Orsay LPT-08-40

Adaptive networks of trading agents

Abstract

Multi-agent models have been used in many contexts to study generic collective behavior. Similarly, complex networks have become very popular because of the diversity of growth rules giving rise to scale-free behavior. Here we study adaptive networks where the agents trade “wealth” when they are linked together while links can appear and disappear according to the wealth of the corresponding agents; thus the agents influence the network dynamics and vice-versa. Our framework generalizes a multi-agent model of Bouchand and Mézard, and leads to a steady state with fluctuating connectivities. The system spontaneously self-organizes into a critical state where the wealth distribution has a fat tail and the network is scale-free; in addition, network heterogeneities lead to enhanced wealth condensation.

pacs:

89.75.Fb, 89.75.Hc, 89.65.GhI Introduction

Multi-agent systems often involve only simple ingredients and rules, yet can lead to “complex” dynamical behavior. In general the agents of such systems interact locally (e.g., only within nearest neighbors on a lattice) or may interact with all other agents (corresponding to a mean-field system). The network of interactions is then given a priori and is time independent, only the internal states of the agents change with time. However there are many situations where the network structure will be influenced by the agents’ actions: agents may move around and redefine their neighborhoods, or they may choose their interactions according to their internal states. For instance, in transportation networks, population increases will lead to the construction of new links, and inversely the introduction of new connections will affect the dynamics of the populations. Analogous examples abound both in artificial networks (communication, distribution, etc.) and in natural networks (biological, ecological, social,…). Having both dynamic agents and dynamic connections potentially allows for new phenomena, be-it at the level of the agents or at the level of their network of interactions.

Networks whose links change with time are often referred to as adaptive networks. There is a rich literature on such networks, reviewed in particular in refs. gross . But as noted by these authors, in most such investigations, the dynamics of the network occur on a very different time scale from that of the variables (or “fields”) affecting these changes. Only for consensus-forming networks (see for instance zimmermannEguiluz04 ; holmeNewman06 ; kozmaBarrat08 ) and variations thereof grossLima06 do the links change at a rate comparable to the fields (agent opinions in this case); but because opinions are discrete or because of the nature of these models, one does not reach a critical state generically. For our work we seek systems which spontaneously lead to criticality (without any parameter fine-tuning) and for which the network and the fields driving the network have comparable time scales. This challenge is particularly relevant today because the last decade has revealed that many natural and artificial networks have strong topological heterogeneities and are often scale free. Surprisingly, the modeling of such networks is almost always based on growth rules: attachment of a new link is preferentially done to hubs barabasiAlbertxx , or it depends on fixed hidden variables on the nodes parkNewmanxx . Such frameworks are out of equilibrium and have no steady state; in addition, they ignore the dynamics of the quantities implicitly associated with the nodes in most real world examples. In the work described here, the internal state of each agent can influence the link dynamics, and at the same time the set of existing links affects the dynamics of the agents.

We present our model in the language of macro-economics where agents have wealth, perform transactions amongst themselves, and can see their wealth increase multiplicatively as in financial holdings. This choice is motivated by the overwhelming evidence that wealth dynamics in human societies spontaneously evolves to criticality. In particular, individual wealth follows a “Pareto” law pareto89 with power law tails for the wealthy; similar fat tails also arise in corporate wealth, e.g., in the distribution of sizes of firms mandelbrot60 ; souma01 .

Our framework extends a model proposed by Bouchaud and Mézard bouchaudMezardXX to the case where the network of interactions is heterogenous and adaptive. We find that in the absence of regulatory mechanisms, the system naturally goes to a “collapsed” phase where the great majority of agents becomes marginalized (poverty stricken) and isolated. Including a minimum support level to maintain agent connectivity, the system is instead generically driven to a self-organised critical steady state; in this steady state, the distribution of wealth of agents has a fat tail and the adaptive network is scale free.

The paper is organized as follows. The model is defined in Sect. II; we also present different observables of interest and sketch our simulational methods. In Sect. III we exhibit the power laws arising in the quenched systems: that of the node degree distribution when the wealth is frozen and that of the wealth distribution when the network links are frozen, considering in particular the effects of network heterogeneity. In Sect. IV the settings of the respective time scales for agent vs. network dynamics are presented. Then we examine the full model where the network is adaptive (the link dynamics is affected by the agents and vice-versa) in Sect. V. We conclude in Sect. VI.

II The model

To specify a multi-agent system, one begins with the possible internal states of the agents. Since our model builds on that of Bouchaud and Mézard bouchaudMezardXX , each of our agents will have its internal state specified by a real positive variable, hereafter called its “wealth”. Agents see their internal state change with time: their wealth will fluctuate because of returns on investments on the one hand and because of exchange of goods against currency on the other; such exchanges or “trades” lead to outflux (from purchases) and influx (from sales). Trades are only performed between linked agents; these links are either set a priori (“quenched” or frozen network) or are dynamic as in adaptive networks. We now explain in detail the dynamics of these two parts of our model. (Similar ideas have been formulated independently in ref.garla , but, to our knowledge, have not been further developed.)

II.1 Agent wealth dynamics

Our system has a fixed number of agents, whose state at time is given by . The change in wealth of an agent takes into account trades and returns on investments. For computational simplicity, we consider a discrete time stochastic equation bouchaudMezardXX :

| (1) | |||||

where the parameters describe the fraction of agent ’s wealth which flows to agent as a result of trading at time . The change in an agent’s wealth is also affected by the return on investments in stock-markets, currency exchange rates, housing or commodity prices etc. These investments lead to gains or losses, providing multiplicative changes; if for example a stock price changes by two percent, then the value of a portfolio allocated in that stock will change by two percent. We model the fluctuations by the term which is taken to be a stationary Gaussian variable:

| (2) | |||||

| (3) |

Without the random factors in Eq. (1), the total wealth of the system would be conserved; their presence implies that the total wealth typically grows exponentially with time, as discussed in ref. bouchaudMezardXX .

Note that wealth is a relative concept, i.e., independent of the unit of currency used to measure the ; hence, the wealth dynamics must be invariant under the scale transformation

| (4) |

It is evident that this requirement is satisfied by Eqs. (1).

Let us denote by the adjacency matrix of the graph representing the linking of agents and let us assume, for simplicity, that this graph is undirected, i.e. . In ref. bouchaudMezardXX Bouchaud and Mézard have studied in detail the large time behavior in the class of models where , with a constant proportionality factor , where the graph is time independent. They limited their study to fully connected graphs (the model is then analytically solvable) and to sparse random (Erdös-Rényi) graphs. They have shown that in both cases the system tends to a steady state where wealth distribution has a power law tail at large (relative) wealth values. Furthemore, for sparse random graphs and small enough the tail becomes sufficiently fat to lead to the “wealth condensation” phenomenon: a finite number of agents hold a finite fraction of the total wealth, even in the large limit.

In this paper we propose a two-fold generalization of the study summarized above. First, we will consider highly inhomogeneous graphs. This is motivated by the empirical observation that graphs encountered in nature are very often inhomogeneous. For example, scale-free fat tails of the degre distribution are ubiquitous. It is easy to see that for highly inhomogeneous graphs assuming a simple proportionality relation is untenable. Indeed, the loss term in (1) would then dominate over the income term when is large and the rich agents would therefore prefer to have as few trading partners as possible, contrary to common sense.

We will assume that all agents trade with the same “activity” , which is constant in time. This means that the total outgoing flow of wealth from the agent equals ; in effect, each agent allocates a fixed fraction of its wealth to trading, a reasonable hypothesis when considering life-styles in developped countries.

For each agent , we shall assume that its outflow of trades (purchases) is equally distributed over all agents it trades with. Thus, the matrix reduces to

| (5) |

where is the number of agents trading with . We have checked, keeping the topology of the graph quenched (inhomogeneous by construction), that with Eq.(5) the average wealth is a monotonically increasing function of the node degree: rich agents tend to have many trading partners.

The second generalization we propose concerns the topology of the graph, which will no longer be assumed frozen. On the contrary, it will adapt itself to the demands of agents. We now discuss this point in detail.

II.2 Link dynamics

The “interactions” between agents are their connections, i.e., the support for their mutual trades. The corresponding network depends on the internal state of the agents themselves, and thus the links between agents are dynamical: they can be added or removed over time. To specify these dynamics, we shall model the time evolution of the adjacency matrix , which is now assumed to be time dependent: if at time the agents and can trade with each other and otherwise.

We have to define the dynamics for the graph evolution . To model its dependence on wealth distribution, we propose a preferential trading rule, according to which the probability of establishing a new trade connection between two agents is roughly proportional to the wealth of each agent. To turn this rule into a probabilistic recipe one has to define a quantity in the range which can be interpreted as a probability. Instead of , we will use normalized quantities which express the wealth of agents in units of the current mean value of the wealth in the ensemble:

| (6) |

Clearly is invariant under the scale transformation Eq. (4). The position, or solvency, of the agent in the system is better reflected by its normalized wealth than by its absolute wealth. In these units the mean value of wealth is by construction always equal to unity, . In our wealth preferential trading rule, the probability of establishing a new trading connection, , increases with where is some proportionality factor. The only problem is that even if is small, this quantity may exceed one for large and and thus loose a probabilistic interpretation. To avoid this pathology we set:

| (7) |

Of course trade connections between agents do not necessarily exist for ever. We allow in our model for the possibility of abandoning an existing trade connection, . For simplicity we shall assume that the probability of breaking the trade or equivalently of removing an existing link between and is constant in time and independent of the agents’ wealth:

| (8) |

Taken together, Eqs. (7)-(8) along with Eqs. (1) define an adaptive network, preserving the property of invariance under Eq. (4) of the original Bouchaud-Mézard model.

The model is now formulated. As will be seen, it displays a very interesting pattern of adaptation of the network topology to the wealth distribution and vice versa. Before we discuss these properties, let us first consider the limiting cases in which only one sector is active while the other is quenched: (a) the network topology evolves according to the dynamics described above while the wealth distribution is quenched; (b) the wealth distribution evolves according to the dynamics described above while the network topology is quenched.

III Quenched dynamics

III.1 Quenched wealth distribution

Assume now that the distribution of wealth is constant during the evolution of the network. The process of adding and removing links between nodes and can be viewed as a two-state Markov chain. Since the weights are constant in time , the probability of adding the link (cf. Eq. 7) is constant as well. Similarly, the probability of removing the link is constant (cf. Eq. 8). One can then easily determine the stationary probability for this Markov chain; one finds that for this stationary distribution the probability that there is a link between nodes and equals

| (9) | |||||

where . Assume that the weights are independent identically distributed random numbers with some probability distribution such that the mean is 1, i.e., . In this case one can easily see that the total expected number of links of the network can be bounded from above:

| (10) |

We used the fact that the denominator of is by construction equal or larger than one and . Additionally if the coefficient is inversely proportional to the number of nodes, i.e., , the network will be sparse and the expected number of links will approach the upper bound given in (10) in the limit because the denominator will tend to one. Thus, the mean connectivity of the network is expected to be

| (11) |

for and . For the probability (9) that there is a link between a pair of vertices and is for all practical purposes the same as in the Park-Newman model parkNewmanxx , so we expect that the two models will behave similarly for small , and in fact we have checked that this is indeed the case.

It is known from the considerations of Park and Newman parkNewmanxx that if are independent identically distributed random numbers with a probability distribution having for large a scale-free tail with then the node degree distribution also exhibits the scale-free behaviour (in a range of values of ) provided the network is sparse. This is what we observe too.

The original Park-Newman model used the concept of fitness, closer in spirit to the unnormalized weights rather than the normalized ones (6). The main difference between the two frameworks is that the average fitness for the ensemble of numbers , may differ from ensemble to ensemble while for the normalized weights by construction it is always constant . In effect, if one substitutes ’s by ’s and in (9) and neglects to get the original Park-Newman model, one obtains a simple relation between the two definitions of :

| (12) |

Note that in the Park-Newman model, is constant; then the above identification leads to a that fluctuates from event to event as a result of the fluctuations of the average .

For large , by virtue of the central limit theorem, is, for , a Gaussian random number fluctuating around the mean within a range of size . For , is a Lévy random number whose probable deviations from the mean are of order , Finally, for , is a Lévy random number of order , subject to enormous fluctuations. In other words, as long as , the Park-Newman construction and ours differ for large by a trivial rescaling (12), while for the mapping breaks down.

Our network evolution has been defined using “computer” time. Hence, if denotes the unit of the physical time, the parameters and are both proportional to . However, as was shown above, as long as the relevant control parameter of the model, as far as the topology of the network is concerned, is the ratio , which is insensitive to the value of . However, the value of controls the rate of updates of the algorithm and, therefore, the autocorrelations during the history of a computer simulation. We set in our numerical work, considering as the relevant adjustable parameter.

III.2 Quenched network

III.2.1 The continuous time limit

Now assume that the network is fixed during the evolution of weights: . In this case (cf. ref. bouchaudMezardXX ) Eq. (1) has a continuous time limit under a proper scaling of the parameters of the model. Let denote the physical time and set

| (13) | |||

| (14) |

In the limit one gets from (1) together with (5) the following stochastic equations (in the Stratonovich sense):

where is a -dimensional Wiener process. Dividing both sides by and rescaling the time variable one sees that at large time the only relevant parameter is .

We simulate the model on a computer using its discrete formulation. However, we try to be close to the continuous time limit, setting very small (in our runs we used ). Since with such a choice one expects that the dynamics depends on only, we can without any loss of generality set the physical parameter .

When the graph is complete, that is for , Eq. (III.2.1) can be solved analytically bouchaudMezardXX . For , and one gets a stationary distribution for the normalized weights (6). It has a fat tail at large , with the exponent . Notice, that for the stationary solution does not exist, and therefore the limit is singular. The authors of ref. bouchaudMezardXX have also shown, using numerical simulations, that for sparse random Erdös-Rényi graphs, one again gets a fat tail but with an exponent smaller than one if is smaller than a certain critical value. We have repeated these simulations in our version of the model for a sample of network topologies. We observe that the fat tail always emerges and that the corresponding exponent depends weakly on network topology (see later). The occurence of such a fat tail with in the wealth distribution has consequences that we now discuss in detail.

III.2.2 Poverty and wealth condensation

Let us carefully study the consequences of using the normalized ’s instead of ’s (our discussion is inspired by ref. bouchaudMezardXX2 ). For the sake of simplicity, but without any real loss of generality, assume that the probability distribution of is (we omit the index for simplicity of writing):

| (16) |

and zero otherwise. Assume first that so that the mean is well defined. We want to calculate the probability distribution of the scaled variable defined in (6):

| (17) |

where , and is the sum of remaining terms. For large one can replace by its mean value , where . After trivial algebra one gets from (16)

| (18) | |||||

where , and .

The above distribution has natural cut-offs, as expected. In addition to the behavior inherited from (16) it involves a factor suppressing ’s of order . The lower cut-off is finite as long as . For , one has to redo the analysis.

Let us observe that strictly speaking is not fixed but fluctuates. Hovever, when its departures from the average can be neglected when is large enough. When this is no longer true. If the sum (17) does not increase linearly with : instead scales as , where is some constant, which shall be calculated below. So in this case the lower cut-off in (18) is

| (19) |

as one can see by inserting on the right hand side of (17). The cut-off goes to zero as , but for any finite it is finite. It is essential to keep it finite while calculating the integral since otherwise the singularity at zero would make the integral (18) diverge. With (for ) the integral is properly normalized for and the mean value of is . (In the calculation of the mean value one can set since the singularity at zero is integrable). Hence, if .

One can calculate the probability that is smaller than a given small fixed number :

| (20) |

where , so that for . This means if one makes a fixed-bin histogram of ’s for large , then almost all ’s will be in the first bin adjacent to zero. This phenomenon can be called a “poverty condensation”.

Another surprising feature of the wealth distribution when is that the factor does not introduce a suppression of of order , but an enhancement. The singularity at is integrable. Intuitively this means that in a large sample of ’s, most values are concentrated at zero, but a few remaining ones are of order . This is also what one can infer from the calculation of the inverse participation ratio bouchaudMezardXX ; bouchaudMezardXX2 . For

| (21) |

is a finite positive number when whereas for . This shows that in a large sample of ’s a finite fraction of them is of order . This is the “wealth condensation” signaled by Bouchaud and Mézard. Notice, that poverty and wealth condensation occur simultaneously.

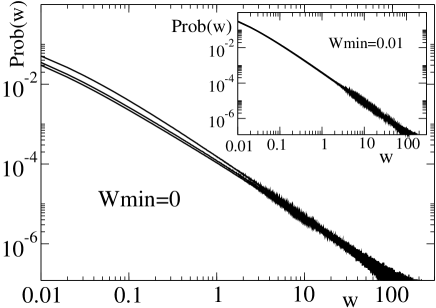

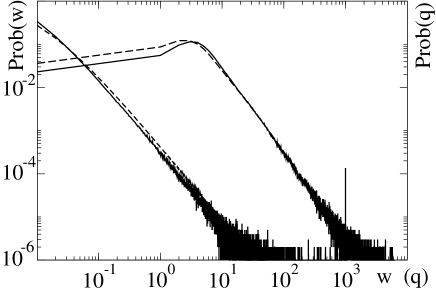

The above discussion refers to simple sampling of ’s. Now let the agent’s wealth be dynamic (but still keeping the geometry frozen). We show in Fig. 1 the wealth distribution calculated keeping the network quenched, for Erdös-Rényi, scale-free with exponent and regular networks with fixed connectivity (in all these cases we set the average connectivity to 4). The parameter is set to . The fitted slopes equal to . In agreement with the above discussion, most of the agents (about 80%) are concentrated in the leftmost bin . This completes the discussion with either the wealth or the links frozen. From now on we focus on the full model.

IV Agent and network time scales

For our simulations, we alternate the updatings of the wealth and links. In one update of the wealth, Eq. (1) is used for each node. Once all new are found, they are renormalized, so that . In one update of the geometry we pick a pair of nodes at random and use Eqs. (7) or (8), when the nodes are connected or not, respectively. This is repeated times. But this poses the problem of the relative frequency of the updates, i.e., what are the two associated time scales for wealth and link updates. In physical systems, these time scales are a priori given by the laws of physics. One example of this is the coupling of matter and geometry in theories of gravity. Network nodes involve “matter” fields while the network links describe the curved geometry of interactions. The theory involves coupling constants which specify the dynamical time scales of matter and geometry degrees of freedom. Comparing to our agent based model, matter is analogous to wealth and geometry is described by the network topology.

For our adaptive network model of agents, how should one set the two time scales? As pointed out in a recent review gross , in most models studied so far the wealth changes either much faster or much more slowly than the geometry. We wish to have the two time scales be comparable. Once the value of has been chosen, the rate of wealth updates is fixed. As already mentioned, the rate of geometry updates is controlled by the parameter or equivalently . To compare the two rates, we have randomized the system and then let it evolve keeping the wealth or the geometry quenched. We found that (with our choice of and ) the autocorrelation length for wealth is two orders of magnitude larger than for geometry. Consequently, in the simulations of the coupled system we alternate 1 sweep of the geometry with 100 sweeps of the wealth (and there are about ten updates of the whole system within one autocorelation time interval).

The physical control parameters are and . Actually, as will be seen, the choice of has little influence on the wealth distribution; it controls the average degree of the network. The degree distribution itself turns out to have a smooth dependence on when it is plotted versus the scaled variable . On the other hand the value taken by is essential for the behavior of the system.

The ansatz Eq. (5) generates a positive correlation between the degree of a node and the wealth stored in this node. One can suspect that this leads to a breakdown of ergodicity for heterogeneous networks. And indeed, ergodicity is broken as long as the geometry is quenched: if at a certain moment a given agent is the poorest (richest) it never becomes the richest (poorest) during the run history. We have found, however, that the ergodicity is restored when wealth and links get coupled. In a sense, this coupling increases the “social mobility”.

V Adaptive network of interacting agents

V.1 Network collapse in the absence of a cut-off

The poverty condensation has dramatic consequences when one couples wealth to geometry. As soon as one enters the regime where the wealth distribution develops a fat tail with , nearly all nodes become progressively isolated (have zero degree) and all wealth becomes the property of a tiny minority. A modification of the rules is called for, either for wealth (welfare) or for connectivity (not considered here). We impose a lower cut-off on ’s viz. . Since we work with scaled variables and since we recalculate them after each wealth update, the ’s inherit a similar cut-off, except that it somewhat smeared around . In the inset of Fig. 1 we show the wealth distribution for quenched networks when this cut-off is imposed; no collapse is possible there. Hence, a calculation with and without cut-off can be compared and one notices that the fat tail appears in both cases, although the exponent is a little larger when the cut-off is present. When the network is adaptive, the cut-off prevents the collapse.

V.2 General overview

Before presenting more datailed data on the wealth and degree distributions and on the correlation between the two, let us have a general view of the model’s properties.

With an ongoing trading activity and link changes, the system evolves and empirically always seems to reach a steady state that is unique (independent of the initial conditions). Furthermore, there is a smooth large volume limit.

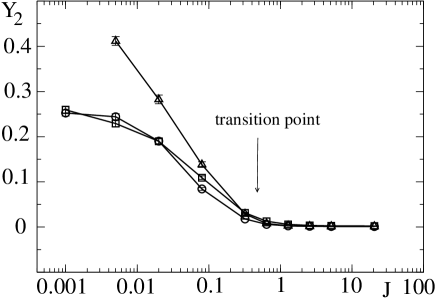

It is most instructive to examine the dependence of the inverse participation ratio defined in Eq. (21) versus (cf. Fig. 2). The qualitative behavior is similar to that observed in the Bouchaud-Mézard model. (For completeness we show also in the figure the data corresponding to a calculation with quenched random network.) We find that is finite as long as is small enough, it falls progressively as increases and eventually settles at a value of order when is increases beyond a certain critical value. Notice that an increase of from to has very little effect. Remember also that as long as the distribution has a tail falling off as a power with (evidence for this scale-free behavior will be presented in Sect. V.4). Hence, the evolution of the wealth distribution slope with can be immediately deduced from Fig. 2.

The model has two distinct phases. An educated guess is that in the large phase the dynamics is qualitatively well described by the “mean field” approximation of ref. bouchaudMezardXX . This is also suggested by the simulations we have carried out, which are however strongly affected by finite-size corrections (the efficiency of our algorithm does not allow us to go far beyond ). The low phase is by far more interesting and we focus on it hereafter. In the following paragraphs, we shall consider successively network properties, wealth properties and joint effects.

V.3 Scale-free steady-state networks

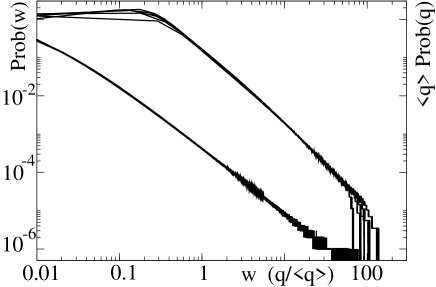

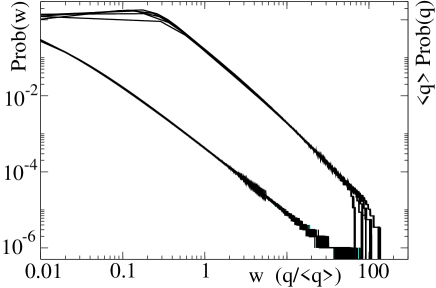

We display in Figs. 3-5 the distribution of node connectivities in the case of sparse networks (cf. Eq. (11)).

For not too large , the degree distribution depends weakly on the value of this parameter whereas the dependence on is rather strong. However, scaling the degree we find that the tail of the degree distribution is both scale free and insensitive to at large . Such scale-free behavior seems to be generic; indeed we find it for all the parameter values we have explored.

[b]

Thus, the tail of the distribution of behaves as

| (22) |

where depends on the values of the control parameters though it is not sensitive to them. Furthermore, we find that does not go below so no node carries a finite fraction of all links. This can be referred to as lack of “link condensation”. One can define for the degree distribution by replacing in the defining equality in (21) (notice that ). One finds that this is typically one order of magnitude smaller than the corresponding parameter for the wealth.

V.4 Power-law wealth distributions

Now we focus on the properties of the agents’ wealth. We saw that when the network was quenched, a fat tail appeared generically so it will come as no surprise that in the adaptive network model the distribution of wealth again has power law tails. Examples of such tails are given in Figs. 3-5 for the case of sparse networks ( scaling as ).

As already mentioned, the exponent depends on the parameters of the model, weakly on , more strongly on , as can be deduced from the curves in Fig. 2.

V.5 Wealth and topology are associated

[b]

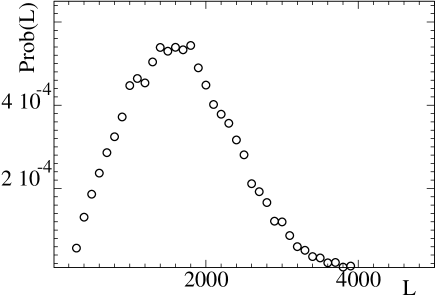

The relative insensitivity of our results to parameter changes might suggest that the steady state reached at large time by the system is extremely stable. It turns out, however, that the system is actually subject to very large fluctuations, for instance for the total wealth, and that these fluctuations are much larger than those observed when the geometry is kept quenched. This can be traced back to the slow fall-off of the wealth distribution: with such ’s the link dynamics of Sect. II.2 necessarily generates networks with strongly fluctuating number of links. An illustrative example is given in Fig. 6, which shows that the total number of links has a fairly broad distribution.

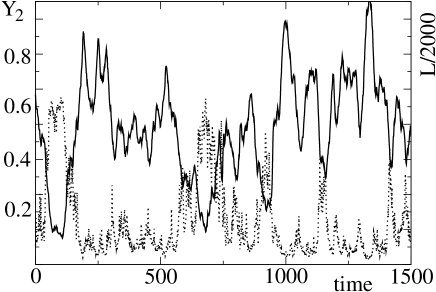

What is even more interesting, one observes a strong (anti)correlation between the wealth inverse participation ratio and the total number of links (see Fig. 7). The periods of relatively low participation ratio and large number of inter-node connections alternate with periods where participation ratio is large and the number of links small. Increasing the number of trading links apparently reduces “social disparities”. Of course, this remark should not be taken too seriously, the frequency of the regime changes is too rapid to be an image of the behavior of actual markets. However, the trend is of interest.

VI Discussion and conclusion

We have introduced a class of models in which agents perform trades and influence the associated network of interactions. We find that these adaptive network systems spontaneously go to a unique steady state, and that several very distinct behaviors arise depending on the parameters defining the models. When no lower cut-off is imposed on agent wealth, the poor go into a spiral of poverty and disconnect from the network which “collapses”; furthermore this is a cascading process so that rapidly nearly all individuals reach this situation. When instead a minimum wealth is enforced, the overall system reaches a critical state where wealth and connectivity distributions have power-law tails; this critical behavior is generic, no fine tuning of parameters is necessary. In this critical steady state, the heterogeneity or “differences” in agent wealth depends on the trade intensity, parametrized in our model by a coupling . For large , the wealth circulates rapidly, and differences in wealth are small. On the contrary when is small, wealth differences are large, and in fact for small enough, one goes into a “condensed” phase where a finite fraction of the wealth is held by just a few agents. Interestingly, we find this phase transition point to be the same as when the network is quenched according to any law for the degree distribution. Not surprisingly, we have also found that the wealth and the network dynamics lead to large correlated fluctuations; in particular, the total wealth tends to be lowest when the network is the densest.

The occurence of power laws in wealth distributions, usually referred to as Pareto’s law pareto89 ; mandelbrot60 ; souma01 , has been empirically observed in many economic contexts. Since such systems almost always involve adaptive networks, it would be of major interest to extend those observations to the properties of the underlying networks. Our model suggests not only that these networks will be characterized by power laws, but that the wealth and network properties will be strongly correlated. In situations where regulation of such behavior is considered necessary, policies may focus on the network “rules” rather than attempting to regulate wealth directly; these policies might involve introducing fees or subsidies for different kinds of trades. Clearly in realistic situations, there may be other features to take into account such as geographic influences on the adaptive network dynamics. One may have to also consider social trends such as spontaneous assortativity formation in trading networks. It seems to us in particular that sufficient assortativity may prevent the spiral of poverty formation when no minimum wealth is imposed. More generally, many of these issues extend far beyond economic adaptive networks: food-webs, transportation networks, or social networks all lead to similar questions.

Acknowledgments— This work was supported by the EEC’s FP6 Marie Curie RTN under contract MRTN-CT-2004-005616 (ENRAGE: European Network on Random Geometry), by the EEC’s IST project GENNETEC - 034952, by the Marie Curie Actions Transfer of Knowledge project “COCOS”, Grant No. MTKD-CT-2004-517186, and by the Polish Ministry of Science and Information Society Technologies Grant 1P03B-04029 (2005-2008). The LPT and LPTMS are Unité de Recherche de l’Université Paris-Sud associées au CNRS.

References

- (1) T. Gross and B. Blasius, arXiv:0709.1858.

- (2) M.G. Zimmermann, V.M. Eguiluz and M. San Miguel, Phys. Rev. E 69, 065102 (2004).

- (3) P. Holme and M.E.J. Newman, Phys. Rev. E 74, 056108 (2006).

- (4) B. Kozma and A. Barrat, Phys. Rev. E 77, 016102 (2008).

- (5) T. Gross, C.D. D’Lima and B. Blasius, Phys. Rev. Lett 96, 208701 (2006).

- (6) L. Barabasi and R. Albert, Science 286, 509 (1999).

- (7) J. Park and M.E.J. Newman, Phys. Rev. E 68, 026112 (2003).

- (8) V. Pareto, Reprinted as a volume of Oeuvres Complètes (Droz, Geneva), 1896 (1989).

- (9) B.B. Mandelbrot, Int. Eco. Rev., vol 1, 79 (1960).

- (10) W. Souma, Fractals, vol. 9, No. 3, 463 (2001).

- (11) J.-P. Bouchaud and M. Mézard, Physica A: Statistical Mechanics and its Applications, vol. 282, 536 (2000).

- (12) D. Garlaschelli et al., Eur. Phys. J. B 57, 159 (2007); for an earlier paper by the same group devoted to adaptive networks see G. Caldarelli, A. Capocci and D. Garlaschelli, Nature Physics 3, 813 (2007).

- (13) J.-P. Bouchaud and M. Mézard, J. Phys. A: Math. Gen. 30, 7997 (1997).