave, we have for every :

This provides the result.

Proof of Proposition 5.1.

In order to prove Proposition 5.1, we need the following preliminary result:

Lemma A.1.

Let be the value function given in (2.7). Fix . Assume the followings:

-

(i)

;

-

(ii)

, for every ;

- (iii)

Given and , for every couple admissible at for , we have the following identity: for

| (A.1) |

with the agreement that

If goes to

| (A.2) |

Furthermore, an admissible couple is optimal at if and only if

such that and otherwise.

Proof.

Let be an admissible couple for the auxiliary problem such that , for every . By applying standard differential calculus to between and , we have:

where in the last equation we have used the fact that satisfies (2.12). This can be easily rewritten as (A.1) by adding and subtracting in the integrand. Now, from the growth condition (3.3) and since is nondecreasing in , we have

from which we deduce by Lemma 4.2 of [6] that

Hence, by sending to infinity, we can easily derive the relation (A.2). Let be an admissible couple such that , for a . Assume that is the first time when this happens. Then , and for every . Then for we get (A.1) as before. Calling

we have that is increasing and from (A.1) that there exists its limit for given by:

>From the positivity of the integrand in , we then get that identity (A.1) also holds in . For we can easily derive (A.1) using the fact that the couple is constant after and that (ii) holds. Now, let us focus on the last statement. Let be an admissible couple at . Then is optimal at if and only if in (A.2) we have

When , for , this is clearly equivalent to

i.e.

| (A.3) |

When on , we have (A.3) on and on . ∎

Now we come to the proof of the Proposition 5.1. First we observe that, thanks to Proposition 4.9 the assumptions (i)-(ii)-(iii) of the previous Lemma A.1 hold. So fix . First we prove the existence of a solution of the problem (5.3). The dynamics of the system is the function , with (5.1), that is well-defined and continuous as composition of continuous functions on . We note that hypothesis (ii) of Lemma A.1 implies , for every . Hence, we can extend the function to a continuous function on such that on . Now the Peano’s Theorem guarantees the existence of a local solution of (5.3). We prove that for every , i.e. that

| (A.4) |

If , we already know that , for , given , so that

, for all .

Now we suppose . Since , for each

, the solution is strictly decreasing on the maximal interval that we denote

by , with . Suppose that there exists an instant

such that . We have that

. In particular this means that there

exists an interval with and such that for all , with , that it

is not possible. This proves the claim

(A.4), for any and that .

Now call as in (5.2).

Then the couple is admissible since , for every and , for . Moreover

so the couple is optimal at thanks to

Lemma A.1. Hence the existence of an optimal couple

for the auxiliary problem is proved.

Now we prove the

uniqueness.

Fix , and . Let ,

be optimal controls at . Then for

where for every , . Since the function is strictly concave, we have by setting , with ,

Moreover, since , for all and is concave in the second variable, we have

Then

that implies the uniqueness of the control of the auxiliary problem.

References

- [1] Bardi M. and Capuzzo-Dolcetta I. (1997), Optimal Control and Viscosity Solutions of Hamilton-Jacobi-Bellman Equations. Birkhäuser Boston Inc., Boston, MA.

- [2] Cannarsa P. and Sinestrari C. (2004), Semiconcave Functions, Hamilton-Jacobi Equations and Optimal Control. Progress in Nonlinear Differential Equations and their Applications, 58. Birkhäuser Boston Inc., Boston, MA.

- [3] Cannarsa P. and Soner H.M. (1989) “Generalized one-sided estimates for solutions of Hamilton-Jacobi equations and applications”, Nonlinear Analysis 13 (3), 305-323.

- [4] Matsumoto K. (2006) : “Optimal portfolio of low liquid assets with a log-utility function”, Finance and Stochastics, 10 (1), 121-145.

- [5] Pham H. and Tankov P. (2007), “A Model of Optimal Consumption under Liquidity Risk with Random Trading Times”. To appear in Mathematical Finance.

- [6] Pham H. and Tankov P. (2007), “A Coupled System of Integrodifferential Equations Arising in Liquidity Risk Model”. To appear in Applied Mathematics and Optimization.

- [7] Rockafellar R.T. (1970), Convex Analysis. Princeton University Press, Princeton.

- [8] Rogers C. (2001), “The relaxed investor and parameter uncertainty”, Finance and Stochastics, 5 (2), 131-154.

- [9] Rogers C. and Zane O. (2002) : “A simple model of liquidity effects”, in Advances in Finance and Stochastics: Essays in Honour of Dieter Sondermann, eds. K. Sandmann and P. Schoenbucher, 161–176.

- [10] Seierstad A. and Sydsaeter K. (1987), Optimal Control Theory with Economic Applications. North Holland, Amsterdam.