Assessment and Propagation of Input Uncertainty in Tree-based Option Pricing Models

| Henryk Gzyl | German Molina | Enrique ter Horst |

| IESA | Vega Capital Services Ltd. | IESA |

| Abstract |

This paper aims to provide a practical example on the assessment and propagation of input uncertainty for option pricing when using tree-based methods. Input uncertainty is propagated into output uncertainty, reflecting that option prices are as unknown as the inputs they are based on. Option pricing formulas are tools whose validity is conditional not only on how close the model represents reality, but also on the quality of the inputs they use, and those inputs are usually not observable. We provide three alternative frameworks to calibrate option pricing tree models, propagating parameter uncertainty into the resulting option prices. We finally compare our methods with classical calibration-based results assuming that there is no options market established. These methods can be applied to pricing of instruments for which there is not an options market, as well as a methodological tool to account for parameter and model uncertainty in theoretical option pricing.

Key words and phrases. CRR, Cox-Ross-Rubinstein model, uncertainty propagation, Bayesian Statistics, Option Pricing, Mixture Models, Metropolis-Hastings, Markov Chain Monte Carlo.

Acknowledgements

We wish to thank Lars Stentoft and The Centre for Analytical Finance, University of Aarhus Denmark for providing us with the SP 500 option data; and Sabatino Constanzo, Samuel Malone, Miguel Mayo, Abel Rodriguez, and Loren Trigo for providing us helpful comments.

1. Introduction

1.1. Option pricing dependencies

Option pricing has become a major topic in quantitative finance.

Pricing models and algorithms, ranging from the now-basic Black &

Scholes (1973) to more complex Partial Integro Differential

Equations (PIDE) (Cont et al., 2004) and tree-based methods (Cox

et al., (1979), Gustafsson et al., (2002)) are being proposed

continuously in what has become a very extensive

literature in mathematical finance.

All these option pricing models rely on some set of inputs, obtained

by either estimation (Polson et al., (2003)) or calibration (Cont et

al., (2004)) to implied market values, with most of them relying on

no-arbitrage arguments. Garcia et al., (2003) provides a good econometric review.

Once a set of input values is determined, they are passed to complex mathematical functions, whenever closed-form solutions are available, or computational algorithms to determine anything from plain vanilla to very exotic option prices. This common framework provides, in most cases, a unique solution, a unique option price that practitioners consider the theoretical, risk-neutral value of the option, and around which the market players will add the risk premium and spread. However, throughout all this process, we must not forget that the quality of such output relies extremely on the quality of the inputs used.

In most cases, a key input, expressed one way or another, is the volatility of the underlying asset (or combination of assets) that defines the option. The realized volatility literature (Andersen et al., 2003) has brought us closer to making this parameter locally observable at higher frequencies. Some problems still persist such as the lack of data, and the existence of other parameters (nuisance parameters), which render the task of making accurate assessments of our uncertainty about inputs for option pricing models more difficult. In practice, it is common to use the most likely input values or calibrated input values to price options, and focus the efforts on good modelling of parameter dynamics.

During the last few years, there have been many advances in the modelling of the underlying (stochastic volatility (Jacquier et al., (1994)), jump-diffusion models (Duffie et al., (2000))) and/or modelling jointly the underlying and the observed options movements (Eraker et al., 2003, Barndorff-Nielsen and Shephard (2001)). However, no matter how accurate our models become to estimate unobservable inputs, a proper accounting of their flaws and pitfalls as well as assessment of input uncertainty is as important to option pricing as the quality of the pricing model itself. Propagation of input uncertainty through complex mathematical model output uncertainty has been explored in other fields, like traffic engineering (Molina et al., 2005) or climatology (Coles and Pericchi (2003)).

The focus of this paper is the assessment and propagation of input uncertainty, and its effects on option pricing through the computation of a posterior distribution of the option prices, conditional on the observed data, that we use to integrate out the parameter’s uncertainty from the option functional. That is, we look for option prices that are unconditional from the parameters they rely on. We illustrate this idea through an alternative way to calibrate a tree-based model. By using the historical returns of the underlying, and looking at the up/down returns with respect to the risk-free rate, but by using a related statistical parametric approach, we not only from the sample variation of the up/down returns, but also from the scale and location parameters from the return probability generating process as well. As time passes by, we are able to observe more returns, and adjust our knowledge about the parameters (assuming that they are constant). We undertake a bayesian approach to the modelling and the estimation of the underlying (Hastings (1970)). Parameter posterior distributions lead us to posterior probabilities on the trees that we use afterwards to price options. However, our goal is not to provide a better pricing model but a new method to estimate model parameters and propagate parameter uncertainty through the use of Bayesian methods, illustrating how uncertainty of inputs can be reflected into uncertainty of outputs. Therefore, we confine our application to the tree-based classic approach of Cox et al., (1979), and build a statistical model that accounts for input uncertainty, and propagate it into option price uncertainty under the framework set by that model.// In sections two and three we motivate our approach to assessment and propagation of input uncertainty into pricing model outputs together with a basic decision-theoretic argument, and show that most likely parameter values do not necessarily lead to optimal option price reference choices. In section four we propose a statistical method for the estimation of such input uncertainty and construct the link between the statistical model, input uncertainty and the Cox-Ross-Rubinstein (CRR) model. Section five contains an application of this method for the S&P500 as well as a comparison with bootstrap-based calibrations of the tree model, together with potential further applications in section 6. Finally, section 7 concludes. We will consider throughout the paper the situation where there are no options markets in place to produce a better calibration, and option prices must be developed solely from the information contained in the underlying instrument.

2. Assessment and Propagation of input uncertainty

2.1. Motivation

Why should parameter uncertainty matter? Does it really make a difference for option pricing? After all, if we fit a model to the most likely values through classical maximum likelihood methods, we should be as close as we can to the ”true” option theoretical, risk-neutral value by the invariance principle of the MLE estimator (assuming one-to-one relationships between input and output). Furthermore, most practitioners want a simple, unique answer as to what the market price should be.

There are four major reasons why we might not know the true value of an option: First, our model might incorrectly represent the dynamics of the underlying (Cont, R. (2006)) leading to incorrect and biased option prices. We choose to ignore model uncertainty in this paper (understanding models as different pricing tools, and not as different trees), although it should be accounted for through the use of model averaging approaches (Hoeting et al., (1999), Cont, R. (2006)). Second, even if our option pricing model was correct, the option’s payoff is random. However, we can price the latter under risk-neutral assumptions. Third, which is the focus of our paper, even if the model was correct, the model parameters are not known, and different combinations of inputs lead to different values of the option. Finally, when we have more than one parameter defining the trees, the one-to-one relationship between parameters and option prices breaks down.

The true value of options is not in terms of actual discounted payoffs, but in terms of expected ones. For example, the value of a digital option is either zero or some fixed amount, depending on the path of the underlying until maturity, but what we try to model is the expected value of that option as of today. The theoretical value of the option will be considered known if we were to know the exact value of the inputs that drive the underlying, but not the realized path of the underlying. When pricing options, the most we can aspire to learn from the dynamics of the underlying are the model parameters, as the path will remain stochastic. That is why we define ”value” of an option at a given period only in terms of the risk-neutral valuation based on the true, unknown inputs. Even if the model accurately represents the dynamics of the underlying, the model parameters are still unknown. This is especially true as we construct more complicated models, where parameters could not only be dynamic but stochastic as well, and even an infinite amount of data would not suffice to learn about their future values.

It is common for practitioners to price options by using the mode of the inputs’ probability distributions (eg most likely value of the volatility). A first glitch comes when mapping a multi-dimensional input parameter vector into a 1-dimensional output, as the most likely value of the input does not necessarily lead to the most likely value of the output. This is a strong argument in favor of finding approaches that reflect actual parameter uncertainty. All we want to know is an option s most likely value? Perhaps its value based on the most likely input? What about its expected value? If we obtain the option price’s probability distribution, we can extract much more information, including but not restricted to all those.

2.2. How to propagate input uncertainty

Calibrating a model with the most likely input value does not lead to the ”true” option value, nor to the expected/optimal option value. The most likely value of the parameter has probability zero of being the true value in continuous parameter spaces. This is quite important, since option prices are asymmetric with respect to most of their inputs, making the effect on the option price of a small parameter error in either direction very different.

We illustrate this idea with a simple example. Suppose that the volatility for an underlying can take only three possible values: with probability 30%, with probability 40% , and with probability 30%. is not only the most likely value, but also the expected value. Without loss of generality, we assume that this is the only parameter needed to price an option. The option theoretical, risk-neutral price with volatility is equal to . However, if the true volatility were to be , or respectively, the option price would be equal to . Due to the asymmetric effect of the inputs over the outputs, we know that . Therefore, although is both the most likely and the expected value for the input, is not the expected value of the output. To what extent should we use to price this option? The expected option price is not , but a larger value, even under this symmetric and relatively nice distribution of the input . Considering that 60% of the time we will be wrong by choosing the most likely value for the input, we need to consider not only one possible value, but all possible values of the inputs, together with their probability distributions when assessing the possible values for the output. The question now becomes how to propagate the uncertainty about into a final option price for more general settings.

This argument can be formalized more properly. Suppose that, instead of three possible values, the parameter has a probability distribution of possible values. Therefore, for each value of , we have a possible option price , with probability . This would represent the uncertainty about the output as a function of the input s uncertainty .

Even if we wanted a single option value as an answer, we can still do so by integrating out the option price with respect to the distribution yielding , where the first expression is the expected option value, the second is the price under the expected parameter value, and the third is the price under the most likely parameter value. Our focus is on the first expression. This expected option value propagates the input’s uncertainty when passing it to a final option price that is not dependent on a single volatility value or , but rather on the overall features of the input’s probability distribution and their effect on the output pricing formula. The resulting option price is no-longer conditional on the volatility, but marginalized over it. The estimation problem has not disappeared, but has been transformed. We no longer focus on a single estimate , but rather on the assessment of the input s uncertainty through . In other words, our focus changes from how much we know (most likely value) to how much we do not know (probability distribution). In general a unique option value deprives us from a full assessment of the uncertainty in option valuation. It is not the same to know that the option price is with 99% probability between 40 and 42 than if it is between 37 and 45, even if in both cases the expected and most likely values happened to be the same. Market players will act differently on those two cases. This happens when the option value is asymmetric, as we will show later in the paper.

We can naturally generalize the formulae above to several parameters, making the expected option price a mere integral over the probability distributions of the possible parameters/inputs. , where is a bi-dimensional vector that calibrates a tree to model the price of an underlying, where and are the upward and downward returns respectively. We must here assess the (joint) probability distribution for all the parameters as parameter correlations influence inferential results. Assessing parameter values is of special difficulty when either limited data is available or the dynamics of the underlying are difficult to model, leading to inferential problems.

2.3. Uncertainty estimation as a feature in pricing tools

We outlined how the importance of uncertainty estimation impacts the option value through a probability distribution of the inputs . In practice, such a probability distribution must be estimated/updated using available data for the underlying, more so when options markets do not yet exist.

Our approach bears on model uncertainty. Following Cont (2006), if we regard the data on the prices of the underlying as prior data at , the posterior probabilities describe the model uncertainty regarding the option pricing model through the posterior probability distribution of , or the model misspecification. Bayesian model averaging as described in Hoeting et al., (1999), Cont (2006) is thus a way to incorporate model uncertainty .

We take a Bayesian approach to the statistical estimation of the CRR model in this paper. This has several advantages. First, it allows for prior information to be naturally included whenever available. This is especially useful in situations where the data is scarce, distributions vary over time or we cannot rely on asymptotics for calibration. Second, it provides a natural way to account for uncertainty in the parameters after we observe the underlying’s historical return series, and the necessary dynamic updating as new information becomes available. The posterior distribution of parameters given the data fits conceptually well into this framework, allowing to sequentially update and learn about the parameters of the tree-generating process.

Let be the data available regarding the observable to make inference about its parameter vector at time , linked through the likelihood function . Without loss of generality, assume that the inputs are not time-dependent. Given the data and any additional information regarding the parameter vector , prior to collecting that data, , we can update that information with the data to obtain the posterior distribution for : . One can then use this probability distribution to propagate our uncertainty about through its posterior distribution once is integrated out in the following way:

The posterior distribution for given the data will in turn propage the uncertainty into the option prices, in the following way:

The likelihood function (under the physical measure) becomes the main tool to obtain uncertainty estimates about the parameters , and, consequently, about the option prices . The likelihood function must be consistent with the option pricing tools, as the parameters must have the same meaning under both, or allow some mapping from the physical measure to the risk neutral measure . Therefore, the function is model specific, and must be constructed accordingly, not only to properly reflect the dynamics of the underlying, but also its relationship with the inputs as defined in the option pricing model.

3. Decision-Theoretic justification

3.1. Motivation

We assume that our pricing model perfectly characterizes the dynamics of the underlying, and therefore, if we knew the parameter vector driving the underlying, we could price options correctly. In this section, the input can be as in the previous section or any more general parameter governing the probability model for the underlying model.

A calibration method for an option pricing model must not rely on an existing and liquid option’s market, as otherwise option prices can only be defined if they already exist. Therefore, we will assume that there is not any existing option’s market for that underlying to use as a reference, and to determine, in this case, optimal decisions for pricing.

We assume that as market makers, we must determine the best option price to quote (which in principle needs not be its value), around which we are to add a spread for bid/ask market making. In principle we can assume that this spread is constant and symmetric around that value, so it can be ignored for utility computation purposes, as it becomes a constant for every trade. Therefore, assume that the trader will bid/offer options at the same level.

Define as the set of inputs driving the underlying, whose true value is unknown. Let the set of implied inputs at which we end up making a market, and as the price of an option under any given parameter set . The utility function of a buyer of such an option can be defined as , while the utility function for a seller can be defined as . They could be asymmetric (eg better to overprice than underprice if I would rather buy than sell the option) given the asymmetry of the payoff or other aspects, like the current portfolio or views of the trader, or limited risks he is allowed to undertake. We are defining utility functions at the time the decision is made. We are not considering the true value of the option as a function of the (still unknown) maturity price or path, but instead as a function of the inputs driving the underlying since we estimate them at time t.

Since the true value of is unknown to us, we have a probability distribution, representing our knowledge/uncertainty about its true value. This measure of uncertainty is assumed to be accurate. To proceed, we maximize our expected utility given the information available, represented by . As a market maker, we do not know a priori whether we are going to be buying or selling the option. Suppose that with probability we sell, and with probability we buy, then our utility function, as a function of is equal to , for each possible value of the true unknown parameter . Our target is, therefore, to find the optimal value for that maximizes with respect to the probability distribution . The optimal varies depending on our utility function, pricing model P and posterior distribution .

3.2. Utility functions

-

•

0-1 Utility function When our utility is if true , and 0 otherwise, we maximize it by hitting the true value of the parameters (assuming a one-to-one relationship between parameters and outputs, which is not necessarily the case). In this case the optimal solution is achieved when , which is our most likely value. The optimal decision would be to value all options using the most likely set of inputs. Unfortunately, given the unobservability of , the utility can not be quantifiable. Plus, under a continuous , we know that we reach the maximized utility with probability zero, so the operational exercise is futile.

-

•

Market volatility utility function Say we want to become a market-maker only if we have enough knowledge regarding the market value of the option. Then our utility function could be written as if , and otherwise. The optimal decision will depend not on a single input value, but instead on the uncertainty about the potential output values, as, if the uncertainty is too large, the optimal decision is not to make a market (or make it at a different spread). The utility is purely based on a measure of the input’s propagated uncertainty, instead of a single input estimate.

-

•

General utility functions In general, the optimal parameter set would be the one that maximizes some risk-averse utility function, that is .

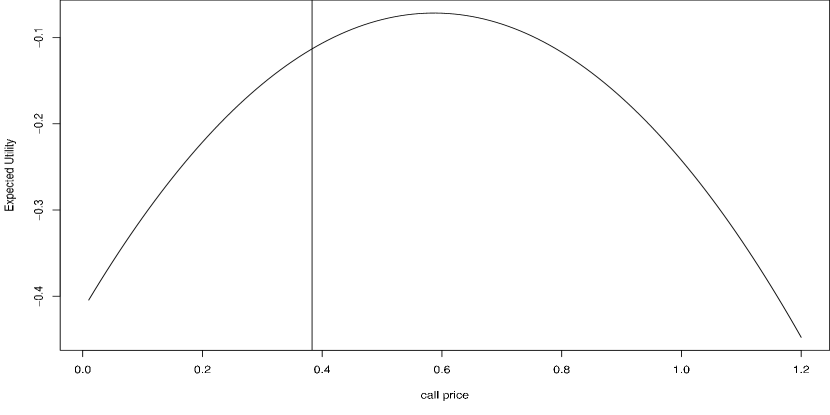

We show an example in Figure 1. We assume a simple quadratic utility function that penalizes divergence of the price we quote, from the true (unknown) value implied by the true (unknown) , that is . Furthermore, our knowledge of will be represented through a gamma density . Using Black Scholes for pricing an at-the-money, 1-period maturity call, assuming the risk-free rate is equal to zero, and strike price at 1, the pricing function becomes a simple expression of the volatility parameter , namely , where is the normal cumulative distribution function. In this case, a maximum of the expected utility is obtained at around 0.59, which corresponds to .

This optimal price is neither the price at the expected value of the parameter, P(=2)=0.68 nor the price at its most likely value, P(=1)=0.38. The optimal and expected prices are different for different distributions of (estimates of uncertainty about) the inputs , therefore, a full measure of the input uncertainty will affect the optimal option value to use for decision-making purposes. Parameter uncertainty assessment and propagation to the final output would allow the market-maker to adjust market valuations according to his own views on the probability of being bid/offer and his own views/utility function about the parameter, in a more systematic way. Notice that an easy extension would be to consider random and perform the previous integral also over as well, according to some probability distribution for this parameter, which would incorporate the market maker’s uncertainty regarding the side that the counterparty takes. We must incorporate full input uncertainty into output uncertainty if we are to target optimal decision-making procedures.

We must stress that what we are computing probability distributions and credible intervals for the risk-neutral option value given the information available at each point in time, and not credible intervals for any actual discounted payoff of that option, which remain stochastic.

4. Likelihood and model equations

Cox et al., (1979) proposed a tree model for valuing options. We propose a new method to calibrate their model to asses the propagation of uncertainty.

4.1. The Probability Model

We start with the classical binomial model, where the value of the underlying at time , , follows dynamics as defined in Cox et al., (1979):

| (4.1) |

where is a dichotomic random variable that represents the possible up and downs of the underlying (only those two moves are assumed possible), and that generates a whole binomial tree, with the following probability distribution:

where is the movement of the underlying in the up

direction, and is the movement of the underlying in the down

direction.

In practice, is unobservable, and so are the values and

. However, conditional on and , the value of is

specified and a whole binomial tree is specified as well, allowing

us to price options. Calibration methods using observed option

prices are typically used to obtain the values

of and implied by the market under the model.

In most cases, however, options market prices could be unreliable,

the options market could be underdeveloped or simply options price

discovery could prove expensive or unfeasible. Additionally, they

include market risk premia, which distorts calculations if the

target is the theoretical, risk-neutral value. Furthermore an

options market needs not exist, especially for ad-hoc or

client-specific options. In these cases, calibration is not

possible, and the most we should expect is to extract some

information about potential and from the historical return

series of the underlying, to value an option on it.

Let for be the returns of the underlying over

the periods in our sample, where could be, indeed, quite

small. In this case we can only attempt to use this model to price

options by extracting and from this sample. Therefore what

we observe are noisy realizations of , which we denote as

. Our aim is to extract from the observed

information about the underlying process to properly value

options on that underlying, as well as to account for the

uncertainty about that process. Then one can update the tree in a

sequential manner as soon as more realizations of are

observed.

The first problem we face is that we cannot assume to know (or estimate without uncertainty) the value of the and with which to generate the binomial tree. Accounting for the level of parameter uncertainty is vital for proper practical option pricing. This is even more important in the case of undeveloped options markets, where spreads tend to be sometimes unreasonably large due to the uncertainty felt by market makers as not being accounted for in the theoretical (point estimate) values.

Additionally, option uncertainty will reflect a skewed nature, as we will show, so the most likely price could be quite different from the expected price or even from the optimal price under a certain loss function (for example drawdown-based loss functions). All these elements lead us to consider computing not only a calibrated parameters, but the overall uncertainty we have about them.

Assuming that the CRR model is true, we would, therefore, observe values of that could potentially have been the true value of some underlying generating the process. Additionally, we know that the no-arbitrage condition must be met, and, therefore, under the down moves must be between 0 and , and under the up moves must be between and . One might have the temptation to model the as a simple mixture of normals or any other overlapping mixture. This would intrinsically violate the no-arbitrage condition, as nothing would prevent the under the up moves to be smaller than the under the down moves. We need a statistical approach that accommodates to the restrictions (truncation) in the pricing model for the up and down returns.

In summary, if we want to extract the information contained in the series about the generating process of an underlying, and additionally we assume the CRR pricing mechanisms are proper for pricing this underlying, a natural choice would be a mixture of non-overlapping (truncated) densities for the up and down moves. We consider the simplest of these mixtures in our formulation, that is the mixture of Truncated Normal densities. For simplicity, we also assume that the generating process is constant in time, although this assumption could easily be relaxed.

Our choice for a parametric formulation, as opposed to, for example, Monte-Carlo/bootstrap-based methods, is that the observed range of data could easily be much more narrow than the potential range, leading to underestimation of the tails/extreme values that could eventually happen. This is of key importance when the pricing tools are applied to risk management, as measures like VaR and expected shortfall would be heavily affected by a correct accounting for potential extreme values.

Our goal, therefore, is to update our knowledge of some unknown

potential value of that describes the future moves of the

underlying (and the corresponding option prices), but accounting

for the inherent

uncertainty and variability of .

4.2.

Risk neutral measure for the CRR model

Given a , that is, given a value of both and , we can generate a whole binomial tree, and in order to rule out arbitrage and under the condition of market equilibrium in any node of the tree, the expected value of the underlying at the end of a given node in the binomial tree is , where is the underlying price at the beginning of the node , and denotes expected value with respect to the risk neutral measure . In our model, this last condition is formalized as:

| (4.2) |

solving for yields:

| (4.3) |

4.3. Description of other classical methods

In this section we present alternative methods to ours. In the next section we present our method. Both of the alternative methods we describe aim at reconstructing the probabilistic nature of a recombinant tree describing the dynamics of the underlying from the observed option prices.

-

•

Rubinstein’s method It is based on the following natural assumptions:

-

1.

The underlying asset follows a binomial process.

-

2.

The binomial tree is recombinant.

-

3.

Ending nodal values are ordered from lowest to highest.

-

4.

The interest rate is constant.

-

5.

All paths leading to the same ending node have the same probability.

Once the probabilities and returns of the final nodes are established, the recombinant nature of the binomial tree plus the non-arbitrage condition, are used to inductively obtain the probabilities of arrival at the previous set of nodes along the tree as well as the returns at these nodes.

The implied posterior node probabilities are obtained solving the following quadratic program:

where is the following set of constraints:

Here are respectively the current ask and bid prices of the underlying asset. and are the prices of the European calls on the assets with strike prices for The are the end nodal prices and the are some prior set of risk neutral probabilities associated with the given tree.

-

1.

-

•

Derman and Kani’s procedure

Their aim is to understand how the underlying must evolve in such a way that the prices of the European calls and puts coincide with the market prices for the different strike prices.

The method ends up with the construction of a recombinant tree for which the up and down shifts and the transition probabilities may change from node to node at each time lapse.

If the prices at the nodes at time have been reconstructed, they propose the following routine for reconstructing the prices at time as well as the transition probabilities out of each node at time .

If is the stock price at the -th node at time , then the end-prices at time are and the probabilities of such a move are reconstructed from a risk neutral requirement and a matching of the option price at time as if strike price were .

This procedure provides equations of the needed to for for determining the prices and the transition probability. They propose a centering condition, to make the center coincide with the center of the standard CRR tree, to close the system of equations.

In both methods outlined above, one ends up with a recombinant tree, describing the dynamics of an underlying in which the prices and/or transition probabilities may change from time to time and from node to node. Once the tree is at hand, one may carry out the computation of all quantities of interest.

In our approach, the historical record of up and down prices of the underlying is used to update a standard binomial tree describing the time evolution of the asset, except that what we have is a whole collection of trees, each occurring with a posterior probability. For each of these trees, we can compute whatever we want, for example the price of a European call, except that each of these values has a posterior probability of occurrence.

4.4. The Statistical Modelling and Estimation

For the purpose of our estimation, we assume that we observe independent, equally-spaced realizations of from the past. Then the joint likelihood is just but the product of independent realizations:

We assume that the distribution of under the up moves is a

truncated normal with parameters and , which

happens with unknown probability , while the distribution of

under the down moves is also a truncated normal with

parameters and , which would happen with unknown

probability . This is consistent with the formulation in

(4.1), but we basically acknowledge our uncertainty and natural

variability about the potential values under the up/down moves.

Later we show how to transfer this into uncertainty about the options prices.

In a Bayesian framework, together with the likelihood, we complete the joint distribution with the following priors for our parameters:

| (4.4) | |||||

| (4.5) | |||||

| (4.6) | |||||

| (4.7) | |||||

| (4.8) |

Also notice that we define the location parameters as and , since these location parameters are not the expected

values of the distributions under the up/down moves respectively.

Finally, to match our notation to that of CRR, we define as a random variable with density that of under the up moves,

and a random variable with density that of under the down moves. In summary,

We chose a mixture of truncated gaussian for several reasons. First we wanted to mimic the assumptions of the options model we use, which force the existence of two kinds of observations: positive, defined as those above the risk-free, and negative, defined as those below the risk-free. This naturally brings the idea of a mixture of truncated densities. However, the inherent uncertainty about the values of those, together with the fact that in reality we don’t simply observe two single values for the series, suggests that the realized positive and negative values do come from some mixture, with the truncation at the point of division between the ups and downs (the risk-free). We allowed different variances for the positive and negative parts to account for possible skewness in the data, potential bubbles and other non-symmetric market behaviors. Finally our choice of gaussian distributions just came from trying to keep the choices simple.

We could in principle have added further layers of complication to

the model (e.g. mixtures of t-distributions, markov switching

behavior or even stochastic volatility or jumps), but decided to

keep things simple, as our target, again, is not a better pricing

model, but a method for a more accurate description of the involved

uncertainties. All these extensions are tractable, because the

statistical model is fully constructed on the physical measure, and

plenty of estimation algorithms are available for these potential

extensions. The extent of divergence in the final output is,

indeed, an interesting topic in itself, but we will focus here on procedures for propagating uncertainty.

It is worth noting that this truncated normal approach becomes a single gaussian distribution in the limit (as gets close to , and both to , gets close to 0.5 and gets close to ). Also we can see that as and get close to zero, the model is equivalent to the original CRR framework, as we have two point masses at and .

We use a Markov Chain Monte Carlo (MCMC) approach to estimate the parameters in the model. Details of the actual algorithm are outlined in the Appendix.

4.5. Monte Carlo use of the MCMC output

In the following subsections, we present three alternative methods for calibration that we shall refer to as the method, the method and the expected method. This names will become clear in the next subsections.

4.5.1. The method

The approach described in the previous section allows us to assess

the level of uncertainty in the inputs of the option pricing

formula. Our posterior distribution for the parameters

given the data

represents our uncertainty about the parameters driving the dynamics of the underlying, where each combination of

values has associated a certain likelihood under the posterior

distribution.

The next step is to use those values to generate possible option

prices. A Monte Carlo approach suffices here to propagate the

uncertainty of the inputs into uncertainty about the outputs

(option prices). The idea is to draw random samples from the

posterior distribution, generate potential up and down moves, and

pass them to the option pricing formula to obtain (random)

possible outputs. This will effectively provide us with the

posterior distribution of the option prices given the

data.

In our problem, what we are trying to compute is the following

double integral, where data, where , and

since only depends on , it is independent of

given :

where is the risk neutral price conditional on the data available and averaged

over all the values of .

The quantity is a function of , averaged over the different . We refer to as

the option price given . Therefore, we need to integrate

out from every

by integrating with

respect to the posterior of . The pseudo-code for the

Monte Carlo part of this first method is comprised by the

following steps:

-

1.

Draw (uniformly) a sample from the MCMC output .

-

2.

From , generate a sequence of possible values for and using .

-

3.

Use these values of and to generate from equation (4.3) and the corresponding :

Compute which is a sequence of binomial trees for that given .

-

4.

Go back to step 1 and repeat times in order to generate a set of averages.

-

5.

If we want a single price , then average these averages.

4.5.2. The method

Here we draw random samples from the posterior distribution of , generate potential up and down moves through , and pass them to the option pricing formula to obtain (random) possible outputs. This will effectively provide us with the posterior distribution of the option prices given the data. There are two possible outcomes that we are interested in. First we are interested in the overall distribution of the option price given the data, as we motivated in subsection 2.3. and section 3. In this case, we need to draw a sequence of form the posterior distribution in order to generate as many Monte Carlo samples from . Finally, since we do not know analytically the predictive marginal posterior distribution , we need to partition the values of and into many bins and compute the proportion of ’s falling in each bin. The option price is computed by solving the following double integral:

where , is the option price generated by a tree given . Given that we do not know analytically , we can approximate it by generating a sequence for big enough, and construct bins with center in order to approximate , where is computed as the number of elements111 is the Dirac delta function. in that fall in the -th bin with center .

We now propose a pseudo-code for the Monte Carlo that is comprised by the following steps:

-

1.

Draw (uniformly) a sample from the MCMC output .

-

2.

Generate possible values for , given , using .

-

3.

Iterate many times steps 1 and 2 in order to generate a sequence .

-

4.

Use generated in steps 1 through 3 to approximate with the use of bins.

-

5.

Sample with probability given by for computed in the previous step, and construct its associated tree given by:

generates a binomial trees that allows us to compute an option value unconditional of .

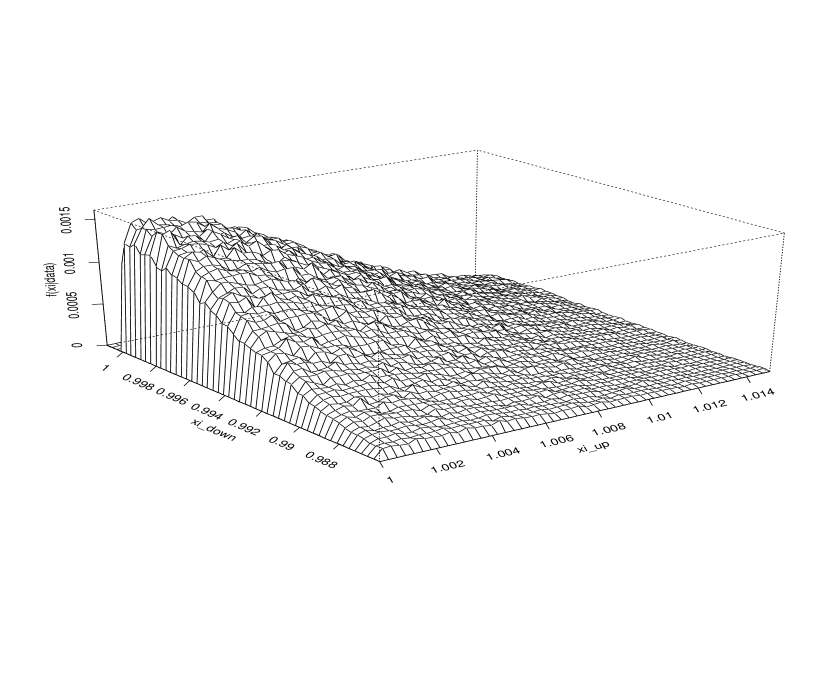

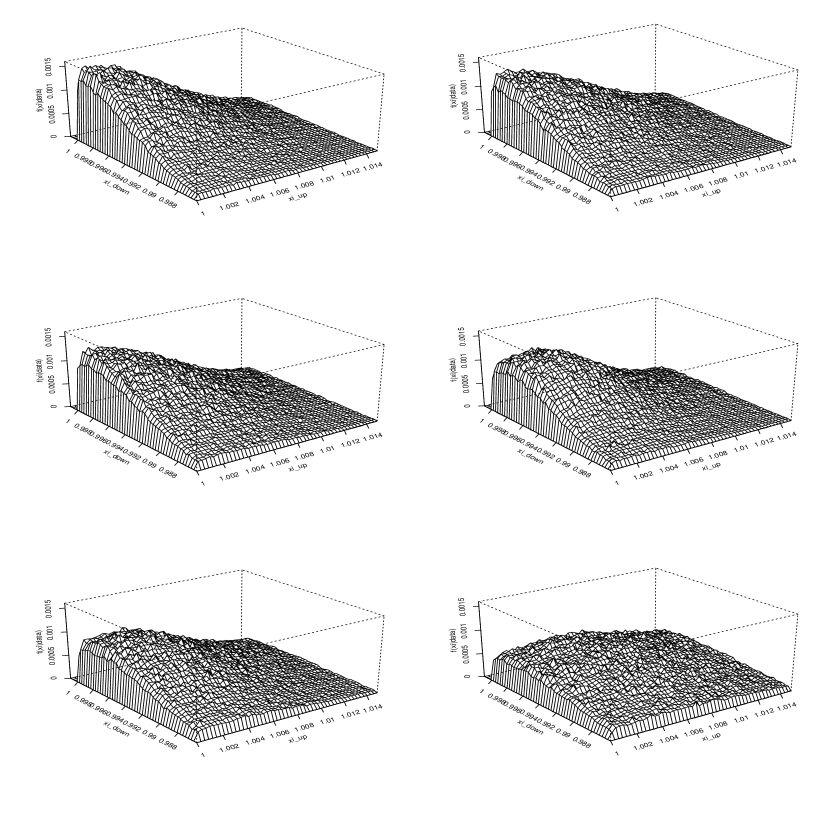

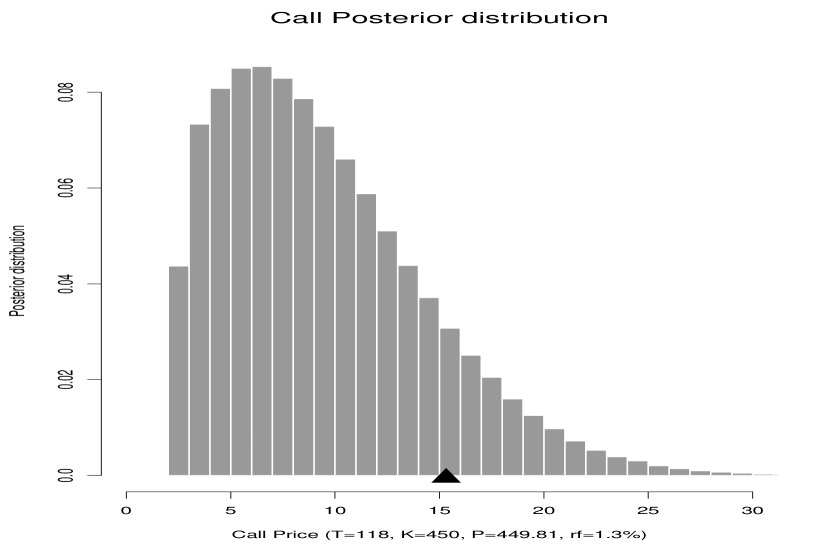

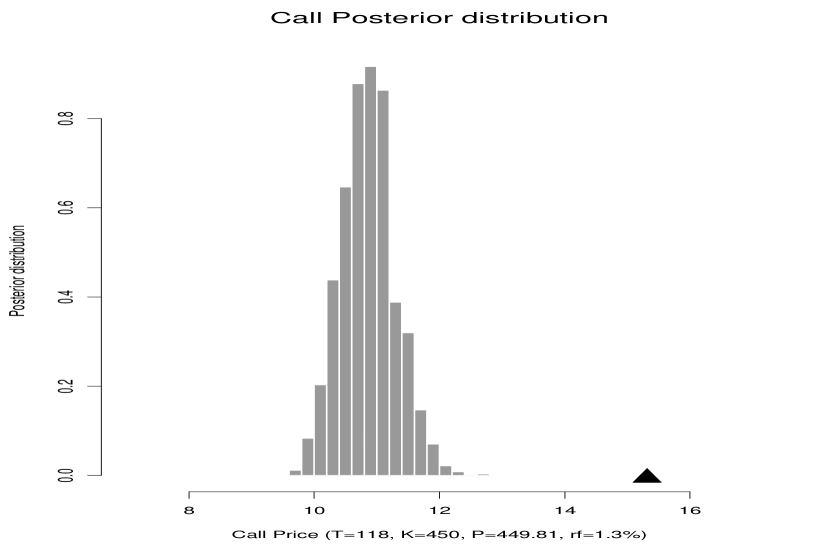

It is worthwhile noticing that the posterior distribution quantifies model uncertainty regarding the space of all available tree models for the underlying. Indeed, each parameterizes a whole tree model which has its associated probability given by (Cont, R. (2006)). The posterior probability distribution of each model is given in figure 2. As the amount of data increases, the posterior distribution becomes tighter as can be seen in figure 3.

4.5.3. The expected method

In this subsection we present the third and last method that consists of using the expected value of as inputs for the tree model. The idea behind this derivation can be found in Cox et al., (1979), where and are known with probability one. However, as these are model parameters, they can only be partially observed together with some noise. Therefore, it is the expected value of and and not their realization which is the quantity of interest under this last approach. What is therefore observable is and , where , and are normally distributed random variables. The idea of this method is to propagate the uncertainty of the parameters through both and as inputs for the tree model. This method can be seen similar to the Bootstrapped Mean method (BM) that will be described in section 5.2. The expected method method accounts for parameter uncertainty, whereas the Bootstrap mean method does not, even so for small sample sizes.

The option price is computed by solving the following integral:

We now describe the following pseudo-code for the Monte

Carlo:

-

1.

Draw (uniformly) a sample from the MCMC output. The sample is a vector of parameters .

-

2.

Given , compute the following moments222Given that and :

(4.9) (4.10) -

3.

Compute the expected value of

-

4.

Compute

-

5.

Go to step 1 and repeat many times.

Here , , , is the standard normal density and is the standard normal cdf. The risk neutral probability is equal to:

| (4.11) |

5. Empirical results

5.1. S&P500 Application

We apply the three methodologies from the previous section to

determine the uncertainty in the price of call

options333USD LIBOR is used as the risk-free interest rate

as suggested by Bliss and Panigirtzoglou (2004). for the S&P500

for a period of 1993. We use this simple example, for which

pricing has become simple and almost automatic, to show the actual

uncertainty we have about the call prices due to uncertainty about

the pricing tool inputs. Again, we must stress that our target in

this paper is not to propose a better pricing tool, but instead to

show the effects of the uncertainty in inputs into option pricing,

and to show an example of how to propagate that uncertainty for a

simple

and well-known tree-based model.

Our data consists of daily returns for the S&P500 index, from the

years 1992 and 1993. We will use, at time , the returns of the

previous 252 business days, to estimate the parameters

, using the procedures

outlined

in section 4.5. We show summaries of the convergence of the Markov Chains in the Appendix.

We use the posterior distribution of the parameters, together with

the underlying price at that time and for a strike of

constant to price an European call

option with maturity on Friday, December 17th, 1993.

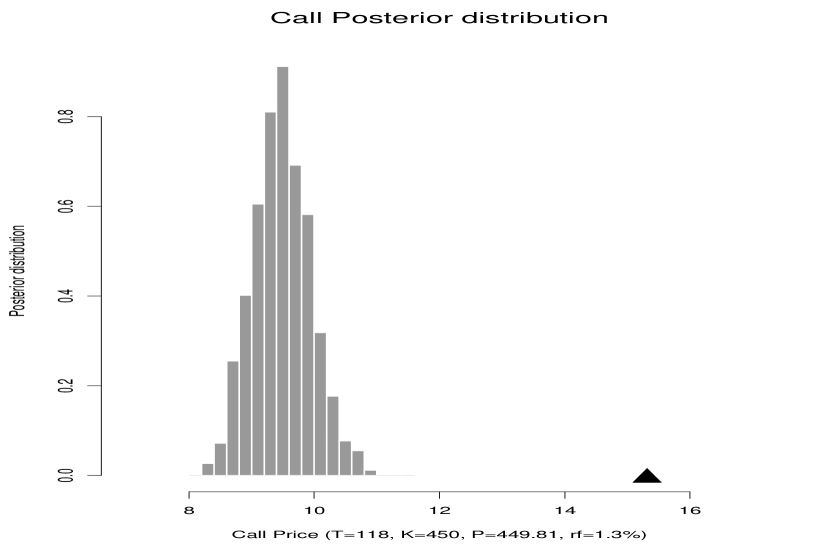

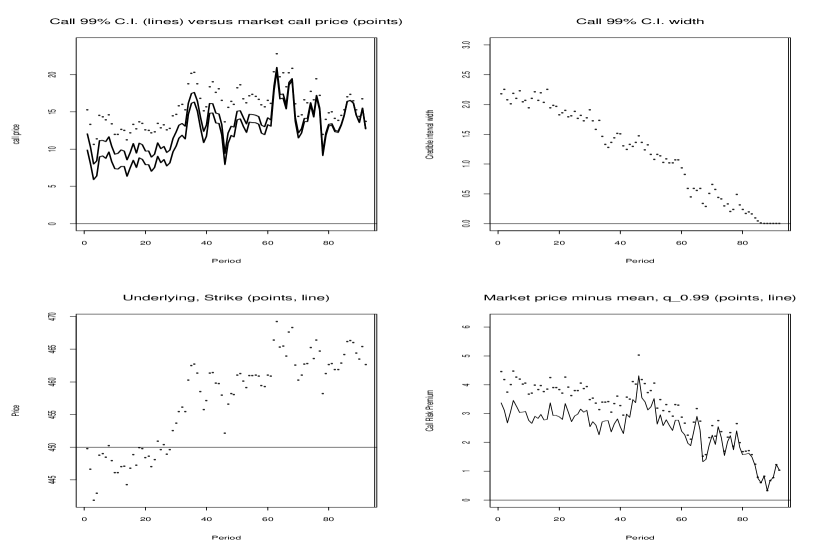

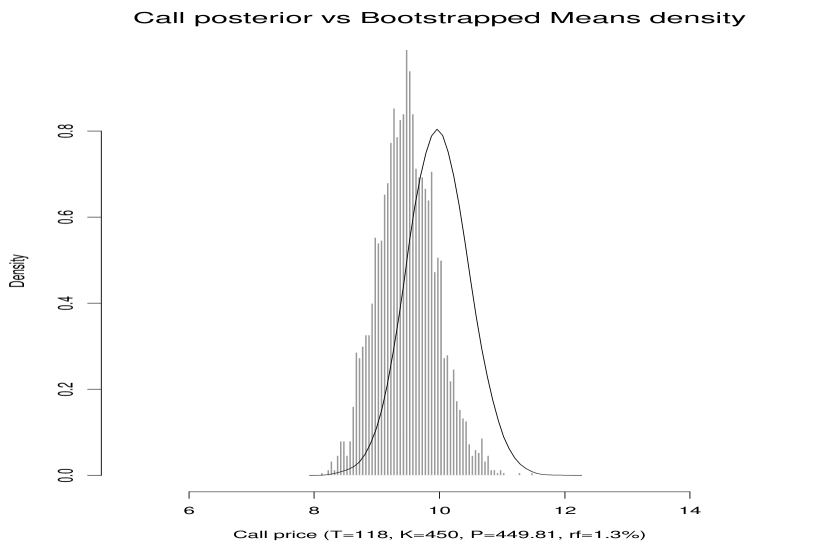

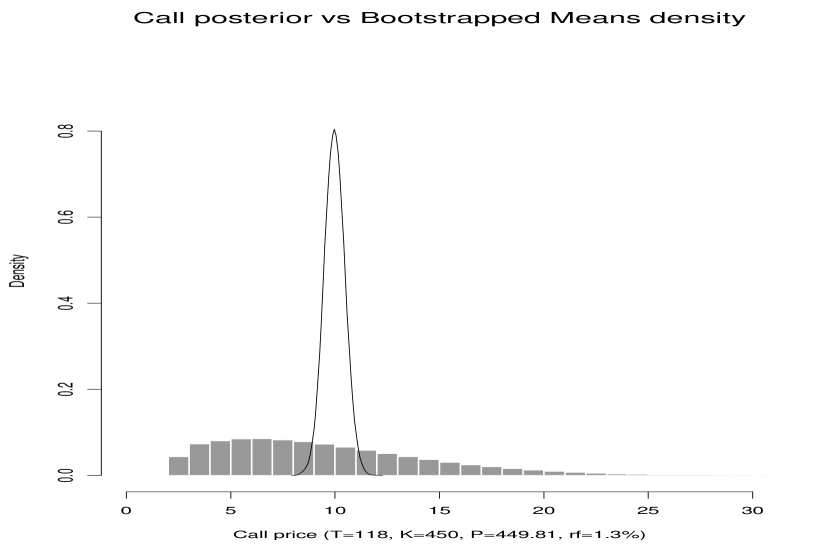

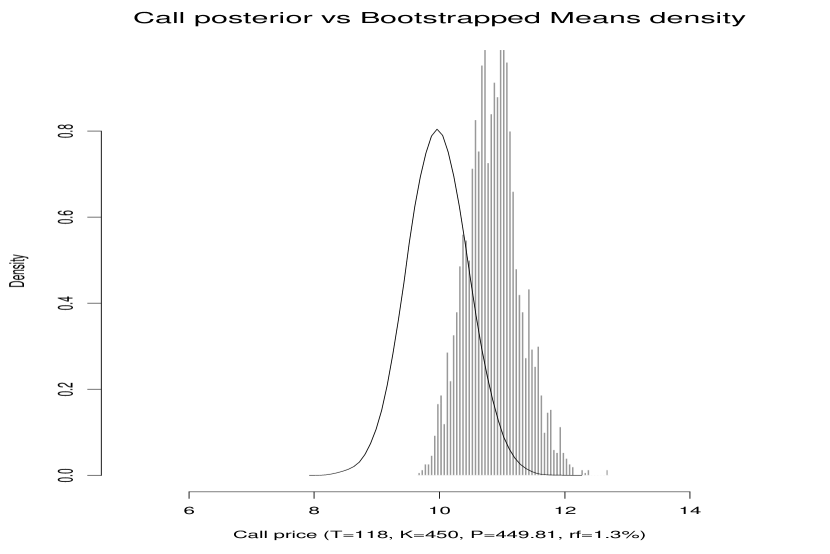

Figures 4, 5, and 6 show the posterior distribution for the theoretical call value on July 1st, 1993 under the three methods. The triangle represents the actual market price of the option. There are three features that are worth noting. First, we can clearly see that the posterior distribution from figure 5 is far from concentrated, which is not the case for figures 4 and 6. The three figures reflect the uncertainty about the inputs and how this propagates into uncertainty about the call price output. Second, they show that the call price is skewed, as also observed by Karolyi (1993). This shows us that even the most likely value of the actual output is not necessarily the most representative one. Under the three methods we obtain similar results with different levels of uncertainty as shown in table 1. Third, we should note that this valuation is still being done under a risk-neutral approach, so the actual call market price is (much) larger than one would expect under risk neutrality. This by no means invalidates the risk-neutral approach, but allows us a better perception and even quantification of the extent of the risk premia in the market as well as empirically the considerable overpricing (underpricing) of in-the-money (out-of-the-money) options (MacBeth and Merville (1979), Rubinstein (1985)). Our work differs from Karolyi (1993) since our bayesian analysis is performed for a greater class of stochastic processes as limits in continuous time, than the classical geometric brownian motion as treated in Karolyi (1993), which is a special case.

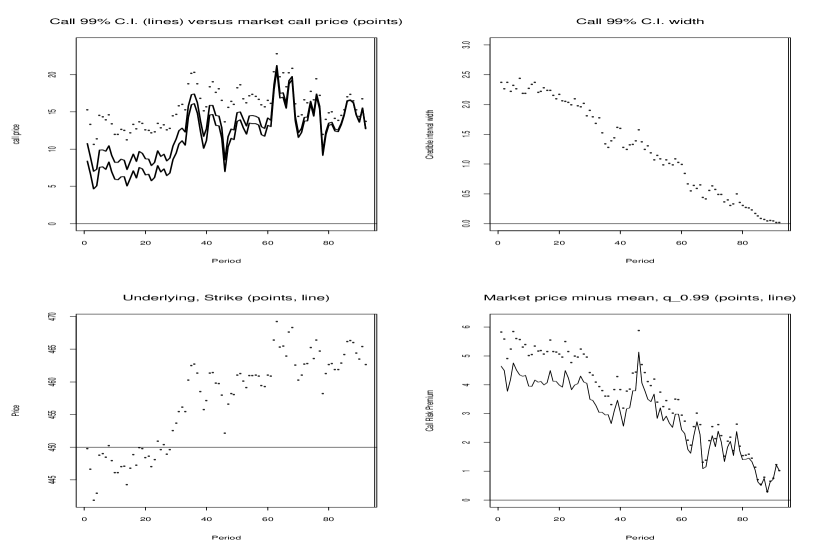

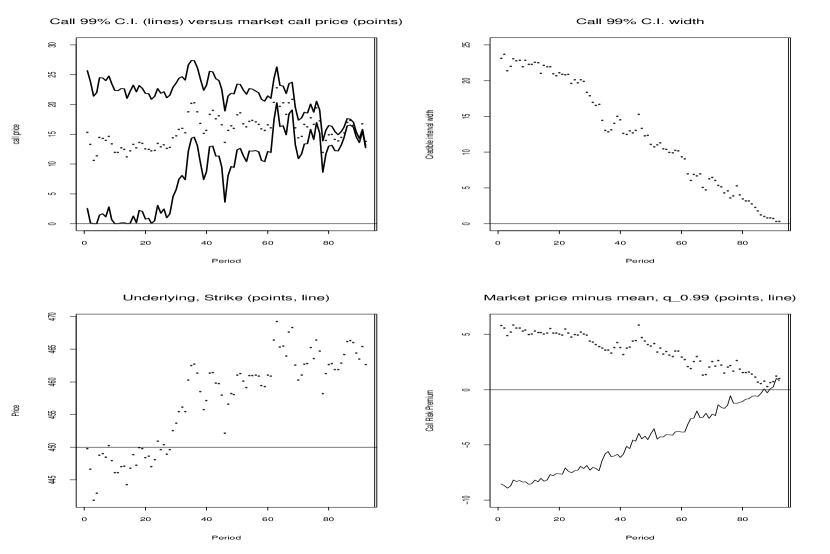

The top-left plot in figures 7,

, and

represent the call market prices (points) as we move closer to

maturity (vertical line). The x-axis represents time, and as we

move towards the right we get closer to the maturity date of that

call. The two lines represent the 0.5% and 99.5% percentiles for

the posterior distribution of the call prices, at each point in

time. We have run the MCMC analysis on a rolling basis for the

three methods based on the information available until each time

point, computing the Monte Carlo-based percentiles for each

posterior sample, and those lines represent the 99% credible

intervals for the call prices for each period until maturity.

Several interesting things can be extracted from these

plots:

First, we can see that the range of the 99% credible interval gets

narrower as we get closer to maturity. We can see this more clearly

in the top-right plot, where we see that range size over time. We

should expect to be more certain about where the call price should

be as we get closer to maturity, since any uncertainty we might have

about the inputs will have a smaller impact. This is more evident

for smooth payoffs, where small differences in the inputs only

become large differences in payoffs if there is a long time to

maturity. The overall extent of the input uncertainty will be a

function of time, so this

methodology is specially suitable for options with longer maturities.

Second, we can see the gap between the credible interval and the

actual market price. This gap, which represents the risk premium

for the call in the market, gets smaller as we get closer to

maturity. The markets are adding a larger nominal spread for

larger maturities, which is reasonable, since larger maturity

implies larger uncertainty and larger risks associated with the

instrument. We can see this more clearly in the bottom-right plot,

where we see the risk premium over time, expressed as market call

price minus expected call price under the posterior (points) or

market call price minus 99% percentile under the posterior

(line). In all three cases, as we get closer to maturity, the risk

premium goes to

zero.

Third, we can see that whenever there is a jump in the underlying,

a strong movement in the market, the risk premium tends to

increase. The bottom-left plot represents the underlying (points)

versus the strike (line). For example, we can see that there is a

strong price movement on the 42nd point. The underlying falls

rapidly, and at the same time, we can see in the top left plot how

both the market call price and the credible interval move

accordingly. What is more interesting is the behavior of these

during this period. First, we can see that the credible interval

has a wider range at that point (top-left plot), showing a larger

uncertainty about the true call price. Second, we can see that the

actual market risk premium increases in figures

7 and 9

(bottom-right plot) showing that the market not only repriced the

call by shifting its value down, but it did it in such

a way that the actual premium increased.

Fourth, from figure 3, we observe

that parameter uncertainty because of lack of data means higher

option prices.

We only need to run one MCMC analysis per instrument and time period. The MCMC algorithm can be partitioned and parallelized, as we mention in the appendix. However, the major advantage comes from the Monte Carlo step, where we can indeed fully parallelize the algorithm to compute the (iid) Monte Carlo samples. This is especially useful if there were time constraints in the pricing and/or the pricing algorithm was slow. In any case, the level of precision required will be the determining factor of the actual speed of the algorithm. In our example, it took a few seconds to run each MCMC step, and the major computational cost came from the Monte Carlo step for options with very long maturities, as it takes longer to price the tree. Still the algorithm is quite tractable and simple to code, and we feel the additional computational burden is very limited compared to the additional information it provides. Of course, for closed-form pricing models, these steps are even more trivial and quick to construct.

5.2. Comparison with naïve calibration methods

This section includes a comparison between the three bayesian parametric results from the mixture model proposed and several possible naive calibration approaches that practitioners might consider. We again use the S&P500 data in a rolling fashion as we did in the previous example, and will assume that there is no options market.

The naive calibration procedures we consider are as follows:

-

•

Sample Means (): For each (rolling) sample of returns that we use for calibration of the models, we take the sample mean of the returns larger/smaller than the libor, which will be our up/down moves. This provides a point estimate of the theoretical value of the option, without a confidence region to account for errors around it.

-

•

Bootstrapped means (): For each (rolling) sample of returns that we use for calibration of the models, we take random samples (with replacement) of the observed data, with sample lengths equal to the number of up/down returns observed in the original (rolling) sample. For each sample we compute the up/down means. We take 5000 such pairs of means and compute the corresponding call prices (on a rolling basis). This provides us with (rolling) confidence regions.

-

•

Bootstrapped values (): For each (rolling) sample of returns that we use for calibration of the models, we take random samples of length 1 of the up and down returns. We take 5000 such pairs of random data points and compute the corresponding call prices (on a rolling basis). This provides us with (rolling) confidence regions.

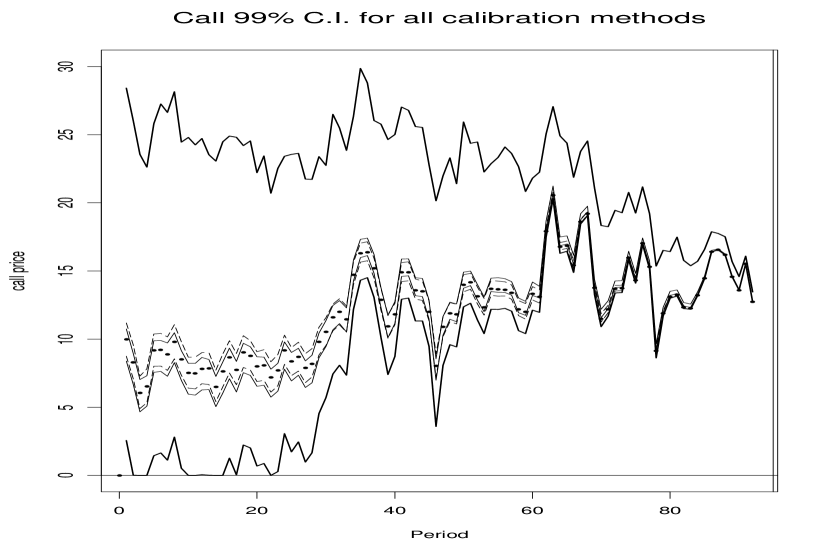

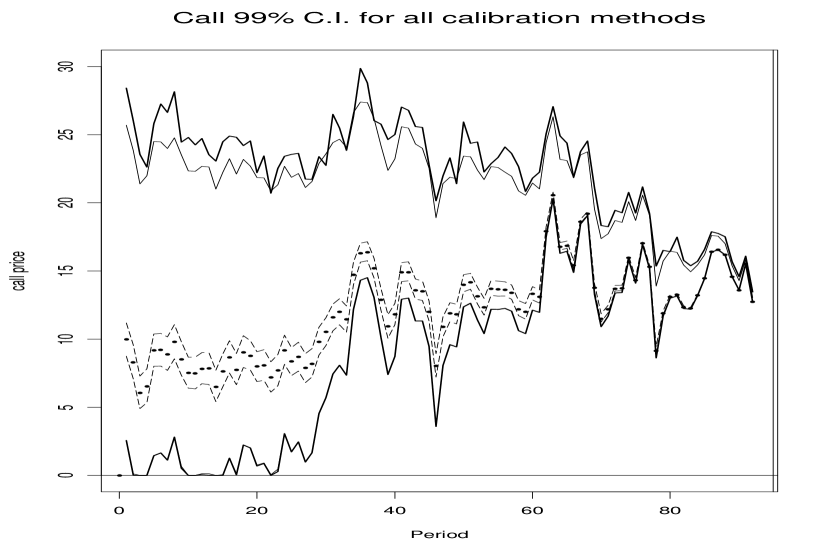

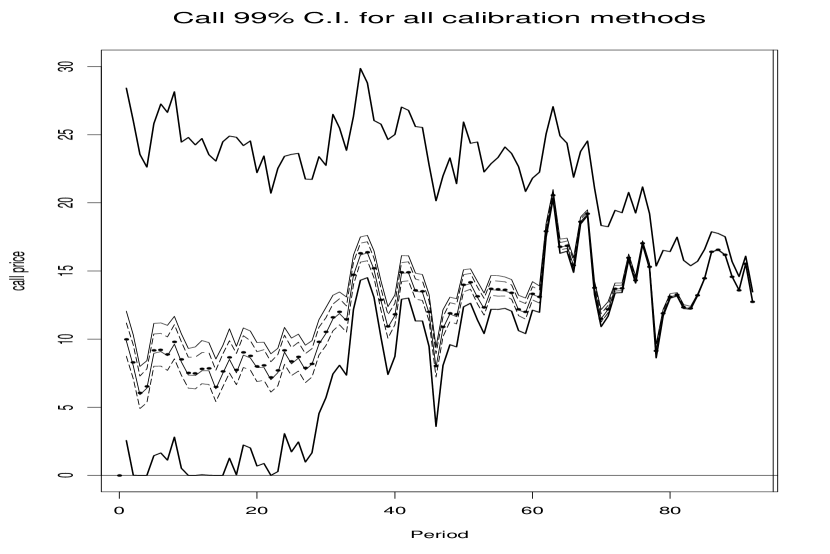

Plots 10, 11, and

12 contain the 99% bayesian credible interval

as well as each of the bootstrapped equivalent confidence

intervals. We perform the analysis in a similar rolling fashion

(with 252 business days of rolling

data) as we did in the previous subsection.

The points represent the calibrated values under the method.

Notice that those values will account for variability in the final

payoff (through the trees), but not for parameter uncertainty. We

show in Table 1 that these point estimates are very close to those

under the bayesian parametric approach. Indeed, in terms of

interval width and mean values, the method and the BV are

similar. The same similarity applies to the and the expected

methods compared to the BM method.

The dotted line represents the 99% confidence interval based on the

method. The confidence intervals are clearly very narrow.

The thin continuous line represents the 99% bayesian credible

interval, while the thick line represents the equivalent under the

method. We can see that the results are in this case quite

close. In any case all methods converge as we approach maturity, and

the option theoretical value is more certain.

| Method | Method | Expected Method | SM | BM | BV | |

|---|---|---|---|---|---|---|

| 12.04 | 12.52 | 12.04 | 12.06 | 12.06 | 11.54 | |

| 12.46 | 12.62 | 12.46 | 12.22 | 12.27 | 12.30 | |

| Range width | 12.49 | 1.17 | 1.25 | 0.00 | 1.30 | 13.57 |

Means, medians, and 99% range for the call prices on the S&P500 data. All values are averages over Monte Carlo samples and over maturities.

There are several reasons that explain why we should use the Bayesian approach in this paper instead of using the bootstrapping one:

-

•

A bootstrapping approach would suffer under low sample sizes. For example, under a 1-period maturity and a sample of points, there are at most possible call prices. As gets smaller, this would hinder the ability to create bootstrapped intervals. The estimation of the tail of the call price distribution would be quite unreliable. For example, the 1% and 5% quantiles for the call price would be equal under a sample size of .

-

•

A bootstrapping approach would suffer from outliers under low sample sizes more than a parametric approach, that would be more flexible to model/identify them. For example, we proposed a gaussian mixture, but non-gaussian approaches would be possible, like mixtures of t-distributions, that would account for outliers. A small sample size with 1 outlier could heavily bias confidence intervals under the bootstrapping approach. A parametric approach allows to incorporate and impose the expected shape of the population, as opposed to the sample shape.

-

•

If we have a large enough iid sample, the bootstrapping approach and our approach provide quite similar results, as long as we correctly represent the population.

-

•

If the data is not iid, we can have more flexible parametric approaches (markov switching, stochastic volatility), which could not possible under the bootstrapping method.

-

•

The use of a bayesian approach (parametric and/or nonparametric) is more appealing when in presence of low sample sizes, and where prior process or parameter knowledge can be incorporated into the analysis.

-

•

Simple variations would allow parameter learning, which would be of special relevance on overly-trending markets. For example, if we assumed a common variance in the up/down moves, having a small sample of down moves would be a problem under the bootstrap approach, whereas it would not be a problem under the parametric setting, as it would learn from the distribution of the positives about the variability of the negatives.

The use of a bayesian parametric approach to propagate uncertainty is justified, therefore, not only by its ability to mimic benchmarks in simple cases, but also adjust to situations when the bootstrapping fails.

6. Other potential applications

6.1. Application to instruments without an options market

We have provided a method that utilizes the data available about some instrument and linked that data to the parameters of the option pricing formula through a statistical model. We then have proceeded to estimate these parameters and pass the uncertainty about them, through the pricing formula, into uncertainty about the outputs. It is worth noting that at no point we needed to use implied or options market prices to do this. Therefore, this method has a very natural use in pricing of instruments for which there is not an options market defined, and for which calibration-based methods that use options prices fail to provide an answer (Rubinstein, M. (1994)). This is the case for most real options (Mun, J. (2005)), as well as client-specific options for which we might want to make a market or anything else where limited data is available.

6.2. Potential applications and extensions

When managing a portfolio of options, it is of great importance to compute and track the Value-at-Risk (VaR) which tells us that with a certainty of percent, we will not lose more than X dollars in the next N days (Hull, J. 2006). Since derivatives are non-linear instruments, one needs to map the option position into an equivalent cash position in its underlying in order to then proceed to compute the VaR. In our framework, the VaR is the percentile of the

Option prices depend on the parameter . Therefore, once is known one can compute the option price . Furthermore, one can generate the price distribution of the option with one of the three methods described above. is the confidence level and percentile of the profit and loss distribution of the derivative that one can choose (usually equal to ). As we notice, the risk measures such as the VaR will depend on parameters (just as we saw with option theoretical values) that we will have to estimate. We therefore need to integrate the VaR (and any other coherent risk measure such as the Expected Shortfall) analytically or numerically with respect to the posterior distribution of given the data and current information set. The same analysis applies to other coherent risk measures. The VaR will be influenced by the uncertainty through the posterior distribution of the model parameter vector . Furthermore, since the posterior distributions can be asymmetric and skewed we get that .

When generating trees through the sampling of the posterior distribution of the model parameter through any of the three methods, we can produce the posterior distribution of the hedging ratio444See Hull (2006). . This distribution, together with the observed underlying returns, allows computation of profit and loss distribution of the derivative. Also, it is worth noticing that the option pricing statistical link that we have developed throughout this paper can be expanded and enhanced. Several improvements could include modelling the variance of the returns of the ups and downs through two stochastic volatility models (Jacquier et al., 1994), or modelling truncated t-students instead of truncated normals.

7. Conclusion

The problem of finding theoretical option values is one where, as we saw in section 3., is a non-linear function of several inputs, making it therefore highly sensitive to small variations from its inputs. We therefore illustrated why it is more adequate to use the whole posterior distributions from model parameter as inputs instead of their most likely values. We then proceeded to show the effects of parameter uncertainty into model outputs and how this should be considered as a joint problem when defining option pricing tools. The link between the pricing tools in mathematical finance and the inferential tools from modern statistics should be stronger if we are to provide full and more accurate answers not only about our current knowledge, but about our ignorance as well.

In section 4. we showed how to construct a posterior distribution on the space of model trees for option pricing indexed by . A posteriori, we described three related methods for model calibration and determination of posterior option price probability distribution.

In section 5. we commented why the bootstrap approach suffers from low sample sizes, hindering the ability to create bootstrapped intervals that would make the estimation of the tail of the call price distribution quite unreliable. For a large sample, the bootstrap method and our approach provided similar results. However, the use of a bayesian approach (parametric and/or nonparametric) is more appealing when in presence of low sample sizes, and where prior process or parameter knowledge can be incorporated into the analysis. Simple variations would allow parameter learning, which would be of special relevance on overly-trending markets, as well as computing theoretical option values when the historical data on the underlying and option prices are quite small.

As a concluding remark, the naive method of plugging into an option pricing model the most likely value of the model parameters poses the problem that the results might not be optimal in a utility-based framework. Considering the whole probability distribution of inputs to express uncertainty about outputs is one of the advantages of our methodology, and allows for a full bayesian update of the tree as we observe more and more realizations of the underlying . The drawback of our methodology is computational, as the simulation needs are much larger.

8. Appendix 1: Bayesian implementation of the MCMC sampler

We derive in this appendix the full conditional posterior

distributions. For full details about Bayesian estimation methods

and algorithms see Chen et al. (2000) or Robert and Casella

(1999).

The likelihood times the priors is proportional to:

Rewriting it in an easier form we get:

Notice that the full conditional of does not depend on any other parameter. Therefore we compute it in closed form. This eases the computation significantly.

8.1. Adaptive variance proposal over pre-burn-in period

The proposals for the remaining parameters are simply

formulated as a random walk around the current value, with fixed

variances . To set these

variance we allow a pre-burn-in period. We monitor the acceptance

ratios for the Metropolis algorithm over this period, and adjust the

variance up or down to reach a target Metropolis acceptance ratio

between 10% and 50%. Then, after we reach this ratio for all

parameters, we fix

that variance and allow the MCMC to start in its regular form.

There are three major advantages of this kind of proposals. First,

it allows the user a more black-box approach, where the algorithm

will adjust itself to reach an acceptable mixing of the chain.

Therefore, it requires less user inputs to run, making it more

automatic and appealing for practitioners. Second, it makes most

of the actual metropolis ratios in the sampling algorithm simpler,

as the contributions of the proposals cancel on numerator and

denominator, due to the symmetry of the proposal

.

Third, it actually does work quite effectively in practice,

requiring in our S&P analysis less than 500 iterations in most

cases to achieve

good proposals.

The pseudo-code for the sampling procedure looks as follows:

-

1.

Preset a number of iterations N, over which we are going to monitor the acceptance frequencies of the Metropolis steps. We chose N=100

-

2.

Assign starting values for . For practical purposes we chose the variances of the positive (negative) returns to set ().

-

3.

Assign starting values for . For practical purposes we chose the means and variances of positive (negative) returns.

-

4.

Set the iteration index n=1.

-

5.

Sample from its full conditional.

-

6.

Sample the remaining parameters according to the sampling algorithms detailed below using the current values for the proposal variances.

-

7.

Record whether we accepted the proposal in the metropolis steps for each of the four parameters .

-

8.

If nN, then set n=n+1 and go back to step 5.

-

9.

If n=N iterations, then check the acceptance frequencies for parameter. If

we accepted the proposal more than N/2 times, reduce the proposal variance by half.

we accepted the proposal less than N/10 times, double the proposal variance.

we accepted the proposal between N/10 and N/2 times, keep the current proposal.

-

10.

If we modified any proposal variance at step 9, then go back to 4. Otherwise, set the current values for the proposal variances and start the actual MCMC.

One could refine this even further, as we can partition the parameter space (and the MCMC) into the up and down blocks, which are independent, and parallelize the computations.

8.2. Full conditionals and the MCMC sampler

Sampling p

Draw

Notice that p is the proportion of ups versus downs (adjusted by the

prior proportion), and with variance tending to as tends to

. A sufficient statistics for this full conditional is the

number of up and down moves in the sample, defined with respect to

the risk-free rate.

Sampling u

Draw and set with probability

Sampling

Draw and set with probability:

Sampling

Draw and set

with probability:

We could in principle adjust the proposal to be a truncated normal,

so that we ensure that we never sample outside the parameter space,

and adjust the metropolis ratios with the normalizing constants.

However, in practice, we did not draw a single value smaller than

zero, so this adjustment, although technically more correct, would

not make any difference in practice, as the mass of the points below

zero for the proposal was effectively zero (under most choices of

).

Sampling

Draw and set

with probability:

9. Appendix: Markov Chain Monte Carlo summary

In this section we include a small summary for one of the Markov

Chains we have ran.

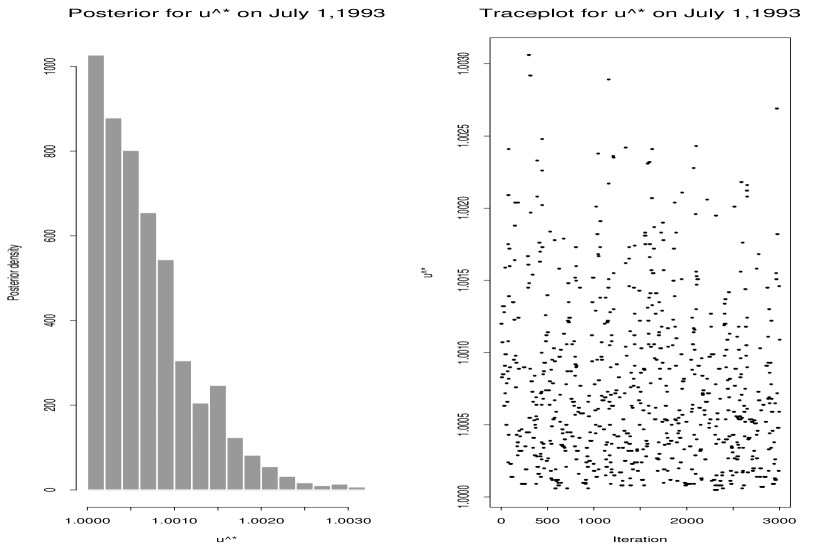

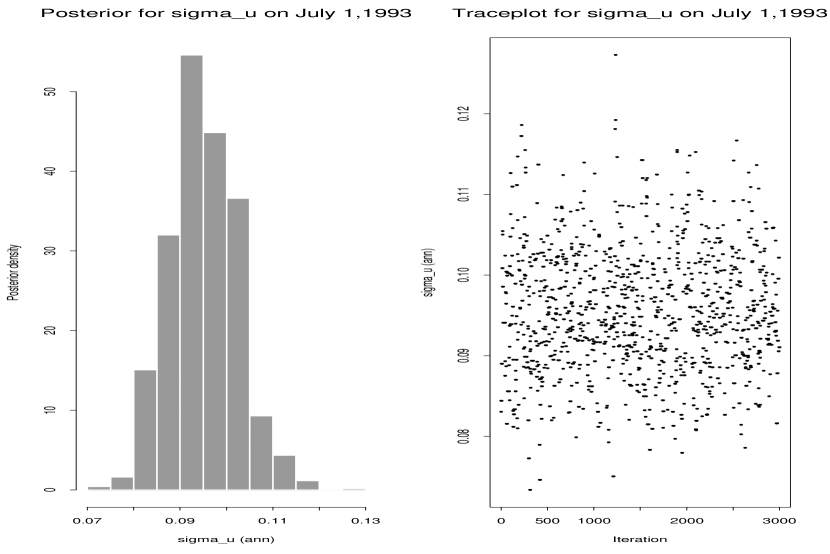

Figure 16 shows the posterior distribution for

the parameter . The left plot is a histogram of the

posterior distribution. We can see that it is truncated (at the

level of the risk-free rate) and skewed. The right plot shows the

traceplot of

the sampler, where we can see a good enough mixing of the chain.

Figure 17 shows the posterior distribution for

the parameter . We can also see a histogram of the actual

posterior and the traceplot. The mixing also seems reasonable,

averaging around 40% acceptances in the metropolis

ratios for each of the parameters.

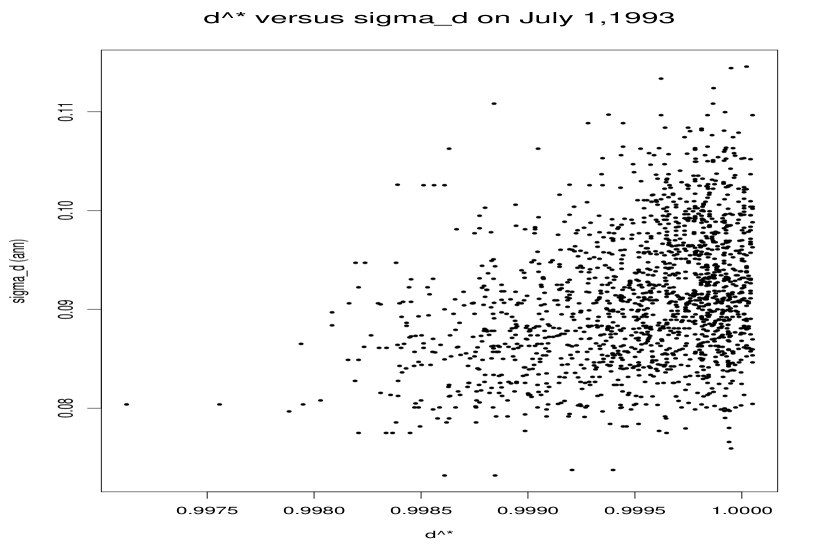

Since we can block the parameter space into three independent blocks, given the structure of the joint distribution [], [ and ] and [ and ], we only need to worry about the posterior correlation between parameters within each block. Figure 18 shows the joint posterior distribution for and . We can see that the posterior correlation is not excessive. Indeed, it averaged 35% over the Markov Chains we ran (one per time until maturity of the option).

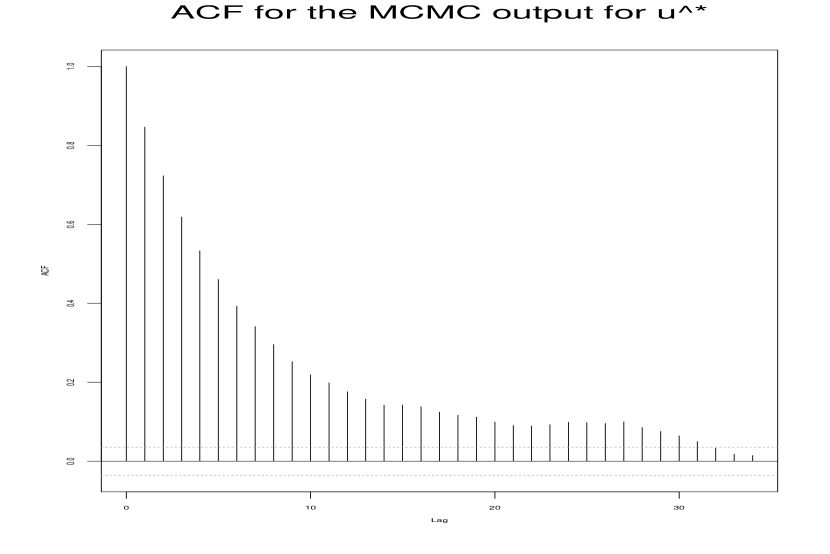

Finally we can see in figure 19 the autocorrelation function for for one of the chains. It indicates us that we can obtain pretty independent samples from the posterior with a relatively small thinning of the chain.

References

- [1] Andersen, T., Bollerslev, T., Diebold, F., Labys, P. (2003), Modeling and Forecasting Realized Volatility, Econometrica, 71, 579-625.

- [2] Barndorff-Nielsen, O., Shephard, N. (2001) Non-Gaussian Ornstein–Uhlenbeck-based models and some of their uses in financial economics (with discussion). Journal of the Royal Statistical Society, Series B, 63, 167-241.

- [3] Baxter, R. and Rennie, A. (1996) Financial Calculus : An Introduction to Derivative Pricing. Cambridge University Press .

- [4] Black, F., Scholes, M. (1973) The Pricing of Options and Corporate Liabilities. Journal of Political Economy, 81, 637-654.

- [5] Bliss, R., Panigirtzoglou,N. (2004) Option-implied risk aversion estimates. The Journal of Finance, 59.

- [6] Chen, M.H., Shao, Q.M. and Ibrahim, J.G. (2000) Monte Carlo Methods in Bayesian Computation. New York: Springer-Verlag.

- [7] Coles, S., Pericchi L.R. (2003) Anticipating catastrophes through extreme value modelling. Journal of the Royal Statistical Society Series C. Applied Statistics, 52, 405-416.

- [8] Cox, J., Ross, S., Rubinstein, M.(1979) Option Pricing: A Simplified Approach. Journal of Financial Economics, 7, 229-264.

- [9] Cont, R. (2006) Model Uncertainty and its impact on the Pricing of Derivative Instruments. Mathematical Finance, 13 519-547. .

- [10] Cont, R., Tankov, P. (2004)Financial Modelling with Jump Processes., Chapman Hall.

- [11] Cont, R., Tankov, P. (2004) Calibration of jump-diffusion option pricing models: a robust non-parametric approach. Journal of Computational Finance, 7, 1-49.

- [12] Dowd, K. (2005) Measuring Market Risk. John Wiley Sons.

- [13] Eraker,B., Johannes, M., Polson, N. (2003) The Impact of Jumps in Volatility and Returns. Journal of Finance.

- [14] Derman,E. And Kani, J. (1994) The volatility smile and its implied tree. RISK, 7, 139-145.

- [15] Duffie, D., Pan, J., Singleton, K. (2000) Transform Analysis and Asset Pricing for Affine Jump-Diffusions. Econometrica, 68, 1343-1376.

- [16] Garcia, R., Ghysels, E., Renault, E. (2003) The Econometrics of Option Pricing. Handbook of Financial Econometrics (Edited by Yacine Ait-Sahalia and Lars Peter Hansen.)

- [17] Gustafsson, T., Merabet, H. (2002) A generalized multinomial method for option pricing in several dimensions. Journal of Computational Finance, 5.

- [18] Hastings, W.K. (1970) Monte Carlo sampling methods using Markov chains and their applications. Biometrika, 57, 97-109.

- [19] Hoeting, J., Madigan, D., Raftery, A., Volinsky, C. (1999) Bayesian Model Averaging. Statistical Science 14, 382-401.

- [20] Hull, J. (2006) Risk Management and Financial Institutions. Prentice-Hall.

- [21] Jacquier, E., Polson, N.G. and Rossi, P.E. (1994) Bayesian analysis of stochastic volatility models. Journal of Business and Economic Statistics, 12, 371-415.

- [22] Karolyi, G.A. (1994) A Bayesian Approach to Modeling Stock Return Volatility for Option Valuation. The Journal of Financial and Quantitative Analysis, 28, 579-594.

- [23] MacBeth,J., Merville, L. (1979) An Empirical Examination of the BlackScholes Call Option Pricing Model. Journal of Finance, 12, 1173-1186.

- [24] Molina, G., Bayarri, M.J. and Berger, J.O. (2005) Statistical Inverse Analysis for a Network Microsimulator. Technometrics, 47, 388-398.

- [25] Mun, J. (2005) Real Options Analysis. John Wiley Sons.

- [26] Polson, N. G., Stroud, J. R. (2003) Bayesian Inference for Derivative Prices. Bayesian Statistics 7 (Bernardo et al., eds.), Oxford University Press, 641-650.

- [27] Robert, C.P. and Casella, G. (1999) Monte Carlo Statistical Methods. New York: Springer-Verlag.

- [28] Rubinstein, M. (1993) Nonparametric Tests of Alternative Option Pricing Models Using All Reported Trades and Quotes on the 30 Most Active CBOE OPtion Classes from August 23, 1976, through August 31, 1978. Journal of Finance, 40, 455-480.

- [29] Rubinstein, M. (1994) Implied Binomial Trees. Journal of Finance, 49, 771-818.