Detecting speculative bubbles created in experiments

via decoupling in agent based models

Abstract

Proving the existence of speculative financial bubbles even a posteriori has proven exceedingly difficult[1-3] so anticipating a speculative bubble ex ante would at first seem an impossible task. Still as illustrated by the recent turmoil in financial markets initiated by the so called “subprime crisis” there is clearly an urgent need for new tools in our understanding and handling of financial speculative bubbles. In contrast to periods of fast growth, the nature of market dynamics profoundly changes during speculative bubbles where self contained strategies often leads to unconditional buying. A critical question is therefore whether such a signature can be quantified , and if so, used in the understanding of what are the sufficient and necessary conditions in the creation of a speculative bubble.

Here we show a new technique, based on agent based simulations, gives a robust measure of detachment of trading choices created by feedback, and predicts the onset of speculative bubbles in experiments with human subjects. We use trading data obtained from experiments with humans as input to computer simulations of artificial agents that use adaptive strategies defined from game theory. As the agents try to maximize their profit using the market data created by humans, we observe certain moments of decoupling where the decision of an agent becomes independent of the next outcome of the human experiment, leading to pockets of deterministic price actions of the agents. Decoupling in the agent based simulations in turn allows us to correctly predict at what time the subjects in the laboratory experiments have entered a bubble state. Finally in one case where the subjects do not enter a permanent bubble state, our method allow us at certain special moments to predict with a 87% success rate an unit move of the market two time steps ahead.

Performing laboratory experiments where subjects trade an asset according to a specific model of a financial market allow for a well controlled environment for testing models of pricing in financial marketsErev . As will be shown combining agent based simulations and experiments with human participants enables study of specific behavioral aspects of subjects thought to be important in for example the creation and thereby also prevention of speculative bubbles.

The Minority GameMG (MG) was introduced as a model to grasp some of the most important aspects of pricing in financial markets. As such it has a parsimonious description given in terms of market participants (agents) that buy or sell assets using a number of different trading strategies. Considering only time scales for which the the fundamental value of an asset is assumed to stay constant, a trading strategy uses the direction of the market over the last time steps in order to make a decision of whether to buy or sell an asset. An example of a strategy that uses the last time steps is given in table 1. This particular strategy recommends to buy (+1) if the market in the last two time steps went down (signal = 0 0), to sell (-1) if the market over the last two time steps first went up and then down (signal = 0 1), etc.

| signal | action |

|---|---|

| 00 | +1 |

| 01 | -1 |

| 10 | +1 |

| 11 | +1 |

For all possible histories of the market performance over the last time steps, a given strategy gives a specific recommendation of what to do. At each time step is kept track of how a given strategy performed. For the MG a strategy gains a point whenever it’s action is opposite to the cumulative action taken by the agents. In the $-GameAndersen1 ($G), a strategy gains (looses) the return of the market over the following time step, depending if it was right (wrong) in predicting the movement of the market in the following step. Therefore in the $G the agents correspond to speculators trying to profit from predicting the movements of the market. Nonlinear feedback, which is thought to be an essential factor in real markets, enters because each agent uses his/her best strategy at every time step. This attribute makes the agent based models highly nonlinear, and in general not solvable (for a discussion of the nonlinearity see Box below). As the market changes, the best strategies of the agents change, and as the strategies of the agents change they thereby change the market.

A large literature now exists on such agent based type of models as the prototype MG, claiming relevance for how pricing takes place in financial markets. To shed further light on the relevance of such models for human decision making in general and financial markets in particular, we have performed experiments on human subjects (students of the Faculty of Psychology, University of Warsaw) that speculate on price movements as introduced in the $G. In the experiments each subject uses the last (collectively generated) price movements, represented by a string of 0’s and 1’s as in table 1, to make a bet on whether the market will rise or fall in the following time step. If the prediction is right (wrong) the subject gains (looses) the return where the sum is over the action of all the subjects. The maximum a subject can gain is fixed whereas a negative return at the end of the experiment does not result in a loss for the subject. As shown in the box below a Nash equilibrium for the $G is given by Keyne’s “Beauty Contest” where it becomes profitable for the subjects to guess the actions of the other participants, and the optimal state is one for which all subjects cooperate and take the same decison (either buy/sell). The price in this bubble state deviates exponentially in time from the fundamental value of the asset which is assumed constant. All subjects profit from further price increases/decreases in the bubble state, but it requires coordination among the subjects to enter and stay in such a state.

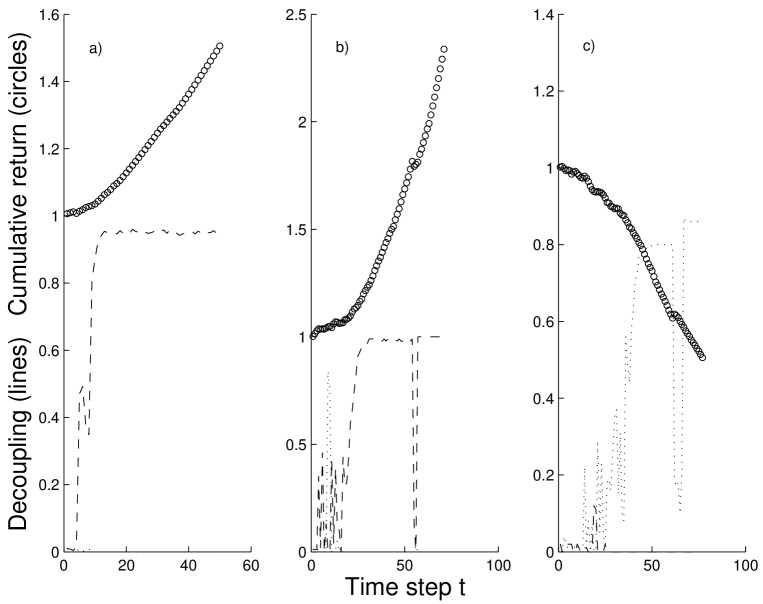

Figure 1a-c show three different experiments with subjects using in figure 1a-b and in figure 1c. As the price evolution (given by the circles) shows, in all three cases do the subjects manage to synchronize and enter a bubble state where the sign of the price increments do not change time after time steps. In all three cases do the subjects manage to find the state which is optimal, which corresponds to a state of either constant buying (figure 1a-b) or selling (figure 1c). Out of the 7 experiments we made, the subjects in 6 cases managed to synchronize. The 7’th case where they did not is discussed below. A note of caution should be made: the simulations and the experiments at first look quite identical since in both cases agents/subjects use a string of bits to try to predict next outcome of cumulative action (the next bit). However the main difference is that the subjects do not hold strategies like table 1. Instead they use “rules of thumb”, or representativeness heuristics which “effectively” give rise to similar type of dynamics as when the the agents agents use lookup tables like table 1 in the simulationsTversky , Barberis .

Especially, results of the 7’th experiment in which subjects do not enter the bubble state seem to confirm this hypothesis. Subjects while playing this game could not find the optimal solution because their dominant strategy, which could be described as the “return to the mean”, does not allow them that. This strategy simply says “every time price increases over (approx.) 5-6 time steps in a row start selling and when the price decreases over (approx.) 3-4 time steps in a row start buying”. Such a strategy prevents synchronisation into a bubble state and shows different solutions of the game can be reached depending on the set of strategies available to the population of the playersMurstein . However it is still quite remarkable that the solution predicted from the $G is indeed found in real experiments in 6 out of 7 cases. This result encourage us to further explore if one can extract behavioral characteristics in the group of subjects using their output (i.e. the bit string generated from their price actions given by circles in figure 1.) as input to computer simulations of agents.

In order to get an understanding of how the process of synchronization takes place we now discuss the concept of decouplingAndersen2 . The simplest example of decoupling in agent based models is to imagine the case where an agent uses a strategy like table 1 but with the action coloumn consisting of only, say, +1’s. In this case the strategy is trivially decoupled since whatever the price history this strategy will always recommend to buy. In the notation used in (Andersen2 ) such a strategy would be called an infinity number of time steps decoupled conditioned on any price history. Notice that the probability that an agent would posses such a strategy is very small (for the moderate values of used in this paper) and given by since is the total number of strategies. The strategy in table 1 is one time step decoupled condition on that the price history was at time since in case where the market at time went up , or down the strategy in both cases will recommend to buy at time (both for and buy is recommended) . Likewise it is seen that the same strategy is one time step decoupled condition on the price history since independent of the next market movement at time the strategy will always recommend to buy at time . In a game with only one agent and with only one strategy, as for example the one in table 1, we could therefore know for sure what the agent would do at time if the price history at time was either or independent of the price move at time . We call a strategy coupled to the price time series conditioned on a given price history if we need to know the price movement at time in order to tell what it will recommend at time . Conditioned on having or as price histories at time the strategy in table 1 is coupled to the price time series since we don’t know what it will recommend at time without first knowing the price history at time . At any time one can therefore write the actions in an agent based model as two contributions, one from coupled strategies and one from decoupled strategies: . The condition for certain predictability one time step ahead is therefore since we in that case know that given the price history at time the sign of the price movement at time will be determined by the sign of . A priori it is highly nontrivial whether one should ever find this condition to be fullfilled. As shown in (Andersen2 ) if the agents play randomly their strategies the condition is never fullfilled. Decoupling therefore has to be related to the dynamics of the pricing that somehow imposes that the optimal strategies of agents will be attracted to regions in the phase space of strategies which have decoupled strategies. In the $G the two most trivial strategies with actions either all +1 or all -1 are natural candidates as attractors. However since it is very unlikely for an agent to posses these two strategies, an attractor would necessarily have to consist of regions in phase space of strategies where one find strategies highly correlated to the two strategies which have actions all +1 or -1. For the MG the issue of attractors becomes even less obvious. Nonetherless in (Andersen2 ) it was shown that one does indeed find moments of decoupling in the MG with the decoupling rate depending on the three parameters of the game.

In order to see if decoupling plays a role in the way the subjects enter the state of synchronization, we have made simulations where $G agents take as input the output of the price time series generated by the subjects. That is, from the price time series of the subjects illustrated by the circles in figures 1a-c, we generated a time series of bits with a 0 whenever the price generated by the subjects went down and with a 1 whenever the price generated by the subjects went up. We then performed Monte Carlo simulations of different $G’s with each game using same as used in the experiment and with agents using the price history of experiments (instead of the price history generated by themselves) in their decision makingLamper . Choosing the number of strategies of the agents, , a fixed variable, different Monte Carlo simulations correspond to $G’s with different initial assignment of strategies to the agents, run on the input string of bits generated by the experiments.

Dashed lines in figures 1a-c represents the percentage of Monte Carlo simulations which at a given time were positively decoupled (), dotted lines the percentage of the Monte Carlo simulations which were negatively decoupled (). The results were done with fixed and number of Monte Carlo games, , larger values of gave identical results. In all three experiments do we find a very high level of decoupling (larger than 80% of the games decoupled) after the synchronizing trend has become clear to the subjects. If one define as the time for which the price increments stay constant (i.e. 0 in figure 1a-b and 1 in figure 1c) it is found that the maximum of decoupling happens shortly after . More natural is however to define the onset of the bubble from the derivatives of the decoupling curves. We therefore define an onset of a bubble as the time for which the last discrete derivatives had same sign. Using this definition we find that in 5 of the 6 experiments where the subjects created a bubblenote2 . is furthermore a more robust measure than since in all three cases shown in figure 1 would we have false alarms, i.e. a sequence of 1’s (or 0’s) happens at a time followed by a 0 (1). No such false alarms were found using . Finally it should be noted that using a lower level of confidence, like e.g. 20% decoupling, would in all cases have predicted the bubble at an much earlier time than .

As an additional test on the hypothesis of decoupling in the subjects decision making, we introduced a false feedback once the subjects had reached the bubble state. If the subjects were truely decoupled the false feedback should not influence their actions. This we indeed found to be the case. The fact that the subjects stuck to their action in the synchronized state independent of the false feedback further solidifies the hypothesis of decoupling as mechanism to create speculative bubbles. Performing computer simulations on the $G and measuring the distribution of we found that the average value to scale as , that is to scale versus the information content used by the strategies. From simple visual inspection of figure 1 one can see all three experiments do follow this trend. Only in one out of 6 cases did we find a creation of a bubble state to happen faster than predicted. However this exceptional result can be explained by the fact that it was the only experiment conducted late in the evening (starting at 8pm and finishing at 9pm). The other experiments were run during day time hours from 10am untill 3pm. It means that the length of history of the game presented to the human subjects have a subjective meaning rather than an objective one. In other words, we claim that taking an advantage of posssessing the access to the longer depends on the availability of cognitive resources to the subjects. Once there resources are blocked or reduced no differences in performance of human subjects between two experimental setups ( and ) were observed.

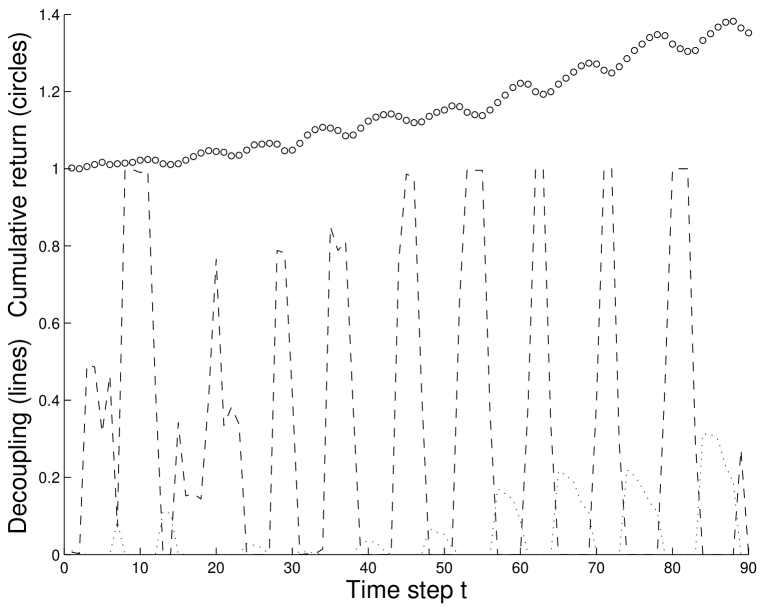

In one case the subjects did not manage to find the optimal state of synchronization as seen by price history in figure 2. Remarkable we still found decoupling at certain moments in time with very high confidence. Using the moments for which decoupling were at 98% or higher (meaning that at those moments, only two games out of 100 would not show decoupling at this specific time) we found a stunning 87% success rate of predicting an unit move of the market two time steps ahead. It is important to note that in the results presented we chose large to try to catch the complexity of the decision making of the subjects. was chosen and it was afterward verified that the results were indentical using even larger values of . There are therefore no parameters used in our predictions which are all out of sample predictions.

In the MG agents possess strategies that use the direction of the last price movements represented as a binary string, , of 0’s (down movement of the market) and 1’s (up movement of the market) to choose one of two alternatives (buy or sell a share) at time . Each agent is assigned (in general) different strategies initially. At each time step an agent uses his/her best (indicated by a star) performing strategy so far to take the action of either buying or selling a share. The optimal strategy of an agent is determined by the payoff funtion updated at every time step according to . The sign of in turn determines the value of the last bit in . with . Instead of the usual algorithm describing the dynamics of the MG it can then be summarized into one equation: (1) with a Heaviside function and represented now as a scalar. (2) with . Inserting the expressions (2) in the expression for (1) one get an expression that describes the Minority Game in terms of just one single equation for depending on the values of the variables and the quenched random variables A major complication in the study of this equation happens because of the non linearity in the selection of the best strategy. For however the expressions simplifies because one only need to know the relative payoff between two strategies (Challet ). The action of the optimal strategy, can be expressed in terms of so that for takes the form: (3) (5) From the bracket of the sum in (5) a change of can arise either because the optimal strategy changes and the two strategies for a given differ (first term in the bracket). Or can change simply because the optimal strategy changes its prediction for the given (second and third terms in the bracket). For the Minority Game and the $-Game, the relative payoff changes in time respectively as: (6) (7) Inserting from (1) and inserting (7) in (5) on gets for the MG: (8) One can make the analog of as a “magnetism” determined by the “spins” represented by the strategies . The first term then correspond to the “interacting” case steming directly from the introduction of the payoff function with interaction between different spins (from products of and ). The second and third terms are “free field” terms, the only terms present without a payoff function. In the case of the $G (7) and with all having same sign, the r.h.s. of (8) becomes 0. This shows that a constant bit, corresponding to either an exponential increase or decrease in price, is a Nash equilibrium for the $G.

D. Kamieniarz, A. Nowak and M. Roszczynska were supported by EU grants CO3 and GIACS

References

- (1) R. S. Gurkaynak, “Econometric tests of asset price bubbles: taking stock”, Journal of Economic Surveys, Vol. 22, Issue 1, p166, Feb. 2008.

- (2) A. Vissing-Jorgensen, “Perspectives on behavioural finance: does irrationality disappear with wealth? Evidence from expectations and actions”, NBER Macroeconomics Annual 18, 194 (2003).

- (3) V. L. Smith, G. L. Suchanek and A. W. Williams, “ Bubbles, crashes, and endogeneous expectations in experimental spot asset markets”, Econometrica, Vol. 56, 1119 (1988).

- (4) I. Erev and A. E. Roth, “ Predicting how people play games: reinforcement learning in experimental games with unique, mixed strategy equilibria”, The American Economic Review, Vol. 88, No. 4, pp. 848 (1998).

- (5) D. Challet, M. Marsili and Y.-C. Zhang, “Minority games: interacting agents in financial market” (Oxford University Press) 2004.

- (6) J. V. Andersen and D. Sornette, “ The $-game”, Eur. Phys. J. B 31, 141 (2003).

- (7) A. Tversky and D. Kahneman, “ Judgment under Unvertainty: Heuristics and Biases” , Science 185, 1124 (1974).

- (8) N. Barberis, A. Shleifer and R. Vishny, “ A model of investor sentiment” , Journal of Financial Economics, 49, 307 (1998).

- (9) B. I. Murstein “ Regression to the mean: one of the most neglected but important concepts in stock market” , Journal of Behavioral Finance, 4, 234 (2003).

- (10) J. V. Andersen and D. Sornette, “ A mechanism for pockets of predictability in complex adaptive systems”, Europhys. Lett. 70, 5 (2005).

- (11) D. Lamper, S. D. Howison and N. F. Johnson, “Predictability of large future changes in a competitive evolving populations”, Phys. Rev. Lett. 88, 017902 (2001).

- (12) In one experiment we found the subjects create a bubble without significant decoupling taking place, so decoupling is a sufficient but not necessary condition to create a state of bubble.

- (13) D. Challet and M. Marsili, Phys. Rev. E 60, R6271 (1999); M. Marsili and D. Challet, Phys. Rev. E 64, 056138-1 (2001).