Bayesian Estimation of Inequalities with Non-Rectangular Censored Survey Data

Abstract

Synthetic indices are used in Economics to measure various aspects of monetary inequalities. These scalar indices take as input the distribution over a finite population, for example the population of a specific country. In this article we consider the case of the French 2004 Wealth survey. We have at hand a partial measurement on the distribution of interest consisting of bracketed and sometimes missing data, over a subsample of the population of interest. We present in this article the statistical methodology used to obtain point and interval estimates taking into account the various uncertainties. The inequality indices being nonlinear in the input distribution, we rely on a simulation based approach where the model for the wealth per household is multivariate. Using the survey data as well as matched auxiliary tax declarations data, we have at hand a quite intricate non-rectangle multidimensional censoring. For practical issues we use a Bayesian approach. Inference using Monte-Carlo approximations relies on a Monte-Carlo Markov chain algorithm namely the Gibbs sampler. The quantities interesting to the decision maker are taken to be the various inequality indices for the French population. Their distribution conditional on the data of the subsample are assumed to be normal centered on the design-based estimates with variance computed through linearization and taking into account the sample design and total nonresponse. Exogeneous selection of the subsample, in particular the nonresponse mechanism, is assumed and we condition on the adequate covariates.

Key Words: Inequality; Wealth distribution; Survey methodology; Bayesian statistics; Monte-Carlo Markov chains.

AMS 2000 Subject Classification: 62F15, 62D05, 65C40, 65C05.

ENSAE - CREST, 3 avenue Pierre Larousse, 92245 Malakoff Cedex, France; gautier@ensae.fr

1 Introduction

Approximately every six years the French statistical office INSEE collects a cross sectional

wealth survey on households. The last dataset was collected in 2004. Several aspects can be

studied focusing for example on holdings or particular types of assets like

the professional wealth or intergenerational transfers. One natural question concerns the nature

of the distribution of wealth and its allocation in the various possible holdings.

However, it is known to be a difficult one as well (Juster and Smith 1997) due to the

difficulty to have good measurements and to possible selection biases. Questions on income

and wealth are particularly sensitive and the nonresponse probability is very likely to be

related to the value itself, resulting in possible endogeneous selection and biases. Also,

it is for example particularly difficult to give a precise amount for the market value of one’s

real estate piece of property unless people assessed it recently, say in order to sell it.

Thus, amounts are usually collected in bracketed format and imputation methods (see experiment

based on the knowledge of the true income distribution in Lollivier and Verger 1988) are used

in practice at the French institute.

For some variables the brackets are defined by each household,

they give upper and lower bounds for the amount based on their evaluation. For other variables the

households choose among a predefined system of brackets. The method allows to replace missing data,

impairing inference due to selection bias and loss of efficiency implied by a reduced sample, by

censored data. In the current article we focus on the evaluation of inequality indices on the total

wealth for the whole French population. A specific

question at the end of the survey: ”Suppose you had to sell everything, how much do you assess the

value of your total wealth including durable goods, artwork, private collections and jewelry” allows to

measure the total wealth.

The values of the last items were not collected. It is troublesome to ask such information because the pollster

comes to the household’s home and they could be suspected of theft in case a robbery

occurs after the visit. The system of brackets for the question collecting the total wealth

has an unbounded last bracket. The threshold for the higher bracket is 450.000 € which is pretty low.

Also in order to improve, in principle, the precision of design based estimates, certain categories have been

over-sampled: self employed, executives, retired people and people living in rich neighborhoods.

These variables,

available from the census, are indeed correlated with the wealth and sampling more a priori wealthy people

improve the precision of design based estimates of inequality indices sensitive to the top of the distribution.

But due to the censoring, a billionaire is equivalent to an household whose total wealth is 451.000 €.

Over-sampling has increased the number of household for which we measure wealth very imprecisely.

Thus, though we are interested in the particular concept of total wealth collected in this final question,

we aim to gather more information in order to better estimate the inequality indices.

Due to the high amount of censoring for the wealthiest, the less wealthy contribute the most to the

likelihood. Moreover, some of the indices are quite sensitive to misspecification of the model.

Though it is pretty usual for wages and even for wealth to specify linear models for the logarithm

with normals residuals, some of the assumptions like the distributional assumption for the residuals are not

testable in the absence of pointwise measurements. Other distributions like Pareto are also quite popular in

the literature on wealth inequalities (Lollivier and Verger 1988). It is also possible that the

influence of certain covariates is not additive, for example the contribution

of the income might differ for low incomes from that of high incomes, and, due to the

censoring of high wealth, it is possible that we do not capture well this mixture

(see for example Duclos et al. 2004 and Esteban and Ray 1994 for theoretical foundations

of polarization). Another possible source of misspecification is heteroscedasticity. If for example

the variance of the residuals increase with income, censoring and specification of an homoscedastic

model will imply lower inequality indices.

Therefore, we gather more information in order to recover better knowledge of

the top of the distribution of wealth and better estimate the total population indices.

We use bracketed information on components of the total wealth as well as bracketed

information involving several components: the total wealth (sum of the components) and the

information on the imposition on the Solidarity Tax on Wealth (ISF) obtained by matching with data

from the tax declarations.

Our approach relies on Bayesian multiple imputations (Little and Rubin 2002) for sample survey

estimation. However, our strategy to produce point estimates or interval estimates is slightly

different. We do not rely on particular rules for combining complete-data inferences or rely

on imputations which are Bayesianly proper (Schafer 2001). We use a hierarchical modeling

in order to take into account in the coverage of the interval estimates the uncertainty due

to sampling and total-nonresponse and to incomplete knowledge of the censored wealth. Under

the assumption that the proper parametric class for the data generating process (DGP) is known,

the uncertainty on the value of the censored wealth boils down to uncertainty on the parameters

values and to the remaining model uncertainty due to imperfect observation conditional on the knowledge

of the parameters. The

first model is the model for the quantities interesting to the decision maker (Geweke 2005)

which are here taken to be the various inequality indices on the finite French population.

The remaining models, which are standard, are instrumental in the sense that it is not our

goal to produce inference on the posterior predictive distribution of the wealth of the

sampled households or on the posterior distribution of the parameters, though they could be obtained

simultaneously with the numerical procedure. In order to gather information

on the components of total wealth, our DGP is multivariate. It allows to account for

example for unobserved heterogeneity.

From that point of view, our approach is similar to that of Heeringa et al. (2002),

where a multivariate model is used in the context of the American Health and Retirement

Survey (HRS). Inference is based on a single path of a Gibbs sampler Markov chain that

updates the sampled data, parameters and an error term accounting for sampling error.

The only mathematical tool is the Ergodic theorem. The model is discussed in Section

2, the non-rectangular censoring is presented in Section 3. In Section 4

we give details on the Gibbs sampler and discuss our strategy to produce point and interval estimates.

Results are presented in Section 5 and it is followed by a discussion in Section 6.

2 The Modeling Assumptions

We denote by the finite population of size composed of all the French households

and the sample, where we number the elements of from to . Due to

total nonresponse, corresponds to a subset of the initial sample drawn from particular

bases of dwellings. The initial sample is stratified and drawn with unequal probabilities

where dwellings composed, at the time of the census, of self employed, executives,

retired people and of people living in rich neighborhoods have been over-sampled. It implies

that probability of selection is related to the wealth but, in principle, the selection is exogeneous.

We assume below that the selection mechanism corresponding to the total nonresponse is also exogeneous

and that in the models we have included the adequate covariates to be able to ignore the selection

mechanism (Little and Rubin 2002).

The target quantities or quantities of interest are taken to be inequality indices

on the total wealth of the French: the Gini,

Theil or Atkinson’s indices, quantiles or inter-quantile ratios.

They are functions of the distribution of the total wealth for

households from 1 to . Recall that, for example, the Gini is defined by

where is the rank of . A design based estimate is then

where is the weight of household , and denotes the indicator function. In practice, at INSEE, a normal approximation for the design based estimate is used in order to obtain interval estimates. Also, since the variance of the estimate requires in principle as well the data in , a variance estimate is used. being nonlinear in the weights, the estimate of the variance of is approximated by that of its linearized version. The variance estimate should take into account the complex design of the sample and the total nonresponse and raking (Deville et al. 1993). The procedure is well explained in Dell et al. 2002. It is however difficult to justify all the approximations rigorously. We do not aim to enter in these details and start off from the approximation:

where the error term is a standard centered Gaussian random variable and the

variance estimate is denoted by .

Since the total wealth is censored, we are not able to apply the above tools to estimate the target quantities.

We rely a priori on a two stage model. But, since for practical issues we have adopted

the Bayesian point of view, we have added an additional ladder to the hierarchy of models:

-

1.

The model (I) for the quantities of interest like the Gini, conditional on the relevant data from the sampled household.

-

2.

The model (DGP) for the components of the wealth for sampled households. It is a multivariate model for owned macro-components of the total wealth among: the financial wealth , the value of the principal dwelling , of the other real estate including secondary dwellings rented or for leisure and parking lots , the professional wealth and the remainder (durable goods, artwork, private collections and jewelry) , conditional on the value of covariates , , and on the parameters in a certain parametric class of models.

-

3.

The prior distribution (P) of the parameters of density .

For simplicity, we assume that every household has some financial wealth (eg. money on a checking account)

and some wealth in form of remainder. Therefore, if we make groups according to the type of portfolio in the 5

above components of wealth we have to distinguish 8 groups. We denote by

the binary vector such that and define the function which associates to each

the number of the pattern. In the remaining, we use capital letters for random variables and lowercase

letters for realizations. We also use bold characters for vectors.

The model is defined as follows. In the first stage (I) we set, for example for the Gini,

| (2.1) |

with the Assumption (A):

independent of (A).

Concerning the model (DGP), we have the following model for pattern :

| (2.2) |

where is of size for any such that . We make the following restriction on the parameters:

Only the coefficient of the constant is group specific (fixed effect), the remaining coefficients of are equal for all (RP).

For the last model (P), we choose proportional to

| (2.3) |

In usual design based inference in survey sampling, the Gini index has an unknown

but fixed value. Hence, Equation (2.1) is not usual since is now random. In some

approaches to survey sampling though, the finite population values correspond to draws

in a super-population and it makes sense to assume that the quantities of interest

on the finite population are random. It is also usual to revert the Gaussian approximation

to obtain interval estimates. We may also think about estimating in terms of prediction.

We present in Table 1 the kind of covariates we have introduced in the model (DGP).

| Covariate / Component | |||||

| Life cycle | |||||

| single and no child | |||||

| age and age square | |||||

| position in the life cycle111detailed variable which interacts age, number of children and family type | |||||

| Social and Education | |||||

| social/professional characteristics | |||||

| higher educational degree | |||||

| Income | |||||

| level of the salary | |||||

| social benefits received | |||||

| rent received | |||||

| other income received | |||||

| Location of the residence | |||||

| History of the wealth | |||||

| donation received | |||||

| donation given | |||||

| recent increase/decrease of wealth | |||||

| type of wealth of the parents | |||||

| Surface and square of the surface | |||||

| Professional wealth | |||||

| wealth used professionally | |||||

| firm owned |

Covariates can also improve a priori

the coverage of the interval estimates, up to a certain stage since increasing the size of the vector of

parameters deteriorates the knowledge on the parameters. The main justification for introducing the covariates

is however to justify Assumption (A). Indeed, the survey sample is drawn exogeneously and we have to condition

by the corresponding observed covariates in order to estimate the law of the data unconditional

of the selection. Total nonresponse is a second stage of selection for which the selection mechanism is

unknown and we assume that this mechanism is ignorable (Little and Rubin 2002 and Gautier 2005) and that

we condition by the adequate covariates to decondition from selection.

The model (DGP), is such that, though we take into account observed

heterogeneity in the form of portfolio allocation and through several covariates, there might remain

unobserved heterogeneity (eg. in the form of a missing covariate) like the preference for the risk and time

that causes the residuals to be dependent. In order to use product specific variables for the principal dwelling

we model the value of the good. In contrast in the other models, for which the variables are sums of components collected in the survey,

we model the amount of the share

that the household possesses and use household specific variables only.

The vector of parameters in corresponds to the ’s and the matrices

where, denoting by the dimension of ,

The prior is a product of usual priors in the context of Gaussian linear models which are limits of normal/inverse-Wishart’s (see for example Little et Rubin 2002 and Schafer 2001). They are often called non-informative. They indeed correspond to a proper objective choice for the prior for the coefficients . The posterior, if the data were observed, is a bona-fide normal/inverse-Wishart probability distribution.

3 Censoring

In the absence of scalar measurements, intervals are the main information

for identification and estimation. As already discussed, we aim to localize as much as possible

the missing . For that purpose we use two summarizing questions and the information

on which household is eligible to the Solidarity Tax on Wealth.

The answers to the summarizing questions take the form of brackets for the sum of the collected

components of the financial wealth as well as brackets for the total wealth.

Recall that the total wealth includes the

remainder which is not collected per se in the detailed questionnaire. The information on which

household pays the Solidarity Tax on Wealth has been obtained by matching with a data set from the

tax department.The condition to pay the Solidarity Tax on Wealth is to have a taxable wealth exceeding 720.000

€. This taxable wealth corresponds to a different concept of wealth.

Only part of the professional wealth is taken into account. It is possible to deduct the

professional wealth used professionally with the exception that if one owns a

share in a firm which is too low then it is not deductible.

It is possible to have a rebate of

20% on the value of one’s principal dwelling. The artworks are not taxed either. Finally, debts are

deducted. It is possible to take into account most of the specificities of this tax.

For example, by chance, the few households that possessed a share in a firm gave equal upper

and lower bounds for its value. However, it is not possible to distinguish the artworks within the remainder.

Hence, we produce lower and upper bounds on the taxable wealth which take the form

of an extra bracketing condition.

When an household pays the tax, the upper bound for the taxable wealth

| (3.1) |

is greater than 720.000 €, where is an upper bound of the nondeductible professional

wealth obtained using the detailed information and the total debts which is deductible.

We assume that households always subtract the deductible amounts.

When an household does not pay the tax, the lower bound for the taxable wealth

| (3.2) |

is lower than 720.000 €, where is a lower bound of the nondeductible

professional wealth obtained using the detailed information.

The above conditions involving several variables allow, by manipulation of lower and upper bounds,

to shorten the initial intervals for each component and to obtain intervals for the remainder.

The censoring takes form of a hyper-rectangle.

The final summarizing condition for the total wealth

and the eligibility to the Solidarity Tax on Wealth imply censored domains which are subsets of these

hyper-rectangles.

Note that further external information has also been used in order to specify upper

bounds on the a priori unbounded total wealth. This choice is questionable but these

upper bounds are very loose. The motivation is that, since design based inference is

the initial goal and each sampled household has a weight that is the inverse of the probability of

selection222It is in fact estimated due to total nonresponse. and the data

is collected once and for all, we want to have reasonable ”representativity” of the

samples333The samples are simulated, as explained later.

The average weight is around 2.000. Suppose a billionaire is drawn, then it is assumed to

represent 2.000 households. In turn, if we were able to draw at random a second time the sample,

it is very likely that no billionaire would be drawn. It might result in inequalities which are often

too low and sometimes too high. Probably due to the over-sampling of households suspected to be wealthy,

an household with a share in a firm of the order of 25.000.000 € has been drawn.

We have introduced upper bounds on the total wealth based on Cordier et al. (2006) and published information

on the highest French professional wealth.

We have bounded by 50.000.000 € the total wealth of the apparently wealthiest household and by

10.000.000 € the total wealth of the others. Such restriction might cause under coverage

of the interval estimates. Heeringa, Little and Raghunatan (2002) have noted, using a similar modeling and the HRS survey,

that introducing such restrictions implies slightly lower means, Ginis or other concentration indices.

On the other hand its impact on more robust quantities such as quantiles is minor.

4 Numerical Procedure for Point and Interval Estimates

4.1 The Gibbs sampler

We adopt the Bayesian point of view for practical reasons.

From a frequentist point of view, the first stage consists in the estimation

of the parameters of the multivariate linear Gaussian model with censored

observations. Several methods are at hand among which simulated based methods

like the simulated maximum likelihood, simulated scores or simulated method of moments

(see Train 2003 for a lively and basic introduction) or a MC-ECM variant of the EM

algorithm (Little and Rubin 2002).

Also, since the criterion function has in general several local extrema, it

is often useful to use a stochastic optimization method or at least to try several

initial starting points. It is also useful, as we will see below, to simulate in the

multivariate truncated normals in order to finally infer on the finite population

inequality indices. The GHK simulator (Geweke 2005) in the non-rectangular context

is not standard and also requires proper importance sampling weighting which in the

context of our hierarchical modeling does not seem feasible. Accept-reject with

instrumental distribution the unconditional distribution is known to be very ineffective,

especially as the dimension increases. Robert (1995) for example suggests the use of the

Gibbs sampler (Arnold 1993). The total procedure is extremely intensive from a

computational viewpoint. Moreover, we need to modify slightly the procedure

if we want to take into account the uncertainty on the parameters due to the finite

distance.

The Gibbs sampler easily adapts to the Bayesian modeling, see for example

McCulloch and Rossi (1994) for Bayesian inference for multinomial discrete

choice models. It is also popular in missing data problems (Little and Rubin

2002 and Schafer 2001) and the extension is called data augmentation. The

only difference with the usual Gibbs sampler is that the state space of the

Markov Chain is augmented in order to include the parameters. Also, in order

to infer on the quantities of interest, we augment the state space once more

and include the ’s. The Gibbs sampler relies on an exhaustive block

decomposition of the coordinates of the state space. These blocks are numerated

according to a specific order. Starting from an initial value , the

Gibbs sampler simulates a path from a Markov chain .

Given , a vector decomposed in the above system of blocks

is simulated by iteratively updating the blocks and sampling from the distribution

of the block conditional on the values at stage of the future blocks and the

value at stage of the previously updated blocks. Here is taken to

be

The sequence is such that

we start by updating the covariance matrices, followed by the , then by the

components of wealth one by one, household by household and finish with the error term in model

(I). The updating for the distribution without truncation is for example explained in Little and

Rubin (2002). Here, we simulate the components of wealth in truncated univariate normals, which

is easy and efficient. We update the intervals of truncation for the current variable

at each stage of the sequence with the previously simulated components for the same household.

The limit theorems for the Gibbs sampler are given in Tierney (2004) and Roberts

and Smith (1994). We can also check as in Roberts and Polson (1994), minorizing the transition

kernel using that we have introduced upper bounds for the a priori unbounded amounts, that there

is uniform exponential ergodicity. Thus convergence of the laws of the marginals of the Markov chain to

the target joint posterior and posterior predictive and distribution444Recall that it

is always independent of the rest of the components. of , which is the invariant

probability , is very fast. The main result on Markov chains which is useful

for the inference here is the ergodic theorem. It states that for in ,

| (4.1) |

4.2 Posterior Predictions and Posterior Regions

Suppose that the decision maker wants the statistician to give him a single value for each quantity of interest. A natural question is then to ask: ”What is the optimal answer one can give?”. Once a loss function, say quadratic, is specified, the optimal answer

| (4.2) |

among all answers , minimizes the posterior risk

| (4.3) |

where the domains correspond to the domains of truncation in

and are the matrices of the covariates555For example block diagonal with

rows.. The expectation giving the posterior prediction

in (4.2) could be approximated by a MCMC method (Robert and Casella 2004): the empirical mean along one

path using (4.1). Since is chosen by the statistician, this approximation of the

integral could be as good as one wishes. As usual in MCMC methods we present in Section

5 results with burn-in, i.e. where we have dropped the first simulations.

According to the Cesarò lemma, (4.1) still holds starting the sum from and replacing by .

Heuristically, it allows to wait for for the chain to stabilize close to the steady state.

It only changes the very last decimals here since we have taken , which is very large as

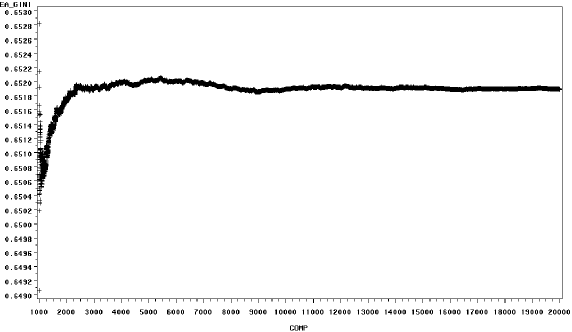

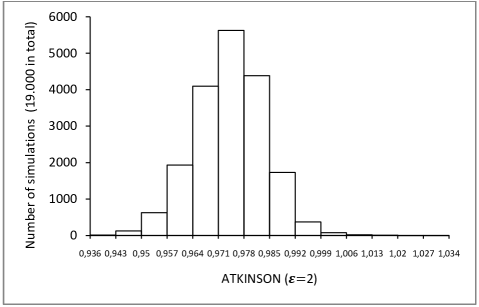

attested by Figure 1, and .

With the optimality as a goal, simple imputation is no good. The researcher arbitrarily chooses

one scenario for among an infinity of possible scenarii. Also, it is natural that predicting

the quantities of interest is different from predicting the unobserved wealth due to the

nonlinearity of in the wealth. Predicting the unobserved wealth is doomed to introduce biases.

Suppose that the statistician has convinced the decision maker that it is better to be given

an interval estimate. We take in Section 5 symmetric posterior regions but we could

have taken highest posterior regions666HPD regions. or posterior regions of minimal length.

The boundaries of the intervals can be obtained, without Central Limit Theorem and with a single

path,

by inverting the functional:

| (4.4) |

where the left hand-side could be well approximated for large by

| (4.5) |

using (4.1). Again it is possible to use burn-in.

Remark 4.1

Unlike the original Bayesian multiple imputations (Little and Rubin 2002 and Schafer 2001) we do not require proper Bayesian imputations, i.e. independent sampling, nor rely on formulas to combine multiple imputations. Multiple imputations here is only a tool to infer on the quantities of interest.

Such interval estimates take into account the uncertainty due to sampling and total nonresponse, to imprecise knowledge of the value of the parameters among a parametric class of models due to finite sample size and to the uncertainty due to the imperfect measurement of the components of wealth conditional on the knowledge of the parameters.

5 Presentation of the Results

We have applied the methodology of Section 4 to the data set and runned a Gibbs sampler with and . We have tried to diagnose convergence by plotting the convergence of empirical averages required for the inference. As expected due to exponential ergodicity, the convergence seems to occur very quickly. We have plotted in Figure 1 the convergence of the empirical averages for the Gini.

In Table 2 we collect the estimated posterior predictions and confidence regions.

| Quantity of interest | Prediction | Lower bound | Upper bound |

|---|---|---|---|

| Mean (€) | 205.003,98 | 192.879,50 | 217.647,24 |

| Median (€) | 111.459,26 | 105.672,32 | 117.563,45 |

| P99 (€) | 1.584.602,96 | 1.359.261,98 | 1.825.362,43 |

| P95 (€) | 690.793,96 | 636.924,50 | 746.759,31 |

| P90 (€) | 434.458,13 | 416.410,51 | 452.006,79 |

| Q3 (€) | 232.307,50 | 224.849,03 | 240.204,86 |

| Q1 (€) | 16.998,67 | 15.117,08 | 19.149,60 |

| P10 (€) | 3.959,07 | 2.870,83 | 5.070,55 |

| P95/D5 | 6,1972 | 5,7232 | 6,6808 |

| P99/D5 | 14,2175 | 12,1667 | 16,4388 |

| Q3/Q1 | 13,6847 | 12,2838 | 15,1034 |

| D9/D1 | 109,9332 | 80,7615 | 140,5827 |

| D9/D5 | 3,8981 | 3,7081 | 4,0858 |

| Gini | 0,6519 | 0,6328 | 0,6717 |

| Theil | 0,9044 | 0,8138 | 1,0001 |

| Atkinson () | 0,9063 | 0,8838 | 0,9253 |

| Atkinson () | 0,9742 | 0,9549 | 0,9920 |

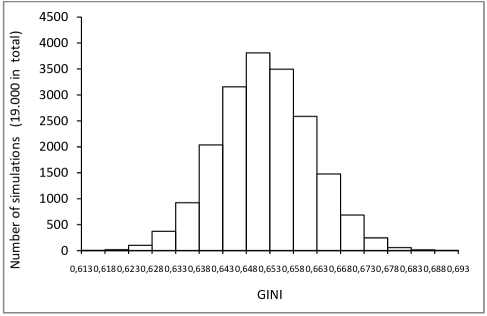

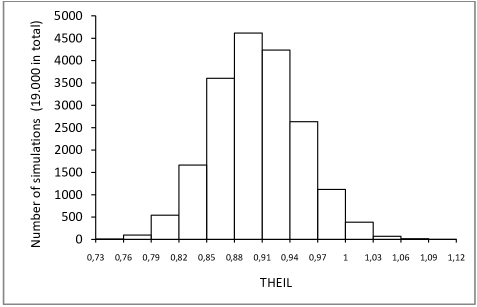

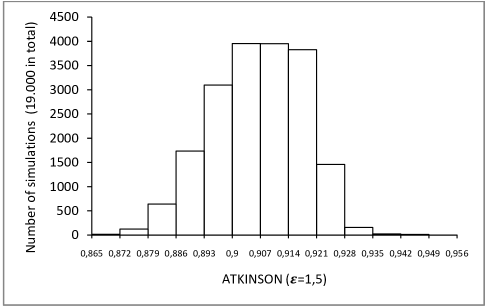

We finally represent in Figure 2 histograms for the posterior distribution of some of the target quantities of interest.

6 Discussion

Our multivariate model is similar to the model specified in Heeringa et al. (2002).

Al well we consider different models for different types of portfolios. There are still two differences.

We introduce much more information on covariates. This information is at least useful for selection issues.

We also allow for different covariance matrices in the different groups while they assume the covariance matrices are

blocks extracted from a unique matrix which here would be . It seems that it amounts to integrating with

respect to components which are not in the portfolio as if they existed but were not observed.

We are not able to justify this choice. Also, it is not clear that the posterior of the unique latent

covariance matrix is also normal/inverse-Wishart. One relative disadvantage of our approach is that we have many

parameters. That is why we have considered only 5 ”macro”-components and introduced the restriction on the parameters (RP).

It is possible to consider finer decompositions of the total wealth introducing less covariates. Note that

it is possible to avoid the introduction of group specific coefficients by specifying one multivariate

Tobit model where the residuals of the 5 latent variables are correlated. These latent variables account for both

the amount and the decision to invest in the components. We believe that this is a severe restriction. We have also

noted that, since the composition of the portfolio is observed, we do not need to model the choice mechanism and can

condition on that information.

One of the main difficulty not treated in the paper is inconsistency implied by the fact that brackets

for the variables are not coherent with the brackets involving several variables. It allowed to detect

errors like confusion between old Francs and Euros. Concerning the final question

it turns out that it is very little informative on the top of the distribution. This is troublesome

for specification issues when we want to use only this last question. It is troublesome as well when we use

the detailed components since we have a quite poor information on the remainder. The remainder is a mixture

of luxury and durable goods and the bottom of the distribution for which the intervals are more informative

is likely to be mainly composed of durable goods.

It is thus always important, but difficult due to different selection mechanism especially due to nonresponse and

different perception of surveys, to gather information from sources exterior to the survey. It is expected for the

future French survey on Wealth to ask for the right

to use more auxiliary information from the tax declarations. Also, it is possible that

survey sampling use over sampling based on data from these tax declarations.

However, it is customary to inform

the households that their data will be matched and it sometimes increases the nonresponse rate when it is matched

with tax declarations. The threshold for the last bracket for the final question on the total wealth

was set to 450.000 € in order to be far from the threshold of 720.000 € implying eligibility

to the Solidarity Tax on Wealth and mitigate nonresponse rates to this question.

Acknowledgement. Eric Gautier is grateful to Christian Robert for his guidance on Monte-Carlo Markov chains and his colleagues at the French Statistical Office INSEE among which Marie Cordier, Cédric Houdré, Daniel Verger and Alain Trognon for stimulating discussions on Economics of Inequalities and Econometrics. The author also thanks the participants of the Social Statistics Seminar at INSEE and the Econometrics Research Seminar at Yale.

References

- [1] Arnold, S. F. (1993), ”Gibbs sampling” in Handbook of Statistics, ed. C. R. R. Rao, North-Holland, 599–625.

- [2] Cordier, M., Houdré, C., and Rougerie, C. (2006), ”Les inégalités de patrimoine des ménages entre 1992 et 2004”, Insee R férences, special issue ”Les revenus et le patrimoine des ménages”, 47–58.

-

[3]

Dell, F., d’Haultfoeuille, X., F vrier, P., and Massé, E. (2002),

”Mise en œuvre de calcul de variance par linéarisation” in Actes des Journées

de Méthodologie Statistique,

http://jms.insee.fr/site/index.php. - [4] Deville, J. C., Särndal, C.E., and Sautory, O. (1993), ”Generalized Raking Procedures in Survey Sampling,” Journal of the American Statistical Association, 88, 1013–1020.

- [5] Duclos, J. Y., Esteban, J., and Ray, D. (2004), ”Polarization: Concepts, Measurement, Estimation,” Econometrica, 72, 1737–1772.

- [6] Esteban, J., and Ray, D. (1994), ”On the Measurement of Polarization,” Econometrica, 62, 819–851.

-

[7]

Gautier, E. (2005), ”Eléments sur les mécanismes de sélection dans les enquêtes et sur

la non-réponse non-ignorable” in Actes des Journées de Méthodologie Statistique,

http://jms.insee.fr/site/index.php. - [8] Geweke, J. (2005), Contemporary Bayesian Econometrics and Statistics, Hoboken NJ, USA: Wiley.

- [9] Heeringa, S. G., Little, R. J. A., and Raghunathan, T. E. (2002), ”Multivariate Imputation of Coarsened Survey Data on Household Wealth,” in Survey Nonresponse, eds. R. M. Groves, et al., Hoboken NJ, USA: Wiley, 357–372.

- [10] Juster, T. F., and Smith, J. P. (1997), ”Improving the Quality of Economic Data: Lessons From the HRS and AHEAD, Journal of the American Statistical Association, 92, 1268–1278.

- [11] Little, R. J. A., and Rubin, D. B. (2002), Statistical Analysis with Missing Data, 2nd edition, Hoboken NJ, USA: Wiley.

- [12] Lollivier, S., and Verger, D. (1988), ”D’une variable discrète à une variable continue : la technique des r sidus simul s,” in M langes conomiques - Essais en l’honneur de Edmond Malinvaud, Economica.

- [13] McCulloch, R., and Rossi, P. E. (1994), ”An Exact Likelihood Analysis of the Multinomial Probit Model,” Journal of Econometrics, 64, 207–240.

- [14] Robert, C. P., and Casella G. (2004), Monte Carlo Statistical Methods, 2nd edition, New York, USA: Springer-Verlag.

- [15] Schafer, J. L. (2001), Analysis of Incomplete Multivariate Data, 2nd edition, London, UK: Chapman & Hall.

- [16] Train, K. E. (2003), Discrete Choice Methods with Simulation, New York, USA: Cambridge University Press.