Optimal quantization for the pricing of swing options

Abstract

In this paper, we investigate a numerical algorithm for the pricing of swing options, relying on the so-called optimal quantization method.

The numerical procedure is described in details and numerous simulations are provided to assert its efficiency. In particular, we carry out a comparison with the Longstaff-Schwartz algorithm.

Key words: Swing options, stochastic control, optimal quantization, energy.

Introduction

In increasingly deregulated energy markets, swing options arise as powerful tools for modeling supply contracts [14]. In such an agreement between a buyer and a seller, the buyer always has to pay some amount even if the service or product is not delivered. Therefore, the buyer has to manage his contract by constantly swinging for one state to the other, requiring delivery or not. This is the kind of agreement that usually links an energy producer to a trader. Numerous other examples of energy contracts can be modeled as swing options. From storages [6, 8] to electricity supply [17, 7], this kind of financial device is now widely used. And it has to be noticed that its field of application has recently been extended to the IT domain [12].

Nevertheless, the pricing of swings remains a real challenge. Closely related to a multiple stopping problem [10, 9], swing options require the use of high level numerical schemes. Moreover, the high dimensionality of the underlying price processes and the various constraints to be integrated in the model of contracts based on physical assets such as storages or gas fired power plants increase the difficulty of the problem.

Thus, the most recent technics of mathematical finance have been applied in this context; from trees to Least Squares Monte Carlo based methodology [25, 16, 18], finite elements [26] and duality approximation [20]. But none of these algorithms gives a totally satisfying solution to the valuation and sensitivity analysis of swing contracts.

The aim of this paper is then to introduce and study a recent pricing method that seems very well suited to the question. Optimal Vector Quantization has yet been successfully applied to the valuation of multi-asset American Options [2, 1, 3]. It turns out that this numerical technique is also very efficient in taking into account the physical constraints of swing contracts. For sake of simplicity we shall focus on gas supply contracts. After a brief presentation of such agreements and some background on Optimal Quantization methods [22], we show that a careful examination of the properties of the underlying price process can dramatically improve the efficiency of the procedure, as illustrated by several numerical examples.

The paper is organized as follows: in the first section, we describe in details the technical features of the supply contracts (with firm or penalized constraints) with an emphasis on the features of interest in view of a numerical implementation: canonical decomposition and normal form, backward dynamic programming of the resulting stochastic control problem, existence of bang-bang strategies for some appropriate sets of local and global purchased volume constraints. Section 2 is devoted to some background on optimal vector quantization. In Section 3, our algorithm is briefly analyzed and the a priori error bound established in the companion paper [4] is stated (as well as the resulting convergence result of the quantized premium toward the true one). In Section 4, numerous simulations are carried out and the quantization method is extensively compared to the well-known least squares regression algorithm “à la Longstaff-Schwartz”. An annex explains in details how the price processes we consider in this paper can be quantized in the most efficient way.

1 Introduction to swing options

1.1 Description of the contract

A typical example of swing option is an energy (usually gas or electricity) supply contract with optional clauses on price and volume. The owner of such a contract is allowed to purchase some amount of energy at time until the contract maturity , usually one year. The purchase price called strike price may be constant or indexed to past values of crude oil. Throughout the paper we will consider that the strike prices are constant and equal to over the term of the contract. The volume of gas purchased at time is subject to the local constraint

The cumulative volume purchased prior to time ( up to ) is defined by . It must satisfy the following global constraint (at maturity):

Two approaches can be considered:

– The constraints on the global purchased volumes are firm.

– A penalty is applied if the constraints are not satisfied.

The price at time of the forward contract delivered at time is denoted by , being a deterministic process (the future prices at time ) available and tradable on the market.

Let be the underlying Markov price process defined on a probability space . Note that it can be the observation at time of a continuous time process. Ideally should be the spot price process of the gas . However it does not correspond to a tradable instrument which leads to consider in practice the day-ahead contract .

We consider its (augmented) natural filtration

. The decision sequence is

defined on as well and is

-adapted, is

measurable,

. At time

the owner of the contract gets .

Remark 1.1.

The results of this paper can also be applied to every physical asset or contract where the owner reward for a decision is a function . In the case of supply contracts, . As for a storage, represents the amount of gas the owner of the contract decides to inject or withdraw and the profit at each date is then

where (resp. ) denotes the injection (resp. withdrawal) cost [6].

1.1.1 Case with penalties

We first consider that the penalties are applied at time if the terminal constraint is violated. For a given consumption strategy , the price is given by at time

where is the interest rate. The function is the penalization: and represents the sum that the buyer has to pay if global purchased volume constraints, say and , are violated. [6] have already investigated this kind of contract.

Then for every non negative measurable random variable (representing the cumulated purchased volume up to ), the price of the contract at time , is given by

| (1) |

The standard penalization function is as follows:

| (2) |

where and are large enough – often equal – positive real constants.

1.1.2 Case with firm constraints

If we consider that constraints cannot be violated, then for every non negative measurable random variable defined on , the price of the contract at time is given by:

| (3) |

where

At time , we have:

Note that this corresponds to the limit case of the contract with penalized constraints when . Furthermore, one shows that when the penalties in (2), the “penalized” price converge to the “firm” price. This has been confirmed by extensive numerical implementations of both methods. In practice when both methods become indistinguishable for usual values of the volume constraints.

1.2 Canonical decomposition and normalized contract

In this section we obtain a decomposition of the payoff of our swing contract (with firm constraints) into two parts, one having a closed form expression. It turns out that this simple decomposition leads to an impressive increase of the precision of the price computation. It plays the role of a variance reducer. Moreover, its straightforward financial interpretation leads to a better understanding of the swing contract.

In fact, we can distinguish a swap part and a normalized swing part:

where

and

| (5) |

The price models investigated in the following sections define the spot price as a process centered around the forward curve, and so is known for every . Thus, the swap part has a closed form given by

The adaptation to contracts with penalized constraints is straightforward and amounts to modifying the penalization function in an appropriate way.

1.3 Dynamic programming equation

In [6], it is shown that, in the penalized problem, optimal consumption is the solution of a dynamic programming equation.

Proposition 1.1.

Assume that for some positive constants p and C, the following inequality holds for any , and :

Then, there exists an optimal Markovian consumption given by the maximum argument in the following dynamic programming equation:

| (6) |

Usually, the function is given by (2). Then, the case with firm constraints corresponds to the limit case where .

When considering a contract with firm constraints, a more operating form (see [4]) can be the following

1.4 Bang Bang consumption

1.4.1 Case with penalties on purchased volumes

[6] showed the following theoretical result.

Theorem 1.2.

Consider the Problem 1 and , being a continuously differentiable function. If the following condition holds

the optimal consumption at time is necessarily of bang-bang type given by

The above assumption seems difficult to check since it involves the unknown optimal consumption. However, this would be the case provided one shows that the random variable is absolutely continuous as noticed in [6].

1.4.2 Case with firm constraints

In the companion paper [4], we establish some properties of the value function of the swing options viewed as a function of the global volume constraints . Thanks to (1.2) one may assume without loss of generality that the contract is normalized, and . We consider the following value function:

defined on the unit (upper) simplex .

Proposition 1.3.

The premium function is a concave, piecewise affine function of the global purchased volume constraints, affine on elementary triangles , , and , , which tile of the unit (upper) simplex.

Theorem 1.4.

For integral valued global constraints, , there always exists a bang-bang optimal strategy the a priori -valued optimal purchased quantities are in fact always equal to or .

Remark 1.2.

This result can be extended in some way to any couple of global constraints when all the payoffs are nonnegative (see [4]). Furthermore, it has nothing to do with the Markov dynamics of the underlying asset and holds in a quite general abstract setting.

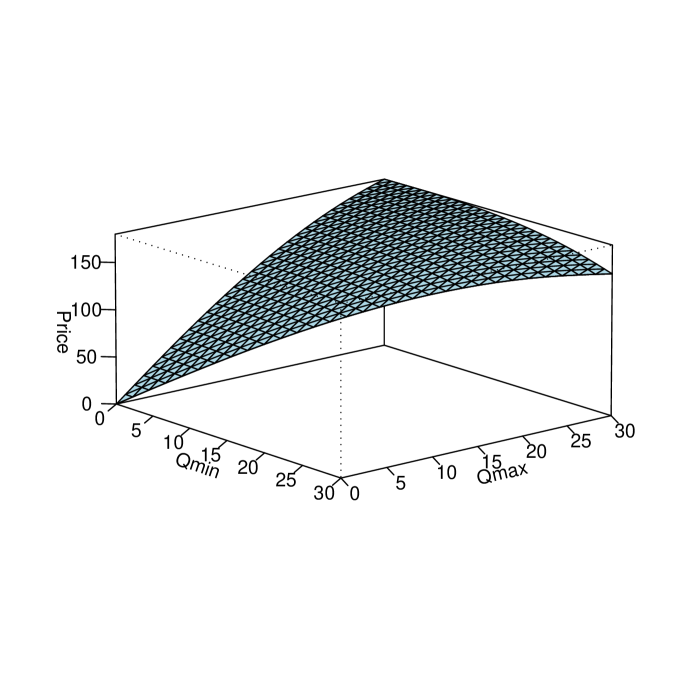

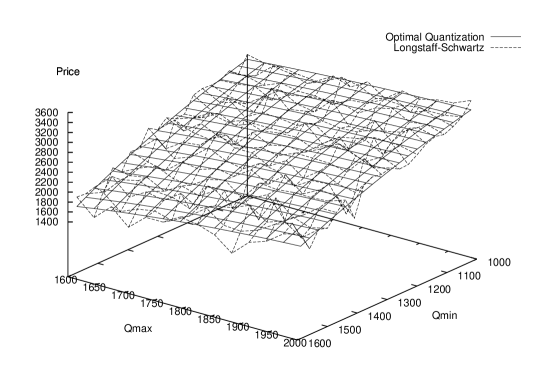

An example of the premium function is depicted on Figure 1.

Now we turn to the problem of the numerical evaluation of such contracts. As announced, we focus on an optimal quantization algorithm.

2 Optimal quantization

Optimal Quantization [21, 1, 2, 3] is a method coming from Signal Processing devised to approximate a continuous signal by a discrete one in an optimal way. Originally developed in the 1950’s, it was introduced as a quadrature formula for numerical integration in the late 1990’s, and for conditional expectation approximations in the early 2000’s, in order to price multi-asset American style options.

Let be an -valued random vector defined on a probability space . Quantization consists in studying the best approximation of by random vectors taking at most fixed values .

Definition 2.1.

Let . A partition of is a Voronoi tessellation of the -quantizer (or codebook; the term grid being used for ) if, for every , is a Borel set satisfying

where denotes the canonical Euclidean norm on .

The nearest neighbour projection on induced by a Voronoi partition is defined by

Then, we define an -quantization of by

The pointwise error induced when replacing by is given by . When has an absolutely continuous distribution, any two -quantizations are - equal.

The quadratic mean quantization error induced by the the -tuple is defined as the quadratic norm of the pointwise error .

We briefly recall some classical facts about theoretical and numerical aspects of Optimal Quantization. For details we refer to [15, 22].

Theorem 2.1.

[15] Let . The quadratic quantization error function

reaches a minimum at some quantizer . Furthermore, if the distribution has an infinite support then has pairwise distinct components and is decreasing to as .

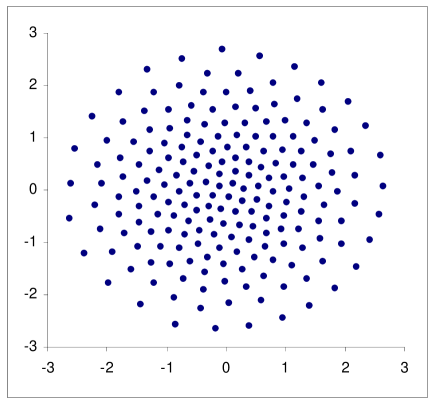

Figure 2 shows a quadratic optimal quantization grid for a bivariate normal distribution . The convergence rate to of optimal quantization error is ruled by the so-called Zador Theorem.

Theorem 2.2.

[15] Let , with , ( Lebesgue measure on ). Then

The true value of is unknown as soon as . One only knows that .

Zador’s Theorem implies that as .

Proposition 2.3.

The random vector takes its value in a finite space , so for every continuous functional with , we have

which is the quantization based quadrature formula to approximate [21, 22]. As is close to , it is natural to estimate by when is continuous. Furthermore, when is smooth enough, on can upper bound the resulting error using , or even (when the quantizer is stationary).

The same idea can be used to approximate the conditional expectation by , but one also needs the transition probabilities:

The application of this technique to the quantization of spot price processes is discussed in details in the Annex, page Optimal quantization for the pricing of swing options.

3 Pricing swing contracts with optimal quantization

3.1 Description of the algorithm (general setting)

In this section we assume that is a Markov process. For sake of simplicity, we consider that there is no interest rate. We also consider a normalized contract, as defined in Section 1.2.

In the penalized problem, the price of the swing option is given by the following dynamic programming equation (see Equation 6):

where , .

The bang-bang feature of the optimal consumption (see Section 1.4) allows us to limit the possible values of in the dynamic programming equation to . At time , possible values of the cumulative consumption are

| (8) |

At every time we consider a(n optimized) -quantization , based on an optimized quantization -tuple (or grid) of the spot .

The modeling of the future price by multi-factor Gaussian processes with memory (see Section 4 for a toy example) implies that is itself a Gaussian process. Then the quantization of can be obtained by a simple dilatation-contraction (by a factor ) from optimal quantization grids of the (possibly multivariate) normal distribution, to be downloaded on the website [23]

| www.quantize.maths-fi.com |

Then we compute the price at each time , for all points on the corresponding grid, and for all the possible cumulative consumptions:

| (9) |

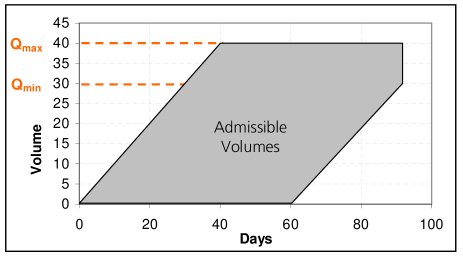

When considering a contract with firm constraints, we need to compute the price at each time , for all the points of the quantization grid of the spot price, and for all the admissible cumulative consumptions (See Figure 3)

| (10) |

Using the bang-bang feature (See section 1.4) and the dynamic programming principle (Equation 1.3), this price is given by

Since takes its values in a finite space, we can rewrite the conditional expectation as:

where

is the quantized transition probability between times and . The whole set of quantization grids equipped with the transition matrices make up the so-called “quantization tree”. The transition weights matrices are the second quantity needed to process the quantized dynamic programming principle (9 or 3.1). A specific fast parallel quantization procedure has been developed in our multi-factor Gaussian framework to speed up (and parallelize) the computation of these weights (see Annex). In a more general framework, one can follow the usual Monte Carlo approach described in [1] to compute the grids and the transition of the global quantization tree.

When has no longer a Markov dynamics but appears as a function of a Markov chain : , one can proceed as above, except that one has to quantize . Then the dimension of the problem (in term of quantization) is that of the structure process .

Of course one can always implement the above procedure formally regardless of the intrinsic dynamics of . This yields to a drastic dimension reduction (from that of downto that of ). Doing so, we cannot apply the convergence theorem (see Section 3.3) which says that in a Markovian framework the premium resulting from (9) or (3.1) will converge toward the true one as the size of the quantization grid goes to infinity.

3.2 Complexity

The first part of the algorithm consists in designing the quantization tree and the corresponding weights. The complexity of this step is directly connected to the size of the quantization grids chosen for the transitions computation in 1-dimension, or to the number of Monte Carlo simulations otherwise. However those probabilities have to be calculated once for a given price model, and then several contracts can be priced on the same quantization tree. So we will mainly focus on the complexity of the pricing part.

We consider a penalized normalized contract, and . The implementation of the dynamic programming principle requires three interlinked loops. For each time step (going backward from to ), one needs to compute for all the points , of the grid and for every possible cumulative consumption () (see (8)) the functional

which means computing twice a sum of terms.

Hence, the complexity is proportional to

In the case where all layers in the quantization tree have the same

size, , the complexity is

proportional to . This is not an optimal design

but only one grid needs to be stored. It is possible to reduce

the algorithm complexity by optimizing the grid sizes

111To minimize the complexity, set , which leads to a global

complexity proportional to (with the

constraint ), but it costs more memory space.

In the case of firm constraints, the dynamic programming principle (3.1) has to be computed for every admissible cumulative consumption, for every (, see (10)). The complexity is proportional to

The complexity in the case of firm constraints is lower than the one for a penalized problem, and depends on the global constraints . But the implementation is easier in the case of a penalized problem, because one does not need to check if the cumulative consumption volume is admissible. Both approaches have been numerically tested and results are indistinguishable for large enough penalties. For the implementation readiness, the approach with penalties has been adopted.

In order to reduce the complexity of the algorithm, one usually prunes the quantization tree. In most examples, at each layer , many terms of the transition matrix are equal to 0 or negligible. So while the transition probabilities are estimated, all the transitions that are not visited are deleted. This step is important because it allows to reduce significantly the algorithm complexity.

In practice we can even neglect transitions whose probability is very low, say less than .

3.3 Convergence

In [4] is proved an error bound for the pricing of swing options by optimal quantization.

Let denote the price of the swing contract at time . is the number of time step, and is the global constraint. We consider a contract with normalized local constraints, and . The “quantized” price is the approximation of the price obtained using optimal quantization.

Proposition 3.1.

Assume there is a real exponent such that the (-dimensional) Markov structure process satisfies

At each time , we implement a (quadratic) optimal quantization grid of size of . Then

where is the set of admissible global constraints (at time ).

In fact this error bound turns out to be conservative and several numerical experiments, as those presented in Section 4, suggest that in fact the true rate (for a fixed number of purchase instants) behaves like .

4 Numerical experiments

In this section the same grid size has been used at each time step, we always have . The results have been obtained by implementing the penalized problem and using the canonical decomposition (see Section 1.2).

4.1 The one factor model

Swing options are often priced using the least squares regression method “à la Longstaff-Schwartz” [19]. This section aims to compare our numerical results to those obtained with Longstaff-Schwartz method. We consider a one factor model, which corresponds to a one dimensional Markov structure process.

4.1.1 Quantization tree for a one dimensional structure process

We consider the following diffusion model for the forward contracts :

where is a standard Brownian motion. It yields:

where

Denote . The structure process can be quantized using the fast parallel quantization method described in the Annex (page Optimal quantization for the pricing of swing options). Let denote an (optimal) quantization grid of of size . We have to compute for every , and every , the following (quantized transition) probabilities:

| (12) |

where , and and are scalar coefficients that can be explicited.

This can be done by using quantization again and importance sampling as presented in the Annex, page Quantization of the Gaussian structure process (see (21)).

4.1.2 Comparison with the regression method

We first use the following parameters for the one factor model:

, , .

The following tables present the results obtained with Longstaff Schwartz and optimal quantization, for different strike values. Monte-Carlo sample paths have been used for Longstaff-Schwartz method and the confidence interval of the Monte Carlo estimate is given in the table. A -point grid has been used to quantize the spot price process, and the transitions have been computed with a -point grid. The local volume constraints and are set to and respectively .

We first consider a case without constraints (Table 1), which means that the swing option is a strip of calls, whose price is easily computed with the Black-Scholes formula.

| Longstaff-Schwartz | [32424,33154] | [21360,22127] | [11110,11824] | [3653,4109] |

|---|---|---|---|---|

| 10 point grid | 32726 | 21806 | 11311 | 3905 |

| 20 point grid | 32751 | 21834 | 11367 | 3943 |

| 50 point grid | 32759 | 21843 | 11380 | 3964 |

| 100 point grid | 32759 | 21843 | 11380 | 3964 |

| 200 point grid | 32761 | 21845 | 11382 | 3967 |

| Theoretical price | 32760 | 21844 | 11381 | 3966 |

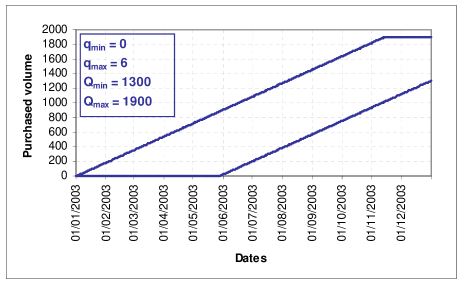

Table 2 presents the results obtained with the global constraints and . Volume constraints are presented on Figure 4.

| Longstaff-Schwartz | [29068,;29758] | [19318,;19993] | [10265,;10892] | [2482,;3038] |

|---|---|---|---|---|

| 10 point grid | 29696 | 20216 | 10981 | 3067 |

| 20 point grid | 29494 | 20018 | 10841 | 2863 |

| 50 point grid | 29372 | 19895 | 10729 | 2718 |

| 100 point grid | 29348 | 19872 | 10704 | 2687 |

| 200 point grid | 29342 | 19866 | 10698 | 2680 |

The results seem consistent for both methods, the price given by quantization always belongs to the confidence interval of the Longstaff-Schwartz method. One can note that it is true even for small grids, which means that quantization gives quickly a good price approximation. Moreover, the price given by quantization is very close of the theoretical price in the case of a call strip.

4.1.3 Execution time

In this section are compared the execution times to price swing options using optimal quantization and Longstaff-Schwartz method.

The size of the quantization grid is for the pricing part and

for the transitions computation. And Monte Carlo

simulations are used. The maturity of the contract is one year.

The computer that has been used has the following characteristics:

Processor: Celeron; CPU 2,4 Ghz; 1,5 Go of RAM; Microsoft Windows 2000.

The execution times given in Table 3 concern

the pricing of one contract, which yields the building of the

quantization tree and the pricing using dynamic programming for

quantization.

| Longstaff-Schwartz | Quantization: | Quantization: |

| Quantization tree building + Pricing | Pricing only | |

| 160 s | 65 s | 5 s |

If we consider the pricing of several contracts, there is no need for re computing the quantization tree if the underlying price model has not changed. That is why quantization is really faster than Longstaff-Schwartz in this case, as one can note from the results presented in Table 4.

| Longstaff-Schwartz | Quantization |

| 1600 s | 110 s |

4.1.4 Sensitivity Analysis

When contracts such as swing options ought to be signed, negotiations usually concern the volume constraints. That is why the valuation technique has to be very sensitive and coherent to constraints variation. In this section we will compare the sensibility to global constraints for Longstaff-Schwartz method and optimal quantization.

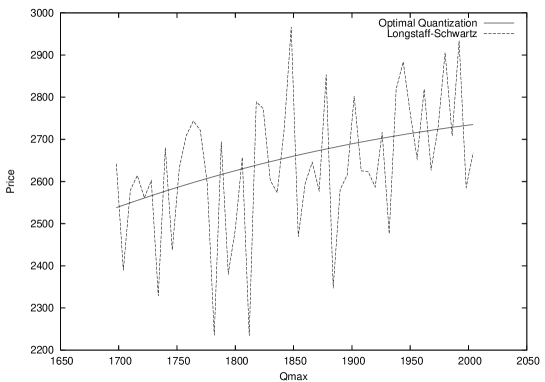

Figure 5 represents the price of the contract with regards to the global constraints and , and Figure 6 represents the price versus for a fixed value of equal to .

One can notice that the surface obtained with optimal quantization is very smooth. If increases, the price increases. However, it is not always true with Longstaff-Schwartz because of the randomness of the method, and the limited number of Monte Carlo simulations imposed by the dimension of the problem and the number of time steps.

New Monte Carlo simulations are done for each different contract, each time or varies. Of course, the same simulations could be used to price all the contracts, but unfortunately these simulations could be concentrated in the distribution queues and give a price far from the real one for all the contracts. As concerns quantization, the grid is build in order to give a good representation of the considered random variable. One of the great advantages of optimal quantization over Monte-Carlo is that this first algorithm always approximates the whole distribution of the payoff meanwhile it can take a while before Monte-Carlo explores some parts of it.

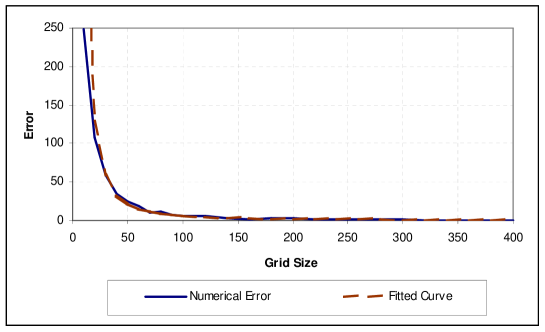

4.1.5 Convergence

In this section we will study the convergence

of the quantization method. We focus on the convergence of the

pricing

part of the algorithm.

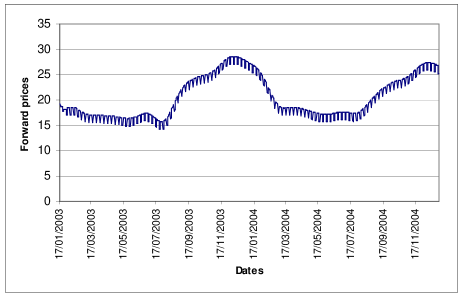

We consider a one year maturity contract with the volume constraints depicted on Figure 4, and the daily forward curve depicted on Figure 7.

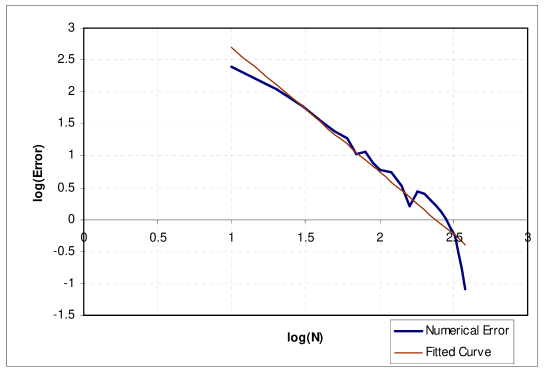

Let be the price obtained for a quantization grid of size , the error has been computed as . We assume that the error can be written as a functional of the grid size with the following shape:

A linear regression in a logarithmic scale is done to find the

functional that best fits the empirical error. The

coefficient obtained is .

Figures 8 and 9 show the obtained numerical convergence and the corresponding fitted functional.

The same experiments have been done for other contracts, results are presented in Table 5. and are set to and .

| Forward Curve | Strike | Constraints () | Estimated |

|---|---|---|---|

| Figure 7 | 20 | 1300-1900 | 1.96 |

| Flat (20) | 20 | 1300-1900 | 2.07 |

| Flat (20) | 10 | 1300-1900 | 2.32 |

| Flat (20) | 20 | 1000-2000 | 1.95 |

| Flat (20) | 20 | 1600-1800 | 2.26 |

We can conclude that the convergence rate of the quantization algorithm for pricing swing options is close to . This convergence rate is much better than Monte-Carlo, and leads to think that optimal quantization is an efficient alternative to Longstaff-Schwartz method for this problem.

4.2 Two factor model

We consider the following diffusion model for the forward contracts :

where and are two Brownian motions with correlation coefficient .

Standard computations based on Itô formula yield

where

Unlike the one factor model, the spot price process obtained from the two factor model is not a Markov process. Hence the dynamic programming equation (6) cannot be used directly. However, the structure process of the two factor model (See Annex, page Example: Two factor model)

is a Markov process, and where is a continuous function. So we can rewrite the dynamic programming equation as follows:

| (13) |

Then we need to quantize the valued structure process . This can be done using the Fast Parallel Quantization (See Annex). The transitions are computed using Monte Carlo simulations and importance sampling (see (19)).

4.2.1 Call strip

We first consider a case without constraints, and compare the results with the theoretical price of the call strip, for several values of the strike . The maturity of the contract is one month. Transitions have been computed with of Monte-Carlo simulation. The parameters of the two factor model are:

| (14) |

Table 6 presents the results obtained for a strip of call. Even if the quantized process is taking values in , prices are close to the theoretical price even for small grids.

| Theoretical Price | 2700 | 1800.21 | 924.46 | 268.59 |

|---|---|---|---|---|

| 50 point grid | 2695.26 | 1795.26 | 918.18 | 261.06 |

| 100 point grid | 2699.79 | 1799.89 | 923.64 | 267.17 |

| 200 point grid | 2697.67 | 1797.83 | 921.94 | 266.71 |

| 300 point grid | 2702.02 | 1800.16 | 924.40 | 268.52 |

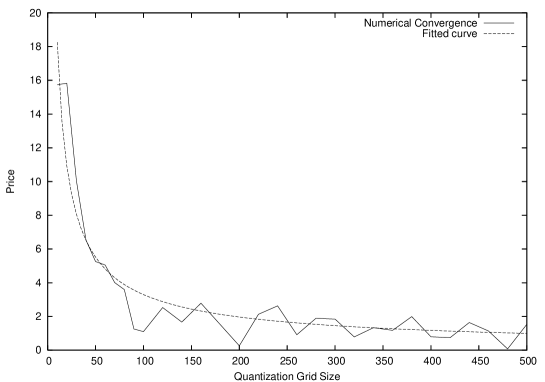

4.2.2 Convergence

We use the same procedure as in section 4.1.5 to find the functional that best fits the empirical error.

Figure 10 shows an example of the empirical error and table 7 gather the values of obtained for different contracts. The contract maturity has been set to one month.

| Forward Curve | Strike | Constraints () | Estimated |

|---|---|---|---|

| Flat (20) | 10 | 80-140 | 1.26 |

| Flat (20) | 20 | 80-140 | 1.00 |

| Flat (20) | 20 | 30-170 | 0.67 |

| Flat (20) | 20 | 100-120 | 1.19 |

The convergence of the quantization algorithm is close to . The convergence rate is linked to the dimension of the structure process, and from the results obtained in section 4.1.5 and in this section, we can assume that the convergence rate is close to , which is better than the error bound theoretically established in Section 3.3.

4.3 Dimension reduction

In the case of multi-factorial models, we need to quantize the structure process instead of the spot process in order to work with a Markov process (See section 4.2). Only the one factor model is Markovian. That is why quantization and Longstaff-Schwartz method have been compared just for this model. Longstaff Schwartz method also requires a Markov underlying process.

From an operational point of view, it is interesting to study the results obtained by formally quantizing the spot process , regardless to its dynamics, and using the approximation

for any random variable , even if the spot price is not a Markov process. Similar approximation has already been proposed by Barraquand-Martineau in [5]. Numerical tests have shown that the resulting prices remain very close to those obtained by quantizing the structure process in the case of a two factor model. Execution time and convergence rate are significantly faster, and the quantization tree can be computed as presented in the Annex page Quantization of the Gaussian structure process using Equation (21).

Even if there is no theoretical evidence on the error, this approach seems useful to get quick results. Table 8 presents some results, parameters of the two factor model are those of (14) and volume constraints are represented on Figure 4.

| Quantized Process | ||||

|---|---|---|---|---|

| Spot Price | 30823.38 | 21414.30 | 13021.87 | 5563.68 |

| Structure Process | 30705.78 | 21518.75 | 13123.56 | 5722.89 |

The convergence rate obtained in this case is always , which is consistent with the general rate , because the quantized process is -valued.

Therefore, even if the spot process is not Markov, the quantization method can be performed all the same way as if it were, with small damage in practice. This is of course not a general consideration but rather an observation over the considered problem. The dramatic increase in the computation effort that can be gained from this observation can justify in this case a lack of formal rigor.

Conclusion

In this article, we have introduced an optimal quantization method

for the valuation of swing options. These options are of great

interest in numerous modeling issues of the energy markets and their

accurate pricing is a real challenge.

Our method has been compared to the famous Longstaff-Schwartz

algorithm and seems to perform much better on various examples. In

fact, the optimal quantization method shares the good properties of

the so called tree method but is not limited by the dimension of the

underlying. Moreover, specific theoretical results provide a

priori estimates on the error bound of the method.

Thus, optimal quantization methods suit very well to the valuation

of complex derivatives and further studies should be done in order

to extend the present results to other structured products arising

in the energy sector.

References

- [1] Bally V., Pagès G. (2001). A quantization algorithm for solving multi-dimensional optimal stopping problems, Bernoulli, 6(9), 1-47.

- [2] Bally V., Pagès G. (2003). Error analysis of the quantization algorithm for obstacle problems, Stochastic Processes & Their Applications, 106(1), 1-40.

- [3] Bally V., Pagès G., Printems J. (2005). A quantization tree method for pricing and hedging multi-dimensional American options, Mathematical Finance, 15(1), 119-168.

- [4] Bardou O., Bouthemy S., Pagès G. (2007). Pricing swing options using Optimal Quantization, pre-print LPMA-1141.

- [5] Barraquand J. and Martineau D., (1995). Numerical valuation of high dimensional multivariate American securities, Journal of Financial and Quantitative Analysis 303, 383-405.

- [6] Barrera-Esteve C., Bergeret F., Dossal C., Gobet E., Meziou A., Munos R., Reboul-Salze D. (2006). Numerical methods for the pricing of swing options: a stochastic control approach, Methodology and Computing in Applied Probability.

- [7] Carmona R. and Ludkovski M. (2007). Optimal Switching with Applications to Energy Tolling Agreements, pre-print.

- [8] Carmona R. and Ludkovski M. (2005). Gas Storage and Supply Guarantees : An Optimal Switching Approach, pre-print.

- [9] Carmona R. and Dayanik S. (2003). Optimal Multiple-Stopping of Linear Diffusions and Swing Options, pre-print.

- [10] Carmona R. and Touzi N. (2004). Optimal multiple stopping and valuation of swing options, Mathematical Finance, to appear.

- [11] Clewlow L., Strickland C. and Kaminski V. (2002). Risk Analysis of Swing Contracts, Energy and power risk management.

- [12] Clearwater S. H. and Huberman B. A. (2005). Swing Options : a Mechanism for Pricing It Peak Demand

- [13] Eydeland A. and Wolyniec K. (2003). Energy and Power Risk Management, Wiley Finance

- [14] Geman H. (2005). Commodities and commodity derivatives - Modeling and Pricing for Agriculturals, Metals and Energy, Wiley Finance.

- [15] Graf S., Luschgy H. (2000). Foundations of Quantization for Probability Distributions. Lect. Notes in Math. 1730, Springer, Berlin.

- [16] Jaillet P., Ronn E.I., Tompaidis (2004). Valuation of Commodity-Based Swing Options, Management Science, 50, 909-921.

- [17] Keppo J. (2004). Pricing of Electricity Swing Options, Journal of Derivatives, 11, 26-43.

- [18] Lari-Lavassani A., Simchi M., Ware A. (2001). A discrete valuation of Swing options, Canadian Applied Mathematics Quarterly, 9(1), 35-74.

- [19] F. Longstaff and E.S. Schwartz (2001). Valuing American Options by Simulation: A Simple Least Squares Approach, The Review of Financial Studies, 14, 113-147.

- [20] Meinshausen N. and Hambly B.M. (2004). Monte Carlo methods for the valuation of multiple exercise options, Mathematical Finance , 14, .

- [21] Pagès G. (1998). A space vector quantization method for numerical integration, J. Computational and Applied Mathematics, 89, 1-38.

- [22] Pagès G., Pham H., Printems J. (2004). Optimal quantization methods and applications to numerical problems in finance, Handbook of Numerical Methods in Finance, ed. S. Rachev, Birkhauser, 253-298.

- [23] Pagès G. and Printems J. (2005). www.quantize.maths-fi.fr, website devoted to quantization, maths-fi.com

- [24] Ross S.M. and Zhu Z. (2006). Structure of swing contract value and optimal strategy, The 2006 Stochastic Modeling Symposium and Investment Seminar, Canadian Institute of Actuaries

- [25] Thompson A.C. (1995). Valuation of path-dependent contingent claims with multiple exercise decisions over time: the case of Take or Pay. Journal of Financial and Quantitative Analysis, 30, 271-293.

- [26] Winter C. and Wilhelm M. (2006). Finite Element Valuation of Swing Options, pre-print.

- [27] Zador P.L. (1982). Asymptotic quantization error of continuous signals and the quantization dimension, IEEE Trans. Inform. Theory, 28, Special issue on quantization, A. Gersho & R.M. Grey eds, 139-149.

Annex: Fast Parallel quantization (FPQ)

In this annex we propose an efficient method to quantize a wide family of spot price dynamics . To be precise we will assume that a time discretization being fixed,

| (15) |

where is a -valued Gaussian auto-regressive process and a family of continuous functions. The fast quantization method applies to the Gaussian process . We will apply it to a scalar two factor model in full details. As a conclusion to this section we will sketch the approach to a multi-factor model.

Quantization of the Gaussian structure process

We consider a centered Gaussian first order auto-regressive process in :

| (16) |

where , lower triangular, and

i.i.d. with distribution.

Denote by the covariance matrix of . We have :

Denote the lower triangular matrix such that .

We consider for every , an optimal (quadratic) quantizer of size , for the distribution. The quantization grid of the random variable is taken as a dilatation of ,

To calculate the conditional expectations in the dynamic programming equation, we need to get the following transition probabilities:

where denotes the -th Voronoi cell of the generic quantizer . Then

with . This probability is provided as a companion parameter with the normal distribution grid files (available on [23]).

To get the transition probability we need to compute

Proposition 4.1.

Let be a discrete time process described as above. Let , be two gaussian random variables . Then we have for every , every , every ,

| (17) |

where and are matrices whose coefficients depend on , and on the matrices , . If ,

| (18) |

Proof.

We have:

We consider the couple . is independent of . Let a couple of independent Gaussian random vectors: . Then and

Setting

we get

If and , the quantity

is given as a companion parameter with the quantization grids of the normal distribution. ∎

Remark 4.1.

Equation (17) emphasizes the fact that the transitions can be computed in parallel.

Remark 4.2.

To simplify the structure of the quantization tree we propose to consider the same normalized grid of size at each step but other choices are possible like those recommended in [1].

Numerical methods

Hereafter we will focus on the numerical computation of these transitions.

The standard Monte Carlo approach The simplest way is to use a Monte Carlo method. One just needs to simulate couples of independent gaussian random variables . This approach can be used whatever the dimension of the random variables and is. It can clearly be parallelized as any MC simulation but fail to estimate the transition form states which are not often visited.

Fast Parallel Quantization Method In order to improve the accuracy, especially for the points of the grids which are rarely reached by the paths starting from the cell of , it is possible to perform importance sampling. The idea is to use Cameron-Martin formula to re-center the simulation: for every and every ,

| (19) |

Then these expectations can be computed by Monte Carlo simulations, the transitions between the different times steps can be computed in parallel.

Quantized Parallel Quantization Method If , the transitions can be computed using again optimal quantization, because in low dimension (say ), quantization converges faster than Monte Carlo method. In this case, we have to compute a two dimensional expectation.

We estimate for every , every and every the following probabilities:

| (20) |

where , and and are scalar coefficients satisfying :

To alleviate notations, we temporarily set and .

We define (the same shortcut is implicitly defined for ).

In order to reduce the problem dimension, it is possible to write the probability as a double integral, and to integrate first with respect to the second variable by using Fubini theorem:

where is the distribution function of the normal distribution.

Importance sampling can again be used to improve the results precision. Eventually we have to compute the following one dimensional expectation:

| (21) |

For this one-dimensional expectation computation, quantization can be used again since it converges faster than Monte Carlo method.

Example: Two factor model

We consider the following diffusion model for the forward contracts :

where and are two Brownian motions with correlation coefficient .

Standard computations based on Itô formula yield

where

We have , where is the following structure process:

| (22) |

Proposition 4.2.

Let be an Ornstein-Uhlenbeck process. where is a standard Brownian motion, and is Gaussian and independent of . can be written at discrete times as a first order auto-regressive process:

| (23) |

where is i.i.d and .

is made up with two Ornstein-Uhlenbeck processes. Using Proposition 4.2, it yields:

Proposition 4.3.

with i.i.d. and

Hence it is possible to use the fast parallel quantization method described in section Quantization of the Gaussian structure process.

General multi-factor Gaussian model

More generally, we consider a family of price dynamics that can be written as follows:

| (24) |

where is a polynomial function of degree , for every , and is a Brownian motion, with .

The two factor model (Section Example: Two factor model) corresponds to , , .

In order to price a swing option with such a model, we first need to quantize it. Equation (24) yields:

| (25) |

where

Practically we focus on the spot price or the day-ahead contract . Unfortunately these processes are not Markovian in a general setting, except when and (Ornstein-Uhlenbeck process).

We consider a discretization time step , and we set, for all and for all

Proposition 4.4.

is a -valued gaussian AR(1).

Lemma 4.5.

Let , and . Then is a basis of .

Proof.

Using a dimension argument, only the linear independence of the family has to be checked. And we have

Since is a basis of , it yields

so that since (Vandermonde determinant). ∎

Proof.

Finally we have

where

and

where is independent of . The process is thus a gaussian AR(1). ∎

is the structure process for the spot price . Its dimension is . For the two factor model, the structure process is -valued, because , and . This is coherent with (22).