A Direct Method for Solving Optimal Switching Problems of One-Dimensional Diffusions

Abstract

In this paper, we propose a direct solution method for optimal switching problems of one-dimensional diffusions. This method is free from conjectures about the form of the value function and switching strategies, or does not require the proof of optimality through quasi-variational inequalities. The direct method uses a general theory of optimal stopping problems for one-dimensional diffusions and characterizes the value function as sets of the smallest linear majorants in their respective transformed spaces.

1 Introduction

Stochastic optimal switching problems (or starting and stopping problems) are important subjects both in mathematics and economics. Since there are numerous articles about real options in the economic and financial literature in recent years, the importance and applicability of control problems including optimal switching problems cannot be exaggerated.

A typical optimal switching problem is described as follows: The controller monitors the price of natural resources for optimizing (in some sense) the operation of an extraction facility. She can choose when to start extracting this resource and when to temporarily stop doing so, based upon price fluctuations she observes. The problem is concerned with finding an optimal switching policy and the corresponding value function. A number of papers on this topic are well worth mentioning : Brennan and Schwarz Brennan and Schwartz (1985) in conjunction with convenience yield in the energy market, Dixit Dixit (1989) for production facility problems, Brekke and Øksendal Brekke and Oksendal (1994) for resource extraction problems, Yushkevich Yushkevich (2001) for positive recurrent countable Markov chain, and Duckworth and Zervos Duckworth and Zervos (2001) for reversible investment problems. Hamdadène and Jeanblanc Hamadene and Jeanblanc (2004) analyze a general adapted process for finite time horizon using reflected stochastic backward differential equations. Carmona and Ludkovski Carmona and Ludkovski (2005) apply to energy tolling agreement in a finite time horizon using Monte-Carlo regressions.

A basic analytical tool for solving switching problems is quasi-variational inequalities. This method is indirect in the sense that one first conjectures the form of the value function and the switching policy and next verifies the optimality of the candidate function by proving that the candidate satisfies the variational inequalities. In finding the specific form of the candidate function, appropriate boundary conditions including the smooth-fit principle are employed. This formation shall lead to a system of non-linear equations that are often hard to solve and the existence of the solution to the system is also difficult to prove. Moreover, this indirect solution method is specific to the underlying process and reward/cost structure of the problem. Hence a slight change in the original problem often causes a complete overhaul in the highly technical solution procedures.

Our solution method is direct in the sense that we first show a new mathematical characterization of the value functions and, based on the characterization, we shall directly find the value function and optimal switching policy. Therefore, it is free from any guesswork and applicable to a larger set of problems (where the underlying process is one-dimensional diffusions) than the conventional methods. Our approach here is similar to Dayanik and Karatzas Dananik and Karatzas (2003) and Dayanik and Egami Dayanik and Egami (2005) that propose direct methods of solving optimal stopping problems and stochastic impulse control problems, respectively.

The paper is organized in the following way. In the next section, after we introduce our setup of one dimensional optimal switching problems, in section 2.1, we characterize the optimal switching times as exit times from certain intervals through sequential optimal stopping problems equivalent to the original switching problem. In section 2.2, we shall provide a new characterization of the value function, which leads to a direct solution method described in 2.3. We shall illustrate this method through examples in section 3, one of which is a new optimal switching problem. Section 4 concludes with comments on an extension to a further general problem.

2 Optimal Switching Problems

We consider the following optimal switching problems for one dimensional diffusions. Let be a complete probability space with a standard Brownian motion . Let be the indicator vector at time , where each vector with is either (closed) or (open), so that . In this section, we consider the case of . That is, takes either or . The admissible switching strategy is

with where where where are an increasing sequence of -stopping times and , are -measurable random variables representing the new value of at the corresponding switching times (in this section, or ). The state process at time is denoted by with state space and , and with the following dynamics:

If (starting in open state), we have, for ,

| (2.1) |

and if (starting in closed state),

| (2.2) |

We assume that and are some Borel functions that ensure the existence and uniqueness of the solution of (2.1) for and (2.2) for .

Our performance measure, corresponding to starting state , is

| (2.3) |

where is the switching cost function and is a continuous function that satisfies

| (2.4) |

In this section, the cost functions are of the form:

The optimal switching problem is to optimize the performance measure for (start in closed state) and (start in open state). That is to find, for both and ,

| (2.5) |

where is the set of all the admissible strategies.

2.1 Characterization of switching times

For the remaining part of section , we assume that the state space is where both and are natural boundaries of . But our characterization of the value function does not rely on this assumption. In fact, it is easily applied to other types of boundaries, for example, absorbing boundary.

The first task is to characterize the optimal switching times as exit times from intervals in . For this purpose, we define two functions and with

| (2.6) |

where . In other words, is the discounted expected revenue by starting with and making no switches. Similarly, is the discounted expected revenue by staring with and making no switches.

We set and . We consider the following simultaneous sequential optimal stopping problems with and for :

| (2.7) |

and

| (2.8) |

where is a set of stopping times. Note that for each , the sequential problem 2.7 (resp. (2.8)) starts in open (resp. closed) state.

On the other hand, we define -time switching problems for :

| (2.9) |

where

In other words, we start with (open) and are allowed to make at most switches. Similarly, we define another -time switching problems corresponding to :

| (2.10) |

We investigate the relationship of these four problems:

Lemma 2.1.

For any , and .

Proof.

We shall prove only the first assertion since the proof of the second is similar. We have set . Now we consider by using the strong Markov property of :

On the other hand,

Since both and are stopping times, we have for all . Moreover, by the theory of the optimal stopping (see Appendix A, especially Proposition A.4), and hence are characterized as an exit time from an interval. Similarly, we can prove . Now we consider which is the value if we start in open state and make at most switches (open close open). For this purpose, we consider the performance measure that starts in an open state and is allowed two switches: For arbitrary switching times , we have

Hence we have the following multiple optimal stopping problems:

where and for every . Let us denote , ,

We also define

with . By using Proposition 5.4. in Carmona and Dayanik Carmona and Dayanik (2003), we conclude that and is optimal strategy where is the shift operator. Hence we only consider the maximization over the set of admissible strategy where

and can use the relation with some exit time .

Now by using the result for , we can conclude

Similarly, we can prove and we can continue this process inductively to conclude that and for all and . ∎

Lemma 2.2.

For all , and .

Proof.

Let us define . Since , and hence . To show the reverse inequality, we define to be a set of admissible strategies such that

Let us assume that and consider a strategy and another strategy that coincides with up to and including time and then takes no further interventions.

| (2.11) |

which implies

As , the right hand side goes to zero by the dominated convergence theorem. Hence it is shown

so that . Next we consider . Then we have some such that . Hence for all . The second assertion is proved similarly. ∎

We define an operator where is a set of Borel functions

Lemma 2.3.

The function is the smallest solution, that majorizes , of the function equation .

Proof.

We renumber the sequence as . Since is monotone increasing, the limit exists. We have and apply the monotone convergence theorem by taking , we have . We assume that satisfies and majorizes . Then . Let us assume, for induction argument that , then

Hence we have for all , leading to . Now we take the subsequence in to complete the proof. ∎

Proposition 2.1.

For each , and . Moreover, the optimal switching times, are exit times from an interval.

Proof.

We can prove the first assertion by combining the first two lemmas above. Now we concentrate on the sequence of . For each , finding by solving (2.7) is an optimal stopping problem. By Proposition A.4, the optimal stopping times are characterized as an exit time of from an interval for all . This is also true in the limit: Indeed, by Lemma 2.3, in the limit, the value function of optimal switching problem satisfies , implying that is the solution of an optimal stopping problem. Hence the optimal switching times are characterized as exit time from an interval. ∎

2.2 Characterization of the value functions

We go back to the original problem (2.3) to characterize the value function of the optimal switching problems. By the exit time characterization of the optimal switching times, are given by

| (2.12) |

where and . We define here and to be continuation and stopping region for , respectively. We can simplify the performance measure considerably. For , we have

We notice that in the time interval , the process is not intervened. The inner expectation is just . Hence we further simplify

The third equality is a critical observation. Finally, we define and obtain

| (2.13) |

Since the switching time is characterized as a hitting time of a certain point in the state space, we can represent for some . Hence equation (2.13) is an optimal stopping problem that maximizes

| (2.14) |

among all the . When (i.e., ),

and hence

In other words, we make a switch from open to closed immediately by paying the switching cost. Similarly, for , we can simplify the performance measure to obtain

By defining , we have

Again, by using the characterization of switching times, we replace with ,

| (2.15) |

In summary, we have

| (2.16) |

and

| (2.17) |

Hence we should solve the following optimal stopping problems simultaneously:

| (2.18) |

Now we let the infinitesimal generators of and be and , respectively. We consider for . This ODE has two fundamental solutions, and . We set is an increasing and is a decreasing function. Note that and . We define

By referring to Dayanik and Karatzas Dananik and Karatzas (2003), we have the following representation

for where and .

By defining

the second equation in (2.16) and the first equation in (2.17) become

| (2.19) |

and

| (2.20) |

respectively. We should understand that and that . In the next subsection, we shall explain and in details. Both and are a linear function in their respective transformed spaces. Hence under the appropriate transformations, the two value functions are linear functions in the continuation region.

2.3 Direct Method for a Solution

We have established a mathematical characterization of the value functions of optimal switching problems. We shall investigate, by using the characterization, a direct solution method that does not require the recursive optimal stopping schemes described in section 2.1. Since the two optimal stopping problems (2.18) have to be solved simultaneously, finding in , for example, requires that we find the smallest -concave majorant of as in (2.17) that involves .

There are two cases, depending on whether or , as to what represents. In the region , that shows up in the equation of is of the form . In this case, the “obstacle” that should be majorized is in the form

| (2.21) |

This implies that in , the function always majorizes the obstacle. Similarly, in , the function always majorizes the obstacle.

Next, we consider the region . The term in (2.16) is represented, due to its linear characterization, as

with some and in the transformed space. (The nonnegativity of will be shown.) In the original space, it has the form of . Hence by the transformation , is the smallest linear majorant of

on where

| (2.22) |

This linear function passes a point where and

Let us consider further the quantity . By noting

and , we can redefine by

| (2.23) |

to determine the finiteness of the value function of the optimal switching problem, , based upon Proposition A.5-A.7. Let us concentrate on the case .

Similar analysis applies to (2.17). in (2.17) is represented as

with some and . Note that . In the original space, it has the form of . Hence by the transformation , is the smallest linear majorant of

on where

| (2.24) |

This linear function passes a point where and

Hence we have . By the same argument as for , we can redefine

| (2.25) |

Remark 2.1.

- (a)

-

(b)

A sufficient condition for : since we have

a sufficient condition for is

(2.26) Similarly,

Hence a sufficient condition for is

(2.27) Moreover, it is obvious and since the linear majorant passes the origin of each transformed space. Recall a points in the interval will be transformed by to .

We summarize the case of :

Proposition 2.2.

Corollary 2.1.

Remark 2.2.

An algorithm to find can be described as follows:

-

1.

Start with some .

-

2.

Calculate and then by the transformation .

-

3.

Find the linear majorant of passing the origin of the transformed space. Call the slope of the linear majorant, and the point, , where and the linear majorant meet .

-

4.

Plug and in the equation for and calculate by the transformation .

-

5.

Find the linear majorant of passing the origin of the transformed space. Call the slope of the linear majorant, and the point, , where and the linear majorant meet.

-

6.

Iterate step 1 to 5 until .

If both and are differentiable functions with their respective arguments, we can find analytically. Namely, we solve the following system for and :

| (2.29) |

where and .

Once we find and , then we convert to the original space and add back and respectively so that and . Therefore, by (2.16) and (2.17), the value functions and are given by:

Proposition 2.3.

If the optimal continuation regions for both of the value functions are connected and if , then the pair of the value functions and are represented as

and

for some with .

Proof.

If the optimal continuation regions for both of the value functions are connected and if , then the optimal intervention times (2.30) have the following form:

| (2.30) |

Indeed, since we have , the linear majorants and pass the origins in their respective transformed coordinates. Hence the continuation regions shall necessarily of the form of (2.30).

By our construction, both and are continuous in . Suppose we have . In this case, by the form of the value functions, . Since the cost function and continuous, it follows . On the other hand, implying . This contradicts the continuity of . Also, will lead to which is impossible. Hence if the value functions exist, then we must necessarily have . ∎

In relation to Proposition 2.3, we have the following observations:

Remark 2.3.

-

(a)

It is obvious that

and

-

(b)

Since is continuous in , the “obstacle” to be majorized by on is also continuous, in particular at . We proved that always majorizes the obstacle on . Hence if there exists a linear majorant of in an interval of the form with some : otherwise, the continuity of does not hold. Similarly, we have if there exists a linear majorant of in an interval of the form .

Finally, we summarize other cases than :

Proposition 2.4.

If either or , then .

If both and are finite, then .

Proof.

Therefore, we can conclude that for the situation where the orders of and are equal ( is finite) as described in Remark 2.1 (a).

3 Examples

We recall some useful observations. If is twice-differentiable at and , then we define and we obtain and with

| (3.1) |

with strict inequality if . These identities are of practical use in identifying the concavities of when it is hard to calculate its derivatives explicitly. Using these representations, we can modify (2.29) to

| (3.2) |

Example 3.1.

Brekke and Øksendal Brekke and Oksendal (1994): We first illustrate our solution method by using a resource extraction problem solved by Brekke and Øksendal Brekke and Oksendal (1994). The price at time per unit of the resource follows a geometric Brownian motion. denotes the stock of remaining resources in the field that decays exponentially. Hence we have

where and (extraction rate) are constants. The objective of the problem is to find the optimal switching times of resource extraction:

where is a discount factor with , is the operating cost and and are constant closing and opening costs. Since and always show up in the form of , we reduce the dimension by defining with the dynamics:

Solution: (1) We shall calculate all the necessary functions. For (open state), we solve where to obtain and where . Similarly, for (closed state), we solve where to obtain and where . Note that under the assumption , we have and .

By setting and , we have and . It follows that and . In this problem, we can calculate explicitly:

and . Lastly, and

.

(2) The state space of is and we

evaluate and . Let us first note that

. Since and

, we have

by (2.27). Similarly, by noting

and

, we have

by (2.26).

(3) To find the value functions together with continuation regions, we set

and make transformations and , respectively. We examine the shape and behavior of the two functions and with an aid of (3.1). By calculating explicitly to examine the derivative of , we can find a critical point , at which attains a local minimum and from which is increasing monotonically on . Moreover, we can confirm that , which shows that there exists a finite linear majorant of . We define

such that where . By the second identity in (3.1), the sign of the second derivative is the same as the sign of . It is easy to see that has only one critical point. For any , the first term is dominant as , so that . As gets larger, for sufficiently small, can take positive values, providing two positive roots, say with . We also have . In this case, is concave on and convex on . Since we know that attains a local minimum at , we have , and it implies that there is one and only on tangency point of the linear majorant and on , so that the continuation region is of the form .

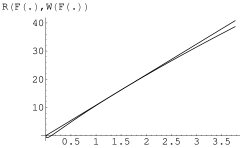

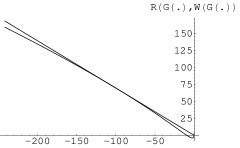

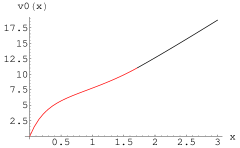

¿From this analysis of the derivatives of , there is only one tangency point of the linear majorant and . (See Figure 1-(a)). A similar analysis shows that there is only one tangency point of the linear majorant and . (See Figure 1-(b)).

(a)

(b)

(c)

(d)

Example 3.2.

Ornstein-Uhrenbeck process: We shall consider a new problem involving an Ornstein-Uhrenbeck process. Consider a firm whose revenue solely depends on the price of one product. Due to its cyclical nature of the prices, the firm does not want to have a large production facilty and decides to rent additional production facility when the price is favorable. The revenue process to the firm is

where with being a rent per unit of time. The firm’s objective is to maximize the incremental revenue generated by renting the facility until the time when the price is at an intolerably low level. Without loss of generality, we set . We keep assuming constant operating cost , opening cost, and closing cost . Now the value function is defined as

Solution: (1) We denote, by and , the functions of the fundamental solutions for the auxiliary process , which satisfies . For every ,

which leads to , , , and where is the parabolic cylinder function; (see Borodin and Salminen (2002, Appendices 1.24 and 2.9) and Carmona and Dayanik (2003, Section 6.3)). By using the relation

| (3.3) |

in terms of the Hermite function of degree and its integral representation

| (3.4) |

(see for example, Lebedev(1972, pp 284, 290)). Since

, we have

and

.

(2) The state space of is . Since

the left boundary is the absorbing, the linear majorant passes

. Since , we have

.

(3) We formulate

and

and make transformations: and , respectively. We examine the shape and behavior of the two functions and with an aid of (3.1). First we check the sign of and find a critical point , at which attains a local minimum and from which is increasing monotonically on . It can be shown that by using (3.3) and (3.4) and the identity (see Lebedev (1972, p.289), for example.) This shows that there must exist a (finite) linear majorant of on . To check convexity of , we define

such that . We can show easily

since

. Due

to the monotonicity of and its derivatives,

can have at most one critical point and can have one or two

positive roots depending on the value of . In either case,

let us call the largest positive root . We also have

. Since we know that attains a local minimum at and

is increasing thereafter, we have . It follows that there is

one and only on tangency point of the linear majorant and

on , so that the continuation region is of

the form . A similar analysis shows that there is only

one tangency point of the linear majorant and .

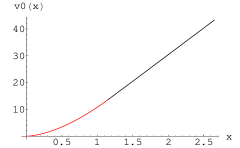

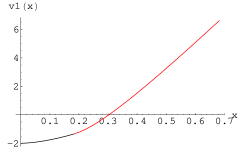

(4) Solving (3.2), we we can find . We transform back to the original space to find

and

Hence the solution is, using the above functions,

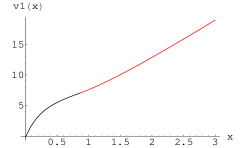

See Figure 2 for a numerical example.

(a)

(b)

4 Extensions and conclusions

4.1 An extension to the case of

It is not difficult to extend to a general case of where more than one switching opportunities are available. But we put a condition that is of the form where only one element of this vector is with the rest being zero, i.e., for example.

We should introduce the switching operator on ,

| (4.1) |

In words, this operator would calculate which production mode should be chosen by moving from the current production mode . Now the recursive optimal stopping (2.7) becomes

Accordingly, the optimization procedure will become two-stage. To illustrate this, we suppose so that and . By eliminating the integral in (4.1), we redefine the switching operator,

| (4.2) |

where

Hence (2.13) will be modified to It follows that our system of equations (2.18) is now

| (4.3) |

The first stage is optimal stopping problem. One possibility of switching production modes is . First, we fix this switching scheme, say , and solve the system of equations (4.3) as three optimal stopping problems. All the arguments in Section 2.3 hold. This first-stage optimization will give , where ’s are switching boundaries, depending on this switching scheme .

Now we move to another switching scheme and solve the system of optimal stopping problems until we find the optimal scheme.

4.2 Conclusions

We have studied optimal switching problems for one-dimensional diffusions. We characterize the value function as linear functions in their respective spaces, and provide a direct method to find the value functions and the opening and switching boundaries at the same time. Using the techniques we developed here as well as the ones in Dayanik and Karazas Dananik and Karatzas (2003) and Dayanik and Egami Dayanik and Egami (2005), we solved two specific problems, one of which involves a mean-reverting process. This problem might be hard to solve with just the HJB equation and the related quasi-variational inequalities. Finally, an extension to more general cases is suggested. We believe that this direct method and the new characterization will expand the coverage of solvable problems in the financial engineering and economic analysis.

Appendix A Summary of Optimal Stopping Theory

Let be a complete probability space with a standard Brownian motion and consider the diffusion process with state pace and dynamics

| (A.1) |

for some Borel functions and . We emphasize here that is an uncontrolled process. We assume that is an interval with endpoints , and that is regular in ; in other words, reaches with positive probability starting at for every and in . We shall denote by the natural filtration generated by .

Let be a real constant and a Borel function such that is well-defined for every -stopping time and . Let be the first hitting time of by , and let be a fixed point of the state space. We set:

and

| (A.2) |

Then is continuous and strictly increasing. It should be noted that and consist of an increasing and a decreasing solution of the second-order differential equation in where is the infinitesimal generator of . They are linearly independent positive solutions and uniquely determined up to multiplication. For the complete characterization of and corresponding to various types of boundary behavior, refer to Itô and McKean Itô and McKean (1974).

Let be a strictly increasing function. A real valued function is called -concave on if, for every and ,

We denote by

| (A.3) |

the value function of the optimal stopping problem with the reward function where the supremum is taken over the class of all -stopping times. Then we have the following results, the proofs of which we refer to Dayanik and Karatzas Dananik and Karatzas (2003).

Proposition A.1.

For a given function : the quotient is an -concave function if and only if is -excessive, i.e.,

| (A.4) |

Proposition A.2.

The value function of (A.3) is the smallest nonnegative majorant of such that is -concave on .

Proposition A.3.

Let be the smallest nonnegative concave majorant of on , where is the inverse of the strictly increasing function in (A.2). Then for every .

Proposition A.4.

Define

| (A.5) |

If is continuous on , then is an optimal stopping rule.

When both boundaries are natural, we have the following results:

Proposition A.5.

We have either in or for all . Moreover, for every if and only if

| (A.6) |

are both finite.

In the finite case, furthermore,

Proposition A.6.

The value function is continuous on . If is continuous and , then of (A.5) is an optimal stopping time.

Proposition A.7.

Suppose that and are finite and one of them is strictly positive, and is continuous. Define the continuation region . Then of (A.5) is an optimal stopping time, if and only if

| there is no such that if and | ||

References

- (1)

- Borodin and Salminen (2002) Borodin, A. N. and Salminen, P. (2002). Handbook of Brownian motion - facts and formulae, 2nd Edition. Birkhäuser, Basel.

- Brekke and Oksendal (1994) Brekke, K. A. and Øksendal, B. (1994). Optimal switching in an economic activity under uncertainty. SIAM J. Control Optim. 32(4), 1021–1036.

- Brennan and Schwartz (1985) Brennan, M. J. and Schwartz, E. S. (1985). Evaluating natural resource investments. J. Business. 58, 135–157.

- Carmona and Dayanik (2003) Carmona, R. and Dayanik, S. (2003). Optimal multiple-stopping of linear diffusions and swing options. Preprint. Princeton University.

- Carmona and Ludkovski (2005) Carmona, R. and Ludkovski, M. (2005). Optimal switching with applications to energy tolling agreements. Preprint. University of Michigan.

- Dayanik and Egami (2005) Dayanik, S. and Egami, M. (2005). Solving stochastic impulse control problems via optimal stopping for one-dimensional diffusions. Preprint. www.math.lsa.umich.edu/ egami.

- Dananik and Karatzas (2003) Dayanik, S. and Karatzas, I. (2003). On the optimal stopping problem for one-dimensional diffusions. Stochastic Process. Appl. 107(2), 173–212.

- Dixit (1989) Dixit, A. (1989). Entry and exit decisions under uncertainty. J. Political Economy. 97, 620–638.

- Duckworth and Zervos (2001) Duckworth, K. (2001). A model for investment decisions with switching costs. Annuls of Appl. Prob. 11(1), 239–260.

- Hamadene and Jeanblanc (2004) Hamadène, S. and Jeanblanc, M. (2004). On the starting and stopping problem: Applications in reversible investments. Preprint.

- Itô and McKean (1974) Itô, K. and McKean, Jr., H. P. (1974). Diffusions processes and their sample paths. Springer-Verlag, Berlin.

- Lebedev (1972) Lebedev, N. N. (1972). Special functions and their applications, Dover Publications Inc., New York. Revised edition, translated from the Russian and editied by R. A. Silverman.

- Yushkevich (2001) Yushkevich, A. (2001). Optimal switching problem for countable Markov chains: average reward criterion. Math. Meth. Oper. Res.53, 1–24.