Quasistatically varying log-normal distribution in the middle scale region of Japanese land prices

Abstract

Employing data on the assessed value of land in 1974–2007 Japan, we exhibit a quasistatically varying log-normal distribution in the middle scale region. In the derivation, a Non-Gibrat’s law under the detailed quasi-balance is adopted together with two approximations. The resultant distribution is power-law with the varying exponent in the large scale region and the quasistatic log-normal distribution with the varying standard deviation in the middle scale region. In the distribution, not only the change of the exponent but also the change of the standard deviation depends on the parameter of the detailed quasi-balance. These results are consistently confirmed by the empirical data.

PACS code : 89.65.Gh

1 Introduction

Log-normal distributions are frequently observed not only in natural phenomena but also in social ones. For representative example, the probability density function of personal income or firm size is considered to obey the log-normal distribution [1]–[2]

| (1) |

in the middle scale region.222 In the large scale region, the distribution of personal income or firm size follows power-law [3]. We discuss this in the next section. In the low scale region, several distributions are proposed (see Refs. [4]–[5] for instance). We do not discuss them in this study. Here is a mean value and is a variance. A large number of persons or firms are included in the middle scale region. The study of the distributions is significant.

The simplest model which describes the log-normal distribution is the pure multiplicative stochastic process defined by

| (2) |

where is a positive random variable. By applying this process iteratively, we obtain

| (3) |

The logarithm of this equation is

| (4) |

If is negligible compared to in the limit and are independent probability variables, follows the normal distribution in the limit. As a result, this model leads the stationary log-normal distribution .

Eq. (2) means that the distribution of the growth rate does not depend on . This is known as Gibrat’s law [1] that the conditional probability density function of the growth rate is independent of the initial value :

| (5) |

Here and are two successive incomes, assets, sales, profits, the number of employees and so forth. The growth rate is defined as and as

| (6) |

by using the probability density function and the joint probability density function .

As far as firm sizes in the middle scale region, however, it is reported that the growth rate distributions do not follow the Gibrat’s law (5) (see Refs. [6]–[8] for instance). The log-normal distribution in the middle scale region cannot be explained by the pure multiplicative stochastic process model (2). Instead, we have shown that the log-normal distribution can be derived [9] by using no model such as the pure multiplicative stochastic process. In the derivation, two laws are employed which are observed in profits data of Japanese firms. One is the law of detailed balance which represents symmetry in a stable economy [11]. The other is a Non-Gibrat’s law which describes a statistical dependence in the growth rate of the past value [9].

In Ref. [10], the Non-Gibrat’s law and the static log-normal distribution in the middle scale region are uniquely derived from the detailed balance. The derivation has been confirmed by the empirical data analysis. In this study, we extend the derivation by replacing the detailed balance with the detailed quasi-balance proposed in Ref. [12] to derive a log-normal distribution in the quasistatic system. By this procedure, the log-normal distribution is described as quasistatic. The derivation is consistently confirmed employing data on the assessed value of land in 1974–2007 Japan.

2 Static log-normal distribution under the detailed balance

In this section, we briefly review the study in Ref. [10]. As an equilibrium system, we investigate profits data of Japanese firms in 2003, 2004 and 2005 which are available on the database “CD Eyes 50” published in 2005 and 2006 by TOKYO SHOKO RESEARCH, LTD. [13].

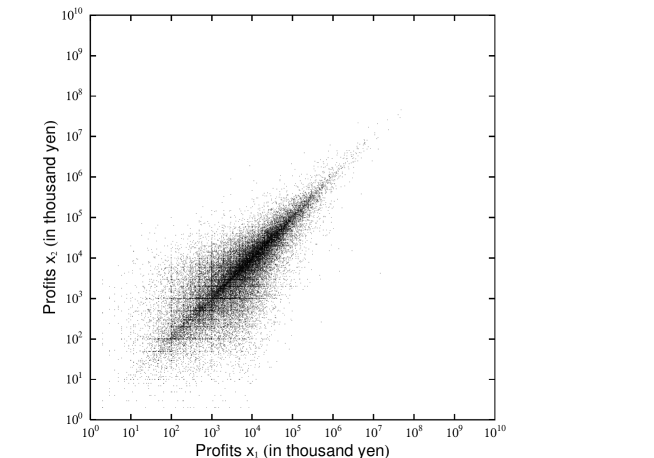

Figure 2 shows the joint probability density function of all firms in the database, the profits of which in 2004 () and 2005 () exceeded , and . The number of firms is “232,497”. From Fig. 2, we approximately confirm the detailed balance which is time-reversal symmetry () of [11]:333 Similarly, we approximately confirm the detailed balance in the joint probability density functions of the profits in 2003–2004 and 2003–2005.

| (7) |

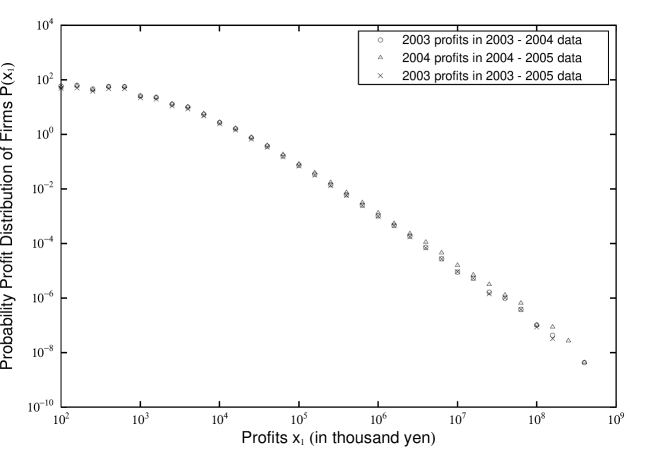

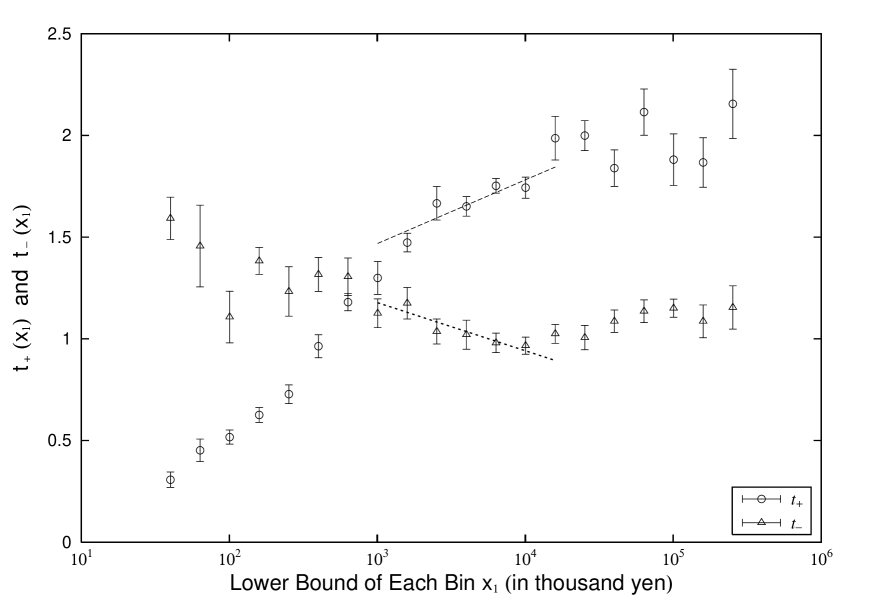

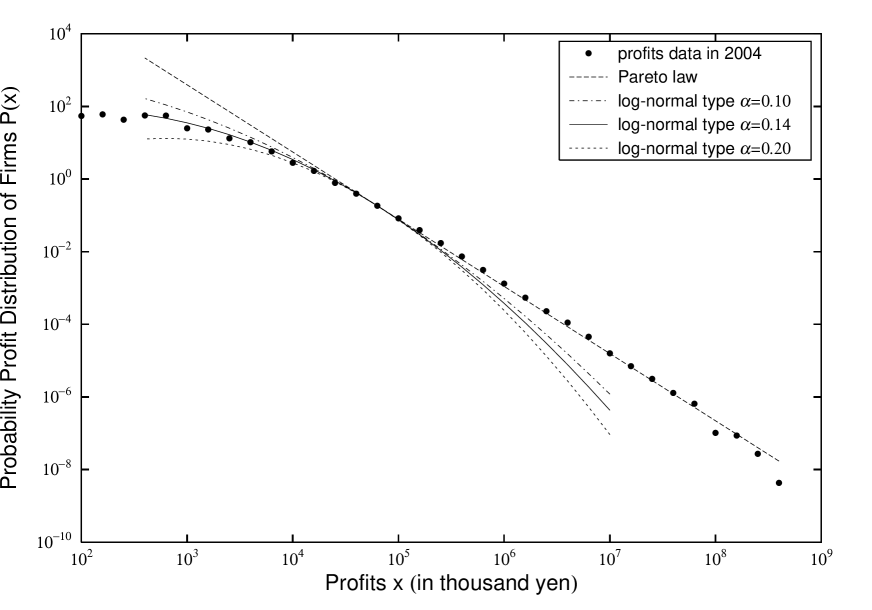

Figure 2 shows probability density functions of profits in the database. The distributions are almost stable and the following power-law is observed in the large scale region

| (8) |

where is a certain threshold. This power-law is called Pareto’s law [3] and the exponent is named Pareto index. Notice that the Pareto’s law does not hold below the threshold . The purpose of this section is to exhibit the distribution in the middle scale region under the detailed balance (7).

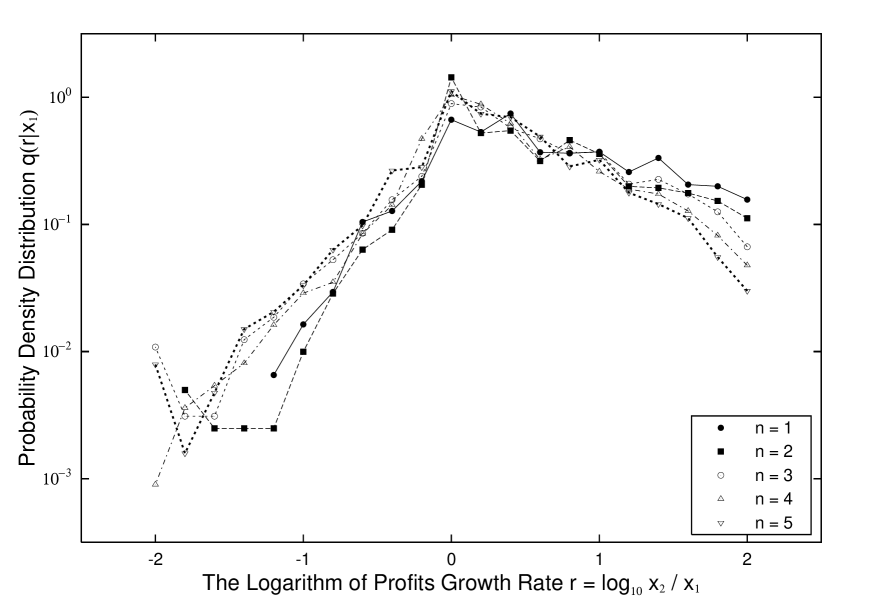

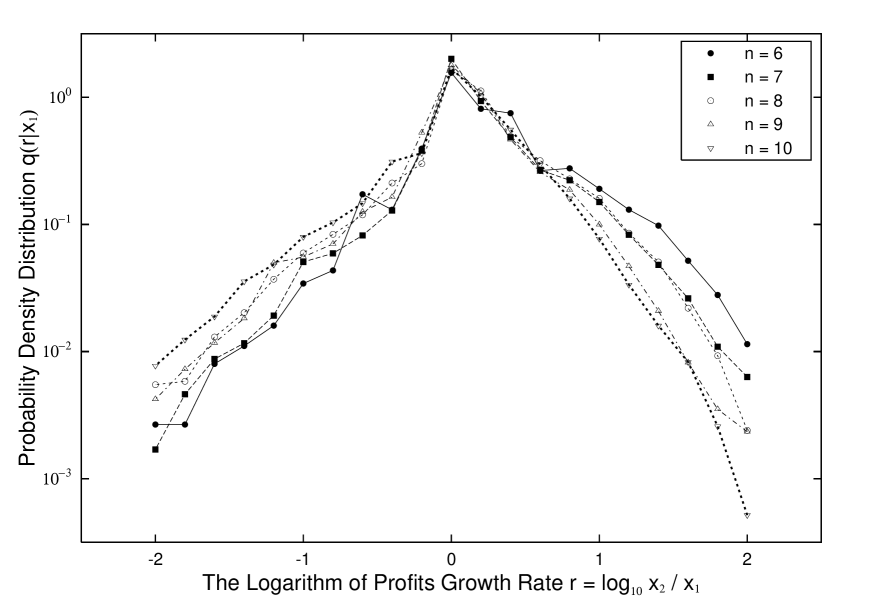

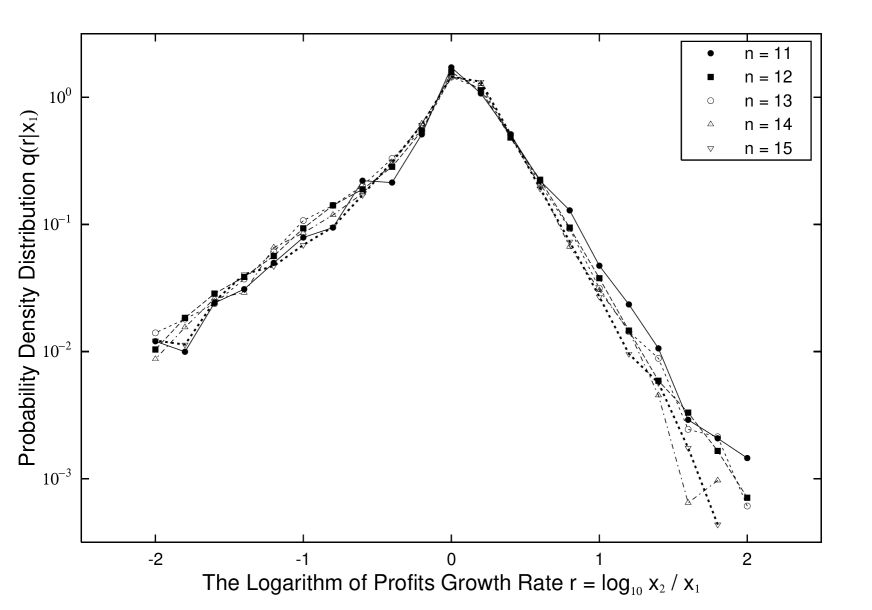

In order to identify a statistical dependence in the growth rate of the past value, we examine the probability density function of the profits growth rate in 2004–2005. In the database, we divide the range of into logarithmically equal bins as thousand yen with . Figure 3 shows the conditional probability density functions for in the case of , , and . The number of firms in Fig. 3 is “”, “”, “” and “”, respectively.

From Fig. 3, we approximate by linear functions of :

| (9) | |||||

| (10) |

Here is the conditional probability density function for , which is related to that for by . These approximations (9)–(10) are expressed as tent-shaped exponential forms as follows:

| (11) | |||||

| (12) |

where . Furthermore, Fig. 3 shows that the dependence of on is negligible for . We assess the validity of these approximations against the results.

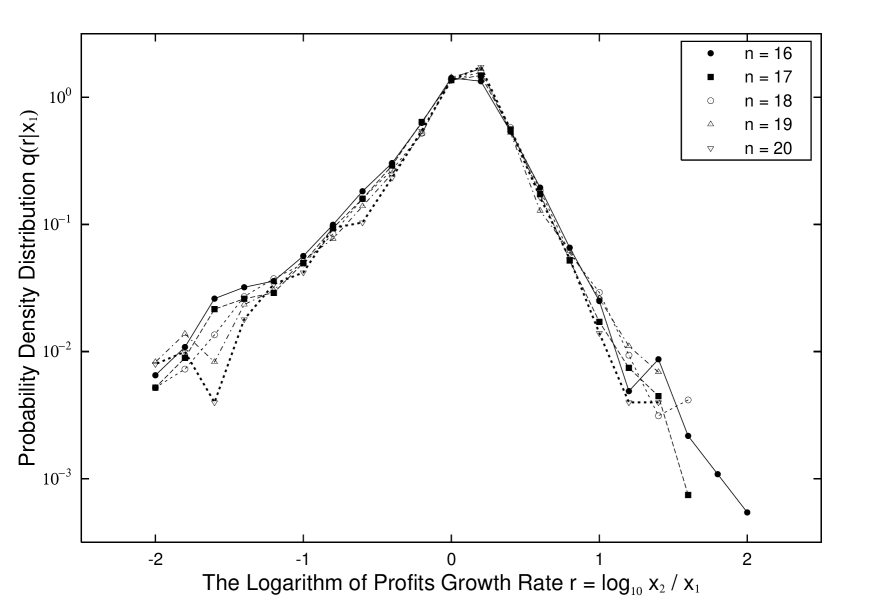

Figure 5 represents the dependence of on the lower bound of each bin . For , hardly responds to . This means that the Gibrat’s law (5) holds only in the large scale region of profits ().444 Fujiwara et al. [11] prove that the Pareto’s law (8) is derived from the Gibrat’s law (5) valid only in the large scale region and the detailed balance (7). In the derivation, linear approximations (9)–(10) need not be assumed. In contrast, linearly increases and linearly decreases symmetrically with for . From Fig. 5, the slops are described as [9]

| (13) |

The parameters are estimated as follows: for , for ,555 Here, a constant parameter takes different values in two regions. This is not an exact procedure. However, for firms which are in the large scale region in both years ( and ) or in the middle scale one ( and ), this procedure is exact. In the database, most firms stay in the same region. This parameterization is, therefore, approximately valid for describing the probability density function . This is confirmed in Fig. 5. thousand yen and thousand yen. Notice that approximations (9)–(10) uniquely fix the expression of under the detailed balance [10]. This derivation is included in the proof in the next section. We call Eqs. (11)–(13) a Non-Gibrat’s law.

For , the dependence of on is negligible. In this case, the Non-Gibrat’s law determines the probability density function of profits as follows:

| (14) |

where [14]. This is the power-law in the large scale region () and the log-normal distribution in the middle scale one (). The relations between parameters , in Eq. (1) and , , are given by , . Figure 5 shows that the distribution (14) fits with the empirical data consistently. Notice that the distribution cannot fit with the empirical data, if is different from the value estimated in Fig. 5 ( or for instance).666 These empirical data analyses are not restricted in the single term 2004–2005. Similar data analyses are checked in 2003–2004 or 2003–2005.

3 Quasistatic log-normal distribution under the detailed quasi-balance

In the previous section, the log-normal distribution in the middle scale region is exhibited by a Non-Gibrat’s law under the detailed balance. The resultant profits distribution is empirically confirmed in data analyses of Japanese firms in 2003–2004, 2004–2005 and 2003–2005. The profits distribution (14) is static, because the derivation is based on the detailed balance (7) which is static time-reversal symmetry observed in the system (Fig. 2).

In the case that an economy is not stable, the detailed balance should be extended to describe the state. In Ref. [12], we have derived Pareto’s law with annually varying Pareto index under the detailed quasi-balance:

| (15) |

It is assumed that, in an ideal quasistatic system, the joint probability density function has “” symmetry where is a slope of a regression line:

| (16) |

The detailed balance (7) has the special symmetry . Because the detailed quasi-balance (15) is imposed on the system, is related to as follows:

| (17) |

Here is a sufficient large value compared to the upper bound in which and are estimated.

In Ref. [12], these results have been empirically confirmed by employing data on the assessed value of land [15]–[16] in 1983–2005. In the derivation, under the detailed quasi-balance, we have used the Gibrat’s law (5) valid only in the large scale region without linear approximations (9)–(10). The purpose of this section is to show that the approximations uniquely fix a Non-Gibrat’s law even under the detailed quasi-balance (15). After that, we identify the quasistatic distribution not only in the large scale region but also in the middle scale one.

By using the relation under the change of variables , these two joint probability density functions are related to each other

| (18) |

where we use a modified growth rate . From this relation, the detailed quasi-balance (15) is rewritten as

| (19) |

Substituting for defined in Eq. (6), the detailed quasi-balance is reduced to be

| (20) |

In the quasistatic system, we also assume that follows the tent-shaped exponential forms (11)–(12).777 For instance, the tent-shaped exponential forms are observed in data on the assessed value of land in Japan [15]. Under the approximations, the detailed quasi-balance is expressed as

| (21) |

for . Here we use the notation . By setting after differentiating Eq. (21) with respect to , the following differential equation is obtained:

| (22) |

where denotes . The same equation is obtained for .

Similarly, from the second and third derivatives of Eq. (21), the following differential equations are obtained:

| (23) |

The solutions are uniquely fixed as

| (24) |

This is the same expression under the detailed balance.

4 Data Analysis

In this section, we confirm the results in the previous section employing data on the assessed value of land in 1974–2007 Japan. In Japan, land is a very important asset which is distinguished from buildings. The assessed value of land indicates the standard land prices evaluated by Ministry of Land, Infrastructure and Transport Japan. The investigation is undertaken on each piece of land assessed once a year according to the posted land price system from 1970.888 We exclude data in 1970–1973, the number of which is insufficient.

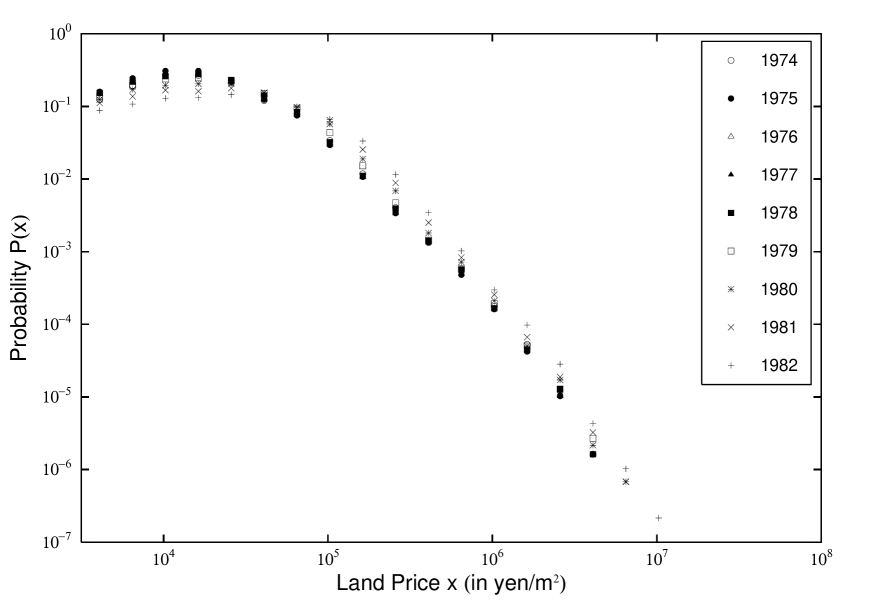

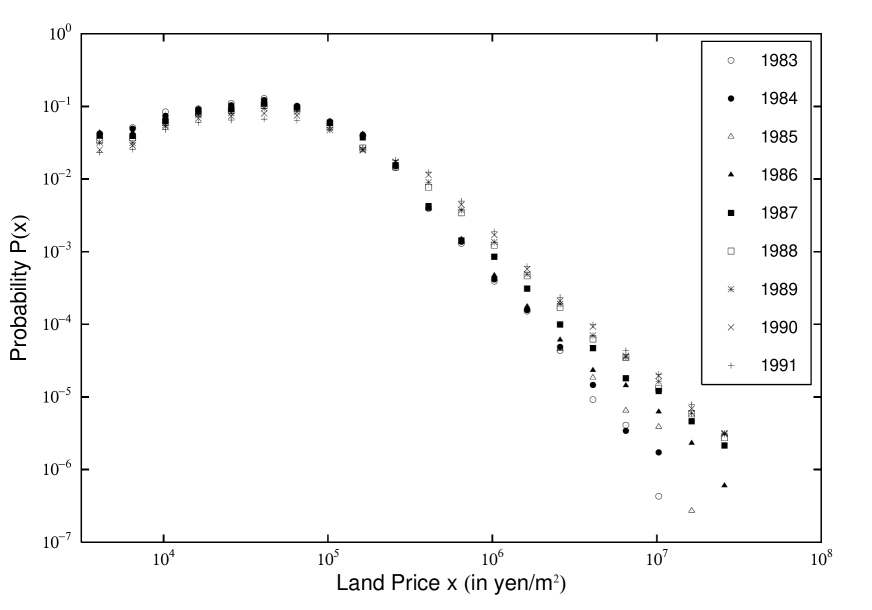

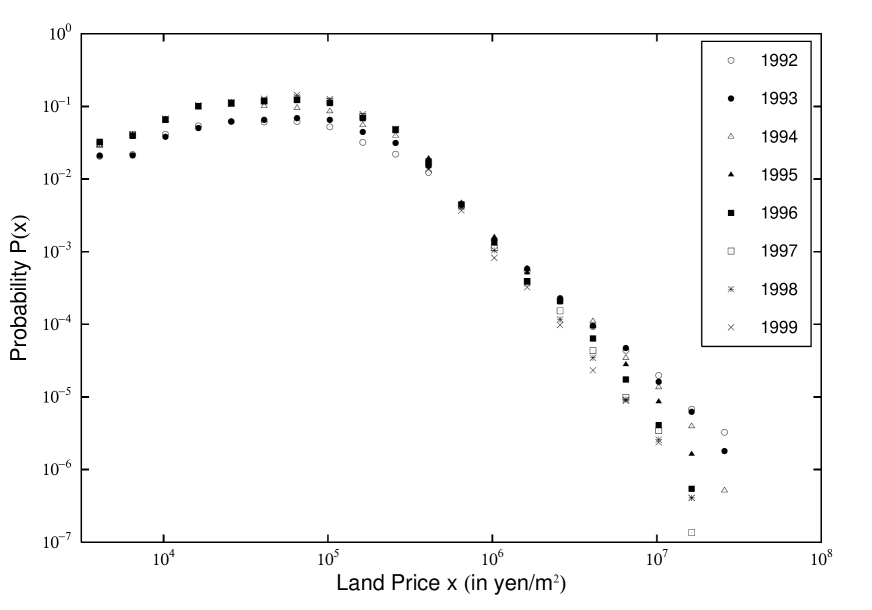

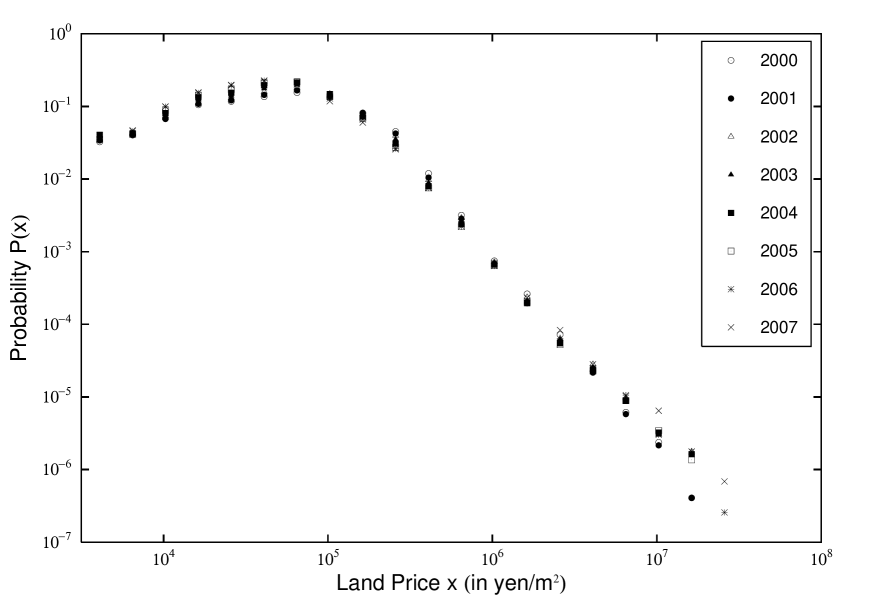

The probability distribution functions of land prices are shown in Fig. 6. The number of data points is “14,570”, “15,010”, “15,010”, “15,010”, “15,580”, “16,480”, “17,030”, “17,380” and “17,600” in 1974–1982, respectively. In 1983–1991, “16,975”, “16,975”, “16,975”, “16,635”, “16,635”, “16,820”, “16,840”, “16,865” and “16,892”, respectively. In 1992–1999, “17,115”, “20,555”, “26,000”, “30,000”, “30,000”, “30,300”, “30,600” and “30,800”, respectively. In 2000–2007, “31,000”, “31,000”, “31,520”, “31,866”, “31,866”, “31,230”, “31,230” and “30,000”, respectively.

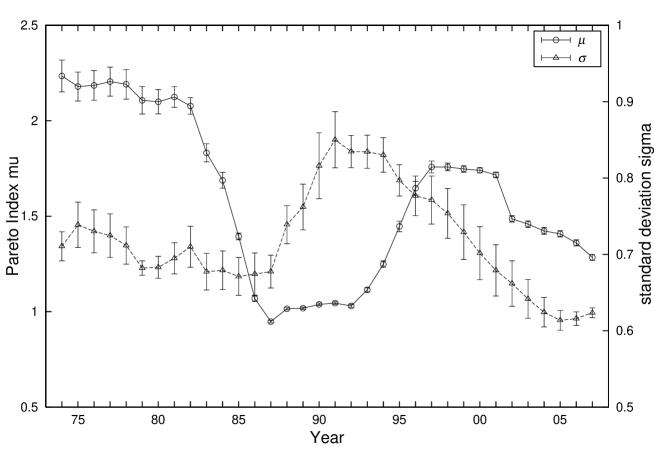

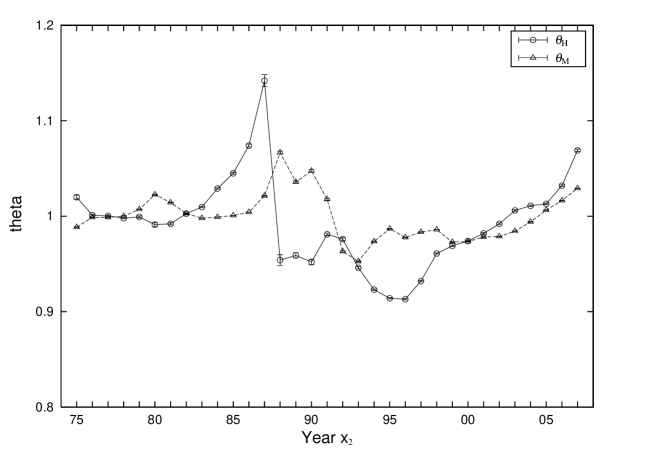

In each figure, the power-law is observed in the large scale region. In addition, Pareto index varies annually and changes significantly before and after bubble years (1986–1991). This is represented in Fig. 7 where each Pareto index is estimated in the range of land prices from to . In Fig. 6, the log-normal distribution is also observed in each middle scale region. The standard deviation varies annually and changes significantly in bubble years. This is also represented in Fig. 7 where each standard deviation is estimated in the range from to .

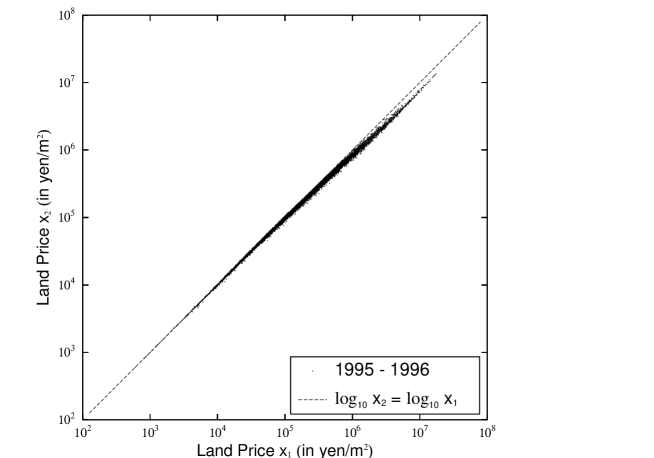

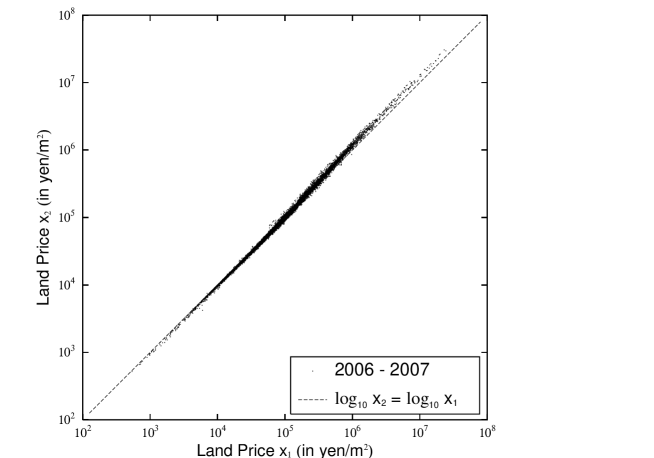

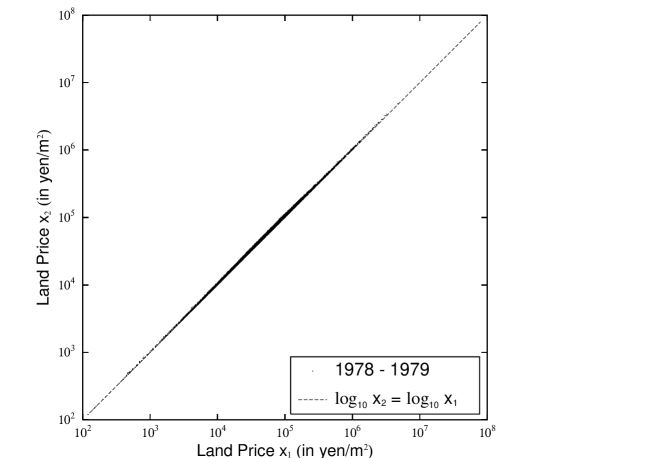

It is well known that the Pareto index for firm sizes hardly changes (Fig. 2). In such a database, the detailed balance (7) is observed [11] (Fig. 2). On the other hand, the Pareto index for the assessed value of land varies annually. This suggests that the system is not stable and the detailed balance does not hold. Actually most of the period, the detailed balance is not observed in the scatter plot of all pieces of land assessed in the database (Figs. 8 and 9 for instance).999 Of course, the detailed balance is observed approximately in the case that the system is almost stable and the Pareto index hardly varies (Fig. 10 for instance).

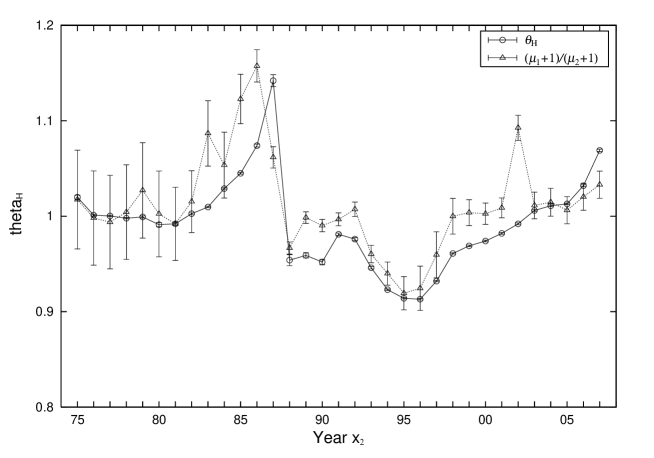

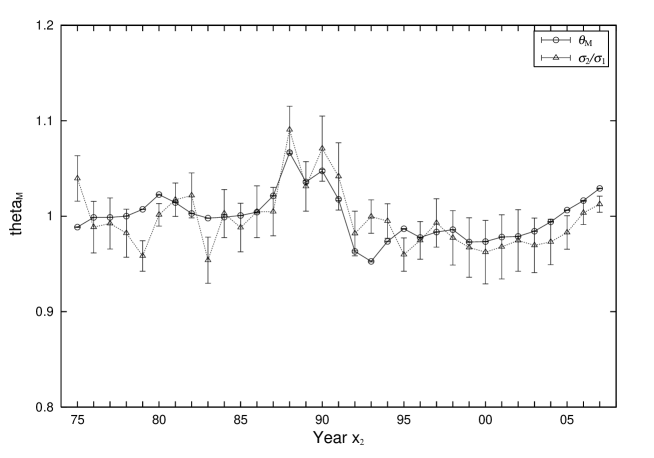

In the previous section, we have proposed the detailed quasi-balance (15) in an ideal quasistatic system. In each scatter plot of all pieces of land assessed in the database, the parameter is measured and the result is shown in Fig. 11. Here is estimated in the following two regions. One is the large scale region between and where Pareto index is estimated. The other is the middle scale one between and where the standard deviation of the log-normal distribution is estimated. In Fig. 11, we represent two parameters by and , respectively.

By using these parameters, we confirm not only the relation between the ratio of and (27) in the large scale region but also the relation between the ratio of and (30) in the middle scale one (Figs. 12 and 13). This warrants approximations assumed in the previous section. The derivation and the data analysis are consistent.

5 Conclusion

In this study, by using no model, we have derived a quasistatically varying log-normal distribution from a Non-Gibrat’s law under the detailed quasi-balance. In the derivation, we have employed two approximations. One is that the probability density function of the growth rate is described as tent-shaped exponential functions. The other is that the value of the origin of the growth rate distribution is constant. Even under the detailed quasi-balance, the first approximation uniquely fixes a Non-Gibrat’s law to be the same expression under the detailed balance. Together with the second approximation, the resultant distribution is described as power-law with varying Pareto index in the large scale region. In the middle scale region, the distribution is reduced to the quasistatic log-normal distribution with the varying standard deviation. Notice that not only the change of Pareto index but also the change of the standard deviation depends on a parameter of the detailed quasi-balance.

Employing empirical data on the assessed value of land in 1974–2007 Japan, we have confirmed these analytic results. In the scatter plot of all pieces of land assessed in the database, the parameter of the detailed quasi-balance is measured in the following two regions. One is the large scale region where Pareto index is estimated. The other is the middle scale region where the standard deviation is estimated. We have observed that two parameters measured in the large scale region and measured in the middle scale one are in good agreement with the ratio of and , respectively.

Intriguingly, it is observed that the change of Pareto index influences the change of the standard deviation in the opposite direction (Fig. 7).101010 This relation is suggested in Ref. [17] by employing personal income data in Japan. In this database, the change of the distribution in the large scale region propagates in the middle scale one. This phenomenon is intelligible by two slopes and of the regression lines in the scatter plot (Fig. 11).

In order to make these discussions more precisely, we need to investigate wealth of data in unstable state for a long period. By analyzing the database, we directly observe the Non-Gibrat’s law which defines the large and middle scale regions. In addition, we should take a statistical test for the symmetry in the two arguments of to confirm the detailed quasi-balance directly. These accurate data analyses are imperative to realize the applications of the study in this paper, such as credit risk management and so forth.

Acknowledgments

The author is grateful to the Yukawa Institute for Theoretical Physics at Kyoto University, where this work was initiated during the YITP-W-05-07 on “Econophysics II – Physics-based approach to Economic and Social phenomena –”, and especially to Professor H. Aoyama for the critical question about my previous work. Thanks are also due to Dr. Y. Fujiwara, Dr. W. Souma and Dr. M. Tomoyose for a lot of useful discussions and comments.

References

- [1] R. Gibrat, Les inegalites economiques, Paris, Sirey, 1932.

-

[2]

W.W. Badger, in: B.J. West (Ed.), Mathematical Models as a Tool for the Social Science,

Gordon and Breach, New York, 1980, p. 87;

E.W. Montrll, M.F. Shlesinger, J. Stat. Phys. 32 (1983) 209. - [3] V. Pareto, Cours d’Economique Politique, Macmillan, London, 1897.

-

[4]

A. Drgulescu, V.M. Yakovenko, Physica A299 (2001) 213;

A.C. Silva, V.M. Yakovenko, Europhys. Lett. 69 (2005) 304. -

[5]

M. Anazawa, A. Ishikawa, T. Suzuki and M. Tomoyose, Physica A335 (2004) 616;

A. Ishikawa and T. Suzuki, Physica A343 (2004) 376. - [6] M.H.R. Stanley, L.A.N. Amaral, S.V. Buldyrev, S. Havlin, H. Leschhorn, P. Maass, M.A. Salinger, H.E. Stanley, Nature 379 (1996) 804.

- [7] H. Takayasu, M. Takayasu, M.P. Okazaki, K. Marumo, T. Shimizu, cond-mat/0008057, in: M.M. Novak (Ed.), Paradigms of Complexity, World Scientific, 2000, p. 243.

-

[8]

H. Aoyama,

Ninth Annual Workshop on Economic Heterogeneous Interacting Agents (WEHIA 2004);

H. Aoyama, Y. Fujiwara, W. Souma, The Physical Society of Japan 2004 Autumn Meeting. - [9] A. Ishikawa, Physica A367 (2006) 425.

- [10] A. Ishikawa, Physica A383/1 (2007) 79.

-

[11]

Y. Fujiwara, W. Souma, H. Aoyama, T. Kaizoji and M. Aoki,

Physica A321 (2003) 598;

Y. Fujiwara, C.D. Guilmi, H. Aoyama, M. Gallegati and W. Souma, Physica A335 (2004) 197. - [12] A. Ishikawa, Physica A371 (2006) 525.

- [13] TOKYO SHOKO RESEARCH, LTD., http://www.tsr-net.co.jp/.

- [14] A. Ishikawa, Physica A363 (2006) 367.

-

[15]

T. Kaizoji, Physica A326 (2003) 256;

T. Kaizoji and M. Kaizoji, Physica A344 (2004) 138. - [16] The Ministry of Land, Infrastructure and Transport Government of Japan’s World-Wide Web site, http://nlftp.mlit.go.jp/ksj/.

- [17] W. Souma, Fractals 9 (2001) 463.