Optimal intertemporal risk allocation

applied to insurance pricing

Abstract.

We present a general approach to the pricing of products in finance and insurance in the multi-period setting. It is a combination of the utility indifference pricing and optimal intertemporal risk allocation. We give a characterization of the optimal intertemporal risk allocation by a first order condition. Applying this result to the exponential utility function, we obtain an essentially new type of premium calculation method for a popular type of multi-period insurance contract. This method is simple and can be easily implemented numerically. We see that the results of numerical calculations are well coincident with the risk loading level determined by traditional practices. The results also suggest a possible implied utility approach to insurance pricing.

Key words and phrases:

Indifference pricing, optimal intertemporal risk allocation, Pareto optimality, exponential utility, insurance, premium calculation method1. Introduction

The insurer of an insurance contract needs to ensure that the premium contains a necessary conservative margin — the so called risk loading or safety loading — to put up the risk capital. When determining this margin in a multi-period insurance contract, the insurer faces two types of risks to evaluate. The first one comes from unfavorable fluctuations in the level of investment funded by accumulated premiums. The second risk comes from the uncertainty of (life) time, i.e., the risk of the unfavorable event occurring at an inopportune time, e.g., before the funding target is reached. It is desirable to determine the margin that reflects both types of risks adequately. However, there seems to be no theoretically established solution to this challenging problem. The main difficulty is in the inseparable nature of the two types of risks themselves; the insurance contract guarantees a defined payment at an uncertain time of the insured event occurring by uncertain funding.

In this paper, toward a solution to the problem above, we present a fairly general approach to the multi-period pricing problem. It is a combination of the utility indifference pricing and optimal intertemporal risk allocation. Though both are quite general concepts, their combination leads us to an interesting new premium calculation method in a multi-period setting.

The general setting of the utility indifference pricing is as follows: we define the indifference price of a risk by

| (IP) |

where denotes the utility of a risk and the constant is the initial wealth of the seller of . The price is the so-called selling indifference price: is the amount that leaves the seller of the risk indifferent between selling and being paid for , and neither selling nor being paid for . In mathematical finance, the indifference pricing approach is becoming one of the major pricing methods in incomplete markets (see, e.g., Hodges and Neuberger [22], Rouge and El Karoui [26], Musiela and Zariphopoulou [24], Bielecki et al. [4], and Møller and Steffensen [25]). The indifference pricing also fits the pricing of insurance well. For example, in the single-period pricing, we can show that many known premium principles are obtained by this method. The expectation, variance and exponential premium principles are among them. Thus, the utility indifference pricing approach has the potential advantage of pricing products in finance and insurance coherently.

We write for the class of admissible intertemporal risk allocations of over the multi-period interval (see Definition 2.1 below): is an essentially bounded adapted process satisfying the risk allocation condition

| (RA) |

where denotes the discounted value of . In this paper, we adopt the following utility in (IP):

| (U) |

Here is a time-dependent utility function describing the intertemporal preferences of an economic agent such as an insurance company. This definition says that if an allocation attains the supremum in (U), then the utility of is based on the choice of . Thus, to precisely investigate , whence , we are led to the problem of finding that attains the supremum in (U), which we call the optimal intertemporal risk allocation of .

The optimal risk allocation problems date back to the classical work of Borch [5, 6, 7], where Pareto optimality in uncertain circumstances is studied extensively, motivated mainly by reinsurance. Since then, various types of optimal risk allocation problems have been considered by Bühlmann [8, 9], Gerber [19], Bühlmann and Jewell [10], and many others. See also Gerber and Pafumi [20], Duffie [16], Dana and Jeanblanc [13] and Dana and Scarsini [14]. Recently, many authors consider the problems based on the preferences defined by coherent or convex risk measures introduced by Artzner et al. [2], Delbaen [15], and Föllmer and Schied [17] (see also [18]). See, e.g., Heath and Ku [21], Barrieu and El Karoui [3], Burgert and Rüschendorf [11], Acciaio [1], and Jouini et al. [23].

Unlike most of these references where the problems of optimal risk allocation among several economic agents are discussed, we consider a single agent in the multi-period framework who seeks to find the optimal intertemporal allocation of her/his risk. As the definition itself suggests, this optimality is closely related to Pareto optimality. Note, however, that classical Pareto optimality is concerned with allocations of risk among economic agents in single-period models, while the Pareto optimality we consider in this paper is concerned with intertemporal allocations of the aggregate risk of a single agent in the multi-period setting, whence it may be called time Pareto optimality.

Our key finding about the optimal intertemporal risk allocation (Theorem 2.8) is that an allocation is optimal if and only if the following first order condition is satisfied:

| (FO) |

where and is the underlying information structure. It is perhaps interesting that this first order condition involves a martingale property. By applying this characterization to the exponential utility, we can derive an algorithm to compute the optimal intertemporal risk allocation and indifference price for it (Theorem 3.4). We illustrate the usefulness of this algorithm by applying it to a popular type of multi-period insurance contract, whereby obtaining an essentially new type of premium calculation method in the multi-period setting (Theorem 4.3). This method is simple and can be easily implemented numerically. We see that the results of numerical calculations are well coincident with the risk loading level determined by traditional practices. The results also suggest a possible implied utility approach to insurance pricing.

In §2, we give basic results on the optimal intertemporal risk allocation, including its characterization by (FO) and its relationship to Pareto optimality. In §3, we apply the results in §2 to the exponential utility function and derive the optimal intertemporal risk allocation and indifference price for it. Section 4 is devoted to the applications of the results in §3 to insurance pricing. We also discuss properties of the indifference prices and some results of numerical calculations.

2. Optimal intertemporal risk allocation

Let . Throughout the paper, we work on a filtered probability space . We write for the space of all essentially bounded, real-valued -measurable random variables. Let be a spot rate process. We assume that the process is bounded, nonnegative and predictable, i.e., is bounded, nonnegative and -measurable for all . Let be the price of the riskless bond:

Throughout the paper, we use as the numéraire, and for each price process , we denote by its discounted price process:

2.1. Optimality

We consider an economic agent such as an insurance company who wishes to allocate her/his aggregate risk over the multi-period interval . In the next definition, we define the collection of all such possible intertemporal allocations of .

Definition 2.1.

For , we write for the following set of admissible intertemporal allocations of :

Example 2.2.

We consider the aggregate risk of a life insurance contract with duration in which the insured receives dollars at time if she/he dies in the period . Then, we have with , where is the stopping time representing the lifetime of the insured. Notice that itself is in . If we define by

then is also in . Insurance companies which have many contracts with policyholders will be able to regard as the aggregate risk of , rather than that of , at a negligible cost.

We assume that the intertemporal preferences of the agent is described by the time-dependent utility function . This means that a rational choice of the agent’s allocation is based on the integrated expected utility . Throughout §2, we assume that the utility function satisfies the following condition:

| (2.1) |

Using , we define the utility of the risk by (U).

Definition 2.3.

An intertemporal risk allocation of the risk is optimal if it attains the supremum in (U).

In other words, is optimal if it solves the following problem:

| (P) |

Proposition 2.4.

The optimal intertemporal risk allocation of is unique if it exists.

Proof.

Suppose that there are two distinct optimal intertemporal allocations and of . If we put for , then is also in . However, concavity of yields

which is a contradiction. Thus the optimal allocation of is unique. ∎

2.2. Indifference pricing

In this section, we assume that for all . This condition holds, for example, if is bounded from above. This also holds if the optimal intertemporal risk allocation exists for all . We thus have the utility functional . We write for the initial wealth of the agent.

Proposition 2.5.

The functional has the following properties for .

-

(a)

Strict Monotonicity: If a.s. and , then .

-

(b)

Concavity: If , then .

Proof.

(a) For , we define by

Choosing so that a.s., we define . Then, by (2.1), . Since , we have

The property (a) follows from this.

(b) The property (b) follows easily from the concavity of , . ∎

From Proposition 2.5, we see that for , the function defined by is concave (whence continuous) and strictly increasing. Moreover, since is bounded, we have for small enough and for large enough. We are thus led to the following definition.

Definition 2.6.

We define the indifference price of by .

From Proposition 2.5, we immediately obtain the next proposition.

Proposition 2.7.

The indifference price functional has the following propertites for .

-

(a)

Strict Monotonicity: If a.s. and , then .

-

(b)

Convexity: If , then .

2.3. Characterization by the first order condition

It should be noticed that, in general, the optimal intertemporal risk allocation may not exist. However, to precisely investigate the utility , whence the indifference price , it seems indispensable to find and describe the optimal intertemporal risk allocation. In this section, we show that the condition (FO) is necessary and sufficient for to be optimal. This characterization plays a key role in this paper. In the proof below, and throughout the paper, we write

Here is the characterization of the optimality.

Theorem 2.8.

For and , the following conditions are equivalent:

-

(a)

is optimal.

-

(b)

The condition (FO) is satisfied.

Proof.

First, we prove (a) (b). Let be the optimal allocation. Choose so that , and put, for , and ,

Then, , so that . Since is optimal, the function defined by takes the maximal value at . Thus or , which implies that is an -martingale.

Next, we prove (b) (a). Assume that and that is an -martingale. By concavity of , we have for , so that for any ,

Since is an -martingale and both and are in , we see that

Combining, . Thus, is optimal. ∎

2.4. Pareto optima

In this section, we introduce Pareto optimality of intertemporal risk allocations. It is closely related to the optimality introduced above.

Definition 2.10.

For , the allocation is Pareto optimal if there does not exist satisfying the following two conditions:

-

(a)

for all .

-

(b)

for at least one .

For , we consider the following problem:

| () |

Lemma 2.11.

Let .

-

(a)

If is the solution to Problem , then is an -martingale.

-

(b)

If Problem has a solution, then .

Proof.

The proof of (a) is almost the same as that of the implication (a) (b) in Theorem 2.8, whence we omit it.

We prove (b). Assume that for , and choose so that . If Problem has a solution , then, by (a), is an -martingale. However, since and , this can never be the case. Thus, (b) follows. ∎

Proposition 2.12.

Let . Then the solution to Problem is unique if exists.

The proof is almost the same as that of Proposition 2.4, whence we omit it.

The next theorem is an analogue of the second fundamental theorem of welfare economics.

Theorem 2.13.

For , the following conditions are equivalent:

-

(a)

is Pareto optimal.

-

(b)

There exists such that solves Problem .

Proof.

(b) (a). If is not Pareto optimal, then clearly it is not the solution to Problem for any .

By Theorem 2.13, we see that the set of Pareto optimal intertemporal risk allocations in is parametrized by the parameters . We also see that the Pareto optimal allocation corresponding to Problem () with is optimal with respect to the intertemporal preferences described by the utility function . Therefore, from Theorem 2.8, we immediately obtain the next characterization of Pareto optimality.

Theorem 2.14.

For and , the following conditions are equivalent:

-

(a)

is Pareto optimal.

-

(b)

There exists such that the process is an -martingale.

3. Exponential utility

Let and be as in Section 2. In this section, we adopt the following time-dependent exponential utility function:

| (EU) |

In what follows, we may also write . We have

| (3.1) |

3.1. The optimal allocation for the exponential utility

In this section, we describe the optimal intertemporal risk allocation for the exponential utility function in (EU). Thus, the problem that we consider here is Problem (P) for in (EU).

To derive the optimal allocation or the solution to (P), we consider the transform for . Then, by Theorem 2.8, Problem (P) reduces to

Problem M. For and , derive a positive -martingale satisfying

| (3.2) |

For and , we define the adapted process by the following backward iteration:

| (L1) |

where as before, and we define , or , in by

| () |

Notice that for all , is bounded away from and . We also define the adapted process by

| (M) |

Here is the solution to the martingale problem above.

Theorem 3.1.

For and , the solution to Problem M is unique and given by for .

Proof.

For simplicity, we write for .

Step 1. Let . Since is -measurable, the process defined by satisfies

However, since , we get

Treating the case similarly, we see that is an -martingale. Also,

yielding (3.2). Thus is a solution to Problem M.

Step 2. We show the uniqueness. Assume that is a solution to Problem M. Then,

| (3.3) |

From this, we have the decomposition

| (3.4) |

where is an -measurable random variable. We see that satisfies

However,

so that

Thus, also has the decomposition

where is -measurable. Moreover, this and (3.4) give

| (3.5) |

The random variable satisfies

However, from

we find that

Therefore,

so that has the decomposition

where is -measurable. Moreover, from this and (3.5), we get

Theorem 3.2.

The optimal intertemporal risk allocation of for the exponential utility function in (EU) is unique and given by

| (3.6) |

We need the next proposition later.

Proposition 3.3.

Let , and . Then, the following assertions hold:

-

(a)

for .

-

(b)

for .

Proof.

The assertion (a) follows immediately from the definition of . If we put for , then satisfies

whence for or (b). ∎

3.2. The indifference prices for the exponential utility

In this section, we derive the indifference prices for the exponential utility in (EU). Let be the utility and indifference price functionals defined from as above, respectively. Recall , and from Section 3.1.

For the exponential utility, the next theorem reduces the computation of the indifference price to that of .

Theorem 3.4.

We assume . Then, for and , the following assertions hold:

-

(a)

.

-

(b)

.

-

(c)

.

Proof.

From Theorem 3.4 (c), we see that the indifference price does not depend on the level of the initial wealth for the exponential utility function.

The next proposition describes the optimal intertemporal allocation of the selling position for the exponential utility.

Proposition 3.5.

We assume . For and , let be the optimal intertemporal allocation of : . Then, is given by

4. Insurance pricing

In this section, we apply the approach above to the computation of insurance premiums.

4.1. Life insurance contract

We consider a life insurance contract with duration in which the insurer pays the insured dollars at time if the insured dies in the interval . Here ’s are deterministic. The insured pays the insurer a one-time premium at time .

We denote by the future life time of the insured, i.e., she/he dies at time . We assume that is a random variable on satisfying for all and for all .

If the insured pays the insurer dollars as one time premium at time , then the present value of the cashflow of the insurer is given by with

In the traditional pricing, the premium based on the principle of equivalence is often used: is defined by or . If the interest rates are deterministic, is given by

Notice that this price lacks the safety loading if the real mortality table is used. Usually, insurance companies use modified mortality tables to ensure the necessary safety loading (see §4.4 below).

We define a discrete-time process by

Then, is a -valued nondecreasing process with . Notice that for , (resp., ) if and only if the insurer is alive (resp., dead) at time . We denote by the filtration associated with the process :

| (4.1) |

We consider the following conditional probabilities:

We have the following equalities:

We use the following well-known result.

Lemma 4.1.

The following assertions hold:

-

(a)

for .

-

(b)

for .

4.2. Algorithm for the premium computation

The aim of this section is to derive an algorithm to compute the indifference premium of the life insurance contract. To this end, in addition to (EU), we assume the following conditions:

| (R) | The interest rate process is deterministic. | ||

| (F) | The filtration is given by in (4.1). |

The condition (R) implies that the riskless bond price process is also deterministic.

The -algebra is generated by the followng decomposition of :

Hence, if , then has the decomposition of the form

| (Z) |

with some real deterministic coefficients , . We also write . For example, in the life insurance contract considered in the previous section, we have for and .

Recall from (). For with representation (Z), we define the real deterministic sequence by the following backward iteration:

| (h) |

Recall the definition of the process from Section 2.

Proposition 4.2.

We assume , and . Then, for with , the process is given by

| (L2) |

Proof.

For simplicity, we write . Since

we have

| (4.2) |

To prove (L2), we use backward mathematical induction with respect to .

Next, we assume that (L2) holds for . Then,

where, as before, we write for . By Lemma 4.1,

Hence, noting that is either or , we obtain

which implies (L2) with . Thus, (L2) holds for . ∎

We are ready to give the algorithms to compute the indifference premium and corresponding optimal allocation of the selling position . We see that the computations are reduced to those of , , in (h).

Theorem 4.3.

We assume , and . Let with representation . Then, the following assertions hold.

-

(a)

The indifference price is given by .

-

(b)

Let be the optimal intertemporal allocation of : . Then, is given by

Proof.

Remark 4.4.

In the premium calcluation method in Theorem 4.3, we have assumed that the interest rate process is deterministic (the condition (R)). If instead we assume, e.g., that is a Markovian processs that is independent of , then we obtain a similar pricing method that involves the transition probabilities of . Such extensions to the case of random-interest-rate will be reported elsewhere.

4.3. Dependence on the risk aversion coefficients

As in the previous section, we assume (EU), (R) and (F). The aim of this section is to investigate the dependence of the indifference price on the absolute risk aversion coefficient set . To emphasize the dependence on , we write , , and for the exponential utility function , utility , indifference price and in (h), respectively. In what follows, (resp., ) means that (resp., ) for all .

To study the asymptotic behavior of as , we need the next lemma.

Lemma 4.5.

For , , and with limit , we define for . Then,

Proof.

Take . If is positive and sufficiently close to , then

which yields

Since is arbitrary, the lemma follows. ∎

For with representation (Z), we have

We define by

We can view (resp., ) as a lower (resp., upper) bound for any reasonable price of . From the next theorem, we see that takes any value in by a suitable choice of .

Theorem 4.6.

We assume , and . We also assume for all . Then, for , the following assertions hold:

-

(a)

for all .

-

(b)

.

-

(c)

.

-

(d)

For every and , there exists such that , where .

Proof.

(b) We have as . Hence, by applying Lemma 4.5 iterately to

with , , , and , we see the existence of the limits , , satisfying

From this, we get

However, we have ,

and more generally,

We also have . Thus

or

(c) Let with . If , then

which, together with (h), gives

Repeating this argument, we finally obtain

Similarly, if , then . Therefore, since as , we obtain

However, by (a), so that .

(d) By the construction in (h), , whence , is continuous in . Therefore, the assertion (d) follows from (a)–(c). ∎

4.4. Numerical examples

We compare the indifference pricing method in Theorem 4.3 with traditional ones by applying them to the following same insurance contract:

-

•

Type of insurance: term mortality insurance.

-

•

Age at issue: 30 years old.

-

•

Sex: male.

-

•

Term of contract: from 1 year to 30 years.

-

•

Loading of premium: excluded.

-

•

Mortality rate: Standard Mortality Table 2007 for mortality insurance (made by the Institute of Actuaries of Japan).

-

•

Discount rate: 2%.

-

•

Payment method: annual payment.

-

•

Sum assured: 1 (during the entire contract term).

By using the notation in the previous sections, the aggregate risk of this contract becomes

The traditional pricing methods that we use here are as follows:

-

(1)

Traditional method without risk loading:

-

(2)

Traditional method with risk loading:

where with .

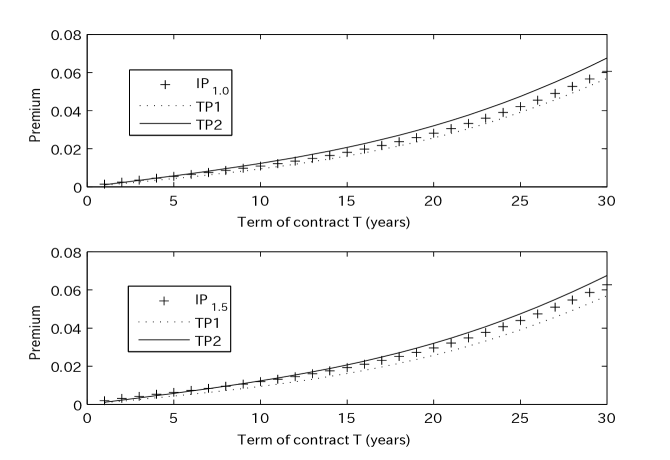

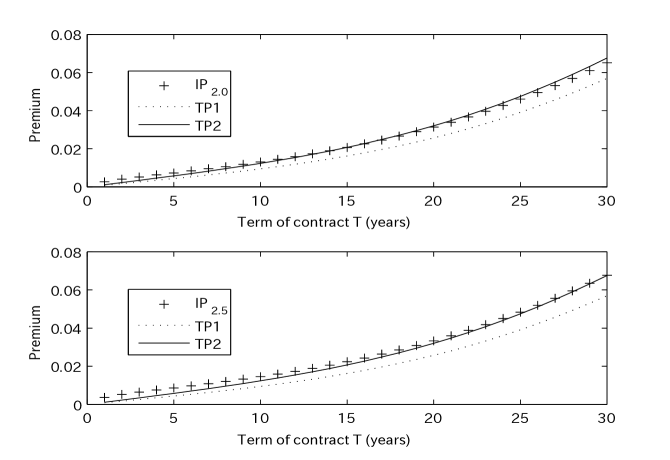

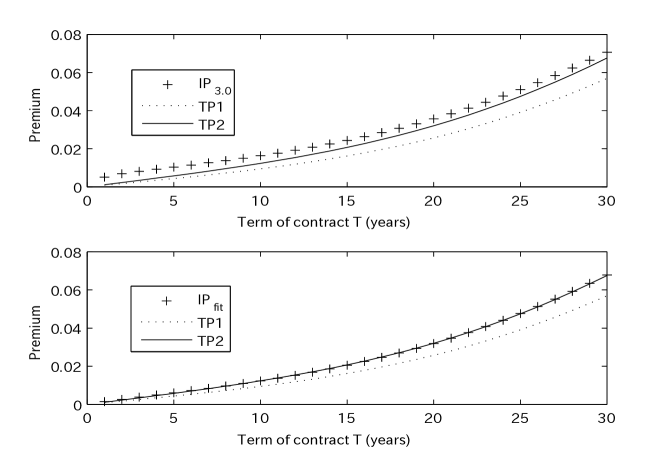

As above, we write TP1 and TP2 for the premiums of the contract with years of term obtained by the traditional pricing methods (1) and (2), respectively. For the values , , and , we denote by the premium of the same contract obtained by the indifference pricing method in Theorem 4.3 with . We also write for the premium of the same contract calculated by the pricing method in Theorem 4.3 with , the form of which is chosen to fit the graph of the indifference prices to that of TP2. We used the nonlinear least-squares to determine the form of for .

In Figures 4.1–4.3, we plot the graphs of TP1, TP2, , and . We see that the fitted premiums simultaneously approximate the corresponding traditional prices TP2 well. We have repeated this procedure for various prices and obtained good fits in most cases. This observation suggests the following implied utility approach to coherent pricing: insurance companies estimate their implied utility functions by applying this method to existing products, and then refers to them in pricing other products.

References

- [1] Acciaio, B. (2007): Optimal risk sharing with non-monotone monetary functionals. Finance Stoch., 11, 267–289.

- [2] Artzner, P., F. Delbaen, J. M. Eber, and D. Heath (1999): Coherent measures of risk. Math. Finance, 9, 203–228.

- [3] Barrieu, P. and N. El Karoui (2005): Inf-convolution of risk measures and optimal risk transfer. Finance Stoch., 9, 269–298.

- [4] Bielecki, T. R., M. Jeanblanc, and M. Rutkowski (2004): “Hedging of defaultable claims,” in Paris-Princeton lectures on Mathematical Finance 2003, eds. R. Carmona, Berlin: Springer, 1–132.

- [5] Borch, K. (1960): Reciprocal reinsurance treaties. ASTIN Bull., 1, 170–191.

- [6] Borch, K. (1960): The safety loading of reinsurance premiums. Skand. Aktuarietidskr., 1, 163–184.

- [7] Borch, K. (1962): Equilibrium in a reinsurance market. Econometrica, 30, 424–444.

- [8] Bühlmann, H. (1980): An economic premium principle. ASTIN Bull., 11, 52–60.

- [9] Bühlmann, H. (1984): The general economic premium principle. ASTIN Bull., 14, 13–21.

- [10] Bühlmann, H. and W. S. Jewell (1979): Optimal risk exchanges. ASTIN Bull., 10, 243–262.

- [11] Burgert, C. and L. Rüschendorf (2006): On the optimal risk allocation problem. Stat. Decis., 24, 153–171.

- [12] Craven, B. D. (1978): Mathematical programming and control theory, London: Chapman & Hall.

- [13] Dana, R. -A. and M. Jeanblanc (2003): Financial markets in continuous time, Berlin: Springer.

- [14] Dana, R. -A. and M. Scarsini (2007): Optimal risk sharing with background risk. J. Econ. Theory, 133, 152–176.

- [15] Delbaen, F. (2002): “Coherent measures of risk on general probability spaces”, in Advances in Finance and Stochastics, Essays in Honor of Dieter Sondermann, eds. K. Sandmann and P. J. Schönbucher, Berlin: Springer, 1–37.

- [16] Duffie, D. (2001): Dynamic asset pricing theory, 3rd. ed., Princeton: Princeton Univ. Press.

- [17] Föllmer, H. and A. Schied (2002): Convex measures of risk and trading constraints. Finance Stoch., 6, 429–448.

- [18] Föllmer, H. and A. Schied (2004): Stochastic finance, 2nd ed., Berlin: De Gruyter.

- [19] Gerber, H. U. (1978): Pareto-optimal risk exchanges and related decision problems. ASTIN Bull., 10, 25–33.

- [20] Gerber, H. U. and G. Pafumi (1998): Utility functions: From risk theory to finance. N. Am. Actuar. J., 2, 74–100.

- [21] Heath, D. and H. Ku (2004): Pareto equilibria with coherent measures of risk. Math. Finance, 14, 163–172.

- [22] Hodges, S. D. and A. Neuberger (1989): Optimal replication of contingent claims under transaction costs. Rev. Futures Markets, 8, 222–239.

-

[23]

Jouini, E., W. Schachermayer, and N. Touzi (2007):

Optimal risk sharing for law invariant monetary utility functions.

to appear in Math. Financ.

http://www.fam.tuwien.ac.at/~wschach/pubs/preprnts/prpr0122.pdf - [24] Musiela, M. and T. Zariphopoulou (2004): An example of indifference prices under exponential preferences. Finance Stoch., 8, 229–239.

- [25] Møller, T. and M. Steffensen (2007): Market-valuation methods in life and pension insurance, Cambridge: Cambridge Univ. Press.

- [26] Rouge, R. and N. El Karoui (2000): Pricing via utility maximization and entropy. Math. Finance, 10, 259–276.