Innovation Success and Structural Change: An Abstract Agent Based Study††thanks: Supported by FCT Portugal project PDCT/EGE/60193/2004

Abstract

A model is developed to study the effectiveness of innovation and its impact on structure creation and structure change on agent-based societies. The abstract model that is developed is easily adapted to any particular field. In any interacting environment, the agents receive something from the environment (the other agents) in exchange for their effort and pay the environment a certain amount of value for the fulfilling of their needs or for the very price of existence in that environment. This is coded by two bit strings and the dynamics of the exchange is based on the matching of these strings to those of the other agents. Innovation is related to the adaptation by the agents of their bit strings to improve some utility function.

Keywords: Innovation, Agent-based models, Artificial societies

1 Introduction

Agent-based models are increasingly being used to model artificial societies. Some of these models fall in the field of biological sciences and a very important part of them deal with economical problems ([1] [2] [3] [4] [5] [6] and [7]). Economical, ecological and social environments share as a common feature the fact that the agents operating in these environments spend a large amount of their time trying to maximize some kind of actual or perceived utility function, related either to profit, to food, to reproduction or to comfort and power. It so happens that many times the improvement of one agent’s utility is made at the expense (or causes) the decrease of the other agents utilities. A general concept that is attached to this improvement struggle is the idea of innovation.

In the economy, innovation may be concerned with the identification of new markets [8] [9], with the development of new products [11] [12] to capture a higher market share or with the improvement of the production processes to increase profits. In ecology, innovation concerns better ways to achieve security or food intake or reproduction chance and, in the social realm, all of the above economical and biological drives plus a few other less survival-oriented needs. In all cases, innovation aims at finding strategies to better deal with the surrounding environment and to improve some utility function. In any system where at least some agents are trying to innovate, the perfect strategy of today may, with time, become a loosing one. It is the well known “red queen effect”: You must run as fast as you can, to stay in the same place.

It is in the economy field that innovation has been more extensively studied. Three main types of innovations were identified:

(i) Market innovation : the identification of new markets and finding out how they are better served or how they may become more receptive to the available products

(ii) Product innovation : the identification and development of new products

(iii) Process innovation : the identification of better and less expensive production ways or the improvement of internal operations

Although these classification types were developed for economics, it is an easy exercise to find the corresponding notions in the other environments. That also applies to the classification of the intensity of the innovations as radical, incremental, architectural and modular. An important point to emphasize is that the intensity of the innovation is an agent-dependent concept. An innovation that is radical for one agent might just appear as incremental or of any other type to some other agent [13]. Another important concept concerning a system of innovation[14] is the flow of information [15] [16] between the agents in the system and its appropriation in terms of knowledge. However, here, systems of innovation are not explicitly taken into account. They may only appear as emergent features.

Other important issues in the innovation field are the identification of the basic mechanisms leading the agents to innovate [17] [18] [19] [20] [21] [22] and its impact on social change and human evolution [23].

The fact that innovation covers so many different fields and particular settings justifies efforts to develop an abstract model that might be easily adapted to any particular field. The dynamical structure of the model should also be sufficiently general to provide general insights on the mechanisms leading to emergent collective structures. In general, in an interacting environment, the agents receive something from the environment (the other agents) in exchange for their effort and pay the environment a certain amount of value for the fulfilling of their needs or for the very price of existence in that environment. We will code the two types of exchanges by two bit strings which conventionally we denote by the products string and the needs string. In an economy environment, products and needs might be actual market products and operating or supplies needs, but in a biology environment they might stand, for example, for hunting success and predation by other species, in the political setting for “slogans and promises” and voters desires, etc.

The dynamics of the exchange is always based on the matching of the products string of each agent with the needs strings of the other agents. Two types of models will be studied. In the first, separating the products and needs functionalities, we study a model of producers and consumers, the main aim being to characterize the conditions for innovation success. In the second, each agent is equipped with two strings representing either products and needs or, more generally, what an agent profits from the environment and what the environment profits from him. In this model we study how, (starting from a uniform distribution of fitness, randomly chosen strings and equal dynamics) structure develops in the agents’ society, both with and without innovation.

2 A model of producers and consumers

At the start, there are agents in the model: producers and the same number of consumers. Each consumer has a set of needs coded by a string of bits and each producer has a product coded by a string of bits. The bit string of a consumer represents what the consumer agent needs to receive from the environment and the bit string of a producer is a code for the products that he is able to supply. No passive actors are assumed in the environment and the environment for each agent is just the set of all the other agents.

In addition to the two bit strings that code for needs and products, each agent has a scalar variable or , depending on the agent type (consumer or producer, respectively). The variable represents the degree of satisfaction of the needs and represents the amount of some commodity (or cash) that may be exchanged for the products that are available. In the economy this role is played by money, but in other contexts it might be protection capacity or power or status.

The dynamics of the model is characterized by exchange, evolution and adaptation. The basic driver of the exchange dynamics of the model is the matching between needs and products. At each time step, the matching between needs and products is made and each consumer chooses at random one among the products that better match his needs. The producer that has this product is a potential supplier. The dynamical evolution is

| (1) |

| (2) |

The index runs over all the consumers that are supplied by the producer

On receiving a product from the producer the consumer increases his satisfaction (or energy) by . The variable stands for the matching of the producer that supplies the consumer . At the same time, the producer increases his commodity (or cash) by , where and stand for two constant costs of living that are subtracted at each time step from the consumers-satisfaction and the suppliers-cash.

At each time step needs and products are compared. The producer that supplies each consumer is chosen at random among those with the larger matching. When this producer either disappears and is not replaced (subsection 2.1) or it is replaced by a new random producer (subsection 2.2). When this consumer is replaced by a new one with random needs string and . As such, a consumer only remains in the field as long as its energy is positive. If it becomes negative, he dies and is replaced by a new random consumer. Initially all agents and the replacement (consumer) agents are endowed with the same initial and .

The replacement mechanism of the agents means that, when applied to real world situations, each agent in the model represents a new consumer trend and in biology not an individual species but an ecological niche.

Once the number of surviving producers stabilizes, several possible evolution mechanisms may be implemented in the model:

-

•

Innovation by the producers

-

–

Market-oriented innovation: the innovating producers find the consumers that have a matching above a certain threshold and flips the worse bit. Corresponds to adaptation of a particular product to expand an existing market.

-

–

Process innovation: process innovation corresponding to a decrease in production costs may be simulated in the model by adding a certain amount (an half point for example) to the matching results of this producer.

-

–

Product innovation: the innovating producer finds a set of consumers that among themselves have a matching above a certain threshold and develops a new product string according to their need bits.

-

–

-

•

Evolution and Adaptation of the consumers: after the exchanges, the less satisfied consumers find the products that have a matching above a certain threshold and flip the (need) bits with the worst scores when compared with the same position bits in the products.

There are of course some important features of real world environments that are not explicitly included in our abstract coding of the products offered by each agent. For example, products sometimes have some core features that are fixed and some others that are adjustable. Then the agent may supply the same core product to different customers as different offerings. This market segmentation technique is particularly important in the services industry [8] [9]. The choice preference in the model being achieved by maximization of the partial matching between products and needs, one may take the point of view that one is dealing only with the core features of products. An explicit coding of core versus adjustable features might be included by keeping some product bits fixed and fuzzying a few others. However, we believe that the qualitative dynamical features of the model would not be very much affected by this change.

In the next subsections, the model is tested in several different scenarios, which are characterized by different combinations of the parameter values, namely:

-

•

The consumer cost of living parameter , providing either stable or volatile environments

-

•

The producer cost of living parameter , providing environments with either low or high amounts of dying (or replacement) rates of producers by time step,

-

•

the innovation mechanism that is adopted: either Market-oriented innovation (MOI) or Adaptation to available products (CAP)

-

•

the quantity of agents that are allowed to perform the above mentioned mechanisms; two possibilities have been considered: just one agent or a randomly determined number of agents.

2.1 Market-oriented innovation

In the first two scenarios, the innovation mechanism is Market-oriented innovation (MOI) by one innovating producer. Scenarios 1 and 2 differ on the value, representing either stable () or volatile () consumer environments. In both cases producers with are not replaced.

In each scenario, one looks for correlations between the nature of the market and the efficiency of the innovation process. The rate of MOI efficiency () of an innovating producer (IP) is defined by

| (3) |

where and represent, respectively, the amount of Cash of the innovating producer at the end of the simulation and when innovation starts.

2.1.1 Stable and volatile environments with one innovating agent

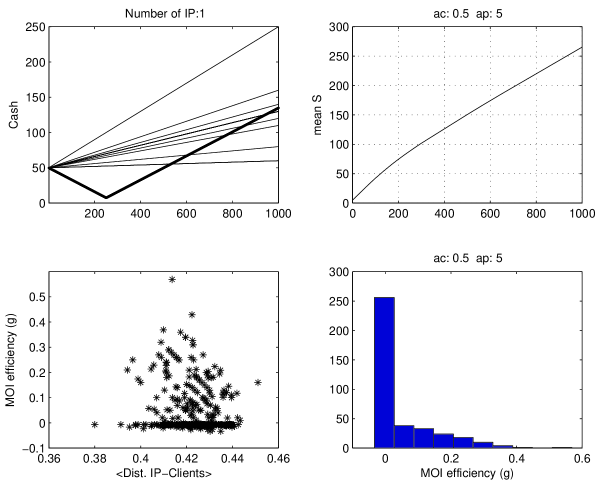

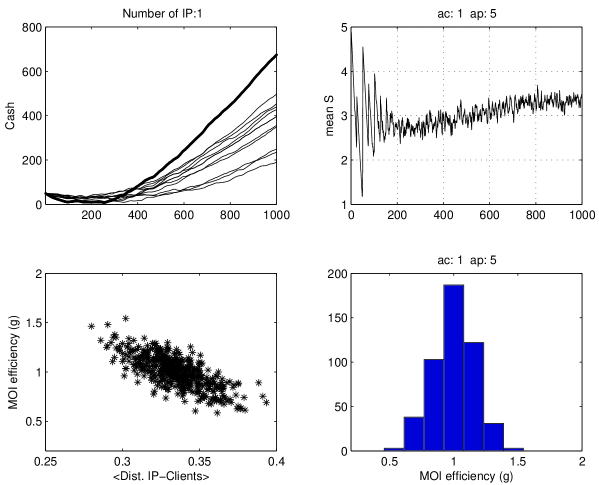

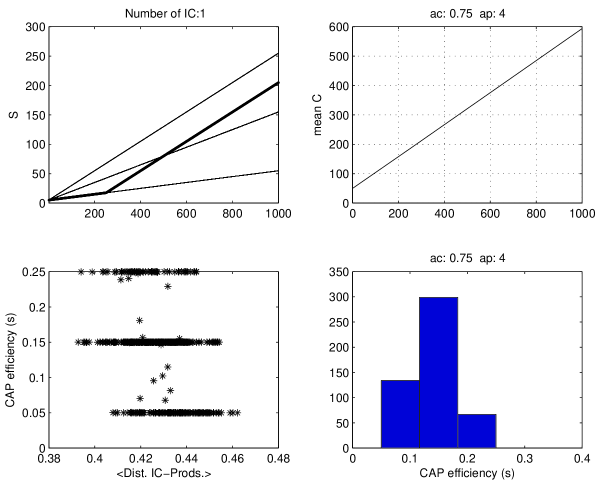

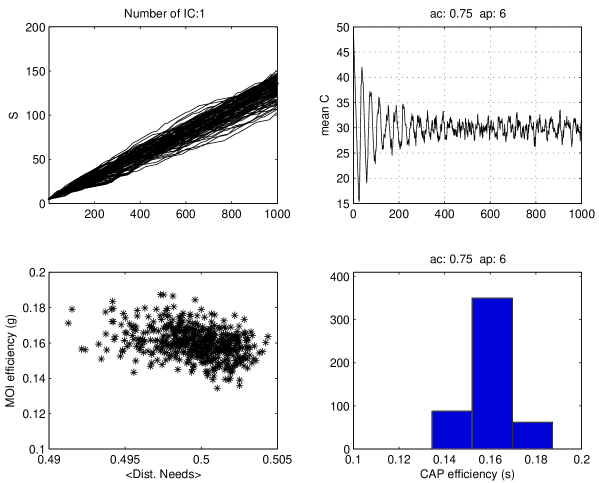

With and , some results are shown in Figs. 1 and 2 for and . At time the surviving producer with the lowest cash starts the market-oriented innovation process as defined above. The two upper plots in the figures show the cash evolution and the mean consumer satisfaction for a typical run. The bold line refers to the innovating producer. The lower plots are obtained with a large number of runs. The histograms in the lower right plots show that this type of innovation is much more efficient on a highly volatile environment () than in a stable consumer environment ().

We also found inverse correlation between MOI efficiency and the distance of the innovating producer () to the nearest consumers (clients). But the correlation is strong only in a volatile environment, as the lower left plot in Fig 2 shows. Simulations have also shown a negative correlation of the innovation efficiency () with the rate of gain before innovation and with the distance to the nearest competitor.

2.1.2 Stable and volatile environments with many innovating agents

Here the system was tested for different numbers of innovating producers (). When more than one producer is allowed to innovate, the innovation efficiency rate () is computed as the average value obtained for the set of innovating producers. In each simulation, the number of s is determined at random, being the innovating producers chosen among the poorest ones.

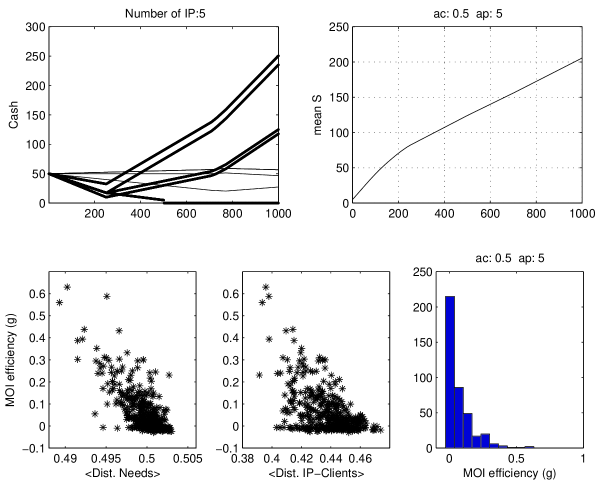

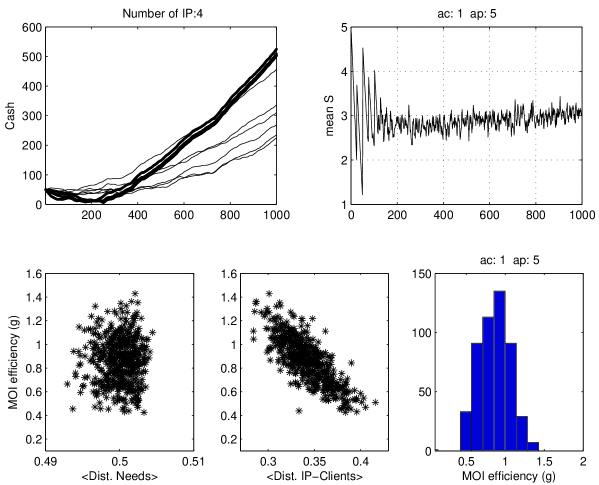

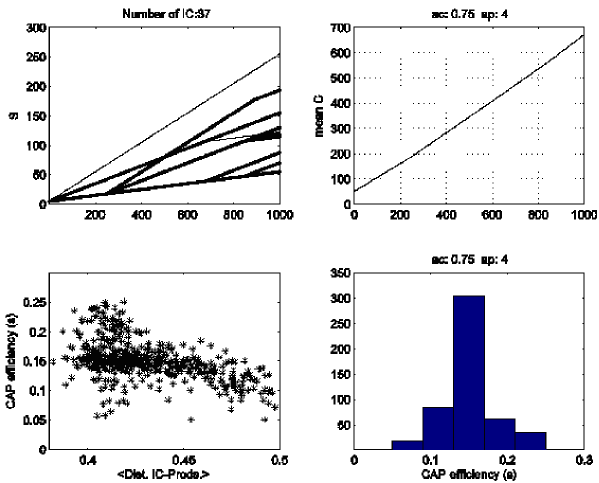

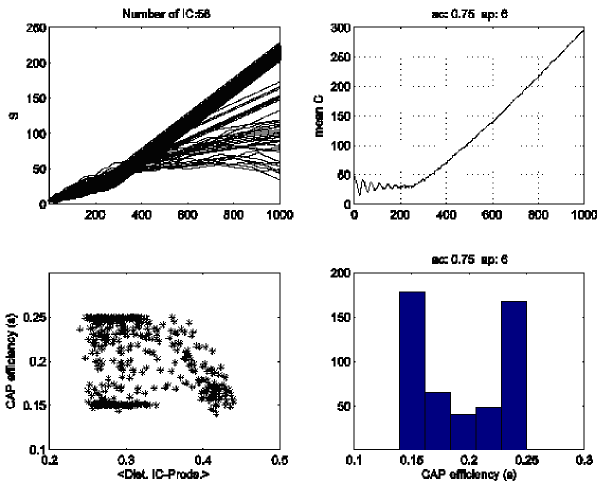

The results presented in the histograms of Figs. 3 and 4 show that Market-oriented innovation by more than one is also much more efficient in a volatile environment than in a stable one. On the relation between innovation efficiency and the structure of the environment, we found inverse correlation between MOI efficiency and the distance among consumer needs in the stable environments. The efficiency of this type of innovation is also inversely correlated to the distance among the innovating producers and their nearest consumers, but the correlation is strong only in volatile environments as the lower left plots in Fig. 4 show.

2.2 Evolution of needs and adaptation to available products

In this scenario, the model contains a mechanism for the evolution of the needs. This mechanism is one of partial adaptation or conformity with the available products (CAP). In this scenario producers and consumers with negative cash or satisfaction are replaced by new random ones.

2.2.1 One adapting consumer

When just one consumer is allowed to adapt, the model is implemented as follows: at each time step (after the exchanges) the less satisfied consumer finds the products that have a matching above a certain threshold and flips the (need) bit with the worst score when compared with the same position bit in the products.

The system is tested for different values of , allowing to simulate environments with different rates of replacement of producers. In this scenario, a producer only remains in the field as long as its capital () is positive; if it becomes negative, the producer is replaced by a new random producer.

A new efficiency rate () is then defined in order to compute the difference between the Satisfaction level of the innovating consumer () after and before innovation,

| (4) |

where and represent, respectively, the amount of Satisfaction (or energy) of the innovating consumer at the end of the simulation and at the start of the innovation process.

The results presented in the histograms of Figs.5 and 6 show that adaptation to the available products is equally efficient either for a small or a large rate of replacement of producers ( or , respectively).

We found inverse correlations between the satisfaction rate () and the distance between the and the overall set of producers in environments with a low rate of substitution of producers, as the lower left plot in Fig.5 shows. From the lower left plot in Fig.6 we see that when increases, there is a correlation between the satisfaction rate and the average distance between needs.

2.2.2 Many adapting consumers

Here, the model is tested with different quantities of innovating consumers. When more than one consumer is allowed to adapt, the satisfaction rate is computed as the average of the satisfaction rate for the set of the innovating consumers.

The results presented in the histograms of Figs. 7 and 8 show that adaptation to the available products by many innovating consumers is slightly more efficient in a market with a high rate of substitution of producers than in the case where the rate of replacement is low ().

The third plot in Fig. 7 shows a weak inverse correlation between the satisfaction rate and the distance between the s and the overall set of producers, in environments with a low rate of substitution of producers. When the environment has a high rate of substitution of producers, the third plot in Fig. 8 shows a weak negative correlation of the satisfaction rate with the distance between the s and the producers.

3 A self-organizing agent model: Innovation and emergent structures

Here we study a model where all agents have two strings, which as before we denote as the string and the string. Here however, rather than products and needs, as in the producers and consumers model, it is more appropriate to interpret the string as the code for the benefits (or energy) that the agent can extract from the environment (the other agents) and the string as a code for what the other agents may extract from him.

As before, the dynamical evolution is based on the matching of the and strings. Each agent has a fitness function which evolves as follows

| (5) |

denotes a sum over all the agents for which the string of has maximal matching . As before only one agent is chosen at random among those with maximal matching. denotes the maximal matching of the string of agent with the other agents. At time zero the and strings of all agents are chosen at random and the fitness is initialized to some fixed value . Whenever, during the time evolution, the fitness of one agent becomes negative, this agent is replaced by another random agent with the initial fitness.

One of the purposes of the study of this model is to show how, starting from a set of agents in identical conditions, the time evolution spontaneously creates fitness inequalities among them. How the structures are affected by innovation will also be studied. In the question of creation of structure in agent societies, an important issue is also how the evolution affects diversity.

Innovation in the model of this section is also an adaptation of the string to the strings. Two kinds of innovation are considered. In first (called innovation) each agent compares his string to the strings of the other agents having matchings above a threshold () and flips his worst scoring bit. Therefore innovation means that the agent tries to maximize what he receives from the other agents. In the second kind of innovation (called innovation) each agent tries to minimize the matching of his string with the strings of the other agents. At each time step, this is also done by flipping a bit, this time the bit that has the better matching. The meaning of innovation is that the agent tries to give the other agents as little as possible or, in a sense, that is trying to protect itself from the wearing out effects of the environment. In this model, whenever innovation is implemented, all agents are allowed to innovate, in line with the equal opportunity point of view of the model.

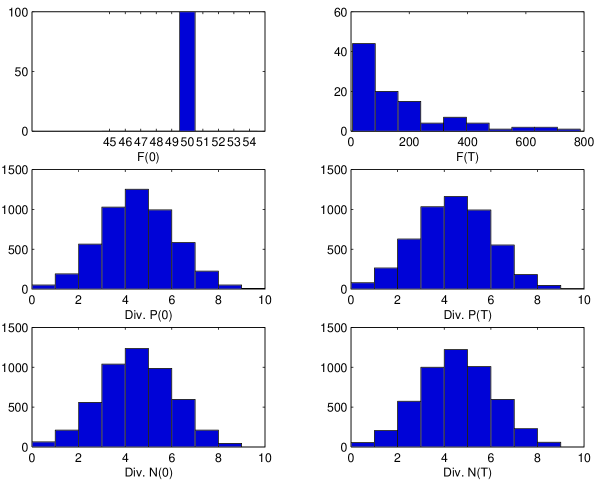

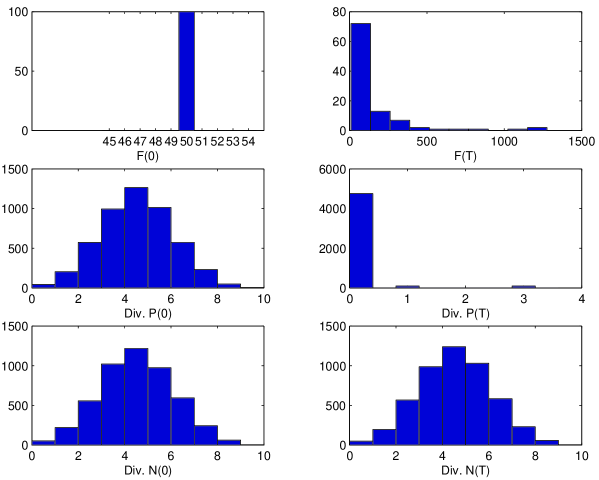

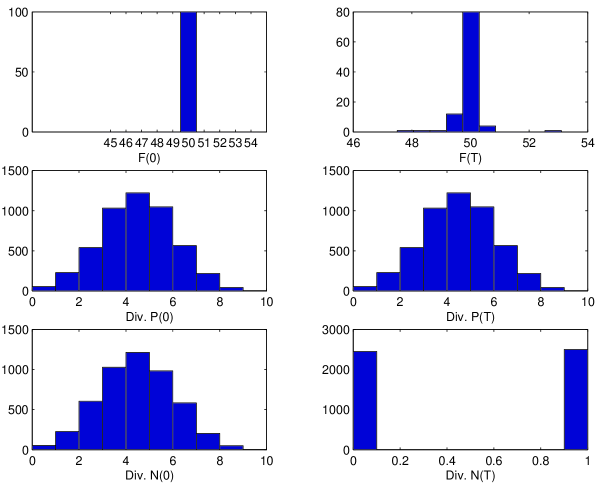

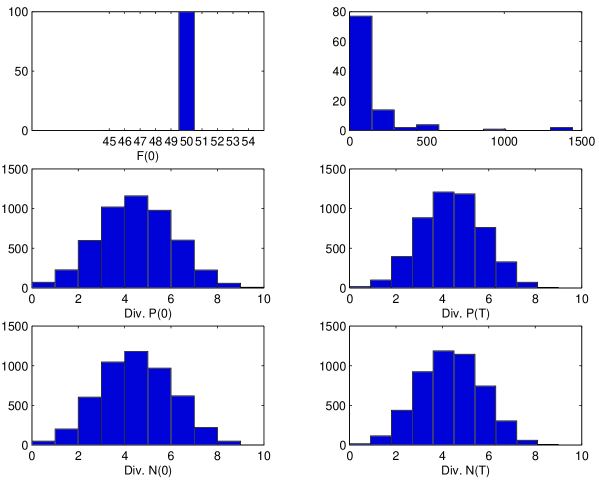

In the Figs. 9 to 12 we compare the situations in different scenarios. The two upper plots compare the histograms of the initial fitness and the fitness after time steps. The middle histograms compare the diversity of the strings at the initial time and at . Diversity of the strings is characterized by the histogram of their Hamming distances. The lower histograms contain a similar comparison for the strings. In all cases where innovation is implemented, .

Fig. 9 is the situation without innovation. Although all agents start with similar conditions a large stratification of fitnesses emerges as a result of the time evolution. The model shows how a well defined structure emerges from the dynamical evolution. Dynamics and random events generate inequality.

In Fig.10, innovation for all agents is implemented. One sees that the stratification effect is even stronger when this type of innovation is turned on. For the dynamics without innovation the string diversities at the initial time and at are similar. However, for the innovation case one sees a concentration of the strings around a dominant type. Inequality stratification is enhanced and diversity decreases.

In Fig.11, all agents perform innovation. Here one sees that the final fitnesses are not very different from the initial ones. The exchanges are minimized, and the most relevant structure that develops is a drastic reduction of diversity in the strings.

When both and innovation are implemented (Fig.12), both the diversity of the strings and the stratification of the fitnesses are restored. It is interesting to notice that in terms of the global parameters of agent’s society, the two types of innovation seem to cancel out and the results are similar to the situation without innovations.

4 Conclusions

A very general feature of any real world complex system is the fact that each agent can extract something from the environment (the other passive or active agents) and the other agents may extract something from him. This is the basic fact behind our and coding strings and their matching. This abstract coding allows to study general effects, independently of the particularities of each actual complex adaptive system. In addition to the dynamics of interaction, ruled by the matching of the strings, the actions of the agents in their adaptation to the environment is conveniently coded by the evolution of the bit strings.

In the first (consumers and producers) model, by separating the functionalities associated to the and strings, we were able to obtain very general conclusions about the effectiveness of the innovation mechanisms and how this effectiveness relates to the overall structure of the agents’ environment and their relation to it.

In the second model, the agents being equipped with both types of interactions with the environment, we obtained a clear manifestation of the fact that a simple dynamics of interaction creates strong structures in agent societies. On the other hand, active actions by the agents to improve their fitness create further structure and, in particular, have a strong effect on diversity. Therefore, the onset of these (innovation) actions at a particular time may be the driving mechanism for structural changes in actual real world situations.

References

- [1] A. Kirman; Economics and Complexity, Advances in Complex Systems 7 (2004) 139-155.

- [2] B. LeBaron; Agent based computational finance: suggested readings and early research, Journal of Economic Dynamics and Control 24 (2004) 679-702.

- [3] G. M. Grossman and E. Helpman; Innovation and Growth in the Global Economy, MIT Press, Cambridge, MA (1991).

- [4] R. R. Nelson and S. Winter; An evolutionary theory of economic change, The Belknap Press of Harvard University, London 1982.

- [5] L. E. Blume and S. N. Durlauf; The interactions-based approach to socioeconomic behavior, in Social Dynamics S. N. Durlauf and H. P. Young (Eds.), MIT and Brookings Institution Press 2000.

- [6] V. I. Danilov, G. A. Koshevoy and A. I. Sotskov; Equilibrium analysis of an economy with innovations, J. of Mathematical Economics 27 (1997) 195-228.

- [7] R. Dawid, M. Reiman and B. Bullnheimer; To Innovate or Not to Innovate?, IEEE Transactions on Evolutionary Computation 5, 471-481 (2001).

- [8] K. Atuahene-Gima; Market orientation and innovation, J. of Business Research 35 (1996) 93-103.

- [9] A. Johne; Using market vision to steer innovation, Technovation 19 (1999) 203-207.

- [10] George Group; “Smart Growth”: Innovating to meet the needs of the market without feeding the beast of complexity, http://knowledge.wharton.upenn.edu

- [11] W. E. Souder and X. M. Song; Contingent product design and marketing strategies influencing new product success and failure in U. S. and Japanese electronic firms, J. Prod. Innov. Manag. 14 (1997) 21-34.

- [12] W. Brian Arthur; The structure of invention, Research Policy 36 (2007) 274-287.

- [13] A. N. Afuah and N. Bahram; The hypercube of innovation, Research Policy 24 (1995) 51-76.

- [14] T. Padmore, H. Schuetze and H. Gibson; Modeling systems of innovation: An enterprise-centered view, Research Policy 26 (1998) 605-624.

- [15] S. Maslov and Y.-C. Zhang; Towards information theory of knowledge networks, arXiv:cond-mat/0104121.

- [16] S. März, M. Friedrich-Nishio and H. Grupp; Knowledge transfer in an innovation simulation model, Techno. Forecasting & Social Change 73 (2006) 138-152.

- [17] E. N. Kaufmann; The innovation enigma, Materials Chemistry and Physics 50 (1997) 120-123.

- [18] A. Kleinknecht (Ed.); Determinants of Innovation. The Message from New Indicators, Macmillan Press, London 1996.

- [19] J. L. Furman, M. E. Porter and S. Stern; The determinants of national innovative capacity, Research Policy 31 (2002) 899-933.

- [20] C. Montalvo; What triggers change and innovation, Technovation 26 (2006) 312-323.

- [21] C. O’Brien and S. J. E. Smith; Strategies for encouraging and managing technological innovation, Int. J. Production Economics 41 (1995) 303-310.

- [22] F. Damanpour and S. Gopalakrishnan; Theories of organizational structure and innovation adoption: the role of environmental change, J. Eng. Technolo. Manage. 15 (1998) 1-24.

- [23] G. Saint-Paul; On market forces and human evolution, J. of Theoretical Biology 247 (2007) 397-412.