Robust Model Selection in Generalized Linear Models

Abstract

In this paper, we extend to generalized linear models (including logistic and other binary regression models, Poisson regression and gamma regression models) the robust model selection methodology developed by Müller and Welsh (2005) for linear regression models. As in Müller and Welsh (2005), we combine a robust penalized measure of fit to the sample with a robust measure of out of sample predictive ability which is estimated using a post-stratified m-out-of-n bootstrap. A key idea is that the method can be used to compare different estimators (robust and nonrobust) as well as different models. Even when specialized back to linear regression models, the methodology presented in this paper improves on that of Müller and Welsh (2005). In particular, we use a new bias-adjusted bootstrap estimator which avoids the need to centre the explanatory variables and to include an intercept in every model. We also use more sophisticated arguments than Müller and Welsh (2005) to establish an essential monotonicity condition.

Keywords: bootstrap model selection, generalized linear models, paired bootstrap, robust estimation, robust model selection, stratified bootstrap

1 Introduction

Model selection is fundamental to the practical application of statistics and there is a substantial literature on the selection of linear regression models. A growing part of this literature is concerned with robust approaches to selecting linear regression models: see Müller and Welsh (2005) for references. The literature on the selection of generalized linear models (GLM; McCullagh and Nelder, 1989) and the related marginal models fitted by generalized estimating equations (GEE; Liang and Zeger, 1986) – though both are widely used – is much smaller and has only recently incorporated robustness considerations. Hurvich and Tsai (1995) and Pan (2001) developed Akaike information criterion (AIC) like criteria based on the quasi-likelihood, Cantoni, Mills Flemming, and Ronchetti (2005) presented a generalized version of Mallows’ , and Pan and Le (2001) and Cantoni et al. (2007) presented approaches based on the bootstrap and cross-validation, respectively. Our purpose in this paper is to generalize the robust bootstrap model selection criterion of Müller and Welsh (2005) to generalized linear models.

The extension of the methodology of Müller and Welsh (2005) from linear regression to generalized linear models is less straightforward than we expected and, as a result, the present paper differs from Müller and Welsh (2005) in two important respects. First, the bias-adjusted -out-of- bootstrap estimator rather than the -out-of- bootstrap estimator is used in estimating the expected prediction loss (definitions are given in Section 2). As discussed in more detail in Section 3.2, this achieves the same purpose but avoids the centering of the explanatory variables and the requirement that we include an intercept in every model used in Müller and Welsh (2005). Second, we present a simpler, more general method than that used in Müller and Welsh (2005) for showing that the consistency result applies to particular robust estimators of the regression parameter. As discussed in Section 3.3, we use generalized inverse matrices to decompose the asymptotic variance of the estimator into terms which are easier to handle, write the critical trace term as a simple sum and then show that the terms in this sum have the required properties. Both of these changes were necessitated by the more complicated structure of generalized linear models but they also apply to regression models where they represent improvements to the methodology of Müller and Welsh (2005).

Suppose that we have independent observations and an matrix whose columns we index by . Let denote any subset of distinct elements from and let denote the matrix with columns given by the columns of whose indices appear in . Let denote the th row of . Then a generalized linear regression model for the relationship between the response variable and explanatory variables is specified by

| (1) |

where is an unknown -vector of regression parameters. Here is the inverse of the usual link function and, for simplicity, we have reduced notation by absorbing into the variance function . Both and are assumed known. Let denote a set of generalized linear regression models for the relationship between and . The purpose of model selection is to choose one or more models from with specified desirable properties.

Our perspective on model selection is that a useful model should (i) parsimoniously describe the relationship between the sample data and and (ii) be able to predict independent new observations. The ability to parsimoniously describe the relationship between the sample data can be measured by applying a penalised loss function to the observed residuals and we use the expected variance-weighted prediction loss to measure the ability to predict new observations. In addition, we encourage the consideration of different types of estimator of each of the models. Possible estimators include the nonrobust maximum likelihood (see Künsch, Stefanski, and Carroll, 1989; Cantoni and Ronchetti, 2001; Ruckstuhl and Welsh, 2001) and the maximum quasi–likelihood estimators (see McCullagh and Nelder, 1989) and the robust estimators of Preisser and Qaqish (1999), Cantoni and Ronchetti (2001), and Cantoni (2004). The Cantoni and Ronchetti (2001) estimator is described in Section 3.3.

We define a class of robust model selection criteria in Section 2, present our theoretical results in Section 3, report the results of a simulation study in Section 4, present a real data example in Section 5, and conclude with a short discussion and some brief remarks in Section 6.

2 Robust model selection criterion

Let denote an estimator of type of under (1), let be a scale parameter, let be a nonnegative loss function, let be a specified function of the sample size , let denote a measure of spread of the data, and let be a vector of future observations at which are independent of . Then, we choose models from a set for which the criterion function

| (2) | |||||

is small. In practice, we often supplement this criterion with graphical diagnostic methods which further explore the quality of the model in ways that are not amenable to simple mathematical description.

As in Müller and Welsh (2005) we separate the estimators and because in practice we want to compare different estimators indexed by and linking to any one of these estimators may excessively favour that estimator. We adopt the view that we are interested in fitting the core data and predicting core observations rather than those in the tail of the distribution so take to be constant for sufficiently large . The simplest example of such a function (and the one we use in our simulations) is the function which is quadratic near the origin and constant away from the origin as in

| (3) |

Following Müller and Welsh (2005), we choose . Smoother versions of such as are required in our theoretical results are easily defined and we can, when appropriate to the problem, use asymmetric functions. The weights are Mallows’ type weights which may be included for robustness in the space but can and often will be constant. The only restrictions on the function are that and as . A common choice is for where we choose (e.g. Schwarz, 1978; Müller and Welsh, 2005). If the criterion were based on the penalized loss function alone then would have to be of order higher than as shown in Qian and Field (2002, Theorem 1–3) for logistic regression models.

Let be an estimator of type of the model , and if has to be estimated, we estimate it from the Pearson residuals , , from a “full” model . A “full” model is a large model (often assumed to be the model ) which produces a valid measure of residual spread (but hopefully not so large that we incur a high cost from overfitting). We omit the subscript and denote the estimator of by for notational simplicity. Then we estimate the penalized in-sample term in the criterion function (2) by , where

| (4) |

Next, we implement a proportionally allocated, stratified -out-of- bootstrap of rows of in which we (i) compute and order the Pearson residuals, (ii) set the number of strata at between and depending on the sample size , (iii) set stratum boundaries at the

quantiles of the Pearson residuals, (iv) allocate observations to the strata in which the Pearson residuals lie, (v) sample (rounded as necessary) rows of independently with replacement from stratum so that the total sample size is , (vi) use these data to construct the estimator , repeat steps (v) and (vi) independent times and then estimate the conditional expected prediction loss by , where

| (5) |

where denotes expectation with respect to the bootstrap distribution. In practice, it seems useful to take to be between of the sample size if working with moderate sample sizes, e.g. . If is small then is small and the parameter estimators in the bootstrap do not converge for some bootstrap samples though this typically occurs less often with the stratified bootstrap. If is large then can be smaller than of the sample size . Combining (4) and (5), we estimate the criterion function (2) by

The use of the stratified bootstrap ensures that we obtain bootstrap samples which are similar to the sample data in the sense that observations in the tails of the residual distribution and outliers are represented in each bootstrap sample or, with categorical data, each category is represented in the bootstrap samples. In essence, we construct an estimate of the conditional expected prediction loss based on samples which are similar to the sample we have observed. The estimated variance function is estimated from a “full” model so does not change with the model . This simplifies the procedure and has the advantage of making the procedure more stable. Finally, we use the bias-adjusted bootstrap estimator rather than the bootstrap estimator in . As discussed in more detail below, this achieves the same purpose as but avoids the centering technique used in Müller and Welsh (2005) and means that we do not have to include an intercept in every model. It is therefore a useful refinement of the criterion given in Müller and Welsh (2005).

The computational burden of model selection can be reduced by limiting the number of different estimators we consider, reducing their computation by, for example, using good starting values from the initial fit to the data, and by reducing the number of models in . Generally, our approach is to use an eclectic mix of methods including robust versions of deviance-tests, search schemes, diagnostics etc to produce a relatively small set of competing models which we then compare using the methodology presented in this paper. In particular, we present a backward model search algorithm in Section 3.4 that substantially reduces the number of models to be considered while maintaining the consistency of .

3 Theoretical results

Our procedure is intended to identify useful models whether or not a true model exists and our interest is not restricted to a single best model but to the identification of useful models (which make small). In this context, if (i) a true model exists and (ii) , then consistency in the sense that a procedure identifies with probability tending to one is a desirable property. Although in practice, we are interested in all the models which make small, we focus in this section on the model which minimises and show that choosing this model is consistent. Specifically, for , we define

| (6) |

and develop conditions under which for each ,

| (7) |

As in Müller and Welsh (2005), we define the subset of correct models in to be the set of models such that ; all other models are called incorrect models. For any correct model , the errors satisfy , for , and the components of corresponding to columns of which are not also in equal zero.

3.1 Conditions

It is convenient to introduce a simplified notation for stating the conditions and simplifying the proof of the main result. Write

Then we require the following conditions.

-

(i)

The matrix

where is of full rank.

-

(ii)

For all models (including the full model), the estimators , with . For all correct models ,

where is of full rank.

-

(iii)

For all models , the bootstrap estimator in probability. For all correct models ,

and for any two correct models such that

(8) -

(iv)

The sequence and .

-

(v)

The derivatives and exist, are uniformly continuous, bounded, , and , .

-

(vi)

The weights are bounded, and its first two derivatives are continuous, and are both positive, and is bounded.

-

(vii)

The are bounded.

-

(viii)

For any incorrect model ,

Condition (i) is a generalization of a standard condition for fitting regression models which we require for generalized linear models. Condition (ii) is satisfied by many estimators; condition (8) restricts the estimators we can consider in but allows us to include maximum likelihood and other estimators such as the Cantoni and Ronchetti (2001) estimator. We refer to (8) as the monotonicity condition. Condition (iii) specifies the required properties of the bootstrap parameter estimator. In contrast to Müller and Welsh (2005), we have adjusted the bootstrap estimator so we do not have to impose conditions on the asymptotic bias of the bootstrap estimator. Combining conditions (ii) and (iii), we obtain . Conditions (v)-(vii) enables us to make various two-term Taylor expansions and to control the remainder terms. We require a higher level of smoothness than exhibited by the -function (3) but there are many functions satisfying these properties. Condition (viii) is a generalisation of Condition (C4) of Shao (1996) to allow a more general choice of .

We have specified a simple set of sufficient conditions (particularly in conditions (v)-(vii)) which are appropriate for a robust function and generalized linear models. However, we note that we can specify alternative conditions and simpler conditions for particular cases. For example, we obtain alternative conditions if we allow the to be stochastic; see for example Shao (1996, Condition C3. b.). We can simplify our conditions if we use the nonrobust function ; again see Shao (1996, p661). Even in the robust case, simpler conditions can be given for homoscedastic linear models because , . These possibilities are somewhat tangential to our main purpose so we will not pursue them in this paper.

Theorem 3.1.

Under the above conditions, the consistency result (7) holds.

Proof of Theorem 3.1.

The proof of this result is similar to that given in Müller and Welsh (2005). The main term we need to deal with is the bootstrap term

where and are constant with respect to the bootstrap. We make a Taylor expansion of as a function of about , to obtain

where . This equation is analogous to (9) in Müller and Welsh (2005) except that we have eliminated the linear term by using the bias-adjusted bootstrap estimator. We consider and in turn.

Order of : Let

and write

Then

by condition (iii) and the first part of condition (i). Similarly

by condition (iii) and the second part of condition (i). Finally,

provided

and

Conditions (v)-(viii) ensure that these requirements hold.

Order of : Let , and . Recall that and write

Then

provided

As for , these results follow from conditions (v)-(vii).

Putting both terms together, it follows that

| (9) |

and the proof is completed as in Müller and Welsh (2005). ∎

3.2 The elimination of bias

One of the main difficulties in constructing model selection criteria like is removing the bias (equivalently the linear term) in the expansion of . Suppose that instead of the bias-adjusted bootstrap estimator , we use the bootstrap estimator in . Then when we expand as in Shao (1996), Müller and Welsh (2005) or the proof of Theorem 3.1, we obtain the linear term

| (10) |

As shown in Müller and Welsh (2005), the bias term is typically a function of with leading term , the same as the quadratic term in the expansion. Since the quadratic term governs the selection of correct models, it is crucial that the linear term be at least of smaller order.

There are various ways to make (10) of order . Notice that ordinarily the mean in (10) is asymptotic to

which is . However, if , then it can be which can be made . This is the approach used in Shao (1996). It holds when but this is a nonrobust choice and hence unappealing in general. Müller and Welsh (2005) took a different approach in which they insisted that each model contain an intercept and then centered the explanatory variables so that they have mean zero and the bias is forced into the intercept. In fact, the intercept can be eliminated by replacing the intercept of the bootstrap estimator by that of the estimator or by fixing the intercepts at the value of the intercept estimated under a “full” model. This approach is much less attractive in the present more general context because the centering vector has to include estimates of and (which previously did not depend on ) and (which was previously not present). This means that the centering vector is stochastic and the centered explanatory variables cannot simply be conditioned on. Even if we overcome these difficulties, we have to ensure that the criterion is consistent and the arguments given in the next subsection do not apply unless the model is fitted with the same covariates as the model selection criterion uses. This approach is not therefore very attractive.

A different approach would be to require as in Müller and Welsh (2005) that , estimate and then adjust the criterion by subtracting off an estimate of (10). Although this will remove the bias, it will add a contribution to the quadratic term which will affect the arguments in the next subsection. Also, it changes the criterion which then loses its natural interpretability. It is far better to think in terms of adjusting the bootstrap estimator for bias. We could do this by focussing on (as we only need the leading term) but then we would need to derive and estimate for each estimator we consider. Fortunately, we have available the bias itself in the very natural form and so we can remove the bias entirely without having to assume any particular form. This is the solution that we have adopted in using the bias adjusted bootstrap estimator in .

3.3 The monotonicity of

The assumption (iii) that is monotone in does not hold in general for arbitrary positive semi–definit matrices and . For example, with

and we find that

However, Müller and Welsh (2005) prove that for linear regression models, the condition holds for the class of Mallows type M–estimators or one–step Mallows type M–estimators etc., because of the relationship between and .

Consider the maximum likelihood estimator for generalized linear models. We can write condition (i) as

where . From McCullagh and Nelder (1989, p43), the maximum likelihood estimator satisfies

where . We have to show that

is strictly monotone increasing in .

Reorder the rows of if necessary so that the top submatrix is nonsingular. Then the matrix is a generalized inverse of . Then we have that

By definition of the generalized inverse, is a symmetric matrix with first diagonal elements equal to and the remaining elements zero so that . Therefore,

The simplest sufficient condition for monotonicity is

| (11) |

Since the left hand side is positive, it suffices to show that for .

The monotonicity condition (11) holds if or . The first case occurs when (i) or (ii) the has a distribution which is symmetric about zero and is antisymmetric and the second when we use the identity link so . Shao (1996) exploited (i) but this choice favours least squares estimation and is non-robust so we prefer not to use it; (ii) applies to Gaussian models but not to models with asymmetric distributions. Similarly, the identity link is widely used in Gaussian models and may be used in gamma models but is not useful in binomial and Poisson models. In these cases, we need to examine (11) more carefully. For the log link which is often used in Poisson and gamma models

and for the reciprocal link which is often used in gamma models

However, for many right skewed distributions like the Poisson and gamma, anti-symmetric functions with sufficiently large truncate more of the upper tail than the lower tail so . To see this, note that for the function (3), we can write

provided is large enough to ensure that . It follows that and (11) holds in these cases. For the logistic link

so that , if and , if and we need a more careful analysis. The Bernoulli model can be left or right skewed depending on the value of so can be positive or negative. Fortunately, for anti-symmetric ,

from which if and if so that and (11) holds.

Next, we consider the quasi–likelihood estimator for the logistic model as defined in Cantoni and Ronchetti (2001, Section 2.2). The Mallows quasi–likelihood estimator is the solution of the estimating equations,

| (12) |

where are the Pearson residuals, is the Huber function defined by

and

When , the estimator is called the Huber quasi–likelihood estimator. In general we do not require that or that . Cantoni and Ronchetti (2001, Appendix B) show that the estimator has an asymptotic normal distribution with asymptotic variance , where

with and are diagonal matrices with diagonal elements

Using the same generalized inverse as before so that

we have to show that is monotone in . Indeed,

is a monotone function in . This function is monotone in under the same conditions as the analogous function for maximum likelihood estimation.

3.4 The reduction of models

For any incorrect model it follows from condition (vi) in Section 3.1 and from (9) that

and for any correct model

Hence, it follows that for fixed we also have

| (13) |

Equation (13) ensures that backward model selection schemes based on maintain consistency for the true model if is the set of all possible submodels. In particular we suggest using the following backward selection algorithm if the number of submodels to be considered is too large to be dealt with in practical problems.

Algorithm 3.1.

-

1.

Calculate for the full model and , , resulting in .

-

2.

Set and repeat 1. if .

-

3.

Estimate by the of over all considered models.

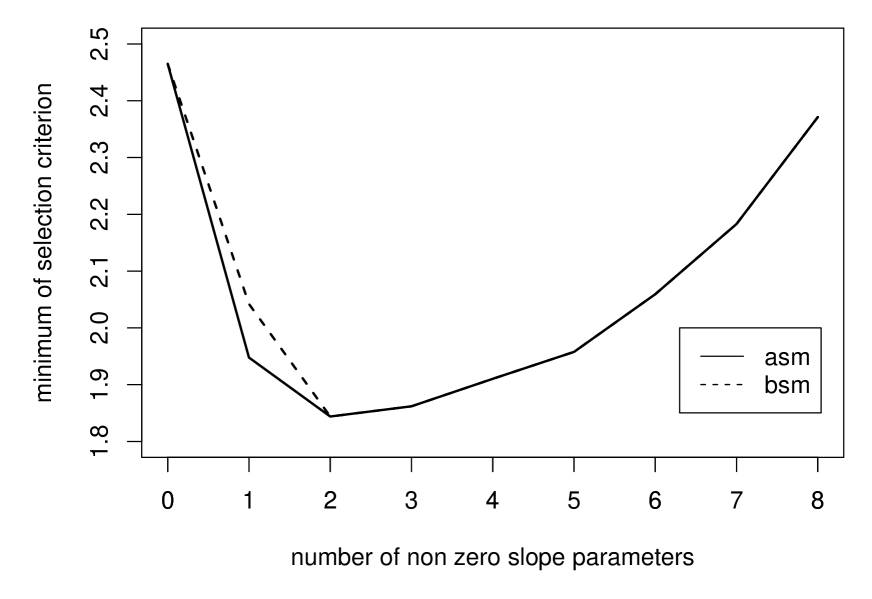

An example of the solution paths of all submodels and of the backward selected submodels is given in Figure 1 in Section 5.

4 Simulation study

In this section we present a range of simulation results for Poisson regression models. The proposed robust model selection criterion based on robust and non robust parameter estimator procedures with and is compared to the AIC and BIC criteria.

We generated data according to the Poisson regression model

| (14) |

with true parameter vectors , , and such that . The response variable is Poisson distributed with mean . The explanatory data is generated by drawing pseudo–random numbers from the multivariate normal with mean vector and covariance matrix given by diagonal elements equal to 1 and off diagonal elements equal to 0.

In this non–robust setting we generated for each of the simulation runs data points and estimated the parameters by using the glm.fit (ML estimator) and by using the glmrob (Mallows or Huber type robust estimators; see Cantoni and Ronchetti, 2001) function in R. We calculated AIC, BIC, and the proposed robust model selection criteria with 8 equally sized strata based on the Pearson residuals from the full model,

The bootstrap estimators for are based on bootstrap samples. Selection probabilities are presented in Table 1. Note that for simulations the empirical standard deviations for the empirical selection probabilities are given by

Put Table 1 around here.

In this non–robust simulation the overall performance of the selection criteria is superior to classical criteria such as the AIC and BIC criterion independently of the chosen estimation procedure. As an example consider the results for the true parameter vector where the selection probabilities of the true model using are for AIC, for BIC, for , and using the estimated probability is for .

Next we generated data according to the model in equation (14) but we added 8 moderate outliers in the response for the 8 observations with largest explanatory variable . That is if then , . All other simulation specifications remain the same. The selection probabilities are presented in Table 2.

Put Table 2 around here.

In Table 2 we see that the proposed selection criterion used with the robust estimator from Cantoni and Ronchetti (2001) performs outstandingly well. Used with the maximum likelihood estimator, it still performs very well compared to AIC and BIC. As an example consider the results for the true parameter vector . The selection probabilities of the true model using are for AIC, for BIC, for , and using the selection probability equals for .

Finally, we generated data according to the model in equation (14) but we added 2 influential outliers in the response variable according to the condition then , . All other simulation specifications remain the same. The selection probabilities are presented in Table 3.

Put Table 3 around here.

Table 3 shows that the robust model selection criterion can break down if it is used with but still perform well with robust parameter estimators. As an example consider the results for the true parameter vector . The selection probabilities of the true model using equals 0 for AIC, BIC, and . On the other hand, using the estimated probability is for .

5 Real data example

In this section we present a real data example on the diversity of arboreal marsupials (possums) in the montane ash forest (Australia) which is part of the robustbase package in R (possumDiv.rda). The dataset is extensively described by Lindenmayer et al. (1990, 1991) and serves as a generalized linear model example with a canonical link function having Poisson distributed responses conditional on the linear predictor (Weisberg and Welsh, 1994; Cantoni and Ronchetti, 2001). The number of of different species (diversity, count variable, mean , range ) was observed on sites. The explanatory variables describe the sites in terms of the number of shrubs (shrubs, count variable, , ), number of cut stumps from past logging operations (stumps, count variable, , ), the number of stags (stags, count variable, , ), a bark index (bark, ordinal variable, , ), the basal area of acacia species (acacia, ordinal variable, , ), a habitat score (habitat, ordinal variable, , ), the species of eucalypt with the greatest stand basal area (eucalypt, nominal variable, three categories), and the aspect of the site (aspect, nominal variable, four categories). We calculate based on with the same specifications as in the simulation study but because is considerably larger than we choose a smaller proportion for the bootstrap. That is which is about of the sample size. The best model according to our criterion includes stags and habitat which are also selected if the backward selection algorithm in Section 3.4 is applied. The solution paths of is given in Figure 1 which shows the minimal value of for all considered models with the same number of variables.

Cantoni and Ronchetti (2001) mentioned that there are four potentially influential data points, namely, observations 59, 110, 133, and 139. According to the results of our simulation study we therefore consider together with to be superior to AIC, BIC, and with . Table 4 presents an overview of the estimated best model which includes also the results of Cantoni and Ronchetti (2001, Section 5.2).

Put Table 4 around here.

6 Discussion and conclusions

We have proposed a bootstrap criterion for robustly selecting generalized linear models. The criterion is a generalization of that developed for regression models by Müller and Welsh (2005) and has its strengths while still improving on that criterion. In particular, the criterion (i) combines a robust penalised criterion (which reflects goodness-of-fit to the data) with an estimate of a robust measure of the conditional expected prediction error (which measures the ability to predict as yet unobserved observations), (ii) separates the comparison of models from any particular method of estimating them, and (iii) uses the stratified bootstrap to make the criterion more stable. The improvement is achieved by using the bootstrap to estimate the bias of the bootstrap estimator of the regression parameter and then using the bias-adjusted bootstrap estimator instead of the raw bootstrap estimator in the criterion. This step widens the applicability of the method by removing the requirement of Müller and Welsh (2005) that the models under consideration include an intercept. We have also developed a more widely applicable method than that given in Müller and Welsh (2005) for establishing that the criterion can be applied with particular robust estimators of the regression parameters. Our main theoretical result established the asymptotic consistency of the method and the simulation study shows that the model selection method works very well in finite samples.

References

- [1] Cantoni, E. (2004). Analysis of robust quasi-deviances for generalized linear models. Journal of Statistical Software, 10, Issue 4.

- [2] Cantoni, E. and Ronchetti, E. (2001). Robust inference for generalized linear models. Journal of the American Statistical Association, 96, 1022–1030.

- [3] Cantoni, E., Field, C., Mills Flemming, J. and Ronchetti, E. (2007). Longitudinal variable selection by cross-validation in the case of many covariates. Statistics in Medicine, 26, 919–930.

- [4] Cantoni, E., Mills Flemming, J. and Ronchetti, E. (2005). Variable selection for marginal longitudinal generalized linear models. Biometrics, 61, 507–513.

- [5] Hurvich, C.M. and Tsai, C.-L. (1995). Model selection for extended quasi-likelihood models in small samples. Biometrics, 51, 1077–1084.

- [6] Künsch, H.R., Stefanski, L.A. and Carroll, R.J. (1989). Conditionally unbiased bounded–influence estimation in general regression models, with applications to generalized linear models. Journal of the American Statistical Association, 84, 460–466.

- [7] Liang, K.-Y. and Zeger, S.L. (1986). Longitudinal data analysis using generalized linear models. Biometrika, 73, 13–22.

- [8] Lindenmayer, D.B., Cunningham, R.B., Tanton, M.T., Nix, H.A. and Smith, A.P. (1991). The conservation of arboreal marsupials in the Montane ash forests of the central highlands of Victoria, South-East Australia: III. The habitat requirements of Leadbeater’s possum Gymnobelideus leadbeateri and models of the diversity and abundance of arboreal marsupials. Biological Conservation, 56, 295–315.

- [9] Lindenmayer, D.B., Cunningham, R.B., Tanton, M.T., Smith, A.P. and Nix, H.A. (1990). The conservation of arboreal marsupials in the Montane ash forests of the central highlands of Victoria, South-East Australia: I. Factors influencing the occupancy of trees with hollows. Biological Conservation, 54, 111–131.

- [10] McCullagh, P. and Nelder, J.A. (1989). Generalized Linear Models, 2nd edition. Chapman & Hall/CRC, London.

- [11] Müller, S. and Welsh, A.H. (2005). Outlier robust model selection in linear regression. Journal of the American Statistical Association, 100, 1297–1310.

- [12] Pan, W. (2001). Akaike’s information criterion in generalized estimating equations. Biometrics, 57, 120–125.

- [13] Preisser, J.S. and Qaqish, B.F. (1999). Robust regression for clustered data with application to binary responses. Biometrics, 55, 574–579.

- [14] Qian, G. and Field, C. (2002). Law of iterated logarithm and consistent model selection criterion in logistic regression. Statistics & Probability Letters, 56, 101–112.

- [15] Ruckstuhl, A.F. and Welsh, A.H. (2001). Robust fitting of the binomial model. Annals of Statistics, 29, 1117–1136.

- [16] Schwarz, G. (1978). Estimating the dimension of a model. Annals of Statistics, 6, 461–464.

- [17] Shao, J. (1996). Bootstrap model selection. Journal of the American Statistical Association, 91, 655–665.

- [18] Weisberg, S. and Welsh, A.H. (1994). Adapting for the missing link. Annals of Statistics, 22, 1674–1700.

| true | model | type | AIC | BIC | ||

|---|---|---|---|---|---|---|

| 0.58 | 0.60 | 0.90 | 0.89 | |||

| 0.10 | 0.10 | 0.02 | 0.03 | |||

| 0.13 | 0.13 | 0.04 | 0.05 | |||

| 0.13 | 0.12 | 0.03 | 0.03 | |||

| 0.03 | 0.02 | 0.00 | 0.00 | |||

| 0.02 | 0.02 | 0.00 | 0.00 | |||

| 0.02 | 0.02 | 0.00 | 0.00 | |||

| 0.00 | 0.00 | 0.00 | 0.00 | |||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| 0.65 | 0.67 | 0.94 | 0.93 | |||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| 0.15 | 0.15 | 0.03 | 0.03 | |||

| 0.17 | 0.16 | 0.03 | 0.03 | |||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| 0.03 | 0.02 | 0.00 | 0.00 | |||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| – | 0.00 | 0.00 | 0.05 | 0.07 | ||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| 0.81 | 0.82 | 0.91 | 0.89 | |||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| 0.19 | 0.18 | 0.03 | 0.04 | |||

| true | model | type | AIC | BIC | ||

|---|---|---|---|---|---|---|

| 0.41 | 0.42 | 0.94 | 0.94 | |||

| 0.12 | 0.12 | 0.02 | 0.02 | |||

| 0.07 | 0.07 | 0.02 | 0.02 | |||

| 0.25 | 0.24 | 0.03 | 0.02 | |||

| 0.04 | 0.04 | 0.00 | 0.00 | |||

| 0.06 | 0.05 | 0.00 | 0.00 | |||

| 0.05 | 0.05 | 0.00 | 0.00 | |||

| 0.01 | 0.01 | 0.00 | 0.00 | |||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| 0.01 | 0.01 | 0.66 | 0.78 | |||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| 0.00 | 0.00 | 0.01 | 0.02 | |||

| 0.79 | 0.80 | 0.33 | 0.20 | |||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| 0.20 | 0.19 | 0.01 | 0.01 | |||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| – | 0.00 | 0.00 | 0.01 | 0.01 | ||

| – | 0.00 | 0.00 | 0.02 | 0.07 | ||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| 0.00 | 0.00 | 0.55 | 0.73 | |||

| – | 0.00 | 0.00 | 0.04 | 0.02 | ||

| – | 0.00 | 0.00 | 0.05 | 0.03 | ||

| 0.99 | 0.99 | 0.34 | 0.13 | |||

| true | model | type | AIC | BIC | ||

|---|---|---|---|---|---|---|

| 0.00 | 0.00 | 0.03 | 0.97 | |||

| 0.00 | 0.00 | 0.00 | 0.01 | |||

| 0.00 | 0.00 | 0.02 | 0.01 | |||

| 0.00 | 0.00 | 0.04 | 0.00 | |||

| 0.00 | 0.00 | 0.00 | 0.00 | |||

| 0.00 | 0.00 | 0.00 | 0.00 | |||

| 0.05 | 0.05 | 0.88 | 0.00 | |||

| 0.95 | 0.95 | 0.04 | 0.00 | |||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| 0.00 | 0.00 | 0.17 | 0.99 | |||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| 0.00 | 0.00 | 0.04 | 0.01 | |||

| 0.00 | 0.00 | 0.15 | 0.00 | |||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| 1.00 | 1.00 | 0.63 | 0.00 | |||

| – | 0.00 | 0.00 | 0.00 | 0.01 | ||

| – | 0.00 | 0.00 | 0.05 | 0.06 | ||

| – | 0.00 | 0.00 | 0.00 | 0.22 | ||

| – | 0.00 | 0.00 | 0.04 | 0.00 | ||

| 0.00 | 0.00 | 0.00 | 0.71 | |||

| – | 0.02 | 0.02 | 0.88 | 0.00 | ||

| – | 0.00 | 0.00 | 0.00 | 0.00 | ||

| 0.98 | 0.98 | 0.03 | 0.00 | |||

| selection criterion | selected variables in the best model | |

|---|---|---|

| stags, habitat | ||

| stags, habitat | ||

| AIC | stags, bark, acacia, habitat, aspect | |

| BIC | stags, bark, acacia, aspect | |

| -value forward stepwise | stags, bark, acacia, habitat, aspect | |

| -value forward stepwise | stags, bark, acacia, habitat, aspect |