Kolkata Restaurant Problem as a generalised El Farol Bar Problem

Abstract

Generalisation of the El Farol bar problem to that of many bars here leads to the Kolkata restaurant problem, where the decision to go to any restaurant or not is much simpler (depending on the previous experience of course, as in the El Farol bar problem). This generalised problem can be exactly analysed in some limiting cases discussed here. The fluctuation in the restaurant service can be shown to have precisely an inverse cubic behavior, as widely seen in the stock market fluctuations.

I Introduction

The observed corrlated fluctuations in the stock markets, giving power law tails for large fluctuations (in contrast to the traditionally assumed exponentially decaying Gaussian fluctuations of random walks), were schematically incorporated in the El Farol Bar problem of Arthur BKC:Arthur:1994 . Here the decision to occupy the bar (buy the stock) or to remaing at home (sell the stock) depends on the previous experience of the “crowd” exceeding the threshold (of pleasure or demand level) of the bar (stock), and the strategies available. The resulting Minority Game models BKC:ChalletMarsiliZhang:2005 still fail to get the ubiquitus inverse cubic law of stock fluctuations BKC:MantegnaStanleyEconophys:1999 . In the Fiber Bundle models BKC:LNP705:2006 of materials’ fracture, or in the equivalent Traffic Jam models BKC:Chakrabarti:2006 , the fibers or the roads fail due to load, exceeding the (preassigned) random threshold, and the extra load gets redistributed in the surviving fibers or roads; thereby inducing the corelations in the fluctuations or “avalanche” sizes. The avalanche distribution has a clear inverse cubic power law tail in the “equal load sharing” or “democratic” fiber bundle model BKC:Pradhan:2002 ; BKC:Pradhan:2007 .

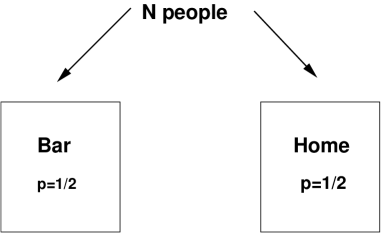

In the El Farol Bar problem BKC:Arthur:1994 , the Santa Fe people decide whether to go to the bar this evening, based on his/her experince last evening(s). The bar can roughly accommodate half the poulation of the (100-member strong) Institute and the people coming to the bar still enjoy the music and the food. If the crowd level goes beyond this level, people do not enjoy and each of those who came to the bar thinks that they would have done better if they stayed back at home! Clearly, people do not randomly choose to come to the bar or stay at home (as assumed in a random walk model); they exploit their past experience and their respective strategy (to decide on the basis of the past experience). Of course the people here are assumed to have all the same informations at any time (and their respective personal experiences) available to decide for themselves independently and parallely; they do not organise among themselves and go to the bar! Had the choice been completely random, the occupation fluctuation of the bar would be Gaussian. Because of the processes involved in deciding to go or not, depending on the respective experience, the occupation fluctuation statistics changes. The “minority” people win such games (all the people “lose” their money if the bar gets “crowded”, or more than the threshold, say, 50 here); the bar represents either the “buy” or “sell” room and the (single) stock fluctuations are expected to be represented well by the model. The memory size and the bag of tricks for each agent in the Minority Game model made this process and the resulting analysis very precise BKC:ChalletMarsiliZhang:2005 . Still, as we mentioned earlier, it cannot explain the origin of the ubiquitous inverse cubic law of fluctuations (see e.g. BKC:MantegnaStanleyEconophys:1999 ).

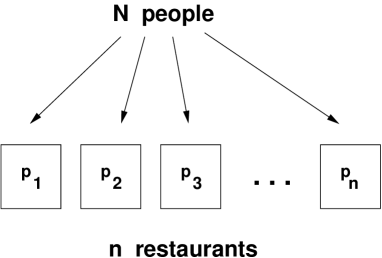

We extend here this simple bar problem to many bars (or from single stock to many), and define the Kolkata Restaurant problem. The number of restaurants in Kolkata, unlike in Santa Fe, are huge. Their (pleasure level) thresholds are also widely distributed. The number of people, who choose among these restaurants, are also huge! Additionally, we assume that the decision making part here in the Kolkata Restaurant problem to be extremely simple (compared to the El Farol bar problem): if there had been any “bad experience” (say, crowd going beyond threshold level) in any restaurant any evening, all those who came there that evening avoid that one for a suitably chosen long time period () and starting next evening redistribute this extra crowd or load equally among the rest of the restaurants in Kolkata (equal or democratic crowd sharing). This restaurant or the stock fails (for the next evenings). As mentioned before, this failure will naturally increase the crowd level in all the other restaurants, thereby inducing the possibility of further failure of the restaurants in service (or service stocks). If is finite but large, the system of restaurants in Kolkata would actually organise itself into a “critical” state with a robust and precise inverse cubic power law of (occupation or in-service number) fluctuation. This we will show here analytically.

II Model

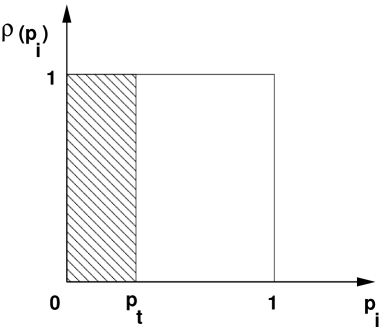

Let represent the number of restaurants in Kolkata. They are certainly not identical in their size and comfort threshold levels. let denote respectively the crowd threshold levels of these restaurants. If, in any evening, the crowd level in the th restaurant exceeds , then all the number (fraction, when normalised) of persons coming to the th restaurant that evening decide not to come to that restaurant for the next evenings, and the th restaurant goes out of service for the next evenings (because others got satisfaction from the restaurants they went last evening, and therefore do not change their choice). If is the total number (assumed to be large and fixed) of people regularly going to various restaurants in Kolkata, and if we assume that people choose completely randomly among all the restaurants in service (democratic or equal load sharing hypothesis and “knowledge” of the “in-service” restaurants available to everybody), the “avalanches” dynamics of these restaurants to fall out of service, can be analytically investigated if and the threshold crowd level distribution for the restaurants are known (see Figs. 1 and 2).

III Avalanche Dynamics: Infinite

This avalanche dynamics can be represented by recursion relations in discrete time steps. Let us define to be the fraction of in-service restaurants in the city that survive after (discrete) time step (evenings), counted from the time when the load or crowd (at the level ) is put in the system (time step indicates the number of crowd redistributions). As such, for all and for for any ; for if , and for if .

If is measured in the unit of the crowd threshold of the biggest restaurant in Kolkata, or in other words, if is normalised to unity and is assumed to be uniformly distributed as shown in Fig. 3 (and as mentioned), then follows a simple recursion relation (cf. BKC:LNP705:2006 ; BKC:Chakrabarti:2006 )

| (1) |

In equilibrium and thus (1) is quadratic in :

The solution is

Here is the critical value of crowd level (per restaurant) beyond which the system of (all the Kolkata) restaurants fails completely. The quantity must be real valued as it has a physical meaning: it is the fraction of the restaurants that remains in service under a fixed crowd or load when the load per restaurant lies in the range . Clearly, . The solution with () sign is therefore the only physical one. Hence, the physical solution can be written as

| (2) |

For we can not get a real-valued fixed point as the dynamics never stops until when the network of restaurants get completely out of business!

III.1 Critical Behavior

III.1.1 At

It may be noted that the quantity behaves like an order parameter that determines a transition from a state of partial failure of the system (at ) to a state of total failure (at ) :

| (3) |

To study the dynamics away from criticality ( from below), we replace the recursion relation (1) by a differential equation

Close to the fixed point we write + (where ). This gives

| (4) |

where . Thus, near the critical point (for jamming transition) we can write

| (5) |

Therefore the relaxation time diverges following a power-law as from below.

One can also consider the breakdown susceptibility , defined as the change of due to an infinitesimal increment of the traffic stress

| (6) |

Hence the susceptibility diverges as the average crowd level approaches the critical value .

III.1.2 At

At the critical point (), we observe a different dynamic critical behavior in the relaxation of the failure process. From the recursion relation (1), it can be shown that decay of the fraction of restaurants that remain in service at time follows a simple power-law decay:

| (7) |

starting from . For large (), this reduces to ; ; a power law, and is a robust characterization of the critical state.

III.2 Universality Class of the Model

The universality class of the model can be checked [4] taking two other types of restaurant capacity distributions : (I) linearly increasing density distribution and (II) linearly decreasing density distribution of the crowd fraction thresholds within the limit and . One can show that while changes with different strength distributions ( for case (I) and for case (II), the critical behavior remains unchanged: , for all these equal crowd or load sharing models.

III.3 Fluctuation or Avalanche Statistics

For , the avalance size can be defined as the fraction of restaurants falling out of service for an infinitesimal increase in the global crowd level (c.f. BKC:Pradhan:2002 )

| (8) |

With taken from (2), we get

If we now denote the avalanche size distribution by , then measures along the versus curve in (8). In other words BKC:Pradhan:2002 ; BKC:Pradhan:2007

| (9) |

IV Avalanche Dynamics: Finite

The above results are for , i.e, when any restaurant fails to satisfy its customers, it falls out of business, and customers never come back to it. This would also be valid if is greater than the relaxation time defined in (4). However, if such a restaurant again comes back to service (people either forget or hope that it has got better in service and start choosing it again) after evenings, then several scenerios can emerge.

V Conclusions

We generalise here the El Farol bar problem to that of many bars. This leads us to the Kolkata restaurant problem, where the decision to go to any restaurant or not is much simpler; it still depends on the previous experience of course, as in the El Farol bar problem, but does not explicitly depend on the memory size or the size of the strategy pool. Rather, people getting disappointed with any restaurant on any evening avoids that restaurant for the next evenings. This generalised problem can be exactly analysed in some limiting cases discussed here. In the limit, the fluctuation in the restaurant service can be shown to have precisely an inverse cubic behavior (see eqn. (9)), as widely seen in the stock market fluctuations. For very small values of , the fluctuatuation distribution become -function like (see eqn. (11)). For large but finite , the system of restaurants in Kolkata will survive at a (self-organised) critical state cc:ChatChakunpub .

Acknowledgement

I am grateful to Arnab Chatterjee for his criticisms, discussions and help in finalising the manuscript.

References

- (1) Arthur WB (1994) Am. Econ. Assoc. Papers & Proc. 84: 406.

- (2) Challet D, Marsili M, Zhang Y-C (2005) Minority Games: Interacting agents in Financial Markets, Oxford Univ. Press, Oxford.

- (3) Mandelbrot BB (1997) Fractals and Scaling in Finance, Springer, New York; Mantegna RN, Stanley HE (1999) An Introduction to Econophysics, Cambridge University Press, Cambridge.

- (4) Bhattacharyya P, Chakrabarti BK (2006) Eds., Modelling Critical and Catastrophic Phenomena in Geoscience, Springer-Verlag, Heidelberg.

- (5) Chakrabarti BK (2006) Physica A 372: 162.

- (6) Pradhan S, Bhattacharyya P, Chakrabarti BK (2002) Phys. Rev. E 66: 016116.

- (7) Hemmer PC, Pradhan S (2007) Phys. Rev. E 75: 046101.

- (8) Chatterjee A (unpublished).